Analyst Weekly, January 26, 2026

This week brings a flood of high-impact earnings from megacaps and sector bellwethers throughout tech, semiconductors, healthcare, shopper, industrials, and vitality. Markets are wanting past headline beats or misses: the main focus is squarely on pricing energy, demand resilience, price self-discipline, and the way administration groups are framing 2026. Under are the important thing earnings to observe and what’s prone to transfer every inventory.

Microsoft (MSFT). Focus: The inventory’s response will hinge on Azure cloud progress and AI providers.Traders are centered on cloud demand and margins: Microsoft’s AI-driven income backlog (together with main OpenAI and Anthropic commitments) is big, so any replace on cloud progress charges, AI monetization, or steering can be key. Market Response Drivers: Robust Azure and AI outcomes (or a steering shock) might reinforce the view that Microsoft’s hefty AI investments are paying off, whereas any signal of cloud deceleration would possibly elevate valuation worries.

Meta Platforms (META). Focus: Meta’s earnings are extremely anticipated as a gauge of digital advert well being. The important thing inventory driver can be whether or not Meta can maintain sturdy promoting progress and present expense self-discipline. Traders’ focus areas embrace advert tendencies, the outlook for 2026 bills, and the continued Actuality Labs losses. Market Response Drivers: Meta has began reining in its metaverse ambitions after Actuality Labs’ cumulative losses topped $70B. Any updates on price cuts there, alongside commentary on consumer engagement or new monetization (like advertisements on Threads), will closely affect sentiment.

Apple (AAPL). Focus: On the earnings name, buyers will hear for updates on its AI partnership and steering on margins, in addition to any hints about new merchandise (AR/VR gadgets or a foldable iPhone) and the way Apple plans to navigate commerce headwinds in 2026. Market Response Drivers: iPhone gross sales and providers progress are anticipated to drive double-digit income and EPS positive aspects, however the principle catalyst could also be Apple’s rising AI technique. The truth is, Apple simply struck a multi-year deal to make use of Google’s Gemini AI fashions to energy Siri and future merchandise: a transfer analysts say lastly addresses the “invisible AI” hole in Cupertino’s technique.

Tesla (TSLA). Focus: The largest driver of Tesla’s inventory response can be automotive revenue margins, which have been squeezed to multi-year lows by worth wars. Traders are hoping to see indicators that gross margins have stabilized or that Tesla’s vitality storage enterprise (which now enjoys increased margins than autos) can offset weak point. Market Response Drivers: Tesla’s commentary on order backlogs in China/Europe, the uptake of its FSD (self-driving) subscriptions, and progress on the robotaxi fleet or Optimus humanoid robotic can be carefully scrutinized. Any constructive surprises, better-than-expected margins or concrete timelines for these tasks, might swing the risky inventory.

Boeing (BA). Focus: Boeing reviews after a robust run: the inventory jumped ~23% in 2025 on hopes of an aviation upcycle. The corporate lastly returned to constructive earnings and expects a ~46% YoY income soar in This fall as deliveries hit their highest since 2018. Market Response Drivers: Traders are in search of Boeing to verify increased jet manufacturing charges and enhancing money technology. Free money movement steering for 2026 can be vital as effectively: if the corporate indicators money flows will considerably rise subsequent 12 months, it could validate the bullish case. Conversely, any hiccups in hitting these manufacturing targets or cautious commentary on supply-chain dangers might mood the passion round Boeing’s restoration.

ASML Holding (ASML). Focus: ASML reviews on 28 January, and the main focus is not going to solely be on income, but in addition on orders. Robust demand from TSMC and reminiscence makers like Samsung might sign a robust setup for progress into 2027, even when 2026 seems constrained. Market Response Drivers: Traders will watch whether or not This fall orders land round €7bn and the way administration frames 2026 steering. Commentary on the trajectory of China-related gross sales, now anticipated to say no beneath export controls, may even matter. If ASML indicators that different areas are ramping quick sufficient to offset this, it might ease geopolitical overhangs. Even when near-term income progress seems modest, sturdy orders would reinforce confidence that ASML’s AI- and memory-driven cycle nonetheless has loads of runway.

Visa (V) & Mastercard (MA). Focus: Visa and Mastercard report on 28 January, with the concentrate on shopper spending tendencies, cross-border volumes and administration commentary slightly than headline earnings beats. Secure card utilization and resilient journey demand would help confidence in continued low-double-digit income progress, regardless of elevated regulatory noise. Market Response Drivers: For Visa, buyers will watch spend indicators and commentary on incentives and pricing, whereas Mastercard’s preliminary framing of 2026 steering and providers momentum can be key. Even largely in-line outcomes might assist stabilise sentiment if each firms reassure markets that volumes stay wholesome and regulatory dangers are manageable.

