Be part of Our Telegram channel to remain updated on breaking information protection

The Ethereum value edged up over 1% previously 24 hours to commerce at $2,963.47 as of 11:57 a.m. EST, with buying and selling quantity surging 24% to $15.7 billion.

This comes as Jack Yi, founding father of Pattern Analysis, introduced on X that his agency is planning a $1 billion allocation to bolster its Ethereum holdings, which now intensifies its market presence.

我宣布Trend Research再准备10亿美金,在此基础上继续增持买入ETH,我们言行一致,强烈建议不要做空,毫无疑问这将是历史性机会。 https://t.co/bJCjdABpB0

— JackYi (@Jackyi_ld) December 24, 2025

The transfer comes amid appreciable institutional confidence in Ethereum’s future development and will considerably influence the Ethereum market dynamics. Because of this, it captures consideration amid ongoing funding methods and market volatility.

The choice to put money into ETH goals to bolster the agency’s substantial holdings. Jack Yi emphasised the agency’s dedication to Ethereum, warning in opposition to short-selling, which aligns with Pattern Analysis’s ongoing technique of shopping for ETH throughout value dips.

These substantial investments are a mirrored image of many establishments’ perception within the token’s long-term worth, reinforcing confidence amongst different institutional buyers and probably stabilizing costs.

In the meantime, this transfer might herald a bigger development of institutional curiosity in ETH, probably affecting market construction and regulatory views.

Ethereum Worth Struggles For Path As Key Indicators Sign Indecision

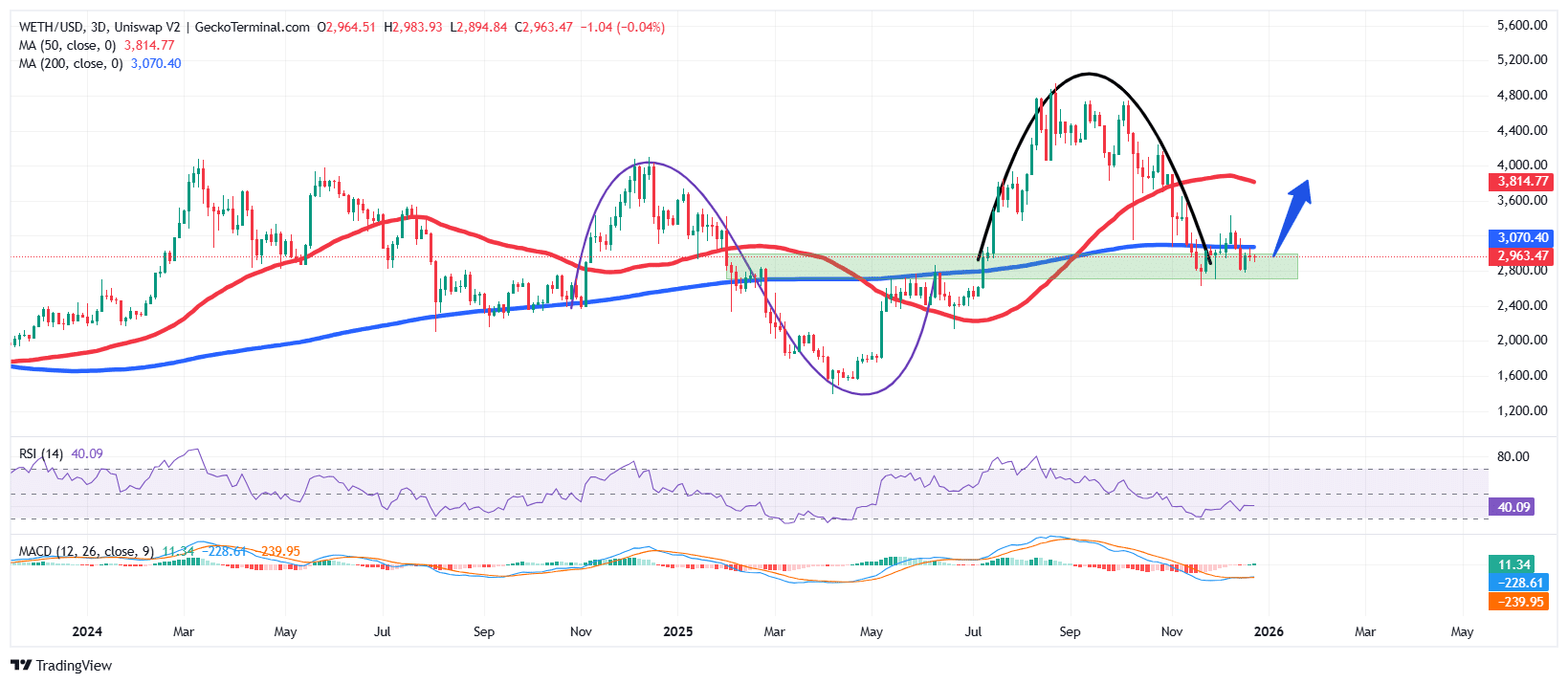

The ETH value motion has shifted right into a corrective part after staging a robust rally from the mid-2024 assist area close to $2,100.

That push propelled the Ethereum value towards a cycle peak round $4,900, the place shopping for momentum started to fade, and profit-taking emerged.

Following the rejection on the highs, Ethereum entered a chronic pullback, carving out a rounded prime sample and slipping again towards its long-term development assist. This retracement has dragged the worth under each the 50-day and 200-day Easy Transferring Averages (SMAs), which now act because the instant resistance ranges.

In the meantime, the Relative Power Index (RSI) is hovering round 40, suggesting subdued momentum with out reaching oversold situations. This stage displays a steadiness between patrons and sellers, reinforcing the concept that Ethereum is consolidating somewhat than trending aggressively in both route.

In the meantime, the Transferring Common Convergence Divergence (MACD) indicator continues to commerce under the zero line, however draw back momentum is weakening. The histogram bars are contracting, signaling that bearish stress is dropping power.

Though no decisive bullish crossover has but shaped, this habits typically precedes a stabilization part or short-term reduction bounce.

ETH Worth At A Choice Zone

Primarily based on the ETH/USD chart on the upper timeframe, the ETH value is at a make-or-break stage. The confluence of the 200 MA and horizontal assist between $2,900–$3,050 types a crucial demand zone that bulls should defend.

A clear breakdown under this assist area might expose the worth of Ethereum to a deeper transfer towards the subsequent main demand zone close to $2,700, with prolonged weak spot probably revisiting the broader base round $2,100–$2,200.

Conversely, if patrons efficiently defend the 200-day SMA and momentum stabilizes, the worth of ETH might try a restoration towards the prior consolidation vary round $3,400–$3,600.

A sustained push above this area would place the 50-day SMA close to $3,800 again into focus as the subsequent resistance hurdle.

So as to add to the bullish case, crypto analyst Ali Martinez says that ETH energetic addresses have practically doubled in every week, which is a sign of buyers locking in.

Ethereum $ETH community exercise has practically doubled in every week, with energetic addresses rising from 496,000 to 800,000. pic.twitter.com/c0espgmwr9

— Ali Charts (@alicharts) December 25, 2025

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection