Picture supply: Getty Photos

Financial savings and funding accounts each serve necessary roles in constructing long-term wealth. I personally maintain merchandise just like the Money ISA to maintain my emergency money and handle danger. I even have a Shares and Shares ISA and Self-Invested Private Pensions (SIPPs) to purchase UK and abroad shares to focus on better returns.

The lion’s share of my surplus money every month is used to buy shares, funding trusts and exchange-traded funds (ETFs) on the inventory market. Historical past exhibits that holding an excessive amount of cash in a low-risk, low-return money accounts can go away a gap in a person’s pension pot.

A £37k shortfall

Contemporary analysis from Moneybox underlines the scale of this potential shortfall. It highlights “a £37,000 distinction in common funding holdings between financially assured people and those that lack confidence, no matter revenue.

It says that “investments have traditionally outperformed money over time,” however {that a} insecurity and monetary training is impacting demand for riskier property.

Moneybox says that funding confidence amongst Britons has risen to 39% in 2025 from 33% final 12 months. Nonetheless, confidence in saving stays far greater, at 84% at present versus 79% in 2025.

The monetary companies supplier notes that “this distinction is highlighted by the truth that because the begin of 2025, solely 11% of people have transitioned cash from financial savings into investments.”

Higher returns

The added danger that accompanies share investing is why — understandably — many individuals are drawn to financial savings accounts. Not like money financial savings, the worth of inventory investments can fall in addition to rise over time.

But whereas previous efficiency isn’t all the time a dependable information, share investing has over time proved a robust method to management danger whereas nonetheless delivering sturdy returns. In keeping with Moneyfacts, the typical Shares and Shares ISA investor has loved a 9.64% common annual return since 2015.

That determine sits means again at 1.21% for Money ISA customers.

Harnessing shares with funding trusts

Moreover, trendy traders can select from a variety of property to mitigate danger. They’ll buy lower-risk shares like utilities, defence contractors, and producers of client staples to restrict volatility.

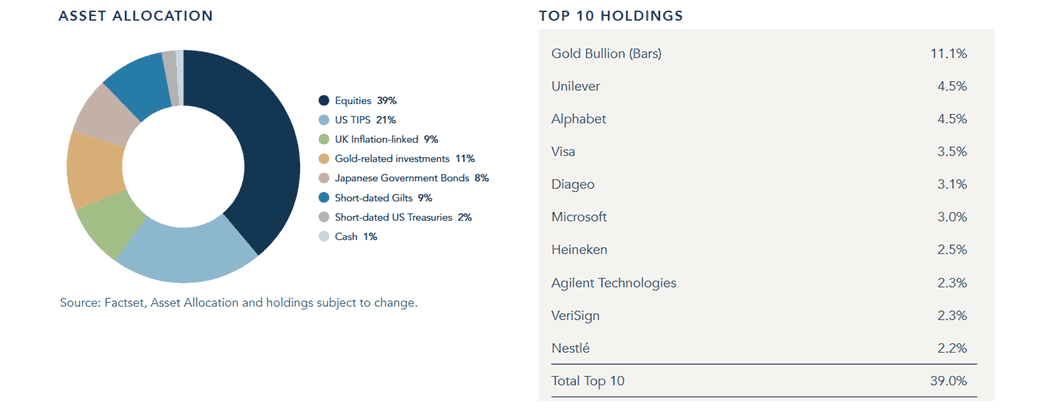

They’ll additionally construct a diversified portfolio spanning completely different sectors and areas to unfold danger. Funding trusts like Private Belongings Belief (LSE:PNL) supply a easy (and low-cost) method to obtain this type of resilience.

Since 2015, it’s delivered a mean yearly return of 5.5%. That’s far forward of what a Money ISA saver would have remodeled the interval.

The belief has achieved this because of a robust ranking of equities of equities. Just below 40% of it’s tied up in world shares, however its holdings are nicely diversified. What’s extra, lower than 5% of it’s tied up in a single single firm, which reduces focus danger.

The rest of the fund is locked up in safe-haven property like gold, authorities bonds and money, which balances investor danger and helps present a clean return throughout the financial cycle.

Private Belongings Belief stays susceptible to broader actions on inventory markets. However I feel it’s nonetheless an ideal funding belief to contemplate to handle danger and goal tremendous returns.