The issue is recognizing these gaps manually whereas monitoring a number of pairs, which will get exhausting. You may catch the plain ones, however delicate gaps in decrease timeframes slip by. Miss these setups, and also you’re leaving high-probability entries on the desk. Worse, by the point you discover a niche forming, the worth has already moved 20-30 pips previous your superb entry.

That’s the place the Honest Worth Hole Indicator for MT4 is available in. This software robotically identifies these imbalances and marks them in your chart, letting you deal with execution quite than limitless sample recognition. The indicator doesn’t predict the longer term, however it highlights areas the place institutional order movement left its fingerprints—zones the place value typically returns to fill inefficiencies.

What Honest Worth Gaps Truly Characterize

A good worth hole varieties when value strikes so aggressively that it leaves behind an imbalance—a spread the place minimal buying and selling occurred. In technical phrases, it’s the area between the wick of 1 candle and the other wick of the candle two durations earlier. If the excessive of candle 1 doesn’t overlap with the low of candle 3 throughout an upward transfer, you’ve received an FVG.

These gaps matter as a result of markets have a tendency towards equilibrium. When giant institutional orders push costs quickly by a stage, smaller members don’t get an opportunity to commerce that vary. The market typically revisits these zones to determine honest worth, creating retracement alternatives for merchants who spot them.

How the MT4 Indicator Identifies Gaps

The Honest Worth Hole Indicator scans your chart utilizing a three-candle sample recognition algorithm. For bullish gaps, it appears for situations the place candle 1’s excessive sits under candle 3’s low, with candle 2 creating the hole. The reverse applies for bearish gaps—candle 1’s low above candle 3’s excessive.

As soon as detected, the indicator attracts a shaded field highlighting the hole zone. Most variations allow you to customise the field colours: inexperienced for bullish FVGs, pink for bearish ones. The containers stay in your chart till value fills the hole otherwise you manually take away them. Some superior variations embrace alerts when new gaps kind or when the worth approaches current gaps inside a sure pip threshold.

Right here’s what separates high quality FVG indicators from primary ones: they filter noise. A superb indicator ignores tiny 5-pip gaps that kind throughout low-volume Asian classes and focuses on substantial imbalances—usually 15+ pips on the 1-hour chart or 30+ pips on the 4-hour. This filtering prevents your chart from turning into cluttered with each minor inefficiency.

Buying and selling Honest Worth Gaps in Actual Market Situations

Let’s get sensible. On EUR/USD’s 1-hour chart in the course of the October 2024 NFP launch, the worth rocketed 60 pips larger in 4 candles after unemployment knowledge shocked to the draw back. That transfer created a 22-pip honest worth hole between 1.0840 and 1.0862. Over the subsequent eight hours, the worth retraced into that zone, tapping 1.0856 earlier than resuming the uptrend.

Merchants utilizing the indicator may’ve set restrict orders inside that hole zone, getting into lengthy positions with tight stops under 1.0840. The danger-to-reward setup provided a possible 3:1 ratio with a 15-pip cease and 45-pip goal again to the highs.

However right here’s the factor—not all gaps fill instantly. Some take days and even weeks. On GBP/JPY’s each day chart, a niche fashioned at 185.20-186.40 throughout a speedy yen selloff in September 2024. Value didn’t revisit that zone for 3 weeks, lastly tapping it throughout a broader pullback in October. Endurance issues when buying and selling these setups.

The indicator works finest when mixed with directional bias. For those who’re bullish on a pair and spot a good worth hole under the present value within the course of the development, that hole turns into a high-probability retracement goal. Conversely, gaps in the other way of the prevailing development typically get ignored as the worth continues its dominant transfer.

