Analyst Weekly, July 14, 2025

Banks First, Large Tech Quickly

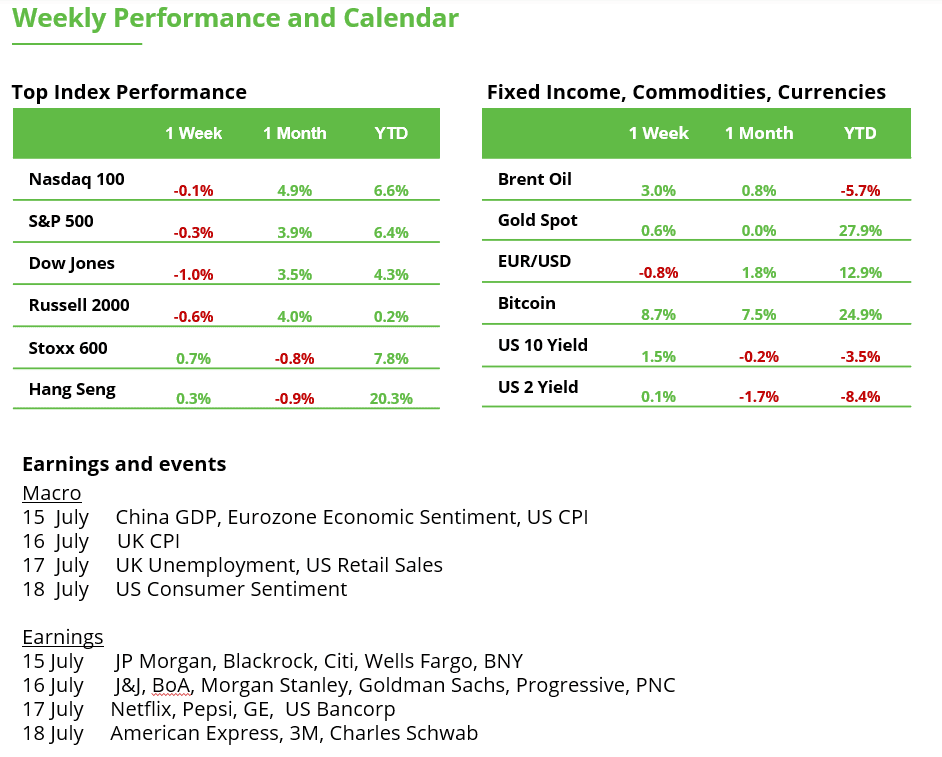

The official begin to Q2 earnings season is right here. Banks take the stage first, however all eyes are on Communications (+31.8% EPS progress anticipated) and Expertise (+17.7%), the 2 sectors set to steer this quarter. With the US greenback weakening, Tech could get an extra increase because of its giant share of foreign-sourced income.

On the opposite finish, Vitality is as soon as once more the earnings anchor, with a projected 25% decline. Strip it out, and S&P 500 earnings are set to develop 7.7%, not simply 5.8%. That is now the fifth straight quarter that Vitality has dragged on combination earnings.

Topline Watch: Income Progress Tracks Nominal GDP

Q2 income progress is pegged at 3.7%, roughly consistent with nominal GDP tendencies. Tech (12.6%) and Well being Care (7.9%) are once more main. Vitality lags, pressured by decrease YoY oil costs.

This quarter ought to supply clearer perception into the impression of tariffs, which had been in impact for practically the whole reporting interval. Whereas the extension of the commerce deadline could extend company choice paralysis, the passing of tax laws has at the least eliminated one layer of enterprise uncertainty.

2025 & 2026 Outlook: 7% Now, 14% Later?

Consensus sees full-year 2025 S&P 500 EPS at $262.61, a strong 7.1% annual progress fee. 2026 estimates name for a pointy rebound to 14% progress, pushing EPS close to the $300 mark.

There’s potential for an upside shock in client companies, particularly journey and leisure, given resilient client spending tendencies noticed in Q2. However with valuations again at cycle highs, rates of interest, not earnings, will seemingly decide whether or not a number of growth continues.

