Dogecoin is confronting a dense provide overhang on the $0.21 neighborhood, the place on-chain knowledge present a putting focus of realized price. Market analyst Ali Martinez (@ali_charts) highlighted a Glassnode cost-basis distribution heatmap exhibiting a heavy band at that stage

Dogecoin Bulls Face $2.2 Billion Wall

“10.50 billion $DOGE had been collected at $0.21. That’s a giant resistance zone forming. Maintain this stage in your radar!” he wrote. The underlying tooltip on Ali’s chart (timestamped Oct. 19, 2025, UTC) pinpoints a Price Foundation Vary: $0.21062334–$0.21144839 with Provide: 10,575,420,761.332544 DOGE clustered there. At $0.21, that cohort represents roughly $2.22 billion in provide.

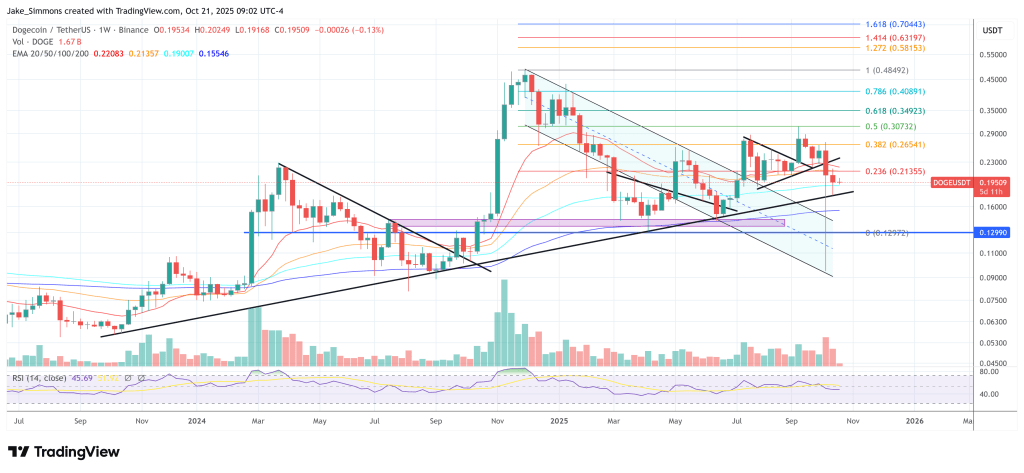

The technical context round that very same band provides weight to the on-chain studying. In a separate TradingView chart shared Oct. 20, Ali famous that Dogecoin “simply bounced off the channel help and appears set to climb. Eyes on $0.29 first, then $0.45 and $0.86.”

Associated Studying: Is The Dogecoin Bull Run Over? Analyst Sees Echoes Of 2021

His channel overlay tracks value respecting an ascending construction throughout a number of checks since 2023, with intermediate waypoints aligning intently to classical retracement and extension ranges. Notably, the $0.21 space intersects the 0.618 retracement at ~$0.21205 on his plot—an overlap of technical and realized-price resistance that helps clarify the present stall and the significance of clearing this shelf with convincing quantity.

DOGE Whales Proceed To Accumulate

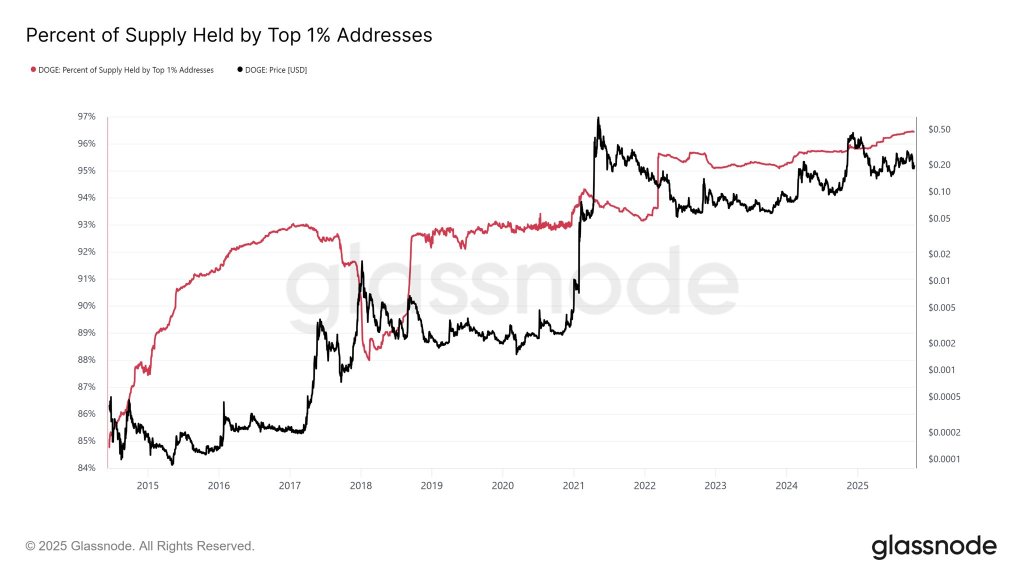

A separate on-chain lens from Cryptollica (@Cryptollica) focuses on holder focus dynamics. Sharing a long-horizon chart titled “P.c of Provide Held by High 1% Addresses,” the analyst noticed, “The provision held %1 knowledge downward pattern has not but been seen as the value strikes towards a brand new all-time excessive. To the moon > Goal: $1.30.”

The graphic reveals the top-1% cohort sustaining an elevated—and lately rising—share of provide as value has recovered from the cycle lows. Whereas such focus is commonly interpreted as a proxy for large-holder conviction or tighter float, it will probably concurrently amplify directional strikes when these balances rotate; for now, the absence of a downtrend within the metric suggests no broad distribution from the biggest addresses has materialized.

Associated Studying

Learn collectively, the three alerts sketch a coherent near-term battleground. First, the cost-basis heatmap identifies a thick realized-supply node exactly the place spot is grappling—$0.21—implying latent promote strain from holders seeking to exit at break-even and equally sturdy validation if value can flip the extent into help.

Second, Ali’s value construction marks that very same zone as Fibonacci resistance inside a longtime rising channel, sharpening the inflection. Third, top-holder focus has not rolled over, lowering proof (thus far) of heavy distribution into energy.

If bulls take up the ~$2.2 billion equal sitting at $0.21 and reclaim the 0.618 band, Ali’s stepped upside $0.29 (0.786 Fib), $0.46 (1.0 Fib) and $0.86 (1.272 Fib extension) path offers a transparent roadmap of overhead targets; in the event that they fail, the confluence argues for a renewed retest of channel help earlier than any bigger transfer.

At press time, DOGE traded at $0.195.

Featured picture created with DALL.E, chart from TradingView.com