US-based crypto ETFs have witnessed a change in dynamics in August, which has seen inflows tipping in direction of Ethereum ETFs. Nevertheless, final week’s development of sturdy inflows ended with substantial outflows on Friday, with Ethereum ETFs main the retreat with $164.64 million and Bitcoin ETFs following with $126.64 million. This sudden reversal coincides with an attention-grabbing timing of cussed inflation knowledge that appears to have rattled institutional traders.

Associated Studying

A Sudden Reversal At Week’s Finish

In line with knowledge from Farside Traders, US-based Spot Ethereum ETFs ended the week with $164.64 million in outflows. The outflows got here from Constancy’s FETH with $51 million, Bitwise’s ETHW with $23.7 million, Grayscale’s ETHE with $28.6 million, and Grayscale’s ETH with $61.3 million. BlackRock, alternatively, witnessed neither inflows nor outflows into its Spot ETH ETFs, alongside 21Shares, VanEck, Invesco, and Franklin Templeton Ethereum ETFs.

Friday’s outflows had been a jarring departure from the regular acquire that had outlined Ethereum’s Spot ETFs since August 21. Ethereum’s six-day influx streak, which had added about $1.876 billion, was delivered to an abrupt finish with the outflows on Friday. Because of this, complete belongings beneath administration for Spot Ethereum ETFs dipped to $28.58 billion.

Ethereum ETF Stream: Farside Traders

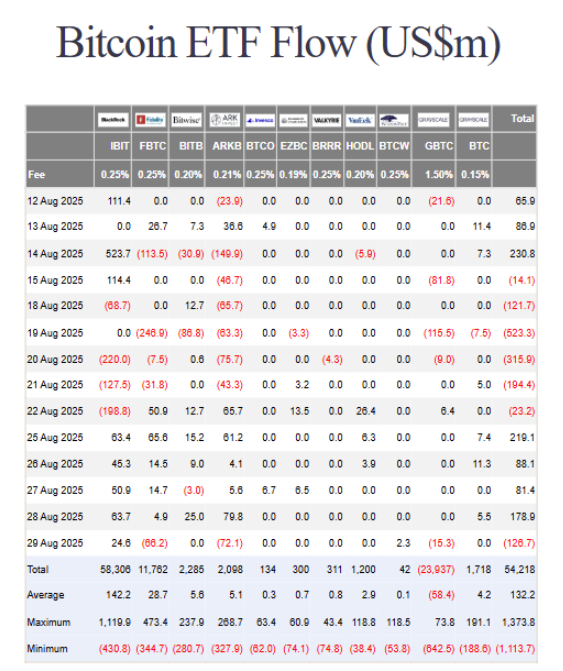

In the meantime, Spot Bitcoin ETFs additionally recorded their first every day decline since August 22 with $126.64 million in outflows on Friday. Because of this, their complete belongings beneath administration dropped to $139.95 billion.

Nevertheless, not each issuer felt the stress with Bitcoin. Constancy’s FBTC led the exodus with $66.2 million, adopted by ARKB’s $72.07 million and GBTC’s $15.3 million in outflows. Alternatively, BlackRock’s IBIT nonetheless managed $24.63 million in inflows and WisdomTree’s BTCW drew in $2.3 million amid the broader outflows.

Bitcoin ETF Stream: Farside Traders

The underlying explanation for the outflows will be attributed to traders digesting the most recent knowledge on inflation launched on Friday. Notably, the US core Private Consumption Expenditures (PCE) index climbed 2.9% year-over-year in July, the quickest tempo since February, creating fears that the Federal Reserve could maintain off on price cuts.

What Might Lie Forward This Week

As a brand new buying and selling week begins, Spot ETF circulate in each Ethereum and Bitcoin is prone to rely on how traders proceed to interpret the information. If inflation pressures persist, institutional traders could retreat additional at the start of the week. Nevertheless, any indicators of cooling might see inflows resume mid-week, notably into Ethereum, the place fundamentals are presently favorable.

On the worth aspect of issues, Bitcoin’s maintain above the $108,000 value could provide some aid. Nevertheless, it wants to remain above $110,000 to ensure that any upside transfer to realize momentum. On the time of writing, Bitcoin is buying and selling at $109,910.

Associated Studying

For Ethereum, a every day shut above $4,500 might verify the return of bullish confidence, whereas a slide beneath $4,400 may sign additional weak point. On the time of writing, Ethereum is buying and selling at $4,470, up by 1.7% up to now 24 hours.

Featured picture from Unsplash, chart from TradingView