Margins Matter (Nonetheless)

Working margins are climbing once more, now at 17.8% and trending greater. Traditionally, margin stability has acted as a buffer towards main market pullbacks. If this pattern holds, it strengthens the case for continued good points in share costs by way of the remainder of the earnings season.

Supply: Bloomberg, Factset, June 11, 2025.

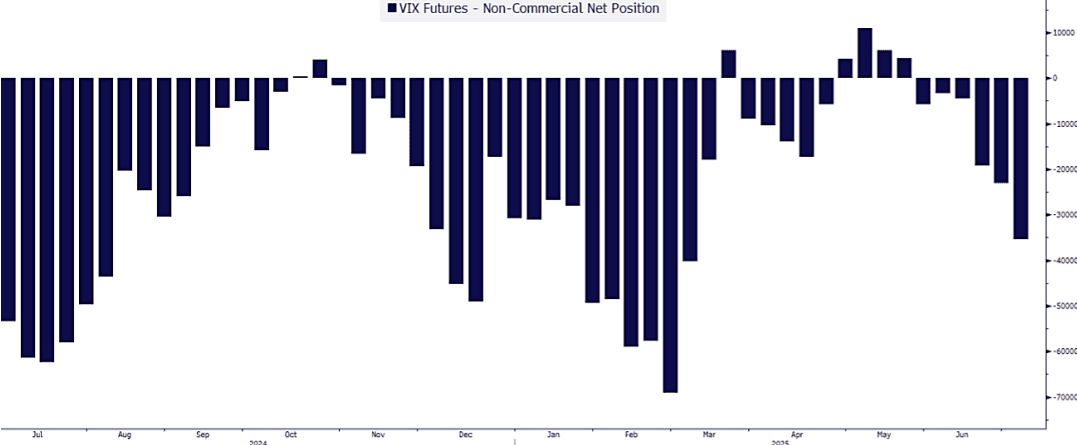

VIX Hits Lows However Don’t Sleep on August

The VIX closed under 16 for the primary time since February, extending a stretch of market calm as breadth improves and NVDA turned the primary firm to cross the $4 trillion mark. The entrance finish of the VIX futures curve stays notably steep, which often alerts that merchants count on volatility to rise from these compressed ranges, however not simply but.

With Q2 earnings season starting and July traditionally a powerful month, seasonality favors continued calm. We’ve now moved previous a number of potential volatility triggers – G7, the tax invoice, the tariff deadline, and debt ceiling dangers – all of which both handed quietly or had been delayed.

Investor Positioning: Confidence, Not Warning

Regardless of technicals displaying overbought circumstances, with persistent name demand throughout NVDA, TSLA, AAPL, and SPY, together with continued put promoting, a sign of robust investor confidence. This mirrors a multi-week theme within the choices panorama the place hedging stays mild and upside publicity stays in demand.

However Don’t Overlook August…

Whereas July tends to carry stability, August is usually one of many extra risky months of the yr, a threat value monitoring, particularly as earnings experiences and Fed expectations evolve. For now, the market appears comfy consolidating good points, however volatility seasonality says a reawakening might be on deck.

TSMC Q2 2025 Earnings Preview: Excessive Hopes, Excessive Hurdles

TSMC is ready to report its second-quarter outcomes on 17 July, and expectations are operating excessive. The world’s largest contract chipmaker already gave a powerful sign in its month-to-month income updates: gross sales had been up 39% year-on-year within the June quarter, confirming sturdy demand throughout its superior nodes. This efficiency helps the bullish thesis of buyers who see TSMC as a long-term AI enabler.

The optimism stems from each short-term momentum and long-term fundamentals. TSMC is a essential provider to shoppers like NVIDIA, Apple and AMD, all of whom depend on its cutting-edge chips for AI coaching, datacenters, cell units, and a quickly rising variety of software program functions. The corporate is increasing manufacturing in excessive gear, with new fabs below building in Taiwan, the US, Japan, and the EU. This international footprint not solely diversifies geopolitical threat but additionally positions TSMC to seize future demand.

