The 2025 crypto market assessment reveals a transparent shift in how digital property are actually traded. Returns have been pushed primarily by ETF flows, macroeconomic liquidity situations, regulatory readability, and the focus of community income on the utility layer, slightly than speculative narratives.

Drawing on verified business knowledge and professional commentary, this report explains what powered the rally, why the market reversed sharply in This autumn, and which structural alerts from 2025 are most probably to form value motion and capital flows in 2026.

Key Takeaways

2025 shifted crypto from hype to infrastructure, with ETFs and establishments setting the tone.

The market briefly touched $4T, then cooled nearer to $3T by year-end.

Bitcoin hit ~$126,000, however two sharp corrections reminded everybody that leverage nonetheless runs the present.

Apps captured a lot of the worth in 2025, pulling within the bulk of community charges.

Clearer guidelines introduced greater gamers in, turning compliance right into a development lever.

Safety remained a significant concern, with fewer incidents general however considerably greater losses when breaches did happen.

2025 Crypto Market Evaluation: Abstract

2025 delivered uneven value motion however clear structural shifts. The overall crypto market cap briefly neared $4 trillion in Q3 earlier than cooling towards $3 trillion by This autumn. Bitcoin nonetheless hit a brand new excessive close to $126,000, as demand for Bitcoin ETFs absorbed provide, regardless of uneven altcoin efficiency and volatility returning in bursts.

The larger story was the place worth accrued. App-layer platforms captured most charge income, whereas tokenization and stablecoins scaled beneath clearer guidelines. Safety incidents have been fewer, however losses have been bigger when breaches occurred. On this article, we spoke with business leaders to uncover deeper insights into how the market actually developed.

2025 regarded like a handover. ETFs, institutional steadiness sheets, and app-layer income started to form market management greater than narratives did.

2025 Crypto Market at a Look

The overall crypto market cap reached $4 trillion on the finish of Q3 2025, however was round $3 trillion on the finish of This autumn.

Bitcoin led the cycle once more, peaking round $126,000 in early October, as spot ETFs attracted practically $26 billion of web inflows throughout 2025.

Income-generating apps quietly turned winners. Platforms like Hyperliquid ($94.6M) and Pump ($34M) ranked among the many prime 30-day charge earners, demonstrating actual enterprise traction past simply being tokens.

Most altcoins didn’t get their very own season. Capital didn’t rotate deeply into the danger curve, not like previous cycles. Thus, leaving many high-beta names underperforming.

Even Bitcoin skilled two brutal corrections, one in April (-30% to roughly $75,000) and one other in November (-35% to roughly $81,000), which shook out late patrons.

ETF flows pushed Bitcoin and Ethereum to start out behaving like monetary benchmarks slightly than hype trades, with regular institutional inflows changing retail mania.

Worth flowed decisively towards purposes, with practically 90% of all crypto charges generated on the app layer, whereas base blockchains captured lower than 10%, highlighting a significant shift in the place financial energy now sits.

The broader financial backdrop appeared favorable for crypto, but heavy leverage and frequent liquidations continued to shake out merchants.

Three forces clarify virtually the whole lot that occurred in crypto in 2025: the normalization of ETFs, the rise of institutional steadiness sheets, and crypto’s tightening hyperlink to macro coverage and liquidity. These drivers altered costs and altered what the market rewarded. Extra on this within the crypto market overview for 2025.

2025 Crypto Market Overview: From Hypothesis to Institutional Shopping for

The broader crypto ecosystem expanded in 2025. Separate business analysis that tracks the cryptocurrency services and products market, which means sector income slightly than token costs, estimates development from $2.48 billion in 2024 to above $3 billion in 2025. In line with Analysis and Markets’ Cryptocurrency Market Report 2025, this represents a roughly 15–16% year-on-year improve.

Trying forward, the report initiatives that the market is predicted to achieve $5.39 billion by 2029, equal to a 17.2% CAGR between 2025 and 2029.

By the tip of 2025, crypto had moved decisively past hype-led buying and selling, with institutional forces and broader macro tendencies shaping the market, in line with executives 99Bitcoins spoke to.

Complete Market Progress and Macro Backdrop

Whereas the 12 months included sharp rallies and equally sharp drawdowns, it was extensively characterised as a interval of structural maturation slightly than a easy bull or bear market cycle.

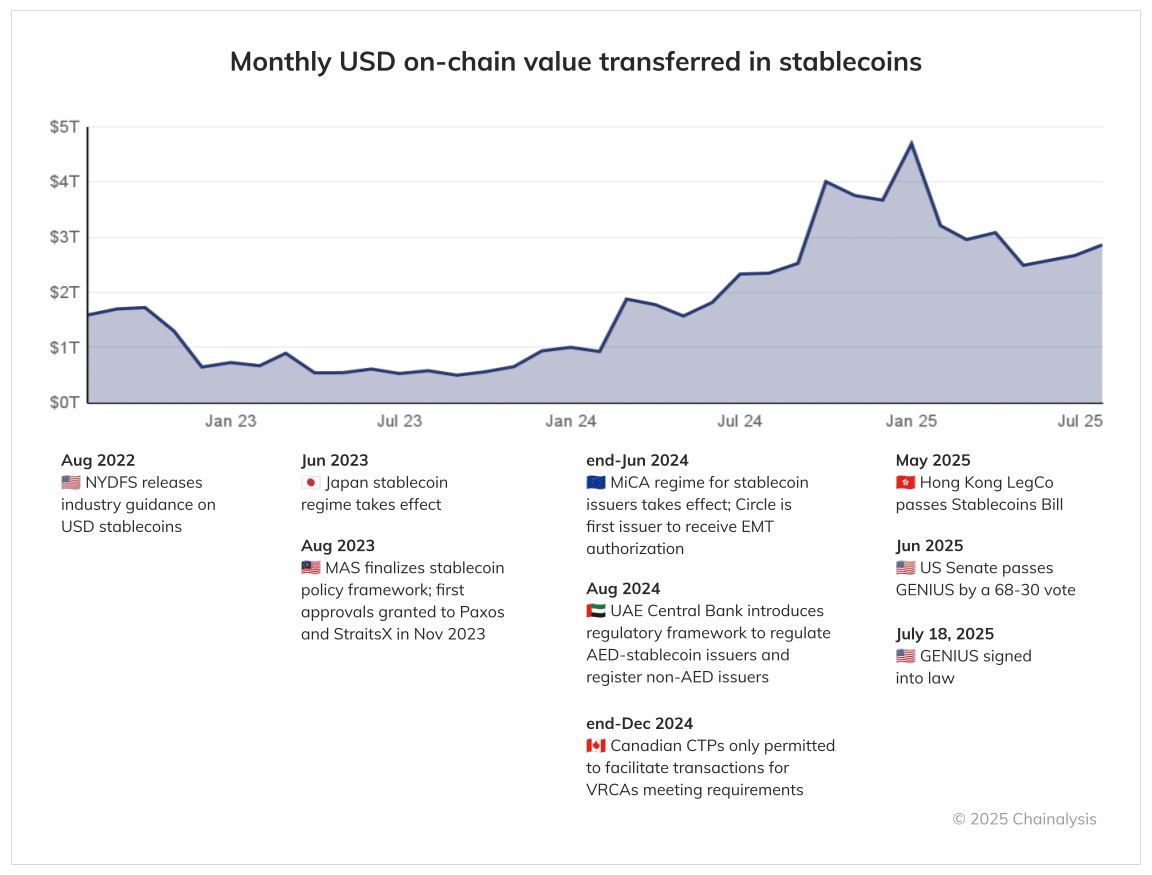

A number of contributors pointed to the market’s scale as proof of this shift. Maksym Sakharov, Co-Founder and Group CEO of WeFi, famous that blockchain infrastructure dealt with as much as 3,400 transactions per second, with stablecoins rising as one of the crucial energetic segments. Sakharov informed 99Bitcoins:

Stablecoins blew the roof with $46 trillion in nominal flows and month-to-month adjusted volumes hitting $1.25 trillion by the tip of Q3 2025.

Sakharov additionally highlighted that cell pockets customers grew by round 20% year-on-year, reinforcing the view that crypto utilization more and more displays real-world funds slightly than pure hypothesis.

Market efficiency, nevertheless, was removed from uniform. Jamie Elkaleh, CMO of Bitget Pockets, spoke to 99Bitcoins and described 2025 as a traditional boom-and-shakeout 12 months for crypto. He noticed that market capitalization approached $4 trillion throughout Q1-Q3, supported by sturdy ETF-driven inflows and an Ethereum rally of greater than 60%, earlier than reversing sharply in This autumn.

ETF Flows and the Rise of Macro-Pushed Crypto

Whereas the Bitcoin rally made headlines, the deeper shift was structural. ETF flows turned the market’s new heartbeat. As a substitute of sentiment alone, allocation and redemption cycles started to indicate up straight in value motion.

