Forward of the Federal Reserve FOMC assembly immediately, economists count on rates of interest to stay unchanged between the 4.25% and 4.5% vary. What would be the FOMC Bitcoin impression? Will BTCUSDT break $110,000?

Bitcoin, Solana, and a number of the greatest cryptos to purchase within the prime 20 are buying and selling inside tight ranges. BTC ▼-1.85% is down, capped beneath $105,500, whereas ETH ▼-1.51% is but to interrupt above $3,000. In the meantime, is struggling to shut above $170, down 11% in 24 hours, making it one of many prime losers within the prime 10, trailing .

Clearly, the crypto market and its individuals are continuing cautiously. Forward of the extremely anticipated Federal Open Market Committee (FOMC) assembly in the USA, Bitcoin merchants are centered on one key query: Will immediately’s Federal Reserve choice shift the tide for crypto property, triggering a wave of demand that lifts costs above essential liquidation ranges?

This query is related: Inflation, tariffs, and an unusually shaky macroeconomic backdrop, worsened by battle within the Center East, dominate headlines, requiring the central financial institution to maneuver with tact.

DISCOVER: 9 Finest Crypto Presales to Spend money on June 2025 – Prime Token Presales

The FOMC Dilemma: Will It Maintain or Reduce Charges?

Most economists and analysts count on charges to stay unchanged between 4.25% and 4.5%.