Analysts estimate a compound annual income progress (CAGR) of 15–20% over the subsequent three years, pushed by AI-related chips and high-performance computing. In Q2 2025, TSMC is predicted to generate over $10 billion in free money circulation, with projections suggesting annual free money circulation may exceed $40 billion by 2027, relying on capex ranges.

Valuation stays a key speaking level. TSMC at present trades at a ahead P/E ratio of round 19, a premium in comparison with its historic common, however nonetheless under some US semiconductor friends. For some buyers, that leaves room for upside if the AI increase sustains and margin growth continues.

Nevertheless, others warning towards extreme optimism. Key dangers embrace export restrictions to China, which nonetheless accounts for a good portion of TSMC’s income. The geopolitical tensions round Taiwan additionally stay unresolved. In the meantime, constructing a number of fabs in parallel will increase execution threat, particularly in areas the place TSMC has no working monitor report. And whereas demand is powerful now, some analysts fear about potential overcapacity from 2026 onwards if AI chip demand slows or effectivity good points scale back unit volumes.

In brief, subsequent week’s earnings will give buyers a clearer learn on whether or not TSMC’s efficiency, and its outlook for the remaining months of 2025, can justify the present valuation. The controversy over whether or not it’s a purchase will seemingly intensify, not conclude.

Banks in Focus: How Sturdy is the Influence of US Coverage?

Large banks are kicking off earnings season this week. Second-quarter outcomes are particularly related for buyers, not solely as a result of banks historically open the season, but additionally as a result of they play a significant position within the international monetary system’s infrastructure.

These earnings will present perception into how considerably US insurance policies have impacted the economic system thus far. Traders ought to concentrate on key indicators resembling web curiosity margin, mortgage demand, credit score high quality, payment earnings, and buying and selling revenues.

Markets stay optimistic for now. The S&P 500 gained 11.0% in Q2, its strongest quarterly rise since 2023, and closed at a brand new report excessive. The earnings season will reveal whether or not this rally is justified or if the results of commerce coverage have been underestimated. The better the deviation from expectations, the stronger the potential market response.

To date, U.S. financial information has proven stunning resilience to the continued commerce dispute. For buyers with direct publicity to financial institution shares, consideration also needs to be paid to any commentary on dividend coverage and share buyback plans.

Tuesday will carry earnings from BlackRock, Citigroup, JPMorgan, and Wells Fargo. On Wednesday, Financial institution of America, Goldman Sachs, and Morgan Stanley will observe. All reporting earlier than the U.S. market opens.

Expectations for the monetary sector are for two.4% earnings progress in Q2 in comparison with the earlier yr—effectively under the broader S&P 500 forecast of 4.8%. Income progress for financials is predicted at 4.7%, barely above the S&P 500 common of 4.2%.

Over the previous three months, the monetary sector has returned 14.8%, a strong efficiency however nonetheless effectively behind expertise at 33.2% and industrials at 22.1%. This week will present whether or not monetary shares can catch up.