In This autumn of 2025, greater than $1 trillion in market worth was erased, because the Bitcoin value fell practically 30% from its peak to under $90,000. Elkaleh defined:

This efficiency marked a 12 months of highs adopted by a bearish correction, lagging behind conventional property like gold and bonds, reminding everybody that even in a extra institutional period, this stays a high-beta nook of worldwide markets.

Throughout responses, ETF flows, and regulatory readability persistently emerged because the dominant drivers of market sentiment. Alexander Zahnd, interim CEO of Zilliqa, described 2025 as the primary full 12 months through which crypto operated in an ETF- and macro-led regime. The manager added:

The only largest driver of market sentiment this 12 months, in my opinion, was the mixture of U.S. financial coverage repricing and ETF flows. Each change within the chance of a Fed reduce, or a spike in ETF redemptions, confirmed up virtually instantly in crypto costs.

A number of executives additionally famous that regulated funding automobiles and digital asset treasury constructions (DATs) had successfully institutionalized entry to crypto and built-in it extra carefully with conventional monetary markets.

Regulation, Stablecoins, and the New Infrastructure Cycle

Regulation performed a central function in shaping confidence. Konstantins Vasilenko, Co-Founder and CBDO at Paybis, pointed to early-year coverage shifts within the U.S., together with the creation of a Strategic Bitcoin Reserve and the repeal of SAB 121, as key catalysts for renewed institutional inflows. Vasilenko informed 99Bitcoins:

The Trump Administration delivering on guarantees to crypto inside the first 100 days was the biggest contributor to optimistic market sentiment.

On the similar time, the EU’s crypto coverage MiCA framework was extensively cited as a contributor to improved readability, significantly for euro-denominated stablecoins and tokenized merchandise.

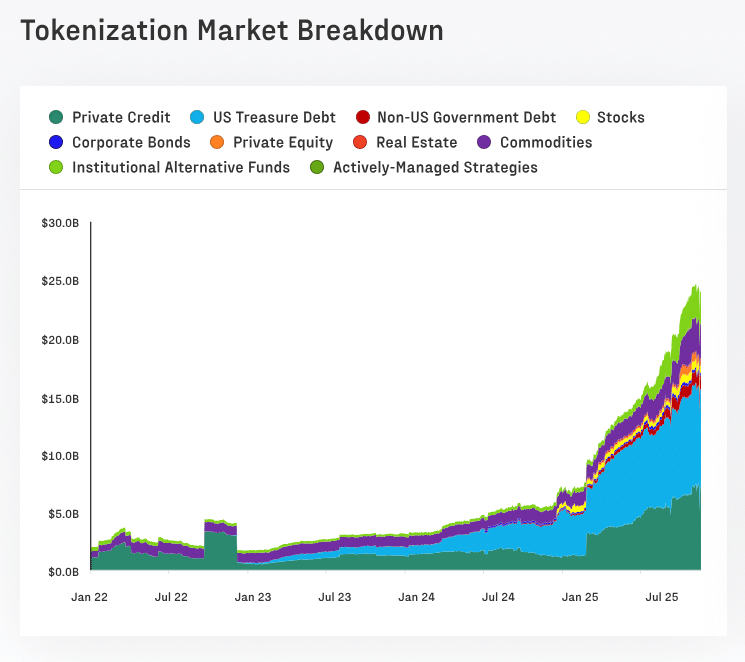

Profitable Sectors: RWAs, Layer-1s, and Utility-Pushed Networks

Sector efficiency mirrored this extra selective market, with stablecoins and real-world asset (RWA) tokenization persistently standing out as prime performers. Sakharov cited that stablecoin transaction volumes rose from round $32 trillion in 2024 to roughly $46 trillion in 2025, whereas Mamadou Kwidjim Toure, Founder and CEO of Ubuntu Tribe, and Elkaleh each highlighted RWAs as one of many fastest-growing segments, with tokenized Treasuries, credit score, and commodities shifting from idea to dwell merchandise. Elkaleh estimated:

Tokenized RWAs grew by roughly 260% in 2025, making it one of many fastest-expanding segments within the ecosystem this 12 months.

On the similar time, capital turned much less forgiving. Zahnd famous that high-throughput Layer-1 networks and main altcoins resembling Solana and XRP benefited from ecosystem development, ETF curiosity, and authorized readability, whereas long-tail DeFi and memecoins de-rated rapidly as soon as liquidity tightened.

Jawad Ashraf, CEO of Vanar Chain, added that Ethereum and its Layer 2 ecosystem outperformed on fundamentals, with DeFi’s whole worth locked approaching $165 billion. This indicated elevated utilization in programmable, utility-driven networks.

Taken collectively, 2025 ended as a transitional 12 months slightly than a decisive cycle peak or trough. The market absorbed report institutional inflows and outflows, reacted sharply to macro and political alerts, and more and more rewarded actual utilization, regulatory alignment, and scalable infrastructure.

As Zahnd summarised, crypto moved away from euphoria and right into a regime outlined by coverage, liquidity, and institutional decision-making. The manager informed 99Bitcoins:

I’d describe 2025 because the 12 months crypto moved from euphoria right into a extra mature, ETF- and macro-driven regime. We entered the 12 months driving the momentum of spot ETFs and new all-time highs, however the second half has been about digestion: report ETF outflows from Bitcoin and Ethereum, rising macro uncertainty, and a shift from greed to persistent worry on sentiment gauges.

With macro sensitivity now unavoidable, Bitcoin turned the cleanest expression of this new regime.

Bitcoin in 2025: The Institutional Period

Bitcoin’s market habits in 2025 turned more and more outlined by institutional capital flows slightly than retail hypothesis.

Its value rose by about 700% from the 2022 low and reached a brand new excessive of practically $126,000, growing its whole worth to $2.48 trillion, in line with the Glassnode × Fasanara Digital Belongings Report 2025.

The launch of spot Bitcoin ETFs marked a big milestone, because it supplied conventional monetary gamers with sustained entry to the market. The report famous that the launch despatched as much as $190 billion monthly into Bitcoin on the peak. In whole, greater than $732 billion flowed into Bitcoin throughout this cycle, surpassing the entire quantity from all earlier cycles mixed.

Business gamers additionally broadly agreed that Bitcoin has entered a brand new part, one the place entry, custody, and portfolio allocation matter greater than narrative-driven momentum.

Institutional Demand and Market Construction

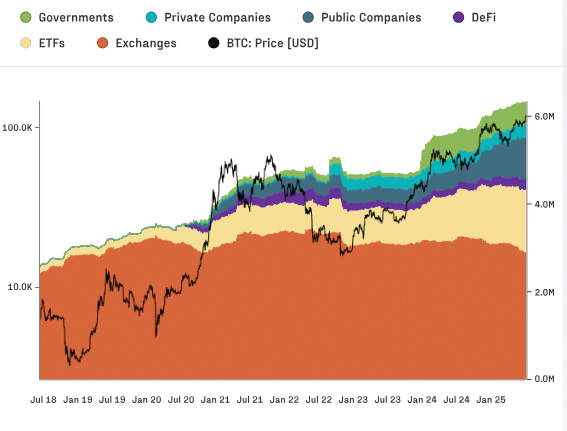

By the tip of the 12 months, 6.7 million BTC sat throughout ETFs, exchanges, and treasuries, in line with Glassnode. The platform described 2025 as Bitcoin’s “institutional provide period”.

Jeremy Dreier, Managing Companion at GoMining Institutional, described institutional demand because the dominant structural power behind Bitcoin’s trajectory in 2025.

Spot ETFs, company treasuries, and controlled funding automobiles made Bitcoin simpler to combine into present monetary workflows, successfully turning BTC into an allocatable line merchandise for registered funding advisors, non-public banks, and establishments.

Dreier emphasised that institutional allocators, as soon as onboarded by authorized and compliance frameworks, are typically “sticky” holders slightly than short-term merchants. Dreier informed 99Bitcoins:

The necessary half isn’t simply the flows, it’s who’s shopping for: RIAs, non-public banks, establishments, company treasuries. These gamers don’t flip out and in each week.

The consequence was a structural removing of provide from the market that retail participation alone couldn’t replicate. In line with Alexander Zahnd, interim CEO of Zilliqa:

Institutional demand by way of spot ETFs and listed merchandise remained the core structural driver of Bitcoin’s trajectory.

Even in periods of ETF outflows, he famous that the presence of regulated, liquid ETF automobiles allowed establishments to rebalance publicity slightly than exit the asset class solely, reinforcing Bitcoin’s function inside diversified portfolios.

Zahnd additionally noticed a rising, although extra nuanced, development of corporates treating Bitcoin as a treasury asset. Whereas early enthusiasm cooled as some crypto-exposed equities underperformed, the broader shift towards balance-sheet allocation remained intact, underscoring Bitcoin’s transition from speculative commerce to strategic asset.

