FinovateEurope 2026 is simply days away!

With its residence in London, it’s no shock that FinovateEurope typically showcases the best variety of demoing corporations headquartered exterior of america. What’s particularly fascinating about this 12 months’s cohort of FinovateEurope demoing corporations, nonetheless, is the share of non-US corporations in comparison with the whole: greater than 77% of this 12 months’s demoers hail from nations apart from the US. Verify them out beneath after which be part of us subsequent week for FinovateEurope 2026!

FinovateEurope 2026 kicks off at London’s Intercontinental 02—February 10 and 11. Tickets are nonetheless accessible. Go to our FinovateEurope 2026 hub to register and save your spot!

AAZZUR—Berlin, Germany

Based in 2019, AAZZUR empowers manufacturers to launch embedded finance options with a single integration, unlocking new income streams and enhancing buyer engagement.

Candour Id—Oulu, Finland

Based in 2021, Candour Id boosts onboarding conversions, reduces fraud losses, permits day by day biometric use, and helps regulatory complaince to assist instituions scale their digital choices.

FINTRAC—London, England

Based in 2024, FINTRAC automates workflows to ship stronger controls, richer analytics, and decrease prices throughout the mannequin lifecycle. The corporate’s Mannequin Ops platform helps banks and different monetary establishments handle their most advanced fashions and calculations.

Francis—London, England

Based in 2025, Francis empowers monetary establishments and fintechs to profit from open finance by leveraging AI. The corporate’s know-how turns fragmented monetary information into actionable wealth insights.

Hagbad—United Kingdom

Based in 2025, Hagbad digitizes trust-based financial savings, enabling compliant engagement, increasing buyer attain and driving monetary inclusion by way of regulated, culturally aligned monetary infrastructure.

Intuitech—Budapest, Hungary

From easy workflows to advanced circumstances reminiscent of business loans and mortgages, Intuitech delivers AI brokers able to automating over 90% of handbook duties, shortening approval instances and reducing prices. The corporate was based in 2018.

Keyless—London, England

Keyless replaces outdated multi-factor authentication (MFA) with biometrics, enhancing the consumer expertise and saving thousands and thousands. Based in 2019, Keyless was acquired by fellow Finovate alum Ping Id.

Maisa—Valencia, Spain

Maisa boosts enterprise effectivity by automating end-to-end processes with traceability, hallucination-resistance, and governance, in regulated industries reminiscent of banking and monetary providers. Maisa was based in 2024.

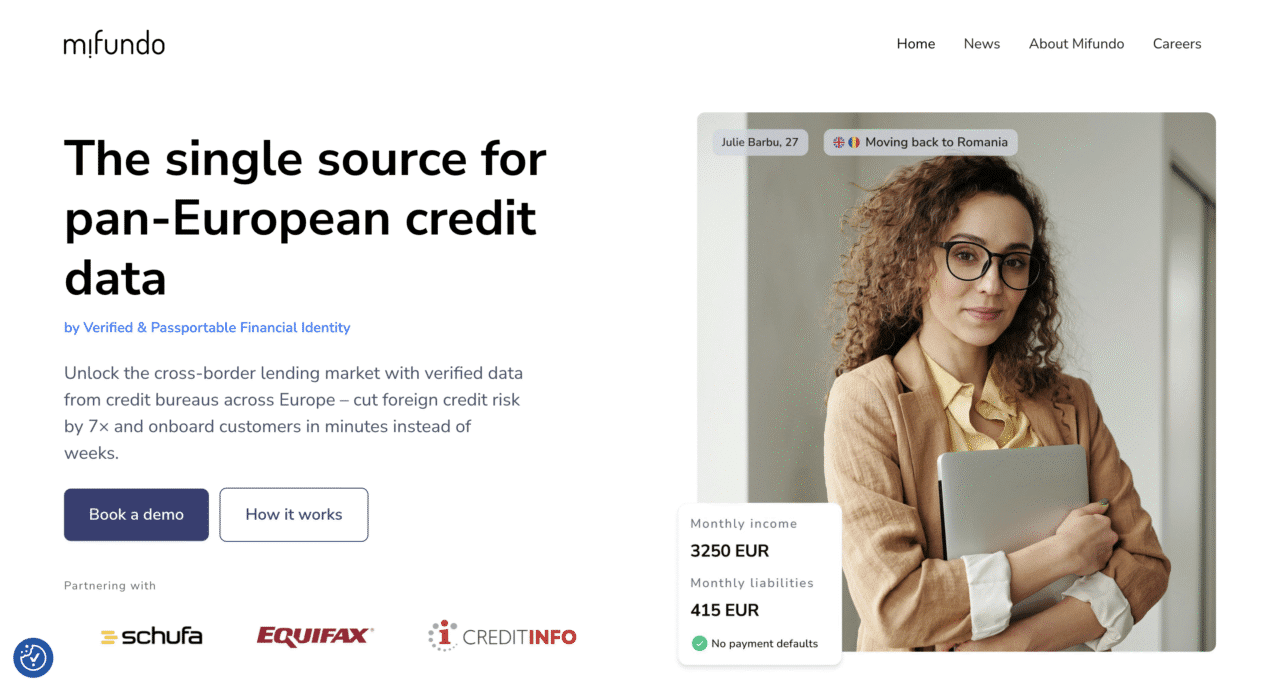

Mifundo—Tallinn, Estonia

Mifundo permits banks and different monetary establishments to develop their enterprise quantity by as much as 15% by enabling them to higher serve overseas and cross-border clients all through Europe. The corporate was based in 2022.