Customizing Settings for Completely different Buying and selling Types

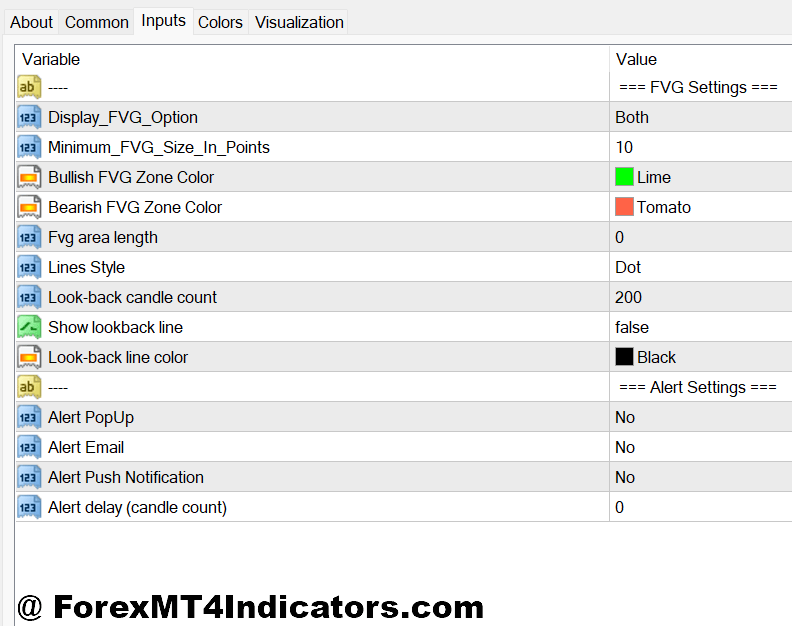

Most MT4 honest worth hole indicators supply a number of adjustable parameters. The minimal hole dimension filter is important—set it too low, and also you’ll drown in alerts. For scalping on 5-minute charts, a 5-10 pip minimal works. Swing merchants on 4-hour or each day charts ought to use 20-30 pips minimal to catch significant imbalances.

The lookback interval determines how far again the indicator scans. Setting this to 50-100 bars retains current gaps seen with out cluttering your chart with historic historical past. Some merchants want limitless lookback to check how outdated gaps ultimately fill, however that’s extra for evaluation than energetic buying and selling.

Coloration customization issues greater than you’d suppose. Use contrasting colours in opposition to your chart background—delicate pastels received’t lower it while you’re scanning 5 charts concurrently in the course of the London open. Brilliant, distinct colours assist your mind course of info sooner throughout high-pressure moments.

Alert settings deserve consideration, too. Allow push notifications for brand new hole formations for those who’re monitoring a number of pairs, however disable alerts for hole fills until you’re actively buying and selling these setups. Getting pinged each time the worth touches a niche zone will get annoying quick.

Benefits: What This Indicator Does Nicely

The most important benefit is automation. As a substitute of manually monitoring three-candle patterns throughout six foreign money pairs and 4 timeframes, the indicator does the heavy lifting. That frees up psychological bandwidth for commerce administration and threat evaluation.

FVG indicators additionally present objectivity. If you’re manually on the lookout for setups, affirmation bias creeps in—you see patterns that help your current place. The indicator doesn’t care about your bias. It marks gaps primarily based on mathematical standards, interval.

These instruments excel at highlighting retracement zones in trending markets. When EUR/USD is in a robust each day uptrend, bullish FVGs under the present value grow to be logical retracement targets for including to positions. The visible markers make it simple to set restrict orders and stroll away quite than observing screens.

Limitations: The place the Indicator Falls Brief

Honest worth gaps don’t assure fills. Typically, value ignores a niche utterly, particularly if momentum shifts dramatically. That stunning 30-pip hole on USD/JPY may by no means get touched if the Financial institution of Japan announcesa shock intervention. No indicator predicts basic shocks.

The software additionally generates false alerts in uneven, range-bound markets. When value whipsaws forwards and backwards with out directional conviction, gaps kind always however not often supply clear buying and selling setups. Throughout these situations, you’ll see gaps get partially stuffed, then deserted, creating complicated value motion.

One other limitation: the indicator can’t let you know which gaps matter most. A spot forming after a serious help break carries a unique weight than one forming mid-range throughout lunch hour. You continue to want market context and expertise to filter high-probability setups from noise.

How FVG Indicators Examine to Different Instruments

Not like transferring averages that lag value, honest worth gaps are forward-looking. They mark zones the place value may return primarily based on market construction, not historic common costs. This makes them extra dynamic for energetic merchants.

In comparison with Fibonacci retracements, FVGs are goal. Fib ranges require deciding on swing highs and lows, which introduces subjectivity. Two merchants may draw totally different Fib ranges on the identical chart. Honest worth gaps kind primarily based on particular candle patterns—no interpretation wanted.

That stated, FVG indicators work brilliantly when mixed with different technical instruments. Utilizing them alongside help/resistance ranges or trendlines creates confluence zones with larger success charges. A good worth hole that aligns with a serious help stage gives higher odds than a niche in no-man’s-land.