That evaluation was echoed by Mamadou Kwidjim Toure, who characterised institutional participation as transformational. He estimated that mixed institutional and company inflows into Bitcoin exceeded $70 billion in 2025, in contrast with $30 billion the earlier 12 months and $5.7 billion 4 years prior. Thus, marking a decisive shift in Bitcoin’s demand base from crypto-native traders to macro portfolios.

These assessments mirror the development however possible understate precise Bitcoin demand. To see how that capital confirmed up in observe, we now look at value efficiency and the important thing catalysts behind every leg.

Value Efficiency and Key Drivers

7d

30d

1y

All Time

A number of executives described Bitcoin’s 2025 value motion as occurring in two distinct phases. Jamie Elkaleh of Bitget Pockets, famous that Bitcoin rallied to new highs above $120,000 in the course of the first three quarters of the 12 months, supported by sustained ETF inflows, regulatory breakthroughs, and macro optimism.

That rally gave method to a pointy This autumn correction as liquidity tightened, danger sentiment turned defensive, and profit-taking accelerated.

Based mostly on reviews and knowledge by Glassnode, we all know that Bitcoin’s value efficiency within the present cycle has been powered primarily by the sheer scale of recent cash coming into the market. A key issue has been the regulation of merchandise, which has led to extra widespread institutional participation.

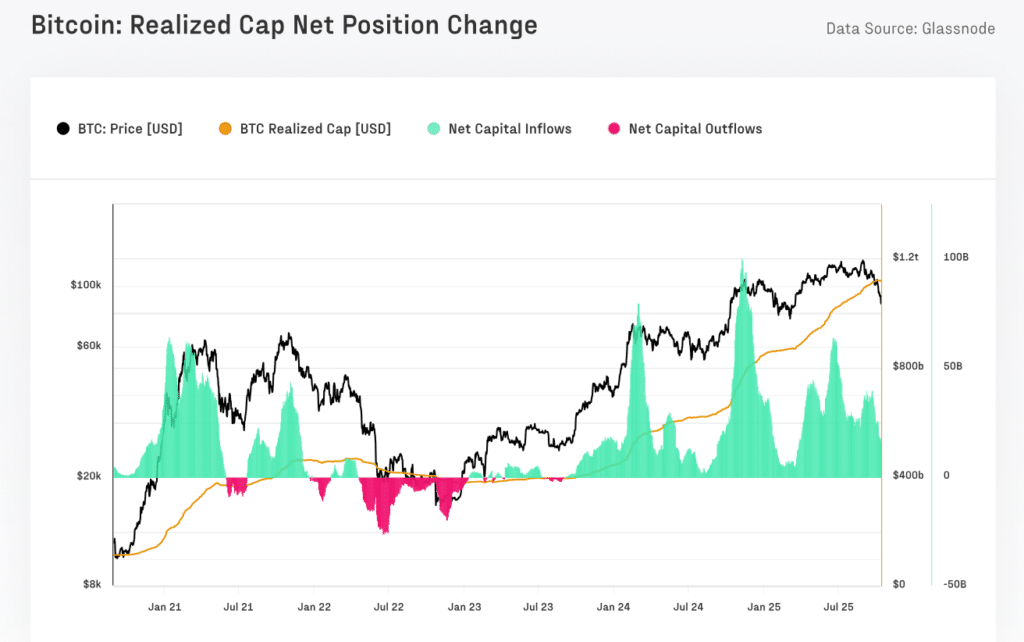

Bitcoin Realized Cap Progress by Cycle (Knowledge: Glassnode)

Bitcoin’s realized cap development highlighted how capital has entered the market throughout totally different cycles, providing a clearer view of long-term investor conviction. This metric reveals how every cycle has constructed on the final, reflecting Bitcoin’s growing maturity and adoption.

Cycle Interval

2011 – 2015

$4.4 Billion

2015 – 2018

$86 Billion

2018 – 2022

$388 Billion

2022 – 2025+

$732 Billion

Konstantins Vasilenko traced related dynamics, highlighting Bitcoin’s rise from roughly $90,000 to above $126,000 by early October earlier than a speedy sell-off tied to commerce battle fears, hawkish Federal Reserve alerts, and report ETF outflows pushed costs under $82,000 by late November. Vasilenko informed 99Bitcoins:

By mid-year, billions poured into Bitcoin and Ethereum ETFs. The cash got here primarily from banks, funds, and company treasuries.

In his view, the rally was pushed by pro-crypto coverage momentum and institutional inflows, whereas the correction mirrored how rapidly confidence can reverse when liquidity situations deteriorate.

From a market-structure perspective, Alexander Zahnd emphasised that ETF flows successfully turned Bitcoin’s new macro indicator. Document outflows from U.S.-listed BTC and ETH ETFs in This autumn coincided with Bitcoin breaking key assist ranges round $98,000 and retesting the low $90,000 vary, underscoring how carefully value motion had develop into tied to regulated capital motion.

Volatility: Decrease Extremes, Sharper Macro Sensitivity

The Glassnode × Fasanara Digital Belongings Report 2025 highlights that Bitcoin has develop into much less risky, with volatility lowering from 84% to 43%, indicating it’s evolving right into a extra secure, institutional asset.

Most executives agreed its volatility profile modified meaningfully in 2025. Vasilenko reported that Bitcoin’s 30-day realized volatility averaged round 38% by September, roughly half of 2024 ranges and much under the 85% swings seen in 2021.

This moderation may imply deeper liquidity, ETF participation, and extra systematic buying and selling methods, as per the business gamers.

Zahnd described Bitcoin’s volatility profile in 2025 as structurally totally different from prior cycles. Whereas volatility remained elevated in absolute phrases, it turned extra institutionalized as deeper derivatives markets and ETFs absorbed shocks extra effectively. The interim government, Zahnd, defined:

Volatility remains to be excessive in absolute phrases, nevertheless it’s turning into extra institutionalized. During the last 12 months, 30-day annualised BTC volatility trended within the 30-45% vary, meaningfully decrease than in earlier boom-bust cycles, however nonetheless above conventional property.

Sharp value strikes continued to happen round macro occasions and ETF movement shocks, however Zahnd famous that the rising presence of futures, choices, and ETF liquidity helped clean among the extremes, decreasing the frequency of sudden, disorderly crashes.

Nevertheless, that stability proved conditional. The October flash crash and subsequent sell-off reintroduced sharp swings as market makers pulled again and liquidity thinned, reinforcing the view that Bitcoin now behaves extra like a high-beta macro asset, able to relative stability in regular situations, however nonetheless vulnerable to violent strikes when risk-off dynamics dominate.

Productization of BTC

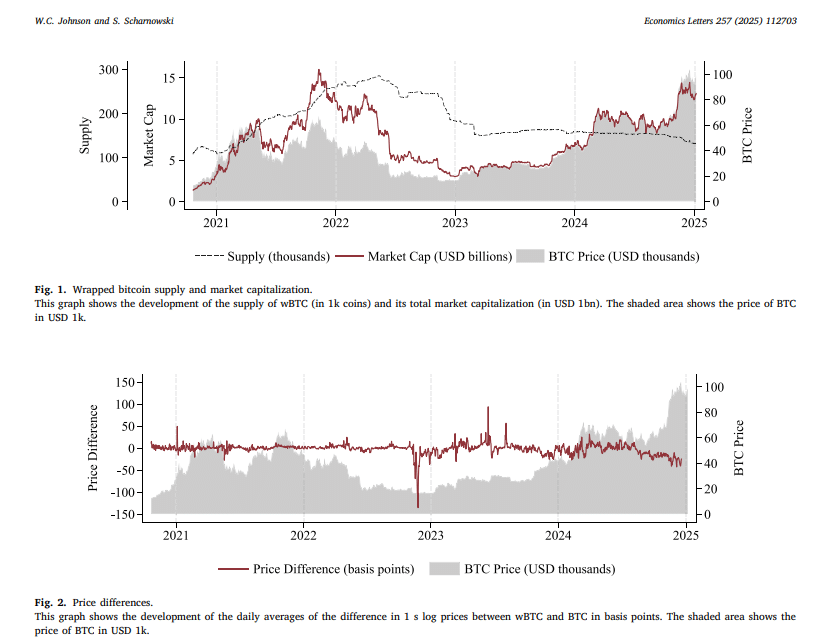

In 2025, Bitcoin was utilized in extra methods than simply holding it on the Bitcoin community. Extra customers began utilizing wrapped Bitcoin (WBTC), which is a 1:1 token model of BTC that runs on Ethereum and different smart-contract blockchains. This enables individuals to make use of their Bitcoin in DeFi apps to earn yield or present liquidity with out promoting their BTC

WBTC expanded to different chains, resembling Hedera, in 2025. It turned absolutely tradable and remains to be backed 1:1 by actual Bitcoin held by custodians on new networks.

