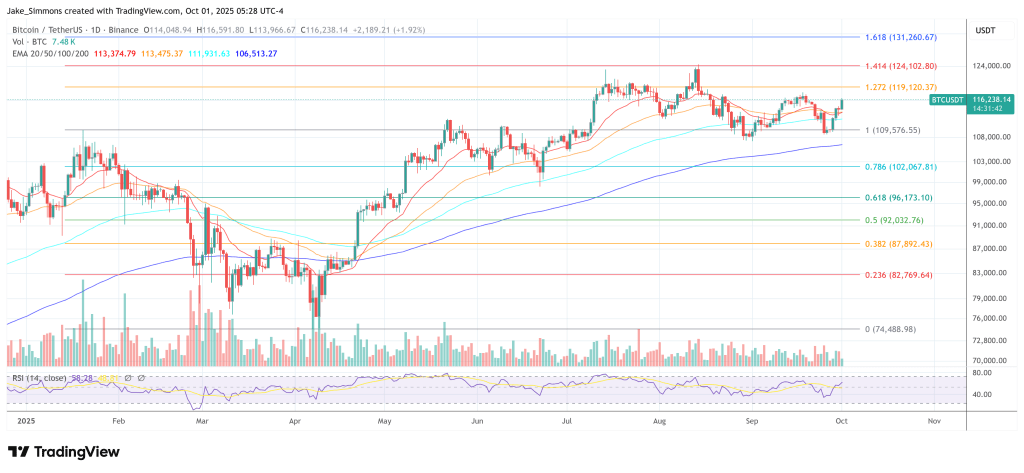

Crypto analyst Dealer Mayne is cautioning that Bitcoin could also be establishing for a sharper drawdown earlier than resuming its broader uptrend into year-end, arguing {that a} “$98,000 weekly liquidity stage” sits uncollected under worth and may very well be focused early in October.

Two Worth Situations For Bitcoin

In a video evaluation posted on September 30 titled “Did Bitcoin Simply Prime? The Sign Everybody’s Ignoring…,”Mayne outlined a two-track playbook: a tactical lengthy on a lower-timeframe liquidity sweep that would precede a deeper correction, and, if that setup fails, a decisive flush that takes out $98,000 earlier than a fourth-quarter continuation increased.

Associated Studying

“TLDR — I feel we’re due for a bigger correction quickly, to take out the $98k weekly liquidity stage,” Mayne wrote in his teaser through X, including that “there could also be a brief time period lengthy arrange that precedes that correction” and that he nonetheless expects increased costs in This autumn, making “an early dump…a shopping for opp.”

