The gold forecast stays tilted to the draw back, aiming to check $4,400 because the greenback recovers forward of the US NFP.

The upbeat US ISM Companies PMI weighed on gold, igniting a sell-off.

The gold’s draw back is proscribed by the easing Fed and China’s continued shopping for of bodily gold.

Gold worth stays softer, buying and selling beneath $4,450 in Thursday’s European session. The valuable metallic has misplaced round 1% from its weekly peak of $4,500. The pullback after Monday’s strong rally displays a stronger greenback forward of US NFP knowledge and a few profit-taking.

–Are you curious about studying extra about foreign exchange indicators? Examine our detailed guide-

The rapid strain got here on gold from Wednesday’s US knowledge, which helped offset bearish strain on the US greenback. JOLTS job openings for November fell to 7.146 million, revealing a gradual cooling of labor markets. In the meantime, the ADP employment surged by 41k in December, an enormous leap from November’s contraction however nonetheless under the forecast. Contrarily, the ISM Companies PMI soared to 54.5, the strongest studying since late 2024. The mix has strengthened the US greenback with out triggering a decisive shift in sentiment.

The valuable metallic’s draw back stays comparatively contained regardless of the near-term dip as markets anticipate round two Fed fee cuts this 12 months. The easing outlook limits the greenback’s holding attraction and favors non-yielding gold. In the meantime, China’s central financial institution continues gold shopping for for the 14th consecutive month in December, lending robust assist to the gold.

On the geopolitical entrance, Trump’s latest remarks about Greenland, capturing the Venezuelan President, and up to date pressure between China and Japan after China’s sanctions on Japan’s sure exports, have stored the chance sentiment deteriorated. In the meantime, equities stay softer too. These elements preserve gold demand underpinned as a safe-haven asset.

Wanting forward, the following decisive transfer for gold is linked with Friday’s Nonfarm Payrolls report. A weaker studying may revive expectations of aggressive Fed easing and weigh on the Greenback, opening the door for an additional push greater in gold. Till then, consolidation under $4,500 seems extra like a pause than a reversal.

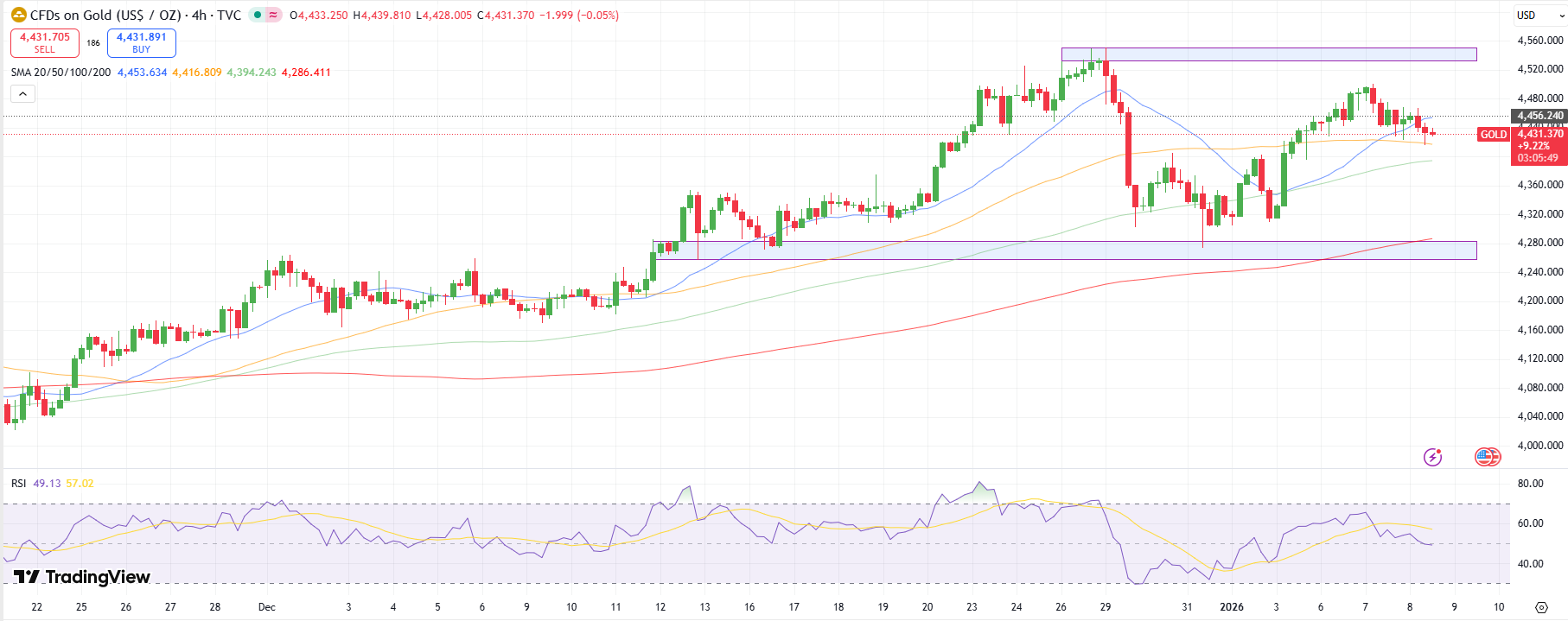

Gold Technical Forecast: Bears to Take a look at 200-MA

The gold worth stays wobbling in a quick vary between 20- and 50-period MAs, whereas the RSI stays flat close to 50.0. A 100-period MA coincided with $4,400 degree, which stays a decisive degree for the merchants. If damaged, the promoting traction may ignite additional to check the $4,280 demand zone aligned with the 200-period MA.

–Are you curious about studying extra about subsequent cryptocurrency to blow up? Examine our detailed guide-

On the upside, shifting above the 20-period MA at $4,455 may alleviate the bearish strain and result in a take a look at of the $4,500 degree forward of all-time highs close to $4,550. Nevertheless, the present worth motion reveals no clear path of least resistance.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It’s best to contemplate whether or not you possibly can afford to take the excessive threat of shedding your cash.