Ethereum-focused (ETH) blockchain agency BTCS Inc. has unveiled plans to lift as much as $2 billion by means of share gross sales to develop its cryptocurrency holdings. The transfer was disclosed in a latest S-3 registration assertion filed with the US Securities and Trade Fee (SEC).

BTCS To Accumulate Extra Ethereum?

Based on a latest S-3 submitting with the US monetary watchdog, US-based digital property agency BTCS is eyeing a increase of $2 billion by means of share gross sales in a bid to develop its digital property portfolio and develop operations.

Particularly, BTCS goals to promote widespread shares throughout a number of choices, topic to a complete providing cap of $2 billion. Within the official SEC submitting, the corporate remarked:

We intend to make use of the online proceeds from the sale of the securities by us to supply further funds for buying digital property, working capital, and different basic company functions.

Along with the S-3 submitting, BTCS submitted a separate submitting for the resale of greater than 5 million shares of widespread inventory associated to prior convertible notes and warrants. The agency expects to generate as much as $12 million from this providing.

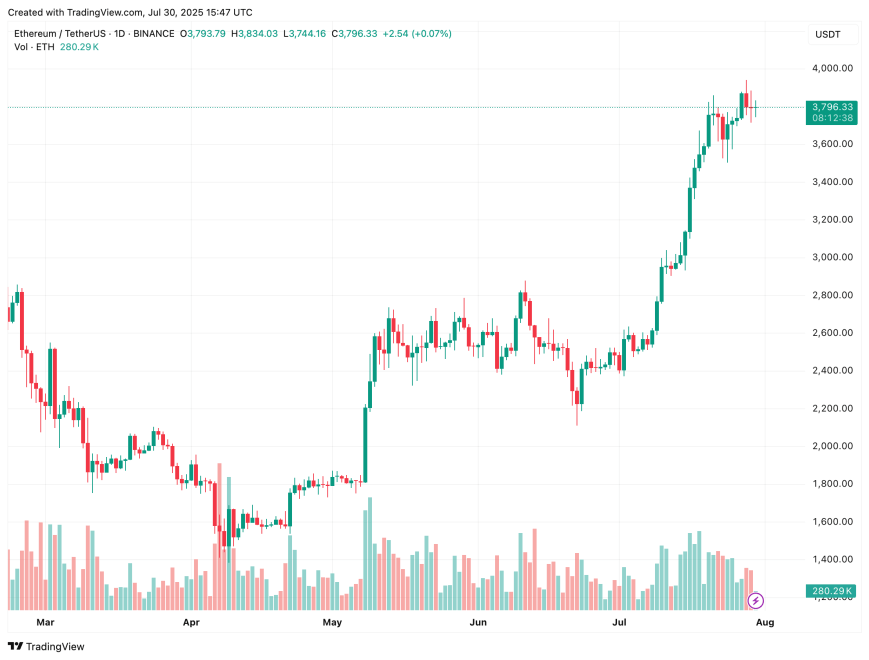

BTCS has been steadily growing its ETH reserves all through 2025. Most lately, it bought 14,420 ETH, bringing its complete holdings to 70,028 ETH – at the moment valued at round $275 million.

Based on information from CoinGecko, BTCS ranks fifth amongst publicly-traded corporations with the biggest ETH treasuries. BitMine Immersion Applied sciences tops the checklist, holding 566,776 ETH on its steadiness sheet.