How you can Commerce with Honest Worth Hole Indicator MT4

Purchase Entry

Bullish FVG in uptrend – Look ahead to value to retrace right into a green-shaded hole zone on EUR/USD 4-hour chart whereas each day development stays bullish, then enter lengthy when value touches the decrease boundary of the hole with a 20-pip cease under.

Hole confluence with help – Enter purchase orders when a good worth hole aligns with a serious help stage on the GBP/USD 1-hour chart, however provided that the hole is no less than 15 pips vast to keep away from low-quality setups.

Partial hole fill entry – Place restrict orders at 50% of the hole zone quite than ready for full retracement; on unstable pairs like GBP/JPY, value typically reverses mid-gap, so this captures entries with out lacking the transfer.

Submit-breakout retracement – After EUR/USD breaks above resistance and creates a 25+ pip honest worth hole, wait 4-8 hours for value to drop again into that hole earlier than getting into lengthy positions with targets on the earlier highs.

Don’t commerce Asian session gaps – Keep away from shopping for into FVGs that kind throughout low-volume Tokyo hours (2-6 AM GMT); these gaps lack institutional footprint and sometimes get ignored when London opens.

A number of timeframe affirmation – Solely take purchase alerts when each 1-hour and 4-hour charts present bullish honest worth gaps in the identical value zone; single-timeframe gaps on EUR/USD fail 60% of the time throughout ranging situations.

Quantity spike requirement – Enter lengthy provided that the candle creating the hole reveals 2x common quantity; weak-volume gaps on GBP/USD each day charts not often appeal to follow-through shopping for strain.

Danger 1% most per hole commerce – By no means threat greater than 1% of account steadiness on any single FVG setup, even when it appears good; surprising information occasions can blow by gaps with out filling them.

Promote Entry

Bearish FVG in downtrend – Enter brief when value rallies right into a red-shaded hole on EUR/USD 4-hour chart whereas each day development factors down, putting stops 15-20 pips above the hole’s higher boundary.

Failed hole fill rejection – If value enters a bearish FVG on GBP/USD 1-hour chart however fails to fill it, displaying a robust rejection wick, brief instantly with stops above the hole excessive.

Hole under damaged help – After help breaks on each day EUR/USD and creates a 30+ pip honest worth hole, brief rallies again into that hole zone concentrating on the subsequent help stage 80-100 pips decrease.

Keep away from counter-trend gaps in sturdy rallies – Don’t brief bearish FVGs when EUR/USD is up 200+ pips in two days; momentum typically steamrolls by gaps with out respecting them throughout parabolic strikes.

Night session hole formation – Bearish gaps forming throughout New York shut (4-5 PM EST) on GBP/USD are inclined to fill in the course of the subsequent day’s London session; brief these setups with 25-pip stops for 50-pip targets.

Skip skinny Friday gaps – By no means commerce honest worth gaps that kind after 12 PM EST on Fridays; weekend place squaring creates synthetic gaps that don’t replicate true institutional order movement.

Divergence affirmation entry – Brief bearish FVGs solely when RSI reveals overbought readings above 70 on the 1-hour chart; this provides confluence that the rally is exhausted and able to retrace.

Dimension down on unique pairs – If buying and selling FVG alerts on USD/ZAR or USD/TRY, scale back place dimension by 50% in comparison with main pairs; unique spreads and volatility make gap-trading riskier with wider cease necessities.

Conclusion

Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and honest worth gaps are not any exception. Markets can stay irrational longer than your account can stay solvent, particularly when buying and selling counter-trend hole fills.

The Honest Worth Hole Indicator MT4 shines when used as a part of a whole buying and selling system. It identifies potential retracement zones, however you continue to want correct threat administration, place sizing, and emotional self-discipline. Set your stops past the hole zone, not inside it—value typically wicks by gaps earlier than reversing.

Begin by observing how gaps behave in your most well-liked pairs and timeframes earlier than buying and selling them with actual cash. Some pairs respect FVGs religiously; others ignore them. GBP/USD and EUR/USD have a tendency to point out cleaner gap-fill habits than unique pairs with wider spreads and decrease liquidity.

The actual worth isn’t in blindly buying and selling each hole. It’s in utilizing these zones as reference factors inside your broader market evaluation, serving to you time entries with precision quite than chasing value or getting into at suboptimal ranges.

Really helpful MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Successful Foreign exchange Dealer

Further Unique Bonuses All through The 12 months

Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90