US Senator Cynthia Lummis (R-WY) on Tuesday praised the Trump administration’s coordinated crackdown on the Prince Group, a Cambodia-based conglomerate that US authorities allege ran forced-labor “pig-butchering” cyber-fraud compounds and laundered felony proceeds by means of bitcoin at unprecedented scale.

A Win For The US Strategic Bitcoin Reserve?

Federal prosecutors in Brooklyn unsealed an indictment charging Prince Group chairman Chen Zhi with wire-fraud and money-laundering conspiracies, whereas the Justice Division filed a civil forfeiture criticism in opposition to roughly 127,271 BTC—about $14–$15 billion at present costs—now in US authorities custody. The Treasury Division, in parallel, designated Prince Group a transnational felony group and moved to sever the Huione Group from the US monetary system.

“One other @POTUS win and a victory for human rights, monetary integrity, and American management,” Lummis wrote on X. In a thread highlighting the scale of the crypto takedown, she added: “The seizure of 127,000 bitcoin underscores two pressing priorities for Congress: first, passing clear digital asset market construction laws to make sure legislation enforcement can act decisively in opposition to dangerous actors whereas defending innovation… Second, codifying how seized bitcoin is saved, returned to victims, and safeguarded for future generations. Turning felony proceeds into belongings that strengthen America’s Strategic Bitcoin Reserve reveals how sound coverage can flip wrongdoing into lasting nationwide worth.”

The underlying case is sprawling. Prosecutors say Chen directed Prince Group’s community of Cambodian compounds the place trafficked employees—detained and abused—have been pressured to run on-line funding and romance-bait frauds, siphoning billions from US and international victims. The EDNY submitting describes the bitcoin cache as proceeds and instrumentalities of the schemes that Chen beforehand managed by way of unhosted wallets; it calls the motion “the most important forfeiture motion within the historical past of the Division of Justice.”

The information ricocheted by means of crypto-forensics circles. Arkham, which tracks government-linked wallets, acknowledged: “The US Authorities has submitted at present a submitting for the forfeiture of 127,271 $BTC… These Bitcoins at the moment are confirmed to be below US Authorities management. It’s the most important forfeiture case of all time.” Whereas on-chain analytics corporations don’t decide authorized possession, their affirmation that the belongings moved to US-controlled addresses aligns with the Justice Division’s representations to the courtroom and Treasury’s sanctions actions.

Does The US Authorities Have To Promote?

The speedy coverage query for markets is whether or not the administration will promote—or maintain—this bitcoin. Right here, the reply is extra constrained by legislation and course of than by politics. The Trump White Home’s March 6, 2025 govt order (EO 14233), “Institution of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile,” created a framework below which the reserve is initially capitalized with bitcoin “owned by the Division of the Treasury that was lastly forfeited as a part of felony or civil asset forfeiture proceedings or in satisfaction of any civil cash penalty.”

Underneath EO 14233, authorities BTC positioned into the Strategic Bitcoin Reserve “shall not be bought” besides when the Treasury workouts its lawful stewardship authority, when a courtroom orders disposal, or when the Lawyer Normal or one other company head determines the belongings (or proceeds) needs to be returned to identifiable victims, used for law-enforcement operations, equitably shared with state and native companions, or launched to fulfill statutory necessities

Thus, the authorized sequencing issues. Tuesday’s 127,271 BTC is in authorities custody pending the result of the civil forfeiture case. Solely after ultimate forfeiture—by means of settlement or judgment—can the belongings be disposed of or allotted below the EO’s hierarchy, which places sufferer restitution first.

Politically, Lummis is pushing for Congress to lock within the coverage structure she outlined on X: market-structure laws that empowers decisive motion in opposition to illicit finance with out kneecapping innovation, and statutes that “codify how seized bitcoin is saved, returned to victims, and safeguarded for future generations.” That second plank is the legislative counterpart to EO 14233’s administrative framework.

As for the market’s operative query—will the US below Trump promote this BTC?—the present alerts level to restraint, not speedy liquidation. The DOJ has affirmed the bitcoin is in US custody whereas the case proceeds; the EO presumes reserve remedy for lastly forfeited BTC after sufferer claims; and senior Republicans like Lummis are explicitly lobbying to embed that method in statute. Till the courtroom enters a ultimate forfeiture order and sufferer restitution is addressed, there’s nothing to promote. If and when these hurdles are cleared, the default, per the 2025 framework, is to deal with the BTC as a part of a Strategic Bitcoin Reserve somewhat than public sale it—until Congress or a courtroom directs in any other case.

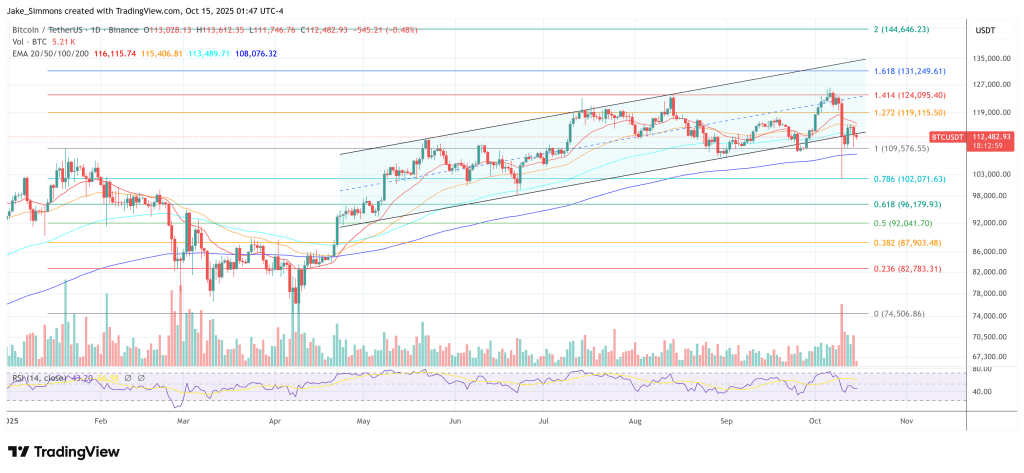

At press time, Bitcoin traded at $112,482.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.