Analyst Weekly, November 24, 2025

Bitcoin: The Market’s Early Sign

Bitcoin’s taking an actual breather, down about 33% (as of Nov. 22 shut) from its October peak to round $80K after a $2.2B wave of liquidations. It’s not the primary time crypto’s been stress-tested: the October 10 selloff worn out $19B in leverage, draining liquidity from the system.

Flows in Flux

Spot Bitcoin ETFs have seen a pause in inflows, whereas some Digital Asset Treasuries (DATs) are rebalancing and stablecoin provide is tightening; all indicators of a market cooling off after months of heavy exercise. We stay cautious within the brief time period, however we’re assured within the long-term fundamentals.

What components are influencing the corrections?

Bitcoin’s dominance rises as altcoins endure deeper losses, however pressures from tight liquidity, institutional promoting, and weak demand, stay.

Macro and liquidity: the delay in charge cuts by the Fed and the momentary liquidity drain have weighed on threat belongings. The short-term correlation between world liquidity and the value of bitcoin is properly documented.

Technical: breakdown of key help ranges and the shifting common crossover (referred to as the dying cross), which reinforces promoting stress.

Institutional flows rotating: a part of the capital has moved in direction of mounted earnings or defensive equities, whereas the crypto ecosystem consolidates.

Quick-term stress could give method to a extra constructive surroundings within the coming weeks if world liquidity improves.

4Q25: Short-term shortage (tariff shock, shutdown, delayed stimulus).2026: We anticipate liquidity rebound as Fed easing and financial flows kick in.

Massive Image

Zoom out, and the story hasn’t modified: adoption, tokenization, and institutional integration proceed to advance. However proper now, it’s all about world liquidity tightening, and Bitcoin’s doing what it all the time does greatest: warning us first. We consider the key drawdown prior to now few weeks additionally invite long-term holders to evaluate their value foundation and probably re-evaluate their accumulation methods when considering long run.

Volatility Whiplash: Fee Cuts Steal the Present

Final week’s wildest chart wasn’t shares: it was charge lower odds. On Thursday, merchants noticed only a 35% probability of a December Fed charge lower. By Friday, that shot again above 60%, one other wild swing in a market that’s been flip-flopping for weeks on when the Fed will lastly ease up.

Market volatility final week stemmed extra from charge expectations than fairness worth motion.

Concern Lingers Beneath the Floor

Although the VIX (the “concern index”) appears to be like comparatively steady, merchants are paying up for draw back safety. The price of places versus calls (referred to as skew) is sitting close to the very best ranges in two years.

Meaning traders are nonetheless nervous about one other drop, even when issues look regular on the floor.

US Jobs Report: Respectable on Paper, Weak Below the Hood

September’s delayed jobs report regarded high-quality at first look, +119,000 jobs added, however the particulars advised a softer story. The pattern retains repeating: jobs studies look high-quality at first, however later get revised weaker as soon as the total information rolls in.

August obtained revised all the way down to -4,000 jobs, making it the second unfavourable month of 2025.

Prior months had been revised decrease by 33,000 jobs.

The unemployment charge rose +0.1% to 4.4%, with the labor pressure participation charge additionally as much as 62.4%.

The freshest jobs information isn’t trying nice: ADP’s weekly payrolls slipped by 2,500 in early November.

The Fed’s cut up however the voters lean dovish.

Most members wish to keep put for now since information’s been messy, however the important thing voters,like Governor Waller and NY Fed’s John Williams, are open to a December charge lower.

Our takeaway for the week: Count on heightened sensitivity to incoming financial information and central financial institution rhetoric. Market volatility is more likely to stay elevated as traders try to cost within the timing of the Fed’s subsequent transfer.

