In a market replace on Oct. 10, technical analyst Nik Patel (@OstiumLabs) argued that Ethereum is approaching a make-or-break zone the place the subsequent few periods may outline whether or not the advance resumes or a deeper unwind unfolds. With spot ETH quoted round $4,000, Patel anchored his thesis to a decent cluster of reclaim and invalidation ranges on each ETH/USD and ETH/BTC, emphasizing that lower-timeframe habits should align with higher-timeframe construction to maintain the bullish path open.

Key Value Ranges For Ethereum Now

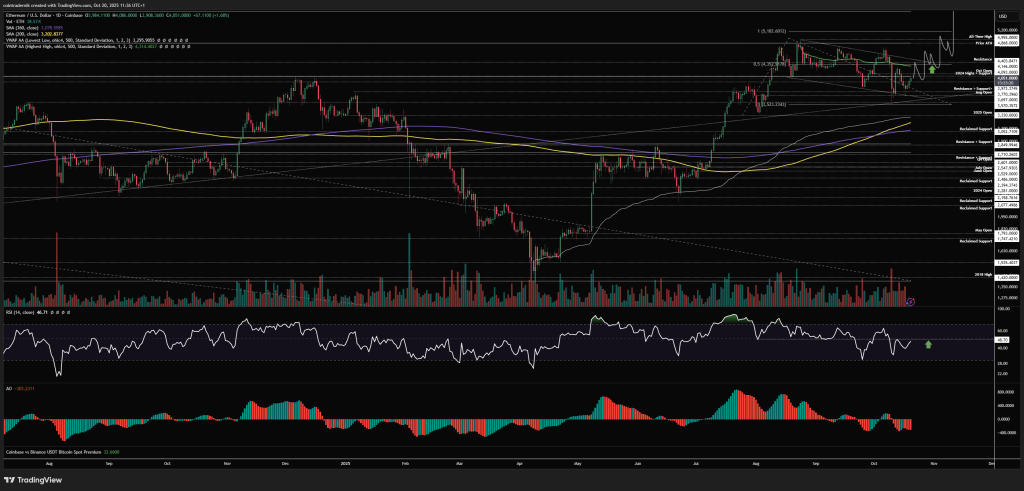

On the weekly ETH/USD chart, Patel mentioned the market “depraved decrease into the August open final week however held above the earlier weekly low and trendline assist,” leading to an inside week that nonetheless closed “marginally under that main pivot.” The pivot is express: “We need to see this pivot at $4,093 reclaimed instantly and never flipped into resistance right here on the decrease timeframes, or else we may anticipate one other flush of the lows in the direction of that 2025 open.”

Associated Studying

If patrons do drive the reclaim, Patel expects final week’s motion to face as a quarterly low: “If we do reclaim $4,093 right here, which is what I anticipate, we should always have our quarterly low now in and I might need to see $4,400 flipped into assist for the transfer greater into all-time highs and past.”

He framed the weekly invalidation at $3,700, warning {that a} shut under would put the yearly open on watch as “last-stand assist” for the bullish construction; failure there dangers “a a lot greater unwind again into $2,850.” Patel’s base case remained constructive: “acceptance again above $4,093 into subsequent week after which an in depth above $4,400 for October, resulting in new highs by means of $5,000 in early November and a really sturdy month for ETH.”

The each day ETH/USD learn connects that high-timeframe blueprint to momentum and market construction. Patel famous “momentum exhaustion into the lows” adopted by a higher-low final week, a formation that now should be defended. He desires to see the sequence reassert itself with a drive above the mid-range and a subsequent higher-low above the weekly pivot: “we completely need to see this construction now protected and value to kind a higher-high above the mid-range at $4,352 after which one other higher-low above $4,093 earlier than a breakout greater and a push in the direction of recent highs.”

For affirmation of an impulsive leg, he flagged a trendline break, a flip of the ATH-anchored VWAP into assist, and an RSI regime shift: “If we get a trendline breakout and value flips that ATH VWAP into assist with each day RSI above 50, I’d anticipate a transfer into $4,950 very swiftly, adopted by value discovery in November.” The each day invalidation mirrors the weekly logic: if $4,093 acts as resistance and the market pushes under $3,700—then closes beneath it—“we’re completely retesting the yearly open,” in his view.

ETH Vs. BTC

Towards Bitcoin, Patel contends that the relative pair has doubtless printed its This autumn low. On the weekly ETH/BTC chart, value was rejected at trendline resistance, then retraced to the yearly open and held, closing “marginally inexperienced” whereas respecting trendline assist off the 2025 lows.

“It’s my view that the This autumn low for the pair has shaped right here,” he wrote, including {that a} retest and break above the descending boundary into early November would set the stage for a measured growth: “acceptance above 0.0417 opens up the subsequent leg greater into 0.055.” He positioned weekly invalidation at 0.0319.

Associated Studying

The each day ETH/BTC map refines these alerts into actionable ranges. Value “marked out that low between 0.0319 and the yearly open earlier than bouncing arduous and reclaiming 0.036 as assist.” Ideally, 0.036 now acts as a springboard; if not, Patel permits for a higher-low “above the 0.0319 stage earlier than continuation greater.”

The tactical inform can be a flip of close by provide: “If we will flip 0.0379 as reclaimed assist right here, that will be promising for the view {that a} trendline breakout is imminent, following which I might anticipate 0.0417 to be taken out and value to go greater, with minor resistance above that at 0.049 earlier than 0.055.” He additionally recognized a confluence band under: “We’ve got a confluence of assist between 0.0293 and 0.0319, so flipping that vary into resistance can be very bearish ETH/BTC.”

Taken collectively, Patel’s Oct. 10 blueprint hinges on three synchronizations: ETH/USD should swiftly reclaim and defend $4,093; $4,400 should convert from ceiling to ground to clear the runway towards prior highs and a possible $4,950 extension; and ETH/BTC ought to drive by means of 0.0379 after which 0.0417 to substantiate relative-strength breadth beneath any dollar-denominated breakout.

The draw back is equally crisp: failure to reclaim $4,093, a weekly shut under $3,700, and a subsequent lack of the yearly open would validate the chance that, in Patel’s phrases, Ethereum may “unwind again into $2,850.”

At press time, ETH traded at $3,872.

Featured picture created with DALL.E, chart from TradingView.com