EUR/USD has retraced earlier losses and trades close to 1.1720 on the time of writing, its highest stage in almost two months, after rallying almost 0.8% within the final two days. An bettering market sentiment has offered extra help to the Euro whereas the US Greenback stays on its again foot, because the market digests Wednesday’s dovishly tilted US Federal Reserve (Fed) financial coverage

Traders have shrugged off the risk-averse sentiment triggered by downbeat gross sales and income forecasts launched by the cloud computing large Oracle on Wednesday, which renewed market considerations about an overvaluation of the AI sector. European fairness markets have turned optimistic after a unfavorable opening, though Wall Avenue futures are nonetheless exhibiting average losses.

On Wednesday, the US Greenback, which had tumbled throughout the board, adopted a much less hawkish-than-expected financial coverage determination by the Consumed Wednesday. The US central financial institution minimize rates of interest by 25 foundation factors, as anticipated, however hawkish dissent was weak, and Chairman Jerome Powell confirmed extra relaxed about inflation, which hints at additional fee cuts in 2026.

On Thursday, the main focus is on the US Preliminary Jobless Claims knowledge, which might be noticed with specific curiosity to verify whether or not the earlier week’s decline was as a result of Thanksgiving vacation or it was a sign of some enchancment within the labour market.

Euro Value Immediately

The desk under exhibits the proportion change of Euro (EUR) in opposition to listed main currencies at present. Euro was the strongest in opposition to the Australian Greenback.

The warmth map exhibits share adjustments of main currencies in opposition to one another. The bottom foreign money is picked from the left column, whereas the quote foreign money is picked from the highest row. For instance, for those who choose the Euro from the left column and transfer alongside the horizontal line to the US Greenback, the proportion change displayed within the field will symbolize EUR (base)/USD (quote).

Every day Digest Market Movers: A dovish Fed is weighing on the US Greenback

The Federal Reserve minimize charges by 25 foundation factors to the three.50%-3.75% vary on Wednesday, and the dot plot signalled just one additional fee minimize in 2026. The absence of a extra hawkish divergence, with solely two votes calling for regular charges, and Chairman Powell’s feedback ruling out fee hikes, are conserving buyers assured that the financial institution will minimize charges no less than two extra instances subsequent yr, as mirrored on the CME Group FedWatch instrument.Past that, the market can also be pricing the substitute of Jerome Powell by a extra dovish Kevin Hassett on the finish of his time period in Might. Hassett, the White Home financial adviser, affirmed earlier this week that there’s “loads of room” to chop rates of interest additional.The Fed additionally introduced a bond-buying program beginning on December 12 with an preliminary spherical of $40 billion, aiming to help market liquidity, which took buyers abruptly and added strain on the USD.In Europe, the European Central Financial institution (ECB) President, Christine Lagarde, caught to her typical rhetoric whereas speaking on the Monetary Instances World Boardroom Convention in London on Wednesday. She reiterated that the financial institution’s financial coverage stays in fine condition and steered that ECB officers may carry the area’s progress forecasts once more, including to proof that the easing cycle has reached its finish.

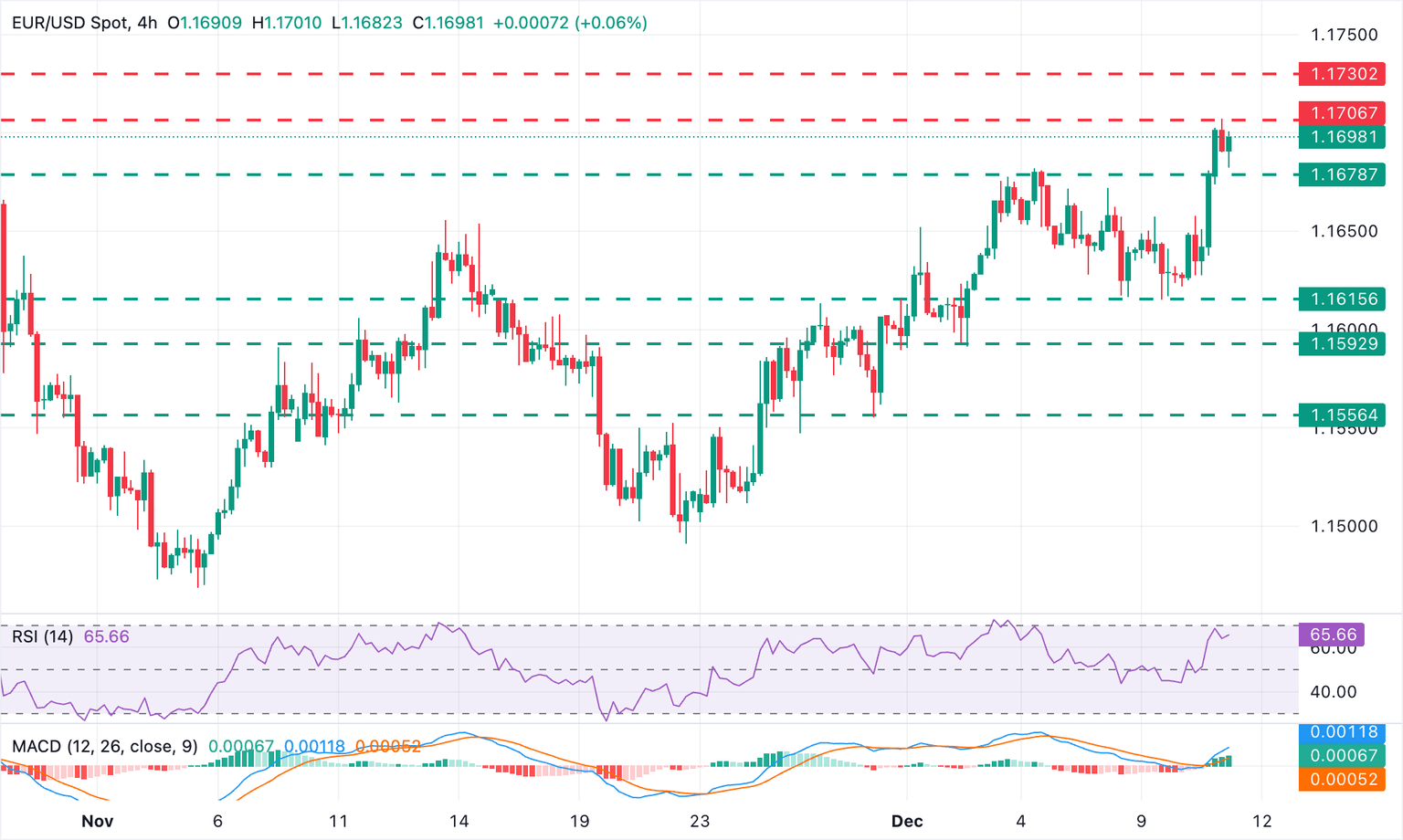

Technical Evaluation: EUR/USD bulls are taking a look at 1.1730

The EUR/USD technical image has turned optimistic after breaking resistance on the 1.1680 space. The 4-hour Shifting Common Convergence Divergence (MACD) is printing inexperienced bars, exhibiting a robust bullish momentum, and the 4-hour Relative Energy Index (RSI) is in optimistic territory, nonetheless under overbought ranges. On this context, and with the US Greenback Index depressed, additional appreciation is on the playing cards.

The pair has confirmed above 1.1705, and bulls are actually focusing on the October 17 excessive, close to 1.1730. The subsequent goal can be the October 1 excessive round 1.1780. On the draw back, the December 4 excessive, close to 1.1680, is offering help forward of the December 9 low, at 1.1615, and the December 1 and a pair of lows, round 1.1590.

Financial Indicator

Preliminary Jobless Claims

The Preliminary Jobless Claims launched by the US Division of Labor is a measure of the variety of folks submitting first-time claims for state unemployment insurance coverage. A bigger-than-expected quantity signifies weak spot within the US labor market, displays negatively on the US financial system, and is unfavorable for the US Greenback (USD). Alternatively, a lowering quantity needs to be taken as bullish for the USD.

Learn extra.

Subsequent launch:

Thu Dec 11, 2025 13:30

Frequency:

Weekly

Consensus:

220K

Earlier:

191K

Supply:

US Division of Labor

Financial Indicator

Preliminary Jobless Claims 4-week common

This indicator measures the common quantity for the final 4 releases of the Preliminary Jobless Claims, that are launched each Thursday. It’s revealed by the US Division of Labor as a measure of the variety of folks submitting first-time claims for state unemployment insurance coverage. It offers a measure of energy within the labor market. An growing development on this quantity signifies weak spot on this market which influences the energy and course of the US financial system. Typically talking, a lowering development needs to be taken as bullish for the US Greenback (USD) whereas the next studying needs to be taken as bearish.

Learn extra.

Final launch:

Thu Dec 04, 2025 13:30

Frequency:

Weekly

Precise:

214.75K

Consensus:

–

Earlier:

223.75K

Supply:

US Division of Labor