On the similar time, blockchain knowledge confirmed that the highest three Bitcoin bridges managed about 32.7% of whole bridged TVL, with round $18.2 billion in property as of Q3 2025. This means that enormous quantities of Bitcoin have been actively shifting throughout chains based mostly on CoinGecko Q3 2025 Crypto Business Report.

Wrapped Bitcoin additionally began influencing how Bitcoin’s value is fashioned. MADOC examine on wrapped token value discovery discovered that about 10% of Bitcoin value discovery now comes from wrapped BTC buying and selling exercise, displaying that tokenized Bitcoin is now not only a utility software however an necessary a part of how BTC markets work.

Dreier and Toure each highlighted spot ETFs and compliant tokenized BTC merchandise because the fastest-growing section, as they allowed establishments to achieve publicity with out operational complexity.

Derivatives turned the workhorse of the Bitcoin market within the 12 months. In the meantime, futures, choices, and foundation trades enabled funds to generate yield and actively handle danger by leveraging Bitcoin’s volatility. Whereas tokenized and wrapped Bitcoin nonetheless powered exercise throughout Layer-1s and Layer-2s, Zahnd emphasised:

Tokenized and wrapped BTC on L1s and L2s continued for use in DeFi, however I’d say that 2025 was extra about trad-market rails than unique on-chain wrappers.

Whereas wrapped and tokenized BTC continued to matter in DeFi, Dreier famous that, in his view, probably the most under-discussed development space was institutional yield merchandise tied to Bitcoin mining infrastructure, which convert community exercise into cash-flowing funding automobiles appropriate for conservative capital.

Dominant Narrative Heading Into 2026

We now have talked about that Bitcoin is more and more being considered by an institutional lens. Dreier described BTC as a yield-generating reserve asset, the place traders focus not simply on holding it however on gaining publicity to the methods that produce it. Toure highlighted Bitcoin’s function as core collateral in a tokenized financial system, whereas Vasilenko pointed to rising adoption by governments and companies as the following main part.

As Dreier put it,

We’re previous the period the place the one query is “Ought to I personal Bitcoin?” For severe capital, the questions now are: “What proportion of our portfolio belongs in BTC? In what format – spot, ETF, fund, yield automobile? Can we flip this from a lifeless asset on the steadiness sheet right into a cash-flowing one?”

Trying forward, Zahnd described Bitcoin’s major narrative as its rise as macro-level collateral inside an ecosystem formed by ETFs and company treasuries. He argued that Bitcoin is more and more handled as a liquid, programmable reserve asset, positioned alongside Treasuries and gold, however with the next sensitivity to shifts in coverage, liquidity, and danger sentiment.

Collectively, these views level to a transparent shift in how Bitcoin is being handled going into 2026.

Bitcoin’s Product and Narrative Shift Heading Into 2026

The desk under summarizes the primary Bitcoin narratives from 2025 and the way they translate into product habits heading into 2026.

Narrative / Product Theme

What It Means in 2026

Yield-Bearing Bitcoin

BTC is now not simply held, it’s structured to generate returns.

Bitcoin as Reserve Asset

Bitcoin is handled like digital gold inside actual portfolios.

ETF-Pushed Entry

Establishments favor regulated wrappers over native BTC.

Bitcoin as Macro Collateral

BTC capabilities as high-beta macro collateral in finance.

Treasury Allocation Technique

Companies deal with BTC as a balance-sheet line merchandise.

Tokenized Financial system Spine

Bitcoin turns into base collateral for tokenized property.

Infrastructure Publicity

Traders purchase into the methods that produce BTC.

Programmable Reserve Asset

BTC is liquid, tradeable, and programmable throughout markets.

Portfolio Optimization Asset

Bitcoin is managed, not speculated on.

Coverage-Delicate Macro Asset

BTC reacts on to charges, liquidity and regulation.

In 2025, Bitcoin was positioned much less as an ideological outlier and extra as a macro asset embedded inside international monetary methods. Unstable, policy-sensitive, however more and more unavoidable. That shift is seen in value motion and investor habits. Additionally it is mirrored in how the Bitcoin community itself is getting used and the way worth is now flowing throughout the ecosystem.

Bitcoin’s Community Fundamentals

In line with the Bitcoin Suisse Outlook 2026 report, Bitcoin is now not getting used primarily for on a regular basis buying and selling or hypothesis. As a substitute, it’s beginning to behave like monetary infrastructure, much like how banks settle giant funds behind the scenes.

The report reveals that just about 90% of all crypto charges in 2025 have been earned by purposes, whereas the underlying blockchains earned lower than 10%, which implies most actual exercise and worth creation is now occurring on prime of networks slightly than straight on them.

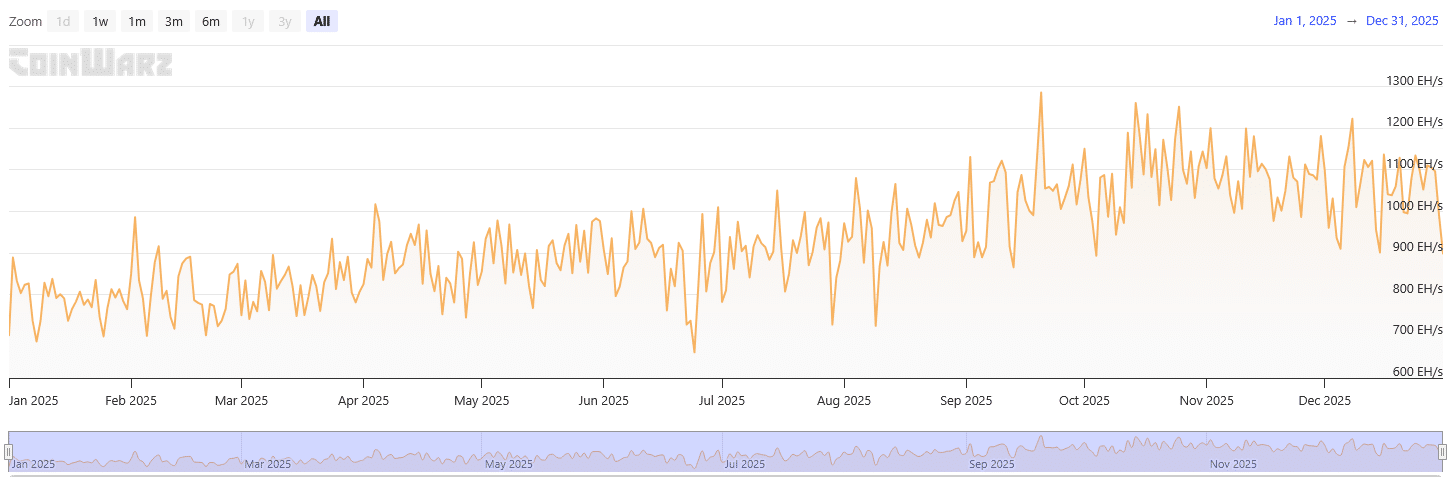

This shift helps clarify why Bitcoin’s function in 2025 moved away from enabling quick, low-cost transactions and towards functioning as a trusted settlement and collateral layer for the broader digital financial system. Supporting this transition, Bitcoin’s hash charge continued to climb steadily, from round 800 EH/s to nicely above 1,100 EH/s, displaying that miners saved including capability and confidence even in periods of sharp value pullbacks.

The temporary dips round mid-year possible mirror short-term miner stress and intervals of value weak spot, however the sturdy restoration within the second half suggests miners upgraded {hardware} and scaled operations as confidence in long-term Bitcoin demand grew.

Total, the development alerts a extra industrial, institution-backed mining sector that handled 2025 not as a boom-and-bust cycle, however as a construct 12 months for community safety.

Key Occasions That Formed BTC’s Value Transfer

In April, BTC’s value dropped round 30% to just about $75,000, adopted by one other 35% fall to about $81,000 in November.

Whereas each declines regarded extreme on the floor, they pushed Bitcoin solely into valuation zones usually seen in deep bear markets, but the value nonetheless held above the important $75K structural bull assist, which the Bitcoin Suisse Outlook report highlights as the important thing stage retaining the cycle wholesome.

Listed here are among the key occasions that formed BTC’s value transfer:

Approval and enlargement of spot Bitcoin ETFs, driving giant institutional inflows

Bitcoin reaching a brand new all-time excessive close to $126,000

Sharp market corrections triggered by leverage unwinds and liquidations

Rising U.S. rate of interest uncertainty and shifting macroeconomic alerts

Elevated regulatory readability throughout main jurisdictions

Rising adoption of Bitcoin as a treasury and reserve asset

Sustained development in Bitcoin hash charge regardless of value volatility

Broader risk-off sentiment impacting crypto alongside conventional markets

Notably, the October-November sell-off was brought on by a mix of short-term pressures, together with sentiment shifts and the unwinding of leverage, regardless of broader macroeconomic situations remaining supportive.