Exxon Mobil (XOM). Focus. In 2025, oil costs fell virtually 20%; Brent averaged within the low $60s which can drag on Exxon’s This fall earnings. Exxon has already warned that decrease crude costs possible lower its upstream revenue by as much as $1.2 billion versus Q3, although stronger refining margins might offset just a few hundred million. Market Response Drivers: Traders will search for confidence that quantity progress and value cuts can drive strong money movement even at decrease oil costs. Key focus areas embrace Exxon’s 2026 capital spending plans, any updates to its just lately raised 2030 revenue outlook (Exxon boosted its long-term earnings/money movement targets with out increased capex), and the way it will deploy its “surplus” money (dividends, buybacks). If Exxon underscores its resilience and guides to strong money technology at $60 to $70 oil, it might uplift the entire vitality sector.

Gold Is Changing Bonds because the Most well-liked Hedge

Gold is more and more being utilized by buyers as a hedge in opposition to fairness threat, displacing long-duration Treasuries. The shift displays a structural breakdown within the conventional equity-bond relationship: since 2022, correlations have hovered close to zero, eroding bonds’ effectiveness as a diversifier.

Traditionally, period publicity cushioned drawdowns in threat belongings. However current episodes, just like the post-Liberation Day drawdown the place equities and lengthy bonds bought off in tandem, have undermined confidence in bonds as a dependable hedge.

Funding Takeaway: Gold has held up as a defensive asset. Flows present buyers allocating to equities and gold concurrently, whereas lowering publicity to longer-dated bonds. The pattern displays greater than inflation hedging and a reallocation of portfolio threat administration. If the bond-equity correlation stays unstable, the function of gold as a volatility dampener might grow to be extra entrenched, redefining how portfolios hedge draw back threat over the cycle.

Netflix Inventory After a Turbulent Week: Promote-Off Halted – What’s Subsequent?

Netflix shares skilled a extremely risky week. Promoting stress initially accelerated. Whereas the quarterly outcomes have been strong, the outlook was perceived as extra cautious. At its low, the inventory fell by practically 9% to $80.26.

Later within the week, a rebound set in, limiting the weekly loss to round 2%. Netflix ended the week at $86.12. The temporary drop additionally resulted in a false breakdown beneath the January and April 2025 lows.

On the identical time, an necessary help zone (honest worth hole) between $79.72 and $80.81 was efficiently defended. Truthful worth gaps symbolize market inefficiencies. The lengthy decrease wick on the weekly candle, mixed with the protection of this zone, factors to a possible stabilization.

Within the coming weeks, buyers ought to look ahead to additional affirmation indicators, akin to a sequence of upper highs and better lows, which might point out the formation of a brand new uptrend. The inventory is at the moment buying and selling about 36% beneath its all-time excessive.

