Euro weakens amid French political turmoil whereas greenback’s safe-haven attraction revives.

The Euro regained short-term power after French political situations eased, however sentiment maintained a bearish bias amid weak Eurozone information and a divided Fed outlook.

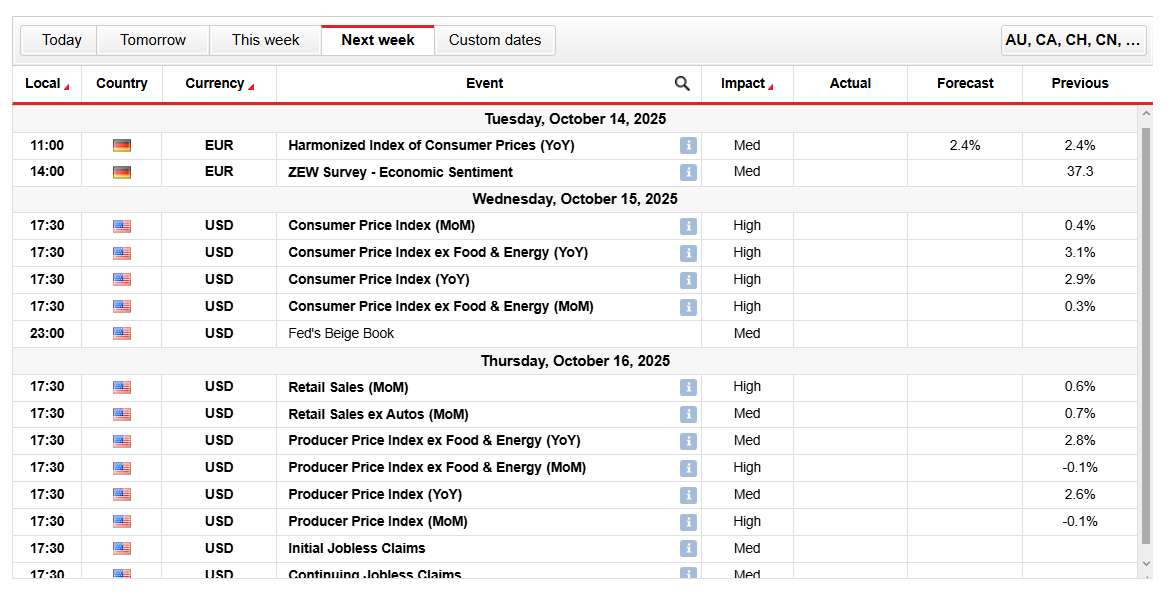

Merchants stay up for the Client Value Index and Eurozone Harmonized Index of Client Costs for market course cues.

The EUR/USD weekly forecast stays softer attributable to political and coverage turbulence through the week. The pair fell to two-month lows round 1.1540 earlier than a modest rebound above 1.1600.

–Are you interested by studying extra about foreign exchange conventions? Verify our detailed guide-

The US greenback strengthened on the week’s outset as international danger sentiment weakened. The persistent US authorities shutdown, unresolved funds negotiations in Congress, and contemporary commerce friction with China revived danger aversion and the greenback’s safe-haven demand. In the meantime, the euro confronted strain due to the political instability in France as a result of resignation of Prime Minister Sebastien Lecornu.

Moreover, the continued shutdown has resulted in restricted US financial information. Buyers centered on the Federal Reserve’s September assembly minutes, which recommended a divided committee over additional charge cuts. As a consequence of rising labor market issues, a slim majority favored two extra charge cuts this 12 months. In the meantime, Trump hinted at an enormous tariff improve on Chinese language items later this week, which put a maintain on financial easing expectations, resulting in fairness sell-offs and a reasonable greenback pullback.

From the Eurozone, blended financial information and deteriorating confidence restricted the euro’s restoration. A decline in German manufacturing unit orders and industrial output underscored issues about weak regional development. In the meantime, ECB president Christine Lagarde emphasised that disinflation objectives had been achieved and the coverage was in a great place.

Late within the week, the euro recovered modestly as Emmanuel Macron reappointed Sebastian Lecornu. The choice eased French political tensions because the greenback softened amid fading danger urge for food. General, the pair stays delicate to political and coverage developments in Europe and the US.

EUR/USD Key Occasions Subsequent Week

Market volatility may improve with Key Eurozone and US information releases within the coming week. Euro merchants might be carefully monitoring Germany’s HICP and ZEW sentiment. The US, the Client Value Index, Producer Value Index, and Retail Gross sales may information inflation and coverage expectations. In the meantime, the Fed’s Beige E-book may impression rate-cut outlooks and general danger sentiment.

EUR/USD Weekly Technical Forecast: Stays Pressured Beneath 1.1700

The EUR/USD weekly technical forecast signifies the pair discovered a quick aid after shifting to the 1.1550 assist space, adopted by a modest rebound to 1.1620. Nonetheless, the pair alerts bearish momentum, staying beneath each the 50- and 100-day MAs, which proceed to restrict restoration makes an attempt. The general construction favors the draw back, with the 200-day MA round 1.1220, which might be the medium-term goal for the sellers. In the meantime, rapid resistance stands at 1.1630, 1.1690, and 1.1725.

–Are you interested by studying extra about Ethereum worth prediction? Verify our detailed guide-

The RSI has edged larger close to 47, shifting out of the oversold territory. It suggests a brief corrective bounce earlier than renewed promoting. Failing to carry above 1.1600 may reinforce a bearish bias towards 1.1500-1.1450. In distinction, a sustained transfer above 1.1700 may shift sentiment towards a extra impartial or bullish outlook. The pair stays susceptible so long as it stays under the important thing shifting averages.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to think about whether or not you possibly can afford to take the excessive danger of shedding your cash.