What stood out most was that Bitcoin closed the 12 months with its long-term uptrend firmly intact, reinforcing the view amongst consultants that the market is positioning for a extremely uneven upside heading into 2026.

In line with Zahnd, the dominant narrative for Bitcoin heading into 2026 is its rising function as a macro-linked reserve asset. He stated:

Bitcoin as macro collateral in an ETF and treasury world. It’s more and more handled as a liquid, programmable reserve asset that sits alongside Treasuries and gold however with its personal, higher-beta response to coverage, liquidity, and danger cycles.

As Bitcoin consolidated its function because the institutional anchor asset, consideration quietly shifted to the place exercise was really occurring. The same story performed out throughout Ethereum and its Layer-2 ecosystem.

Ethereum & Layer-2s

2025 was a significant 12 months for Ethereum, as per a report by The Block. Listed here are among the highlights:

ETH value stayed quiet, however the protocol was busier than ever.

The Ethereum Basis went by a management reset to refocus on long-term objectives.

The Pectra improve in Could launched account abstraction and boosted validator and Layer-2 efficiency.

Over 11,000 smart-account authorizations have been created inside per week of Pectra going dwell.

Ethereum launched its “Trillion Greenback Safety” push to make security and person expertise core priorities.

The community raised its block gasoline restrict to 60 million, bettering throughput forward of Fusaka.

Privateness, interoperability, and rollup scaling turned the primary focus areas going into 2026.

In line with Zahnd, 2025 was not a standout 12 months for Ethereum relative to Bitcoin in value phrases. The manager defined that Bitcoin retained its place as the first institutional allocation, whereas Ethereum underperformed throughout risk-off phases when capital rotated towards less complicated, extra liquid exposures. Additional including,

Ethereum’s fundamentals quietly improved, pushed by staking, L2 enlargement and the continued development of DeFi and RWAs on its rails.

Zahnd famous that staking participation, Layer-2 enlargement, and the continued development of DeFi and real-world asset exercise on Ethereum rails helped reinforce its long-term positioning even when these enhancements weren’t absolutely mirrored in value efficiency.

In his phrases, 2025 was “not a spectacular 12 months relative to BTC on a pure efficiency foundation, however a strong 12 months when it comes to constructing the bottom.”

How Staking Performed a Function?

Staking dynamics performed a central function in shaping ETH’s market habits. Excessive staking penetration, alongside liquid staking and restaking merchandise, made ETH behave extra like a yield-bearing asset.

Nevertheless, as yields compressed and danger urge for food light, flows more and more favored protocols with clearer charge seize and decrease perceived smart-contract danger.

Whereas staking diminished free-float provide, Zahnd emphasised that short-term value motion was nonetheless pushed primarily by derivatives positioning and ETF flows, slightly than Ethereum’s “ultra-sound cash” narrative.

On the infrastructure aspect, Zahnd highlighted that no single improve outlined Ethereum’s trajectory in 2025. As a substitute, a gradual accumulation of enhancements round prices, person expertise, and safety pushed extra exercise towards Layer-2 networks. Zahnd informed 99Bitcoins’ crew:

Completely different L2s led on totally different metrics, however Arbitrum and Base stood out when it comes to constant TVL, actual utilization and developer exercise, with zk-rollups and newer L2s nonetheless in ‘construct and iterate’ mode. Total, 2025 was the 12 months L2s turned regular infrastructure slightly than an experiment.

By the tip of the 12 months, L2s had shifted from experimentation to default infrastructure, with Ethereum mainnet more and more reserved for settlement, high-value transactions, and base-layer DeFi.

Layer-2 2025 Roundup

2025 was the 12 months Layer-2 lastly stopped feeling like a “nice-to-have” and have become extra infrastructure-focused. As a substitute of simply being utilized by crypto-natives, L2s began powering extra enterprise methods. Right here is how they quietly turned the place the place on a regular basis blockchain exercise now occurs, based mostly on analysis.

Complete Layer-2 TVL crossed $39.3 billion by November.

L2 networks dealt with over 1.9 million transactions per day.

Arbitrum dominated with about 51% market share and 1.37 million day by day energetic wallets.

Stablecoins powered the ecosystem, making up over 70% of all Layer-2 funds.

Retail L2 customers grew 42% year-on-year, pushed by decrease charges and simpler wallets.

Over 65% of recent good contracts have been deployed straight on Layer-2 as a substitute of the Ethereum mainnet.

Blockchain gaming and micropayments pushed L2 transaction volumes up by 50%.

Enterprises reduce prices by 30-40% by shifting workloads to non-public or permissioned Layer-2s.

Bridging instances dropped to beneath three minutes, making cross-chain transfers far smoother.

With Bitcoin performing because the macro barometer and Ethereum absorbing utility development, capital turned much more selective throughout the remainder of the market. Now let’s check out the broader narratives throughout markets.

Altcoins, Sectors & Narratives

In line with Zahnd, 4 altcoin narratives stood out in 2025:

Excessive-throughput Layer-1s, significantly Solana, continued to draw inflows and actual utilization even in periods of ETF outflows from Bitcoin and Ethereum. Progress was pushed by increasing DeFi ecosystems and high-velocity client purposes.

XRP’s revival adopted improved authorized readability and the launch of spot XRP merchandise, which introduced the asset again into institutional portfolios and supported extra constructive value expectations.

RWAs and tokenization gained momentum as tokenized Treasury merchandise, funds, and credit score swimming pools scaled beneath clearer regulatory frameworks, particularly within the EU.

DeFi 2.0 and DePIN protocols outperformed earlier yield-farming fashions by specializing in sustainable, fee-based income and real-world infrastructure resembling storage, compute, and connectivity.

Zahnd emphasised that these narratives shared a standard thread: capital more and more rewarded utility, compliance, and sturdiness, slightly than novelty.

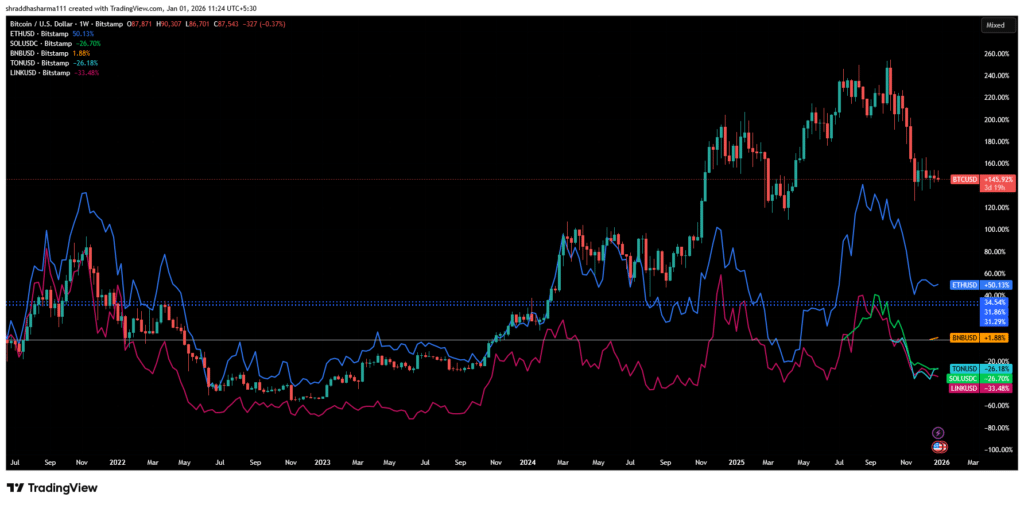

Excessive-Cap Alt Snapshots (ETH, SOL, BNB, TON, LINK)

Altcoin efficiency in 2025 was uneven, with capital concentrating in a small variety of high-liquidity property whereas speculative segments solely struggled in periods of tighter liquidity.

Ethereum (ETH) was the strongest main altcoin, ending the 12 months up round +50%, nevertheless it nonetheless lagged far behind Bitcoin’s +146% achieve, as per TradingView knowledge. ETH exhibited a number of failed breakout makes an attempt, suggesting that traders most popular Bitcoin publicity over smart-contract danger, regardless of sturdy ETF-driven flows.

BNB was the shock stabilizer. It completed roughly flat at +1.9%, making it one of many solely high-caps to keep away from deep losses. This displays BNB’s utility-driven demand contained in the Binance ecosystem slightly than speculative buying and selling.

Solana (SOL), Toncoin (TON), and Chainlink (LINK) all posted heavy drawdowns. SOL ended the 12 months down roughly 27%, TON about 26%, and LINK was the worst performer at practically 33%. These declines present how aggressively capital rotated out of growth-oriented altcoins as soon as Bitcoin dominance rose.

