GBP/USD stays underneath strain amid persistent greenback power and fading BoE charge hike bets.

UK CPI shocked to the upside, however markets doubt the BoE will reply with one other hike.

Subsequent week’s focus shifts to UK and US PMIs, each prone to form GBP/USD’s near-term trajectory.

The GBP/USD value closed decrease for the week, sliding from the 1.3485 area towards 1.3400, because the US greenback discovered contemporary demand and UK charge expectations softened.The most important occasion was the UK CPI print, which got here in hotter than anticipated at 3.6% YoY vs. 3.4% forecast.

–Are you interested by studying extra about ETF brokers? Verify our detailed guide-

This initially boosted the pound, with merchants pricing in a doable late-cycle charge hike by the BoE. Nonetheless, the rally fizzled after BoE members remained non-committal on future tightening, citing underlying disinflationary tendencies and weak wage progress.

Throughout the Atlantic, the US CPI knowledge confirmed cooling inflation, however not sufficient to persuade markets of a near-term Fed charge reduce, particularly as Fed Chair Powell’s feedback leaned hawkish.

Threat sentiment was additional dampened by political headlines, together with rumors (later denied) that Trump might substitute Fed Chair Powell if elected. The greenback rebounded sharply after the denial, inflicting GBP/USD to fall.

Upcoming Occasions for GBP/USD

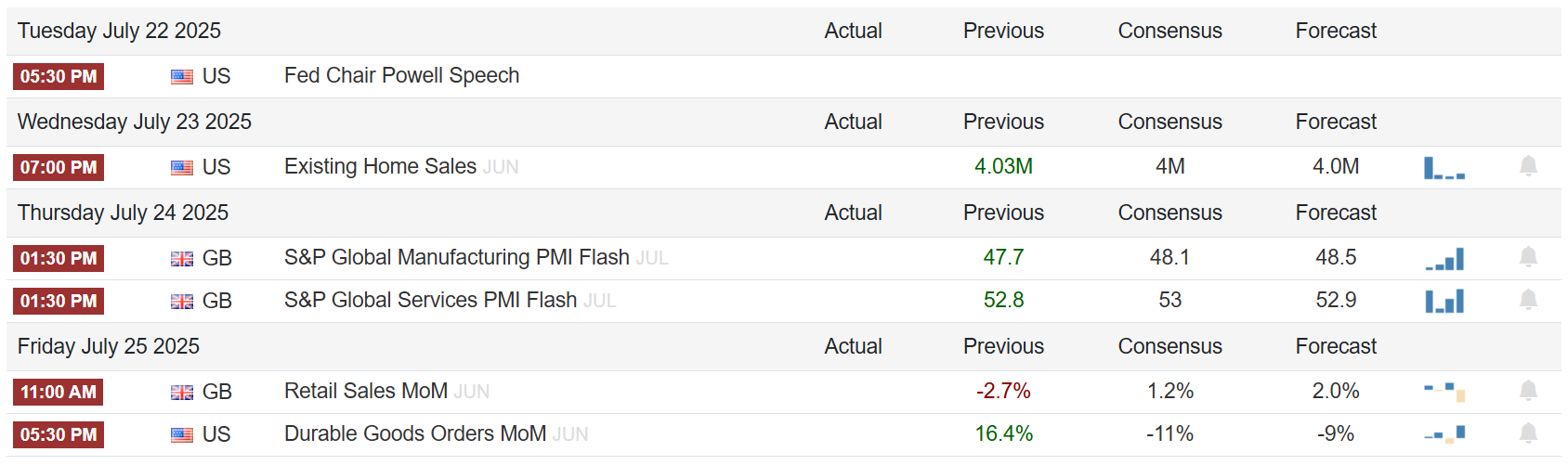

Subsequent week affords a mixture of high-impact UK and US knowledge:

UK S&P International PMIs (Wednesday): A smooth studying may reinforce issues over UK financial momentum, weighing on sterling.

US S&P International PMIs (Thursday): The PMI readings might reveal the financial power of the US that will probably influence the Fed’s financial coverage.

UK Retail Gross sales (Friday): The information will feed into broader sentiment about UK demand-side weak point.

Markets can even be anticipating Fed communicate and BoE commentary, particularly after the current inflation prints.

GBP/USD weekly technical forecast: Bears aiming for 100-day SMA

The each day chart for the GBP/USD reveals a weakening momentum as bearish strain intensifies round 1.3400. Nonetheless, the present value degree coincides with a strong help. The previous couple of each day candles present a bearish momentum, whereas the 20-day and 50-day SMAs have additionally turned bearish.

–Are you interested by studying extra about Canada foreign exchange brokers? Verify our detailed guide-

The subsequent goal for the bears lies on the 100-day SMA close to the 1.3300 area forward of the subsequent help at 1.3150. The RSI worth is close to 40.0, which signifies the likelihood of additional draw back can’t be dominated out.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It’s best to contemplate whether or not you possibly can afford to take the excessive threat of shedding your cash.