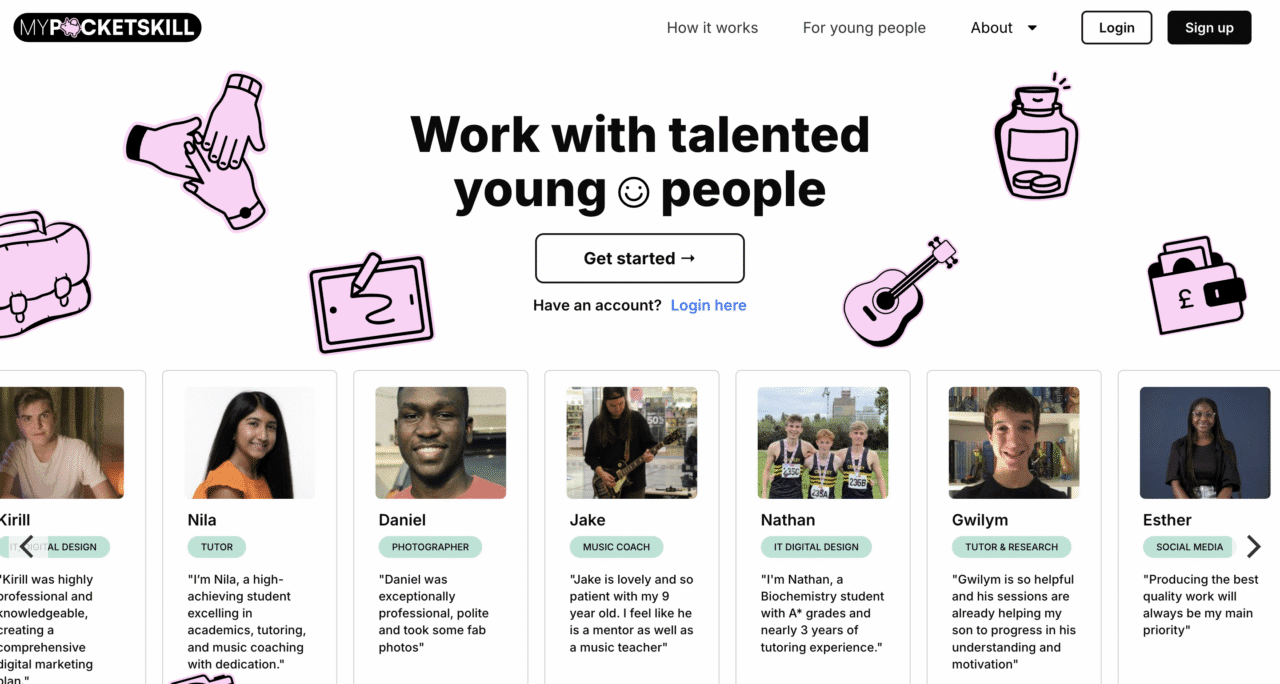

MyPocketSkill—London, England

Based in 2020, MyPocketSkill is a digital know-how firm on the nexus of fintech and edtech that gives options to assist Gen Z to avoid wasting, make investments, and turn into more cash savvy.

Neuralk AI—Paris, France

Based in 2024, Neuralk AI makes predictive functionality a viable choice at each level the place tabular information is obtainable. The corporate’s know-how delivers superior efficiency in comparison with conventional machine studying and large-language fashions.

Opentech—Rome, Italy

Based in 2023, Opentech companions with banks and card issuers, supporting digital transformation with safe, compliant, and scalable cost options. The corporate combines UX design with software program engineering by way of a co-design mannequin that accelerates supply whereas making certain equality and reliability.

R34DY—Budapest, Hungary

Based in 2019, R34DY gives an automatic system, ABLEMENTS, that permits speedy AI transformation for banks, enabling them to ship new merchandise sooner, decrease IT prices, and differentiate themselves by way of context-aware modernization.

Sea.dev—London, England

Sea.dev gives embeddable AI for enterprise lending. The corporate’s know-how automates underwriting workflows, to allow credit score analysts to concentrate on higher-value evaluation, sooner decision-making, and development. Sea.dev was based in 2024.

Serene—London, England

Based in 2023, Serene combines behavioral insights, predictive intelligence, and monetary information to allow establishments to establish and perceive early indicators of fraud, vulnerability, and monetary stress.

Ability Studio AI—Dublin, Eire

Based in 2025, Ability Studio AI transforms coaching paperwork into partaking, AI-powered studying experiences. The corporate’s platform reduces coaching prices, accelerates compliance readiness, and scales globally.

Tweezr—Tel Avi, Israel and Amsterdam, the Netherlands

Tweezr empowers establishments to remodel and develop by accelerating time-to-market and boosting developer productiveness for each sustaining legacy techniques in addition to for modernization initiatives. The corporate was based in 2024.

Photograph by Lucas George Wendt on Unsplash

Views: 222