On a risk-adjusted foundation, Zahnd highlighted Solana because the standout high-cap altcoin of the 12 months. Regardless of broader market volatility, Solana continued to develop its ecosystem and attracted web optimistic ETF and product flows, whilst different main property skilled outflows. In a risk-off atmosphere, this resilience was considered as a robust sign of institutional confidence.

Solana’s mixture of low charges and speedy settlement has additionally made it a most popular venue for meme token launches in 2025. Let’s look at what’s occurring in that section in additional element.

Memecoins’ Efficiency in 2025

Memecoins turned energetic once more in 2025, particularly these launched by one of the best crypto launchpads. The share of memecoin market worth coming from launchpad initiatives rose from simply 1.5% in July 2024 to twenty.5% by January 2025, displaying a pointy return of speculative curiosity as per CoinGecko’s State of Memecoins Report 2025.

The report underlined that the day by day buying and selling quantity for these launchpad memecoins additionally surged, climbing from about $118 million in mid-2024 to roughly $1.2 billion by November 2025. Even so, they nonetheless represented solely round 20% of whole memecoin exercise, with independently launched tokens persevering with to dominate the market.

Speculative exercise in 2025 regarded markedly totally different from what crypto day merchants had come to count on in earlier cycles. Zahnd famous that whereas memecoins continued to expertise sharp value spikes, these rallies have been shorter-lived and extra tactical. The manager defined to us:

Memecoins nonetheless had speculative spikes, however the length of these pumps shortened and the rotation into them was extra tactical. With macro uncertainty excessive and ETF outflows dominating the highest of the stack, we noticed much less persistent retail mania than in 2023-24.

Has speculative buying and selling develop into extra tactical and short-lived? If sure, then the capital would possibly wish to rotate towards sectors with clearer utilization alerts. Gaming, metaverse platforms, and DePIN initiatives stood out in 2025 as a result of they generated measurable exercise. Right here’s what was occurring.

Gaming, Metaverse & DePIN

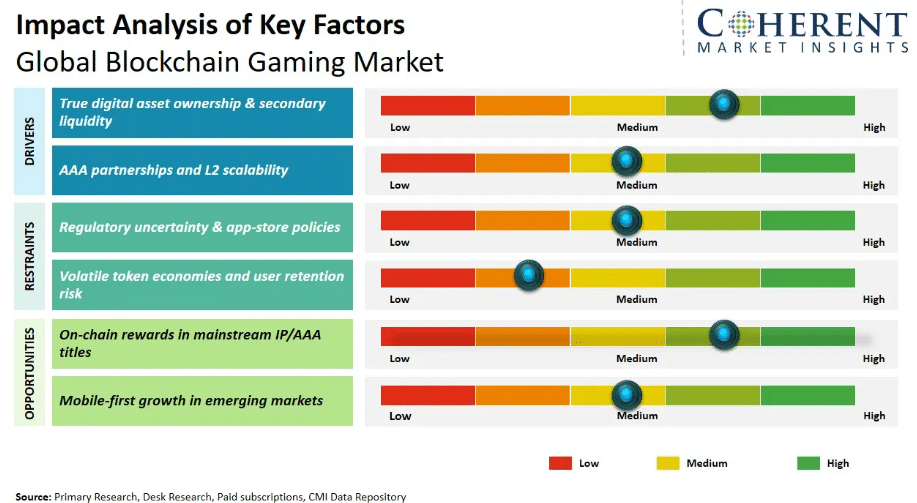

In distinction to the short-lived hypothesis seen in memecoins, gaming, metaverse, and DePIN initiatives attracted capital in 2025 by displaying actual utilization. Blockchain gaming emerged as a significant development engine, with the market valued at roughly $13.97 billion and projected to develop additional as participant possession fashions, NFT integration, and cross-platform interoperability drew in customers and builders, in line with Coherent Market Insights.

The identical demand sample was seen in metaverse gaming ecosystems, the place exercise scaled from roughly $275 million in 2024 to an estimated $409 million in 2025. Digital land gross sales and in-game economies contributed to what has develop into a multi-billion-dollar digital real-estate section, based mostly on World Progress Insights.

Alongside consumer-facing platforms, Decentralized Bodily Infrastructure Networks gained traction as Web3 prolonged into bodily methods. DePIN initiatives used token incentives to assist decentralized compute, connectivity, and knowledge storage, marking a shift towards real-world infrastructure tokenization.

Throughout all three sectors, capital more and more adopted measurable efficiency indicators resembling energetic wallets, transaction charges, in-game spending, and real-world utilization. Protocols that generated seen money flows and sustained engagement persistently outperformed these relying solely on token incentives. This additionally drove curiosity in tokenized real-world property, as they supplied acquainted yield devices on-chain with out the pure volatility of crypto.

RWA & Tokenized Belongings

Tokenized real-world property have been the fastest-growing institutional section in 2025, with whole on-chain asset worth tripling from $7 billion to $24 billion in simply 12 months.

Ethereum remained the dominant settlement layer, internet hosting round $11.5 billion in tokenized property. BlackRock’s on-chain BUIDL fund surged to $2.3 billion, turning into the biggest single institutional product on blockchain.

This shift reveals that tokenization has moved into actual infrastructure, as low-correlation real-world property are actually getting used to strengthen DeFi collateral and supply yield streams which can be much less depending on crypto market volatility.

Jawad Ashraf of Vanar Chain, described real-world property (RWAs) as one of the crucial consequential developments of the 12 months, significantly for institutional participation. Tokenized property, led by tokenized authorities bonds, surpassed $1.5 billion in circulation early in 2025, whereas the broader RWA sector grew past $25 billion.

Ashraf defined that RWAs functioned primarily as an on-ramp for conventional finance, permitting institutional traders to entry acquainted yields on-chain. By importing Treasuries, credit score merchandise, and different yield-bearing devices into blockchain environments, RWAs helped rotate capital towards DeFi protocols with clearer money flows and decrease volatility profiles.

He additionally famous:

The expansion of RWA infrastructure, involving compliant, KYC-gated wallets and standardized custodianship, started to standardize on-chain compliance, turning a distinct segment idea right into a foundational pillar for capital markets.

Deeper liquidity additionally raised the stakes for safety. Bigger platforms, bigger flows, and bigger custodial balances inevitably made 2025 the 12 months of fewer however extra catastrophic breaches.

Safety, Hacks & Exploits of 2026

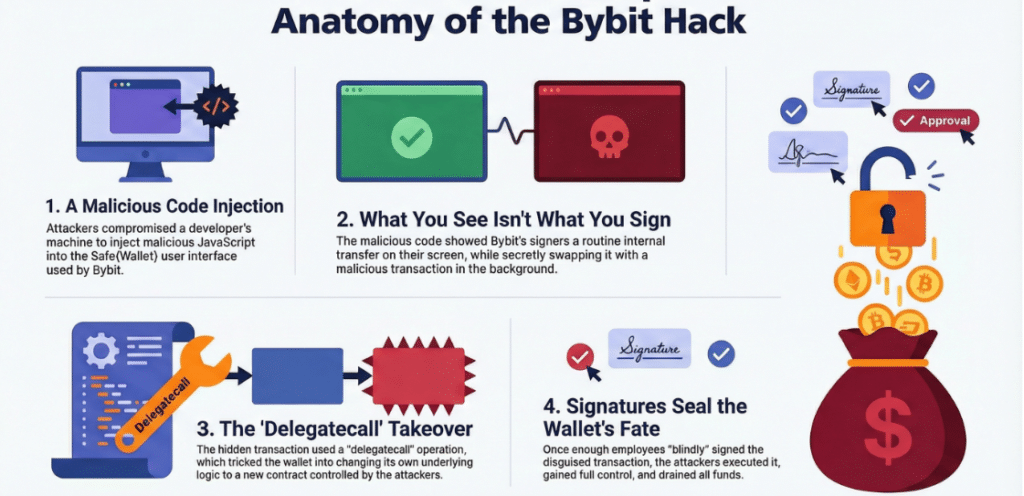

In 2025, crypto crime turned extra concentrated and extra extreme. In line with Chainalysis, over $3.4 billion in crypto was stolen in the course of the 12 months, regardless that the entire variety of hacking incidents really declined, displaying that attackers targeted on fewer however a lot bigger targets.

Regardless of significant enhancements in audits, tooling, and protocol design, 2025 underscored a persistent actuality: safety danger in crypto has shifted sooner than defenses. Throughout exchanges, DeFi protocols, and person wallets, attackers more and more exploited human and operational weaknesses slightly than purely technical flaws.

In line with Danor Cohen, CTO of Web3 safety agency Kerberus, the business has invested closely in audits and monitoring, however this progress has not translated into proportional reductions in person losses. Kerberus’ evaluation of 61 Web3 safety suppliers discovered that whereas good contract defenses improved, customers stay most uncovered on the transaction stage.