Netflix, weekly chart. Supply: eToro

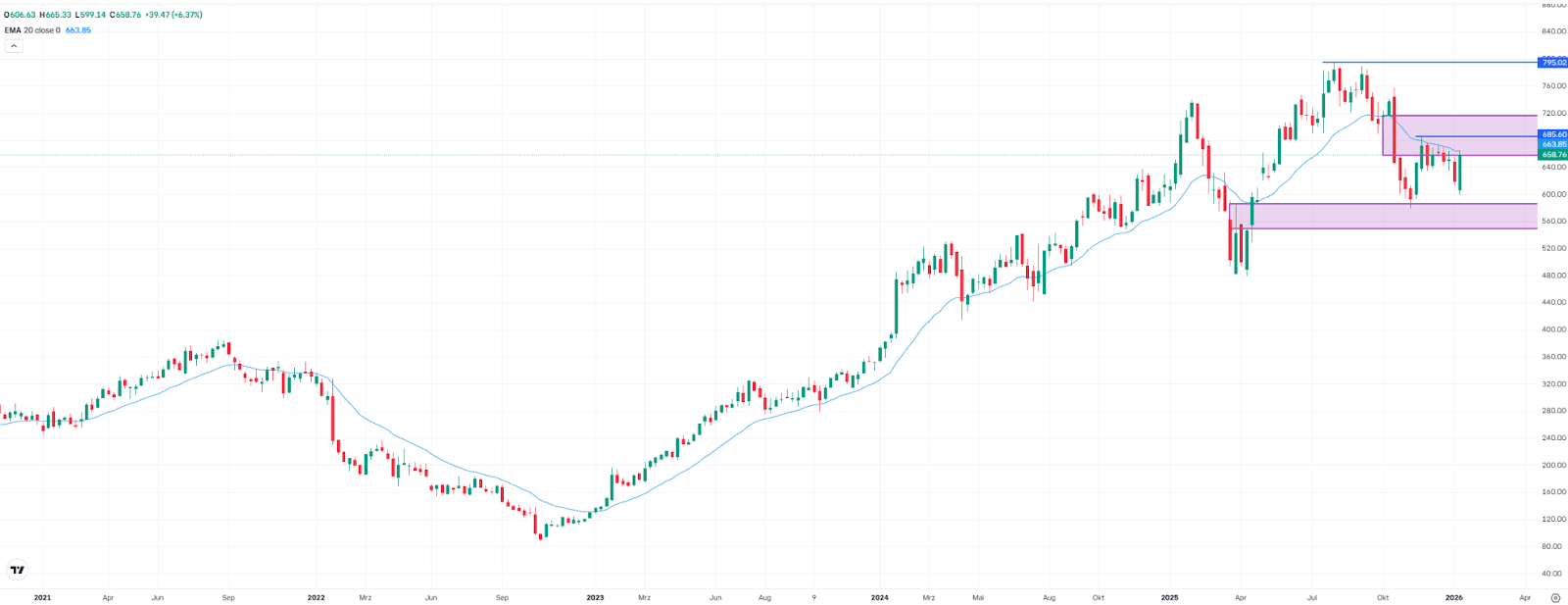

Meta Inventory at Resistance: Earnings because the Key Catalyst

Meta shares gained 6.4% final week, closing at $658.76. This transfer has pushed the inventory into a well known resistance zone (honest worth hole) between $658.13 and $715.30. An space the place patrons have been rejected a number of instances since early December.

The important thing short-term catalyst is earnings on Wednesday night. A sustained transfer above the 20-week shifting common at $663.85 can be a primary constructive sign. A breakout above the intermediate excessive at $685.75 would additional enhance the technical image.

In that state of affairs, the likelihood will increase that the inventory might retest its all-time excessive at $795. For context, Meta had declined by round 27% between August and November, and that hole has now been diminished to roughly 17%.

On the draw back, a robust help zone (honest worth hole) between $548.90 and $588.72 has thus far prevented deeper pullbacks. Ought to a short-term retracement happen, this space might as soon as once more act as a help zone.

Meta, weekly chart. Supply: eToro

Meta, weekly chart. Supply: eToro

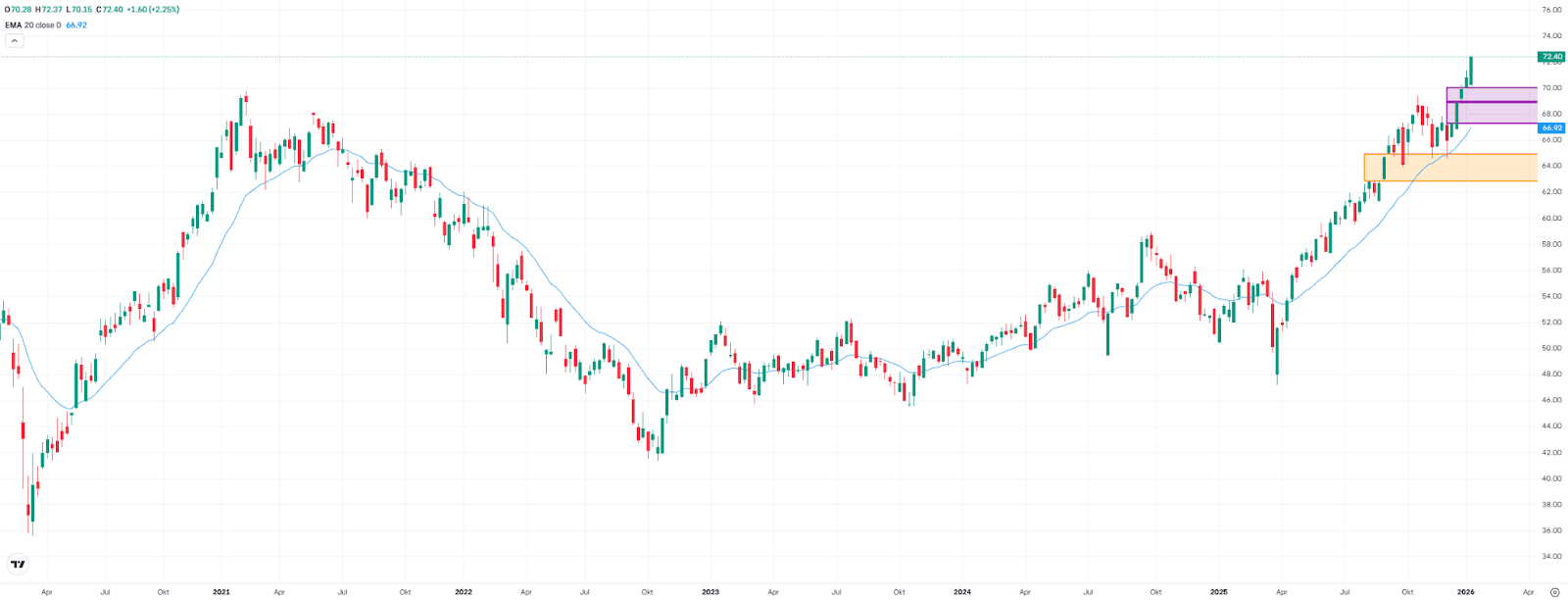

Rising Markets: Fifth Weekly Acquire in a Row – How Sustainable Is the Rally?