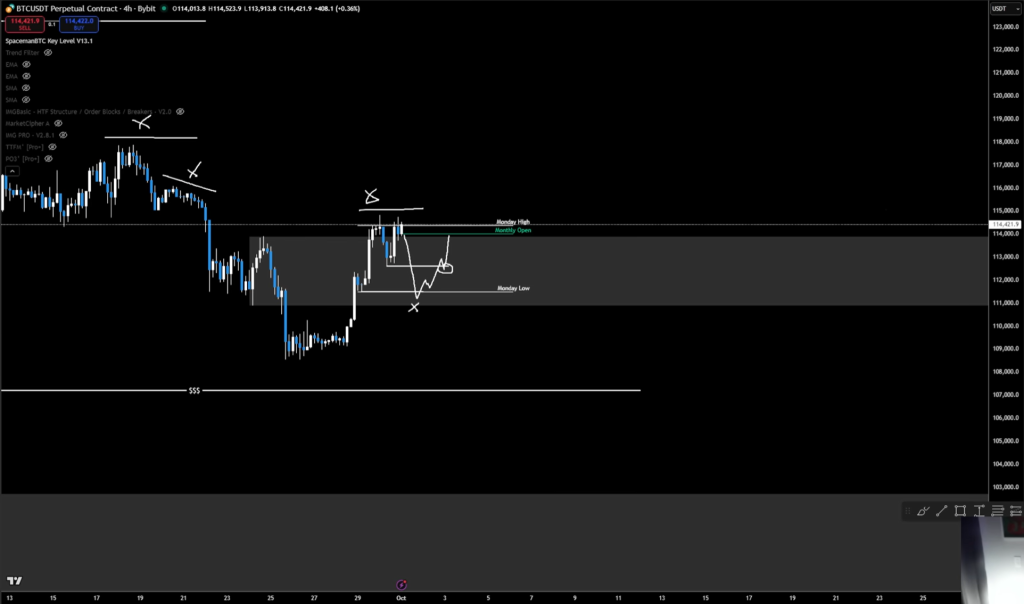

On Bitcoin’s construction, Mayne mentioned the market has revered his current roadmap: a push up, a retest, and now a choice level outlined by higher-timeframe “breaker” ranges and intraweek lows. “We had the each day flip bullish on Bitcoin, proper? We closed above the breaker,” he mentioned, noting that whereas the month-to-month chart can be constructive, “the weekly chart is technically bearish.”

With two increased timeframes leaning bullish in opposition to a smooth weekly, he’s seeking to the four-hour chart to synchronize the following commerce. “If the H4 is bullish, which it’s, if I take a setup on some kind of liquidity run on the H4, that’s going to sync me again up with the each day not less than.”

Associated Studying

The fast set off, in his view, is a sweep of native lows to tighten danger fairly than “aping” right into a broad retest with a large invalidation. “I want to see considered one of these H4 little liquidity swimming pools right here get run after which…that turns into my setup and my cease is tight. I’ve clear targets over right here,” he defined.

He highlighted “Monday’s low” as a related pivot that, if taken, might produce a mean-reversion lengthy into a close-by each day bearish breaker and prior highs. “Possibly we even run this primary, proper? After which get the pullback. However both approach, that’s what I’m on the lookout for on Bitcoin right here.”

Mayne underscored that invalidation is non-negotiable. If worth loses the intraweek baseline on a closing foundation, he abandons longs and prepares for a bigger washout. “If Bitcoin will get an H4 shut under right here…we’ll most likely nuke to $98,000,” he mentioned, tying the set off to a failure again under Monday’s low and the vary flooring. In different phrases, the identical liquidity dynamics he seeks to use for a tactical bounce might, in the event that they break, speed up the “$98k” clean-out he believes the weekly chart nonetheless “owes.”

One Final Dip Earlier than This autumn Fireworks

He mapped the Ethereum construction as analogous, with the each day and 12-hour traits flipping constructive right into a weekly order block, however with the identical want for a exact entry through a low-timeframe liquidity seize. “ETH very comparable, proper? We had the each day flip bullish…we’ve obtained the breaker. It’s retesting this order block right here,” he mentioned. He described an H12/weekly mixture the place a “weekly SFP” and “construction break” are in movement, however careworn placement of the cease stays “tough” except a Monday-low sweep gives a cleaner set off. “To me, ETH appears to be like good right here to fill in a few of this…assuming we will get that setup,” he added.

The conditional nature of the plan is central. Mayne is prepared to try continuation longs into close by resistance if and provided that the market prints the sweep that tightens his invalidation. Failing that, he expects draw back first. “If we don’t get this little setup to right here, I feel there’s a really sturdy probability that we’re going to, you recognize, not less than do considered one of these, proper? and nuke this liquidity right here after which get the actual transfer up,” he mentioned. He reiterated the timeframe examine: “If we get an H4 shut under Monday’s low [near $111,000]…all bets are off and we would really begin the month of October down.”

Regardless of the warning, the macro-tactical stance stays buy-the-dip for This autumn. Mayne repeatedly framed any early-October weak point as a chance fairly than the beginning of a cyclical high. “Finally, I’m of the mindset that…this dip that will come, whether or not it’s from proper right here or after a push increased…is a dip we need to purchase ’trigger we’re within the endgame right here,” he mentioned. “It’s October, November, December. We’re in This autumn… I imagine we commerce increased in This autumn.”

At press time, BTC traded at $116,238.

Featured picture created with DALL.E, chart from TradingView.com