Cohen highlighted a important statistic: round 90% of exploited good contracts in 2025 had already handed audits. This discovering reinforces the view that audits, whereas crucial, are now not adequate on their very own. Losses more and more happen when customers approve malicious transactions, work together with compromised interfaces, or fall sufferer to social engineering, areas that conventional audits don’t cowl.

Yr’s Largest Hacks & Losses

In line with Chainalysis, the most important breach was the Bybit alternate hack, estimated at $1.4-$1.5 billion, and extensively linked to North Korean state-backed teams. The teams have been reportedly chargeable for over $2 billion in whole thefts in 2025, which was a 51% year-on-year improve.

Cohen additionally recognized the Bybit alternate compromise as probably the most consequential breach of 2025. The incident demonstrated that even giant, well-resourced platforms with sturdy technical safeguards stay weak to large-scale losses, significantly when attackers bypass protocol-level defenses and exploit operational or human weaknesses.

In parallel, Ashraf pointed to the $44.2 million CoinDCX insider breach in July as a defining second. Not like typical good contract exploits, this incident stemmed from compromised worker credentials used to empty an inside operational account. Ashraf emphasised that the breach compelled the business to confront a rising shift in danger from code vulnerabilities to operational safety, insider threats, and centralized entry controls.

Repeated Assault Vectors in 2025

Throughout incidents, widespread patterns emerged. Cohen reported that human-targeted assaults, together with phishing, social engineering, malicious dApps, and clipboard hijacking, have been chargeable for a whole lot of hundreds of thousands of {dollars} in losses, with an estimated $600 million misplaced in H1 2025 alone. Regardless of consciousness efforts, phishing click-through charges remained stubbornly excessive, at 7-15%, illustrating that schooling alone has not considerably diminished the danger.

Ashraf added that compromised admin keys, non-public key theft, and credential leaks have been a recurring root trigger behind a number of alternate and DeFi losses, pointing to failures in inside key administration and entry controls. He additionally highlighted enterprise logic and Oracle-related flaws, the place attackers manipulated stale or weak value feeds to inflate collateral values, points that require extra rigorous formal verification slightly than surface-level audits.

Zahnd echoed these observations, citing repeated failures in key administration, bridge and cross-chain routing logic, and compromised front-ends or official communication channels as constant contributors to losses. Massive DeFi exploits, such because the Balancer hack that drained over $100 million, strengthened the necessity for layered defenses, together with timelocks, circuit breakers, and formal verification.

Defensive Traits & Business Response

Whereas threats escalated, some defensive tendencies gained traction. Cohen emphasised that real-time transaction safety, methods that actively intervene in the mean time a person indicators a transaction, has emerged as the best complement to audits. Nevertheless, Kerberus’ analysis discovered that solely about 13% of safety suppliers at the moment supply such real-time safety, regardless of proof that high-quality implementations can obtain near-perfect detection of malicious transactions.

The takeaway from 2025, in line with the executives, is obvious: code safety has improved, however the assault floor has moved. As good contracts develop into more and more more durable to take advantage of, attackers are concentrating on customers, operators, and centralized management factors. With out broader adoption of user-centric, real-time defenses and stronger operational safety practices, systemic danger is more likely to persist into 2026. That actuality has additionally sharpened the deal with governance, oversight, and regulatory frameworks as important market infrastructure.

Crypto Regulation & Compliance in 2025

Regulation emerged as one of the crucial consequential forces shaping crypto markets in 2025, with clearer rulebooks throughout main jurisdictions translating straight into greater institutional participation and buying and selling volumes.

TRM Labs reviewed 30 jurisdictions protecting over 70% of worldwide crypto publicity and located that round 80% noticed monetary establishments launch new digital-asset initiatives. This additionally confirmed a direct hyperlink between regulatory readability and institutional enlargement.

Did Regulation Assist or Harm Confidence in 2025?

Nations with clear frameworks, together with the U.S., EU core markets, Japan, Korea, the UAE, Hong Kong, and Singapore, led in custody approvals, bank-backed stablecoins, and tokenized deposits, as per TRM Labs. This proved that banks now enter crypto when compliance guidelines are predictable.

In line with Paybis’ Vasilenko, jurisdictions that delivered concrete regulatory frameworks noticed fast quantity development, including,

Clear guidelines introduced in actual cash, and each jurisdiction that delivered regulatory certainty.

He pointed to the EU’s MiCA regime, the UAE’s VARA framework, and regulatory progress in Hong Kong, Singapore, and the U.S. as examples the place readability unlocked “actual cash” from institutional members slightly than deterring exercise.

This view was echoed by Ashraf, who argued that uncertainty, not regulation itself, has traditionally been the most important drag on confidence. In 2025, clearer tips round asset classification and stablecoin issuance diminished authorized danger for builders, banks, and company treasuries, enabling extra formal participation by international monetary establishments.

Zahnd acknowledged that regulatory transitions are hardly ever clean and may create short-term friction. Nevertheless, he emphasised that the mixed impression of spot ETF approvals, Europe’s regulatory readability, and ongoing coverage work within the U.S. strengthened the notion that crypto is turning into a everlasting element of the worldwide monetary system, slightly than a marginal or short-term asset class.

Regulatory Traits That Will Matter Most in Early 2026

TRM Labs underlined that stablecoins turned the centre of coverage worldwide in 2025. Trying forward, executives highlighted a number of regulatory developments anticipated to form the following part of adoption.

Aishwary Gupta, World Head of Funds at Polygon Labs, informed 99Bitcoins that the following part of crypto adoption can be settlement infrastructure-led:

They [Stablecoins] are impartial, programmable, interoperable, and liquid throughout borders. Tokenised deposits and bank-issued digital cash will play an necessary function, however largely inside regulated, permissioned environments.

Vasilenko recognized the passage of a U.S. stablecoin framework as a pivotal catalyst. In his view, as soon as absolutely compliant dollar-denominated stablecoin rails are established, competitors will intensify round who controls the dominant on-chain fee infrastructure, doubtlessly defining the following decade of worldwide digital funds.

He additionally famous that Europe’s MiCA regime is successfully “selecting winners” by creating standardized pathways for euro-referenced stablecoins and controlled service suppliers.

Ashraf targeted on the anticipated rollout of formal U.S. crypto market construction guidelines, together with clearer token taxonomies and exemptions for innovation. He argued that shifting away from regulation by enforcement towards a principles-based framework would considerably de-risk the asset class for establishments, whereas additionally attracting developer expertise and company treasury exercise again into compliant U.S.-based Web3 ecosystems.

Zahnd highlighted two complementary tendencies: the normalization of spot crypto ETFs past Bitcoin and Ethereum, enabled by extra generic SEC itemizing requirements, and the complete implementation of MiCA throughout the EU. Collectively, he stated, these developments are pulling crypto deeper into regulated monetary markets, influencing the place severe groups select to construct, domicile, and lift capital.

Whereas a number of main jurisdictions made tangible progress, uneven execution throughout markets raised questions on whether or not infrastructure maturity would hold tempo with accelerating institutional adoption and market development.

Manhar Garegrat, Nation Head India at Liminal Custody, famous that the following part can be outlined much less by coverage intent and extra by enforcement and operational rollout. As the manager put it:

2026 would be the 12 months of extremely developed digital asset frameworks – from discussions to demonstrations and to mandated implementations.

NFTs, Collectibles & Creator Financial system

The NFT market in 2025 underwent a interval of quiet transformation slightly than a dramatic revival or collapse. In line with Zahnd, exercise stabilized after a number of risky years, with annual NFT-related revenues settling within the $600-$700 million vary, nicely under the speculative highs of 2021, however notably extra constant and utility-driven.

Zahnd emphasised that the middle of gravity shifted away from short-term buying and selling towards sensible use circumstances, together with gaming property, ticketing methods, membership entry, and IP-linked collections. This transition marked a broader maturation of the sector, the place NFTs more and more functioned as infrastructure parts slightly than standalone speculative devices.

Market Dimension & Gross sales Traits

After a sluggish begin to the 12 months, NFTs made a robust comeback in late 2025. In October alone, NFT buying and selling quantity climbed to $546 million, up 30% month-over-month, whereas whole gross sales reached 10.1 million, the very best month-to-month rely of the 12 months, based mostly on DappRadar business reviews.

This rebound was pushed by a lot decrease costs, with the typical NFT sale falling from $321 in January to simply $54 by October, making NFTs much more reasonably priced. In line with DappRadar, person exercise additionally elevated, with 820,945 distinctive merchants finishing round 12 trades every. This development reveals that engagement shifted from hype-driven shopping for to common utilization.

The NFT Dapps market was valued at roughly $3.1 billion in 2025, with additional enlargement projected by the following decade.

Main Partnerships & Mainstream IP Offers

Some of the vital developments in 2025 was the rise of long-term model and IP partnerships.

