Ethereum’s rally stalled simply 1.94% under its November 2021 all-time excessive of $4,878 earlier than sellers pressured a pullback. Now, ETH USD is buying and selling close to $4,450, retreating after a +29% climb previously 30 days.

The shortcoming to interrupt via resistance highlights the technical overhang that continues to cap upside momentum at the same time as institutional flows stay a dominant driver of short-term efficiency.

ETF Inflows Crushed After 8 Day $3.7Bn Streak – Are ETH USD Outflows Right here to Keep?

The rejection coincided with the primary internet outflow from U.S. spot Ether ETFs in 9 buying and selling periods.

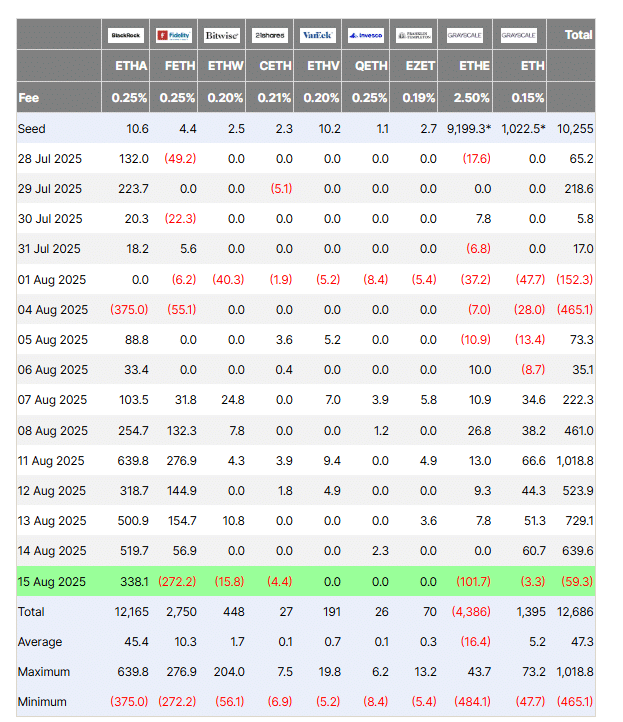

In keeping with Farside knowledge, $59.3M left the merchandise on Friday, ending an eight-day streak funneling $3.7Bn into BlackRock’s ETHA, Constancy’s FETH, and Grayscale’s Ethereum Mini Belief.

(Supply)

Since their July 2024 launch, spot Ether ETFs have amassed $12.68Bn in cumulative flows, however the finish of the influx streak introduces anew datapoint for merchants weighing the sturdiness of the rally.

ETF flows have change into one in every of ETH’s most dependable proxies for institutional positioning. Analysts notice that sustained inflows are important for difficult the $4,878 ATH ceiling.

Commonplace Chartered raised its year-end ETH goal to $7,500 this week, contingent on the continuation of sturdy internet ETF demand.

DISCOVER: Finest Meme Coin ICOs to Put money into 2025

SharpLink Loss Compound Reversal in ETH USD Sentiment

The stream reversal is the shadow of a weak earnings print from SharpLink Gaming, the second-largest Ethereum digital asset treasury firm.

Because the agency reported a $103.4M internet loss in Q2, fairness markets panicked, triggering a -15% inventory decline.

Roughly $87.8M of the hit got here from non-cash impairment costs linked to liquid staked ETH being marked at quarter-low costs of $2,300.

Whereas SharpLink’s 728,804 ETH holdings at the moment are price greater than $3.3Bn at spot, the accounting remedy amplified headline losses and pressured sentiment round Ethereum treasuries extra broadly.

The confluence of a failed breakout, ETF outflows, and a serious treasury holder posting steep paper losses reinforces the significance of institutional demand and accounting remedy in setting the near-term ETH USD narrative – not the retail market.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Ethereum ETFs vs Treasury Accumulation: What’s Driving ETH USD Worth?

The ETF reversal underscores the fragility of momentum when institutional automobiles pause their shopping for.

But beneath the floor, firms’ accumulation of Ethereum treasury stays a strong counterweight.

SharpLink’s headline $103M Q2 loss obscured that its 728,804 ETH place, now price $3.3Bn, has steadily compounded via staking rewards.

At a present yield of three.4%, SharpLink has already booked greater than 1,300 ETH in rewards this yr, an natural influx that cushions in opposition to valuation shocks.

Different treasury companies have quietly expanded publicity, with BTCS Inc. and DeFi Growth Corp including reserves in Q2.

The Block estimates the cumulative market cap of public corporations holding ETH has surpassed $10Bn, marking Ethereum’s arrival as a treasury asset class in its personal proper.

That is structurally necessary: whereas ETF demand is flow-driven and reactive to sentiment, treasury allocations are sticky, recurring, and infrequently tied to working fashions in DeFi infrastructure, gaming, or tokenized yield platforms.

