Right here is the whole description of the enter settings for the buying and selling robotic “Greenback Pilot”, categorized for ease of understanding and configuration:

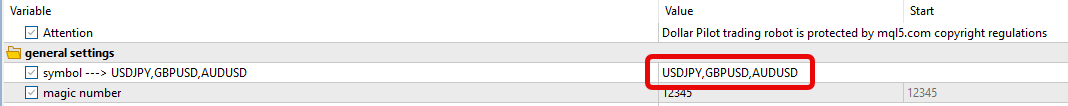

Multicurrency Settings

Add buying and selling symbols: USDJPY,GBPUSD,AUDUSD

Basic Settings

Primary Magic Quantity: 12345A distinctive identifier for trades opened by this EA, guaranteeing no conflicts with different buying and selling techniques. EA Commentary: “Greenback Pilot”Customized label or remark hooked up to every commerce for straightforward identification.

Takeprofit and Stoploss Settings

SL & TP Technique: dynamicDefines whether or not stop-loss and take-profit ranges are mounted or dynamic primarily based on indicators. Fastened Stoploss (Factors): 250Sets a hard and fast stop-loss in factors. Fastened Takeprofit (Factors): 250Sets a hard and fast take-profit in factors. Auto Stoploss Ratio (ATR): 1Multiplies ATR values to calculate dynamic stop-loss (-1 disables). Auto Takeprofit Ratio (ATR): 1Multiplies ATR values to calculate dynamic take-profit (-1 disables). Further Stoploss (Pips): 0Adds further pips to the calculated stop-loss. Further Takeprofit (Pips): 0Adds further pips to the calculated take-profit. Restrict Most SL: falseDisables limiting the stop-loss to a most worth. Most SL (Pips): 30Caps the stop-loss to this worth when enabled. Modify Lot Based mostly on Most SL: falsePrevents computerized lot adjustment when most SL is energetic.

Threat Settings

Lot Calculation Technique: baseonbalanceDetermines how lot sizes are calculated (e.g., steadiness, mounted lot, and many others.). Threat Per Commerce (%): 2.0Specifies the share of the account steadiness in danger per commerce. Fastened Lot Measurement: 0.1Assigns a static lot dimension for trades. Lot per Steadiness Measurement: 1000Uses a hard and fast lot dimension relative to account steadiness increments. Forex Quantity Worth: 10Sets a hard and fast lot dimension primarily based on a particular forex quantity. Most Lot Measurement: 60Caps the utmost allowable lot dimension. Minimal Lot Measurement: 0.01Sets the minimal allowable lot dimension. Lower Lot After Loss (%): 0Reduces lot dimension by this share after a shedding commerce to attenuate threat.

Sign Settings

Max Variety of Trades: 99Limits the variety of simultaneous open trades. Disabled when martingale is energetic. Most Unfold Allowed (Factors): 500Prevents trades when spreads exceed this worth. Commerce Course: purchase – promote or bothAllows trades in each lengthy and brief instructions.

Similar Order Settings

Single Commerce Per Image: trueRestricts the EA to at least one open commerce per forex pair at a time. Minimal Distance Between Trades (Factors): 100Sets a minimal hole between trades on the identical pair. Enable Hedging: falsePrevents simultaneous lengthy and brief positions.

Buying and selling Hour Settings

Proprietary Corporations Choices

FTMO Randomizer: falseAdds random offsets to TP and SL values for proprietary agency accounts. Max Day by day Loss (Forex): 500Prevents new trades if day by day losses exceed this worth. Max Day by day Shedding Trades: 10Stops buying and selling after exceeding this variety of shedding trades in a day. Pause After Loss (Bars): 0Halts buying and selling for a specified variety of bars after a shedding commerce.

Closing Based mostly on Drawdown

Max Drawdown Allowed (%): 60Stops opening new trades when drawdown exceeds this share. Shut Trades on Max Drawdown: falseCloses all open trades when the drawdown threshold is hit.

Closing Based mostly on Day by day Goal

Day by day Revenue Goal (%): 0Halts new commerce entries upon reaching this day by day revenue share. Shut All Trades on Goal Hit: falseCloses all trades upon hitting the day by day revenue purpose.

Closing Based mostly on Time

Shut on Friday at Hour: -1Specifies the hour to shut all trades earlier than the weekend (-1 disables this function).

Trailing Cease Settings

Allow Trailing Cease: falseActivates the trailing cease performance. Trailing Technique: trbyfixed_distanceDetermines the kind of trailing cease (mounted distance, ATR, and many others.). Take away TP After Trailing Begins: falseDeletes the take-profit stage as soon as the trailing cease is energetic.

Closing A part of Order Settings

Shut A part of Order and Path Relaxation: falsePartially closes a commerce and trails the remaining lot. Proportion to Shut: 50Specifies the portion of the commerce to shut when trailing begins.

Fastened Pip Path Settings

Trailing Begin (Pips): 10Begins trailing after this revenue stage is reached. Trailing Distance (Pips): 7Maintains this distance between value and the stop-loss. Trailing Step (Pips): 1Adjusts the stop-loss in steps of this worth.

ATR-Based mostly Path Settings

ATR Interval: 14Number of intervals for ATR calculation. ATR Timeframe: CurrentTimeframe used for ATR values. ATR Multiplier: 1.5Determines the trailing cease distance primarily based on ATR values.

Breakeven Settings

Allow Breakeven: falseTurns on breakeven performance. Breakeven Begin Distance (Pips): 100Initiates breakeven at this revenue stage. Breakeven Further Pips: 0Adds further pips to breakeven ranges.

Martingale Primary Settings

Allow Martingale: falseActivates the martingale technique for place sizing. Martingale Begin Technique: atr primarily based or repair pointSets the gap calculation technique for martingale entries. Takeprofit Technique: averageMethod for calculating take-profit throughout all martingale trades. TP Distance Proportion: 70Percentage of distance between new and final orders for TP calculation.