Firm / Platform

Deal / Launch

Key Knowledge Level

Futureverse

Acquired Sweet Digital (MLB, Netflix, DC Comics IP)

Yuga Labs

Partnered with Amazon to launch Boximus NFTs

Doodles

Partnered with Kellogg’s Froot Loops

OpenSea

Introduced SEA platform token

Zahnd pointed to integrations throughout gaming, sports activities, style, and music, the place NFTs have been deployed as entry, loyalty, and licensing primitives slightly than collectibles meant for resale. These implementations targeted on embedding NFTs into present person ecosystems, prioritizing retention and engagement over secondary market quantity.

This strategy contrasted sharply with earlier NFT cycles, the place worth was largely pushed by shortage narratives and short-lived hype. In 2025, profitable initiatives have been these aligned with recognizable manufacturers, established platforms, and clearly outlined person advantages.

Trying forward, Zahnd expects the NFT and creator financial system to proceed consolidating. He anticipates fewer however higher-quality initiatives, extra tightly built-in into giant platforms and video games, with actual revenue-sharing fashions or practical entry rights changing speculative incentives.

As Zahnd put it:

The speculative mania period is probably going behind us; the infrastructure and licensing part is forward.

This framing means that whereas NFTs might now not dominate headlines, they’re turning into embedded within the broader digital financial system, positioned as a supporting layer for content material, commerce, and neighborhood slightly than a standalone asset class.

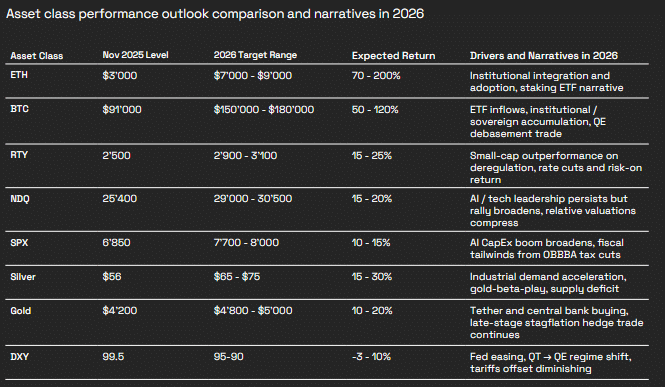

Predictions & What to Watch in 2026

Throughout market members, expectations for 2026 converge round a cautious near-term outlook adopted by a extra constructive medium-term trajectory, formed by macro situations, institutional participation, and regulatory readability.

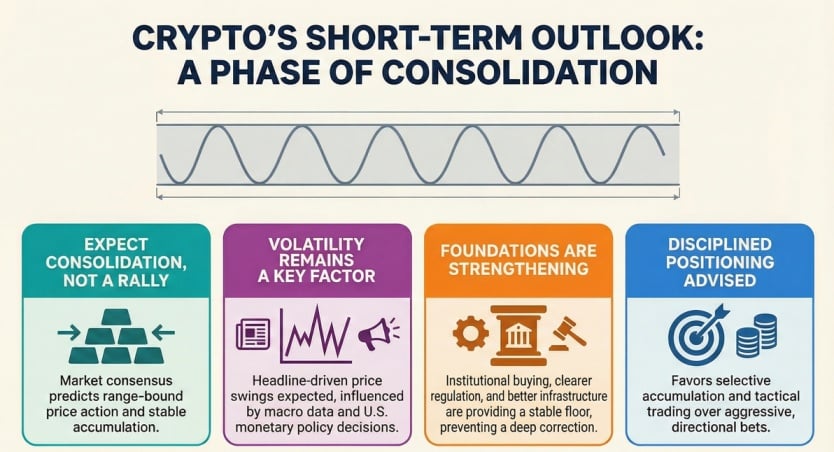

Brief-Time period Outlook (3-6 months)

Maksym Sakharov of WeFi expects traders to stay cautious within the close to time period as a consequence of elevated volatility and up to date corrections throughout main altcoins. Whereas market sentiment has at instances resembled a bear part, he factors to bettering structural situations, together with clearer regulation, increasing institutional merchandise, and rising use of crypto in funds, as indicators that the business’s basis is strengthening. In Sakharov’s view,

It might be a interval of transformative follow-through for the business. If that turns into the case, then slight value wobbles brought on by headline-driven tremors ought to be countered by real-world quantity from continued adoption round ETPs, stablecoin rails, and such.

Jamie Elkaleh additionally characterizes the following few months as a interval of consolidation slightly than a renewed rally. He anticipates range-bound value motion with intermittent volatility round macro knowledge and coverage choices, arguing that the atmosphere favours disciplined positioning and selective accumulation slightly than aggressive risk-taking.

Jawad Ashraf equally describes the near-term market as considered one of consolidation following a robust run-up. He notes that uncertainty round U.S. financial coverage continues to restrict upside momentum, however believes institutional shopping for stress is adequate to forestall a deep correction, making a secure accumulation part.

Konstantins Vasilenko takes a cautiously bullish stance, highlighting latest drawdowns and ongoing ETF outflows as constraints on a speedy restoration. Nevertheless, he argues,

The basics haven’t damaged. Political assist is locked in, institutional infrastructure is stronger than ever, and the halving provide shock remains to be working its manner by the system.

Alexander Zahnd describes the market as being in a “stress part,” marked by elevated worry, technical stress throughout main property, and rotating, slightly than disappearing ETF flows. His base case for the approaching months is a risky, range-bound atmosphere the place tactical buying and selling might outperform directional bets.

Medium-Time period Outlook (12 months)

Trying additional forward, most executives categorical a reasonably to strongly bullish view, contingent upon macroeconomic stabilization and continued institutional integration.

Sakharov expects diminished volatility in contrast with earlier cycles, pushed by deeper institutional participation, increasing use of stablecoins, development in real-world asset (RWA) tokenization, and bettering decentralized buying and selling infrastructure. In his evaluation, these tendencies assist crypto’s transition towards mainstream monetary infrastructure.

Ashraf is extra decisively bullish, pointing to a few structural shifts he believes will outline 2026: the convergence of AI and Web3 in capital administration, the scaling of tokenized non-public markets resembling credit score and personal fairness, and the gradual smoothing of historic four-year crypto cycles as ETF and treasury-driven demand turns into extra constant.

Elkaleh sees regulatory readability, significantly within the U.S., as a key catalyst that would unlock extra conservative swimming pools of capital. He argues that clearer guidelines round custody and market construction would assist renewed ETF and ETP inflows, whereas the enlargement of stablecoins and tokenized RWAs may anchor demand in utility slightly than hypothesis. He acknowledged:

As that readability improves, I count on ETF and ETP inflows to re-accelerate, significantly into Bitcoin, which may feasibly push towards the $200,000 mark over the following full cycle if macro situations cooperate.

Vasilenko stays bullish however measured, suggesting that Bitcoin may attain considerably greater ranges if institutional flows return and macro situations enhance. He highlights the rising function of stablecoins in funds and the speedy enlargement of tokenized real-world property as main drivers of longer-term development.

Zahnd’s 12-month outlook is equally constructive, with emphasis on coverage easing, stabilizing ETF flows, development in Layer-2 ecosystems, and regulatory progress throughout main jurisdictions. If these situations align, he suggests:

2025’s correction and worry part will possible be remembered because the consolidation earlier than the following leg greater.

Main Indicators to Watch in 2026

Regardless of differing outlooks, there may be broad settlement on the metrics that can matter most in 2026. These embody web ETF flows throughout main property, international liquidity situations and interest-rate coverage, stablecoin transaction volumes as a proxy for actual financial exercise, Layer-2 utilization and RWA tokenization development, safety incident frequency, and concrete regulatory milestones resembling MiCA implementation and new ETF listings.

Conclusion

Bitcoin possession is now structurally institutional by the tip of 2025. Provide is now not primarily managed by retail or whales, however more and more by ETFs, corporates, and custodial steadiness sheets. Regardless of BTC dropping momentum by the tip of the 12 months, the trendline is tough to disregard: crypto is now not being “moved” primarily by narratives on X; it’s being pushed by flows, coverage, and product developments.

If 2024 was the 12 months individuals requested “is crypto again?”2025 was the 12 months massive cash answered “sure, however on our phrases.” That’s why the market appeared sturdy on paper, with new highs, massive ETFs, and enormous sectors, but felt emotionally exhausting in real-time, marked by quick reversals, leverage wipeouts, and plenty of altcoins by no means getting their second.

Heading into 2026, that units up a really totally different sport than the final cycle. Upside should still be there, nevertheless it’s more likely to be earned by fundamentals, liquidity, and positioning, not simply hype. If ETF flows keep constructive, stablecoin rails hold scaling, and regulation retains shifting from “discuss” to “implementation,” the following part may look much less like a fireworks present and extra like a sluggish, institutional construct that sometimes spikes into mania when liquidity loosens.

The put up Crypto Market 2025: Yr-Finish Evaluation & Skilled Insights appeared first on 99Bitcoins.