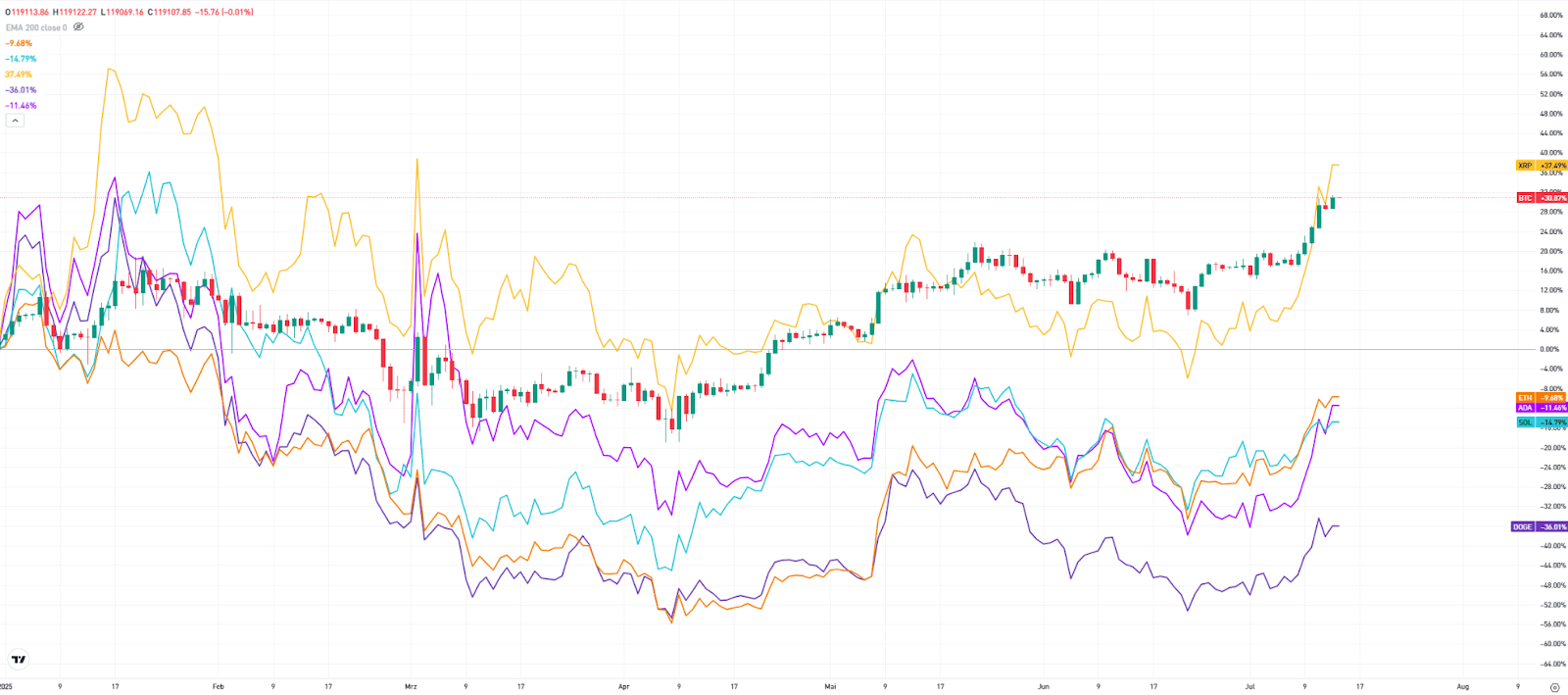

Are Altcoins Able to Catch Up?

It at present feels as if the crypto get together is beginning up once more. Bitcoin ended final week at a brand new all-time excessive of round $119,000. The breakout has renewed hopes for a brand new bull run. Again in early and late 2024, comparable rallies adopted the breakout of key resistance ranges, every lasting for a number of weeks.

Most altcoins have lagged behind Bitcoin because the starting of the yr (see chart). Solely XRP has stored tempo, whereas Ethereum, Solana, Cardano, and Dogecoin stay considerably within the crimson. Nevertheless, in current weeks, shopping for exercise in these cash has picked up once more. A continuation of the Bitcoin rally may assist restore confidence within the broader crypto market.

Crypto Comparability – Efficiency Yr-to-Date (Each day Chart)

Copper Hits Document Excessive: Tariffs Shock the Market

Copper costs surged greater than 10% final week, closing at a brand new report excessive of $5.578 per pound. At one level, costs even reached $5.884.

The principle driver behind the rally was the announcement of fifty% tariffs on copper imports beginning August 1. Copper is a vital uncooked materials, extensively used throughout industries together with automotive, building, information facilities, renewable vitality, and manufacturing.

Including to the stress, the U.S. lacks ample home copper manufacturing capability. This might result in important worth premiums within the U.S. market over the long run.

From a technical perspective, key help is positioned finally week’s low of $4.970, the place the newest upward transfer started. An extra vital stage is $5.200, which acted as a resistance a number of occasions in 2024 and now seems to be serving as a help.

Copper Value (Each day Chart)

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.