The iShares Core MSCI Rising Markets ETF rose by 2.3% final week, reaching a brand new document excessive and marking its fifth consecutive week of positive aspects. Lately, a rotation of capital away from US belongings towards Asia and rising markets has been noticed. The upward momentum that started in mid-December is now effectively superior.

Nevertheless, the fast worth enhance has created new honest worth gaps at $68.90–$70.04 and $67.28–$69.01. Truthful worth gaps symbolize market inefficiencies and are sometimes revisited by worth at a later stage (see the earlier instance highlighted in orange on the chart from September to December).

These areas can subsequently function potential areas of curiosity for patrons. What issues most, nonetheless, is the market’s response. The zone shouldn’t solely be reached but in addition revered. Solely with affirmation, akin to stabilization or clear reversal indicators, do the possibilities of a profitable entry enhance.

IEMG, weekly chart. Supply: eToro

IEMG, weekly chart. Supply: eToro

Bitcoin: Fragile Equilibrium

Bitcoin enters the top of January in a section of fragile equilibrium, outlined extra by flows and positioning than by narrative. Worth stays steady within the USD 88,000–91,000 vary, however current actions make it clear that the market will not be being guided by a structural thesis, however by macro impulses and tactical capital reacting to headlines.

The newest episode illustrated this effectively. It was not a crypto catalyst that moved the market, however politics. The cooling of tariff rhetoric triggered a broad rebound in threat belongings. Bitcoin didn’t lead or decouple, nevertheless it adopted. The transfer was additionally amplified by leverage and resulted in a liquidation occasion, slightly than a clear entry of patrons.

This reinforces a well-known studying: bitcoin continues to behave like a threat asset, not a protected haven. When uncertainty eases, it holds up; when it intensifies, it fails to draw defensive flows, in contrast to gold.

Beneath the floor, on-chain knowledge provides necessary nuance. The market reveals cooling, not weak point. Community exercise has moderated, web flows to exchanges stay detrimental, and a rising share of provide stays immobilized within the fingers of long-term holders. Revenue-taking has fallen considerably in comparison with the fourth quarter of 2025. Put merely, much less is being bought and extra is being accrued, albeit with out urgency. Structural promoting stress is low, however that doesn’t indicate instant upside momentum.

In derivatives, the usage of leverage has elevated once more, however in a contained method. Open curiosity has recovered after the cleanup of positions on the finish of 2025, with a predominance of lengthy positions and still-moderate funding prices. There are not any clear indicators of overheating, though an increase in funding above 5% would enhance the danger of draw back liquidations. The market has room to construct positions, however it isn’t “pressured” in any course.

The choices market reinforces this balanced studying. The “Max Ache” degree sits very near the spot worth, which tends to compress short-term volatility. Skew is beginning to flip increased, with elevated curiosity in calls above USD 95,000–100,000, whereas places at decrease strikes proceed for use as institutional hedges. There isn’t any panic, however there’s warning.

As for contributors, the sample is evident. Demand comes primarily from establishments, ETFs, and huge holders, with sustained accumulation flows. Retail buyers are neither current nor anticipated. Sellers are primarily medium-term holders who proceed to take income steadily, with no indicators of capitulation. Miners and huge whales are lowering gross sales. The web steadiness favors structural patrons.

All of that is occurring at a time when the previous map not works. The four-year cycle not explains market conduct by itself. Liquidity has concentrated in institutional autos that don’t rotate into the remainder of the ecosystem as they as soon as did, leading to a narrower, extra demanding, and slower market. In the meantime, infrastructure continues to advance (tokenization, stablecoins, 24/7 buying and selling), and utility is progressing quicker than worth.

As issues stand, bitcoin will not be damaged, however it isn’t confirming a transparent course both. It’s neither in a breakout section nor in euphoria. Assist is being constructed by quiet accumulation, not exuberance. So long as institutional flows proceed and leverage stays managed, the present vary is sensible.

The bullish catalyst stays the persistence of ETF inflows; the principle threat is an increase in leverage mixed with macro shocks. The market doesn’t want extra narrative. It wants indicators that may face up to stress.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.