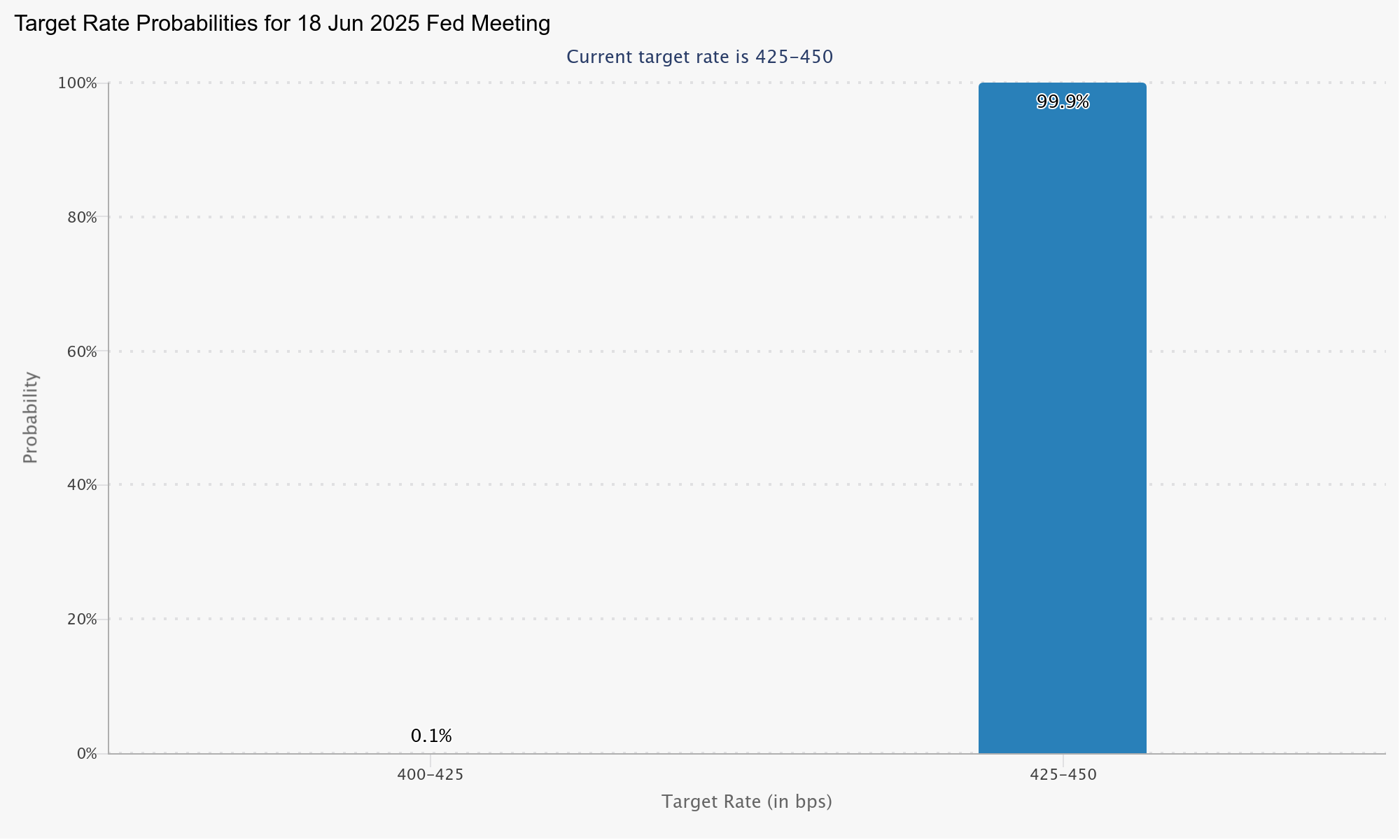

In keeping with the CME FedWatch device, the likelihood of the central financial institution holding charges regular is a staggering 99.9%.

(Supply)

Though the consensus is for charges to stay unchanged, Bitcoin merchants will carefully monitor what the Federal Reserve Chair, Jerome Powell, says through the press convention.

It is because, whereas rates of interest are the main target, the central financial institution’s ideas and ahead steerage are equally essential.

As within the Could 7 press convention, little change is predicted.

Powell will seemingly undertake a data-dependent stance, particularly given President Trump’s aggressive tariff agenda and combined financial information, notably on inflation.

Furthermore, the Federal Reserve is navigating a fragile balancing act between preserving charges low, across the benchmark 2%, whereas making certain financial progress regardless of rising debt ranges.

DISCOVER: Finest Meme Coin ICOs to Spend money on 2025

Impression of FOMC on Bitcoin

As seen through the 2021 crypto growth, crypto and Bitcoin costs thrive in periods of low rates of interest.

When the central financial institution eases financial coverage, extra money circulates, a few of which is invested in Bitcoin and different “dangerous” crypto property, together with a number of the greatest Solana meme cash.

Throughout such occasions, inflation additionally tends to rise.

Nevertheless, in contrast to 2021, the macroeconomic surroundings in 2025 is totally different.

The worldwide financial system is grappling with tariff wars, labor market uncertainty, and stagflation as a consequence of persistent inflation and sluggish financial progress.

Though core inflation slowed in Could 2025, it stays elevated, and tariffs may reignite worth pressures, particularly if no deal is reached with the European Union and China.

For that reason, if the Federal Reserve unexpectedly slashes charges towards economists’ forecasts, the Bitcoin worth may spike. There’s a likelihood that it might break above $110,000 by the top of the week.

Nonetheless, even when charges are minimize, the timing may very well be problematic. This view is contemplating the inflationary dangers posed by tariffs and a slowing financial system.

Consequently, a shock price minimize may set off capital flight to the USD and treasuries. Subsequently, there may very well be an sudden sell-offs in cryptos because the buck strengthens.

DISCOVER: 7 Excessive-Danger Excessive-Reward Cryptos for 2025

Will Federal Reserve Charges Maintain? FOMC Bitcoin Impression

Crypto merchants carefully monitoring the FOMC price choice

Will the Federal Reserve hold charges unchanged?

Macro surroundings combined as inflation and labor markets in focus

Will Bitcoin rip greater or dump?

The submit Crypto Merchants Watching Federal Reserve: What Will Be The FOMC Bitcoin Impression? appeared first on 99Bitcoins.