Shares of Coca-Cola have been a stalwart inside the marketplace for generations. The Every day Breakdown digs into its long term on Wall Avenue.

Earlier than we dive in, let’s be sure to’re set to obtain The Every day Breakdown every morning. To maintain getting our every day insights, all you could do is log in to your eToro account.

Deep Dive

The Coca-Cola Firm has constructed one of many world’s strongest manufacturers, manufacturing, advertising, and promoting a variety of nonalcoholic drinks. Whereas it’s best recognized for its flagship product — Coca-Cola — different notable manufacturers embrace Sprite, Fanta, Schweppes, BodyArmor, Dasani, Powerade, Topo Chico, Merely Orange, Minute Maid, and Fairlife.

The corporate additionally provides beverage concentrates and syrups — together with fountain syrups — to clients similar to eating places and comfort shops. It operates by way of a community of impartial bottling companions, distributors, wholesalers, and retailers, in addition to its personal bottling and distribution operations. Based in 1886, Coca-Cola is headquartered in Atlanta, Georgia.

The Dividend

Coca-Cola is just not sometimes considered as an rising progress inventory, however slightly as a longtime, blue-chip shopper staples title. It is usually recognized for a steadily rising dividend: the corporate has raised its dividend for 63 consecutive years. The inventory at present yields almost 3%, and its payout has remained constant over time regardless of fluctuations in income.

Future Progress Projections

The chart above reveals some wild fluctuations within the agency’s income, however it’s been a lot steadier since 2020. Analysts count on that steadiness going ahead. In keeping with Bloomberg, analysts mission the next:

Earnings Progress: 7.8% in 2026, 6.6% in 2027, and seven.5% in 2028

Income Progress: 5.3% in 2026, 3.9% in 2027, and 4.6% in 2028

Analysts at present have a consensus value goal of ~$79.50 on KO inventory, implying about 13% upside to as we speak’s inventory value.

Wish to obtain these insights straight to your inbox?

Join right here

Diving Deeper — Valuation

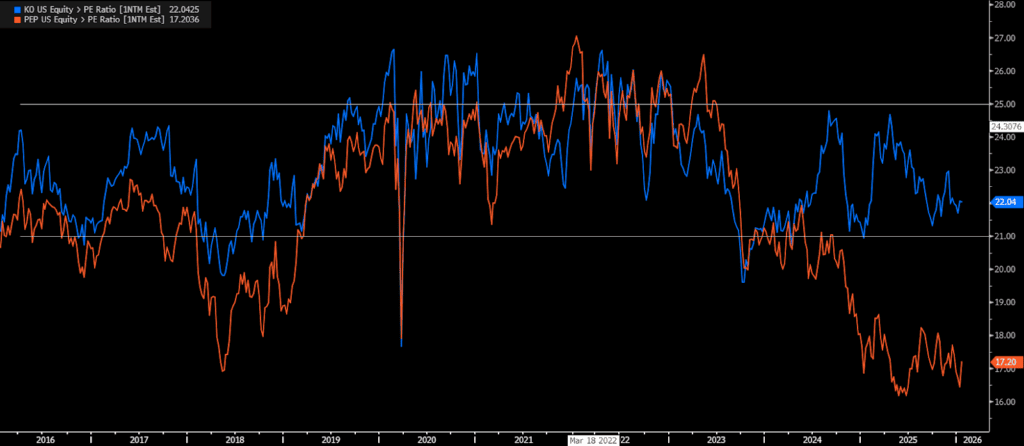

Under is a take a look at the ahead P/E ratio for Coca-Cola (in blue) and PepsiCo (in orange). Discover that each valuations tracked pretty carefully during the last decade, though PepsiCo’s has fallen significantly relative to Coca-Cola’s lately. That displays PepsiCo’s efforts to regular its enterprise after a interval of inconsistency (see our Deep Dive from July). It’s additionally price noting that, together with dividends, KO has outperformed PEP — 68% vs. 21% during the last 5 years and 132% vs. 111% during the last decade.

Additionally discover that Coca-Cola’s ahead P/E has principally traded between ~21x on the low finish and ~25x on the excessive finish over the previous decade. After the COVID-19 selloff and the following 2022 bear market, KO shares traded at a premium as traders sought security. Nevertheless, the valuation has since returned to the decrease finish of its 10-year vary.

Dangers

Coca-Cola’s key dangers embrace shifting shopper preferences away from sugary drinks and elevated regulation. Profitability will be pressured by risky enter and packaging prices (sweeteners, aluminum, PET), foreign-exchange swings, and pricing/combine execution. Client spending is one other variable if financial situations deteriorate within the quarters or years forward. Lastly, intense competitors throughout drinks — together with supply-chain disruptions and geopolitical instability — might weigh on quantity and margins.

The Backside Line

Shopping for Coca-Cola is just not like shopping for Palantir, Amazon, Nvidia, or different high-growth tech names. This inventory is healthier considered as a value-oriented, blue-chip holding slightly than a progress story. It’s recognized for a mature enterprise mannequin and regular dividend funds, which can trigger it to lag the broader market over time (KO is up 68% during the last 5 years versus a 98% acquire for the S&P 500). Some traders will settle for that trade-off for stability, whereas others will desire firms with stronger upside potential.

Disclaimer:

Please be aware that attributable to market volatility, among the costs might have already been reached and situations performed out.