ETF outflows spotlight short-term sentiment, however the parallel progress of treasury stability sheets signifies a strategic layer of demand much less delicate to each day value swings

DISCOVER: 9+ Finest Excessive-Danger, Excessive-Reward Crypto to Purchase in 2025

ETH USD Worth Evaluation: The place Does Ethereum Worth Go From Right here?

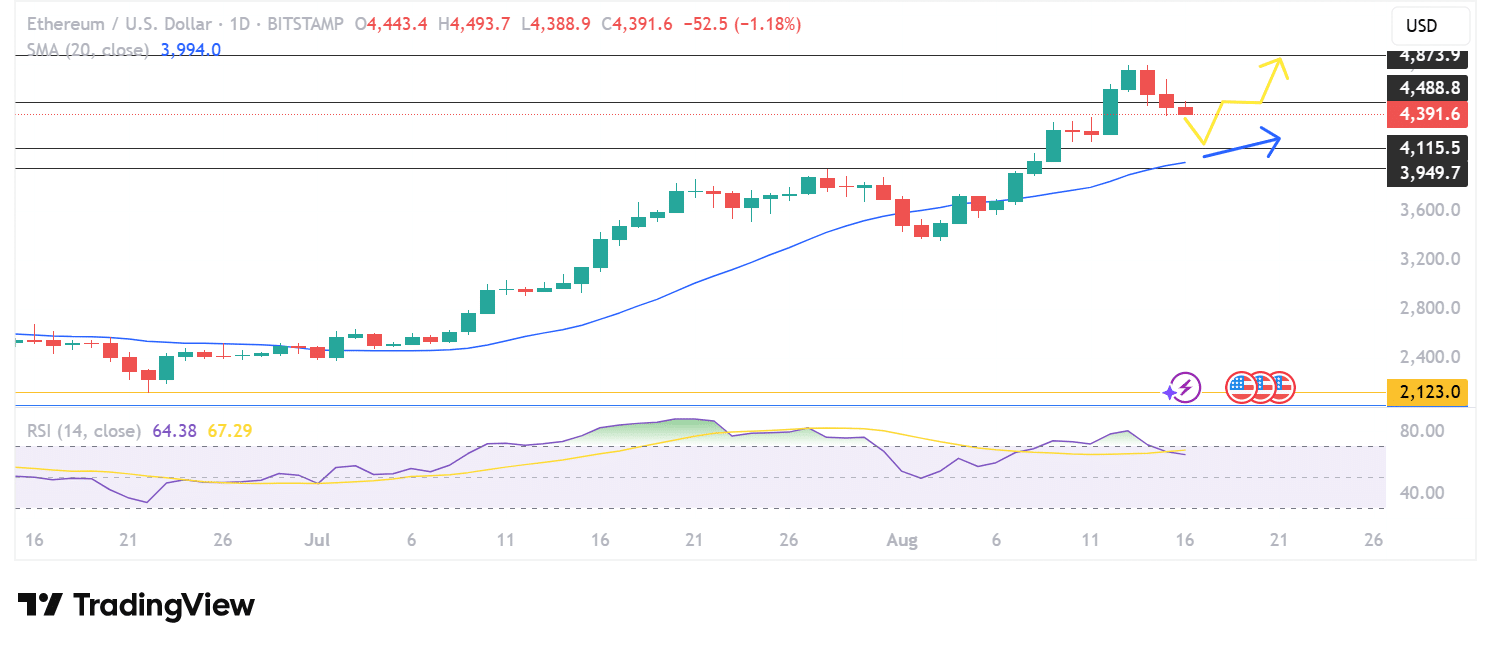

As ETH USD reels from the ATH resistance rejection, Ethereum is at the moment buying and selling at a market value of $4,397 (representing a 24-hour change of -0.95%).

Now looking for a decrease foothold after additional dropping footing round $4,490, ETH USD value motion appears prone to check decrease historic assist on the $4,115 value degree.

(ETHUSD)

To strengthen this case, a steadily rising 20DMA appears intent on converging with this decrease assist degree within the coming days. Notably, the 20DMA assist has been untested by ETH USD for 10 days, that means there was no shifting common assist for the earlier 8 days of ETF inflows.

A profitable consolidation at this degree appears prone to set off a second re-test of ATH resistance within the week forward. In any case, value isn’t fully rejected from a primary resistance check.

Such a transfer would even be bolstered by confidence from a decline within the RSI, which has been overheated at a robust bearish sign for quite a lot of days.

ETH USD will possible be caught by well-established assist round $3,750 within the occasion of a breakdown.

DISCOVER: Finest New Cryptocurrencies to Put money into 2025

The submit Ethereum Worth Rejects at ATH as ETF Flows Reverse and SBET Drops appeared first on 99Bitcoins.