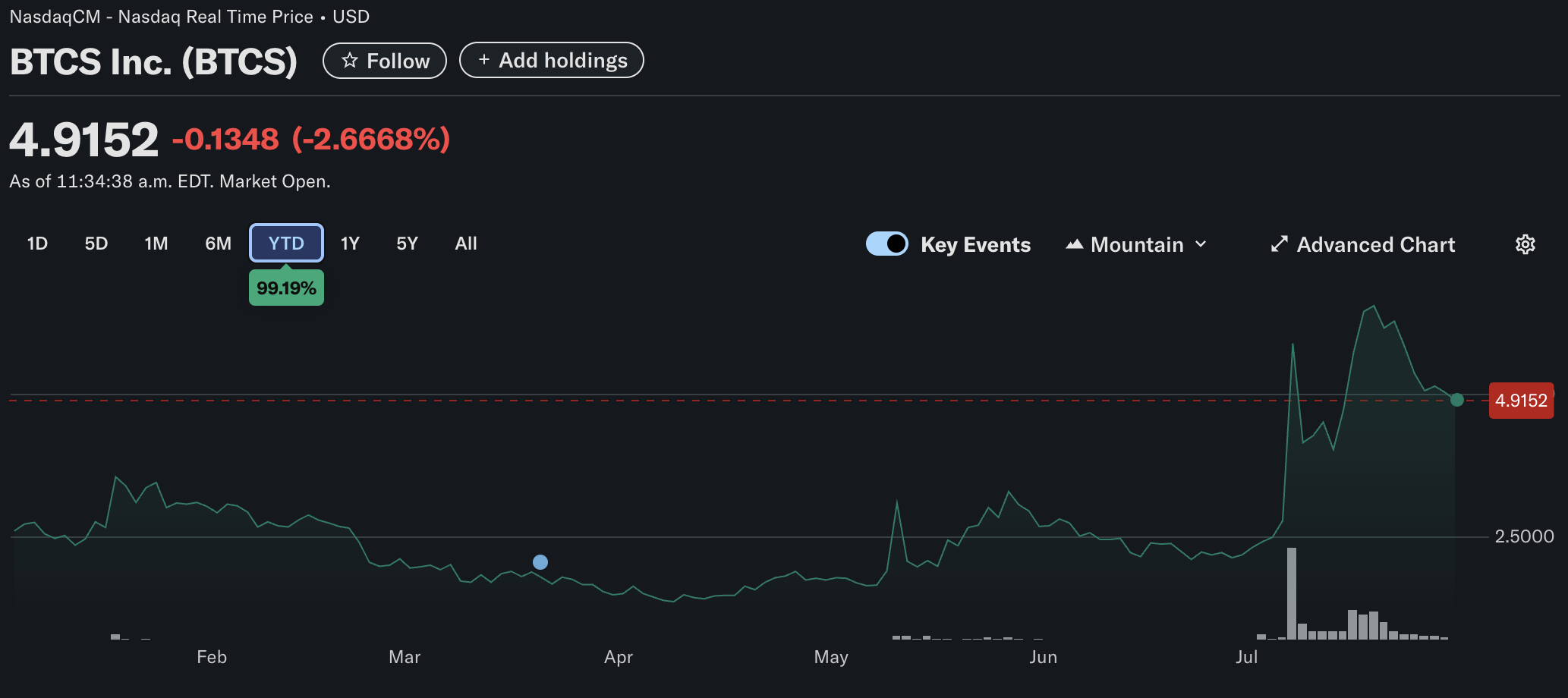

On the time of writing, BTCS shares recorded a slight pullback, buying and selling 2.6% decrease at $4.91. Nonetheless, the Nasdaq-listed agency remains to be up nearly 100% on a year-to-date (YTD) foundation.

ETH Accumulation In Full Pressure

Whereas earlier years noticed company giants like Technique (previously MicroStrategy), Tesla, and Coinbase amassing Bitcoin (BTC) reserves, 2025 is shaping as much as be the yr of Ethereum accumulation.

One other Nasdaq-listed agency – SharpLink Gaming – lately acquired 79,949 ETH, increasing its complete digital property reserves to 360,807 ETH. This got here after the agency had disclosed plans to spend as a lot as $5 billion to purchase extra ETH.

Equally, Bit Digital purchased 19,683 ETH final week, utilizing web proceeds from its lately concluded $67.3 million share providing. One other publicly-traded firm, GameSquare invested $5 million in ETH as a part of company treasury technique.

In the meantime, inflows attracted by spot Ethereum exchange-traded funds (ETFs) proceed to extend, lately eclipsing even these recorded by their BTC counterparts. At press time, ETH trades at $3,796, up 0.8% previously 24 hours.

Featured picture from Unsplash.com, charts from Yahoo! Finance, CoinGecko, and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.