Whereas worry grips the broader crypto market and plenty of merchants are panic-selling their Ethereum holdings, one whale is taking the alternative strategy, snapping up as many ETH tokens as doable amid the market crash. New information from blockchain analytics platform Lookonchain stories that this Ethereum whale has simply scooped up a staggering $127 million price of ETH, elevating eyebrows throughout the crypto group and indicating that they might know one thing the market doesn’t.

Ethereum Whale Goes Full Dip-Purchase Mode

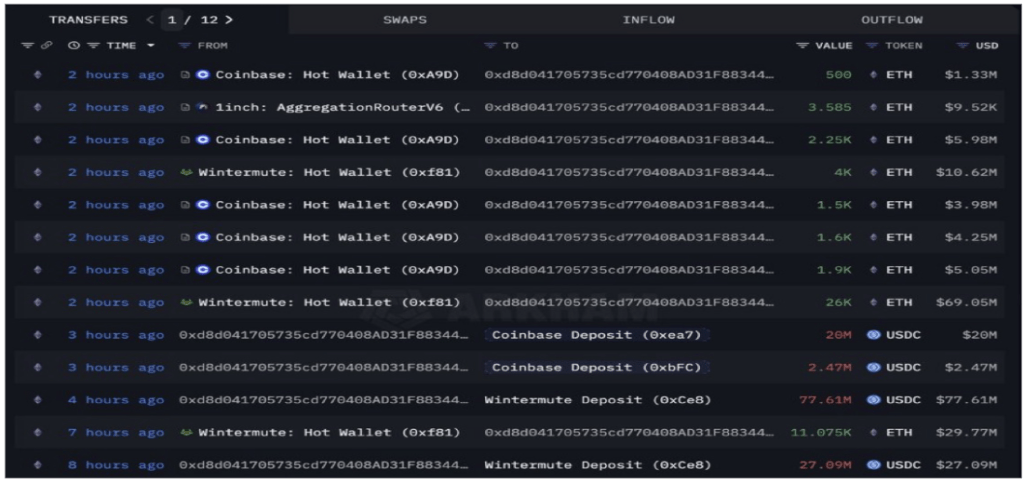

Whereas the market is dealing with volatility from the Bitcoin value crash and the mounting uncertainty from the Israel-Iran battle, a serious Ethereum whale makes a placing transfer by accumulating 48,825 ETH. This large ETH haul, bought from main crypto exchanges like Coinbase and Wintermute, is valued at a whopping $127 million.

Notably, Lookonchain highlights that the large-scale buy had occurred throughout a interval of intense panic promoting and crowd uncertainty. Highlighting the strategic prowess of this whale, the analytics platform revealed that they’d beforehand pocketed a powerful $30 million in income from an earlier ETH commerce. Now, the large-scale investor seems to be re-entering the market, particularly at a time when costs are projected to fall dramatically.

Primarily based on the timing of the whale’s purchases, it appears that evidently the investor is taking a buy-the-dip technique, capitalizing on steep value drops to build up extra ETH. This showcases confidence within the potential for Ethereum to surge as soon as the market stabilizes.

Transferring ahead, Lookonchain reveals that the whale’s current $127 million ETH buy was made at a median value of $2,605 per coin—a degree that many within the retail crowd worry should have room to fall. But, for this investor, the current market downturn has grow to be a possibility price seizing for future features.

Transaction data additionally present giant inflows of ETH right into a single receiving pockets, with high-value transfers coming in fast succession. These included multi-million greenback actions from Coinbase scorching wallets and Wintermute’s buying and selling addresses, consolidating tens of hundreds of ETH cash in a brief window.

Earlier than these ETH acquisitions, the whale had acquired over $127 million in USDC stablecoin, presumably suggesting a deliberate and calculated transfer fairly than a spontaneous dip purchase.

Strategic Timing Or Insider Strikes?

Whereas there’s no direct proof that this whale has insider info, the timing and scale of the ETH accumulation suggests a robust conviction in Ethereum’s near-to-long-term outlook. This type of aggressive shopping for not often occurs with out premises, and primarily based on prior shopping for conduct, this isn’t simply one other speculative dealer.

As Lookonchain reported earlier, this Whale’s pockets is linked to a historical past of well-timed ETH performs. Inside the crypto group, many members have expressed admiration for the whale’s strategic play. Some spotlight that their evaluation primarily based on the earlier $30 million revenue is proof of sharp market perception. Others imagine that after the market settles down and exits its bearish part, the investor might be positioned for even larger income.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.