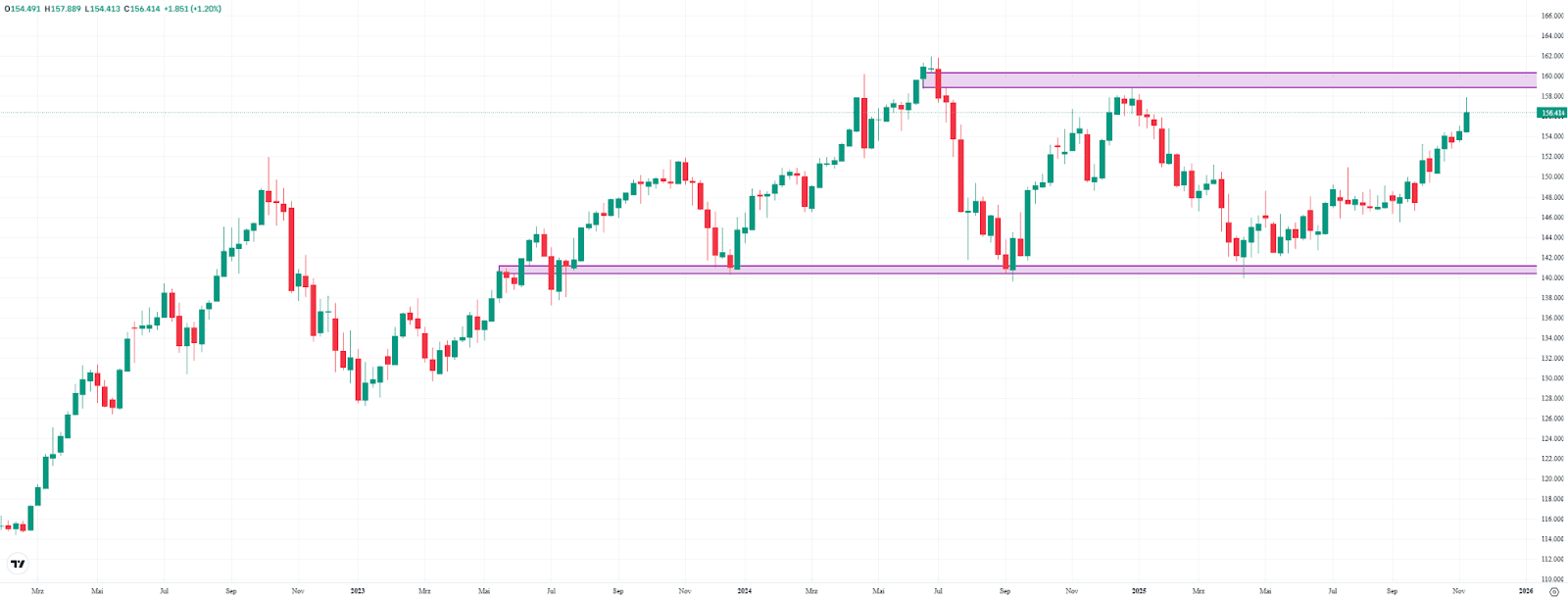

Nikkei Pulls Again, however Uptrend Stays Intact

The Japanese inventory index Nikkei (JPN225) ended final week down 3.4% at 48,710 factors. This widened the hole to its document excessive to over 7%. Nonetheless, the general uptrend stays intact, as seen within the increased highs and better lows over current years (see chart).

Apparently, the index managed to carry the decrease boundary of its help zone (Truthful Worth Hole) between 48,490 and 49,930 factors final week. From a technical perspective, this means an excellent probability of a rebound and probably a brand new all-time excessive.

Nevertheless, if this zone had been to interrupt, the following key help space can be between 43,220 and 44,480 factors. For the reason that market stays in an prolonged upward part, the Nikkei might face up to deeper pullbacks with out placing the long-term uptrend in danger.

Nikkei, weekly chart. Supply: eToro

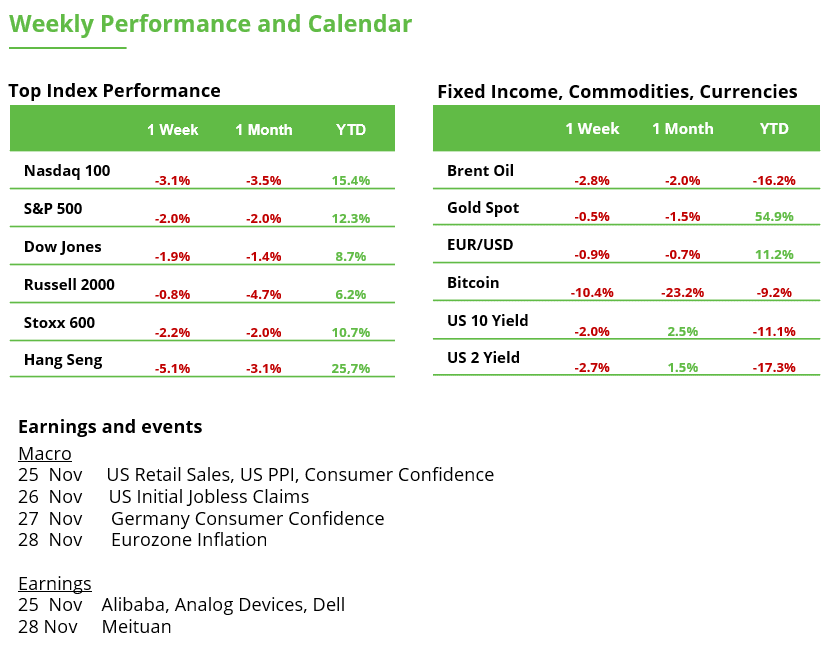

USD/JPY: Yen Continues to Lose Floor

The USD/JPY rose 1.2% final week to 156.41. For the reason that April low, the yen has misplaced round 12% towards the greenback. Again then, help round 140 was as soon as once more defended – a stage that has repeatedly prevented a deeper sell-off lately.

At current, a lot factors to a check of the resistance zone (Truthful Worth Hole) between 158.85 and 160.33. It wouldn’t be the primary try. Consumers had been rejected at this stage again in January. Nevertheless, the extra typically a resistance is examined, the upper the possibility of a breakout.

A break above final yr’s excessive would push the pair to its highest stage since 1986 and unleash additional upside potential. For now, it stays to be seen whether or not patrons can be stronger this time or face one other rejection, as they did in January.

USDJPY, weekly chart. Supply: eToro

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding goals or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.