As we speak, Synthetix launches the canonical perp DEX on Ethereum. This marks the top of the transition part and the start of the Ethereum Mainnet CLOB period for Synthetix.

As a DeFi pioneer since 2017, with years of expertise innovating in artificial property, liquidity incentives, and decentralized stablecoins, Synthetix is returning to Ethereum Mainnet with a clear slate and a renewed concentrate on constructing the last word perp DEX.

So It Begins…

Synthetix Perps are going reside on Ethereum Mainnet in a non-public beta.

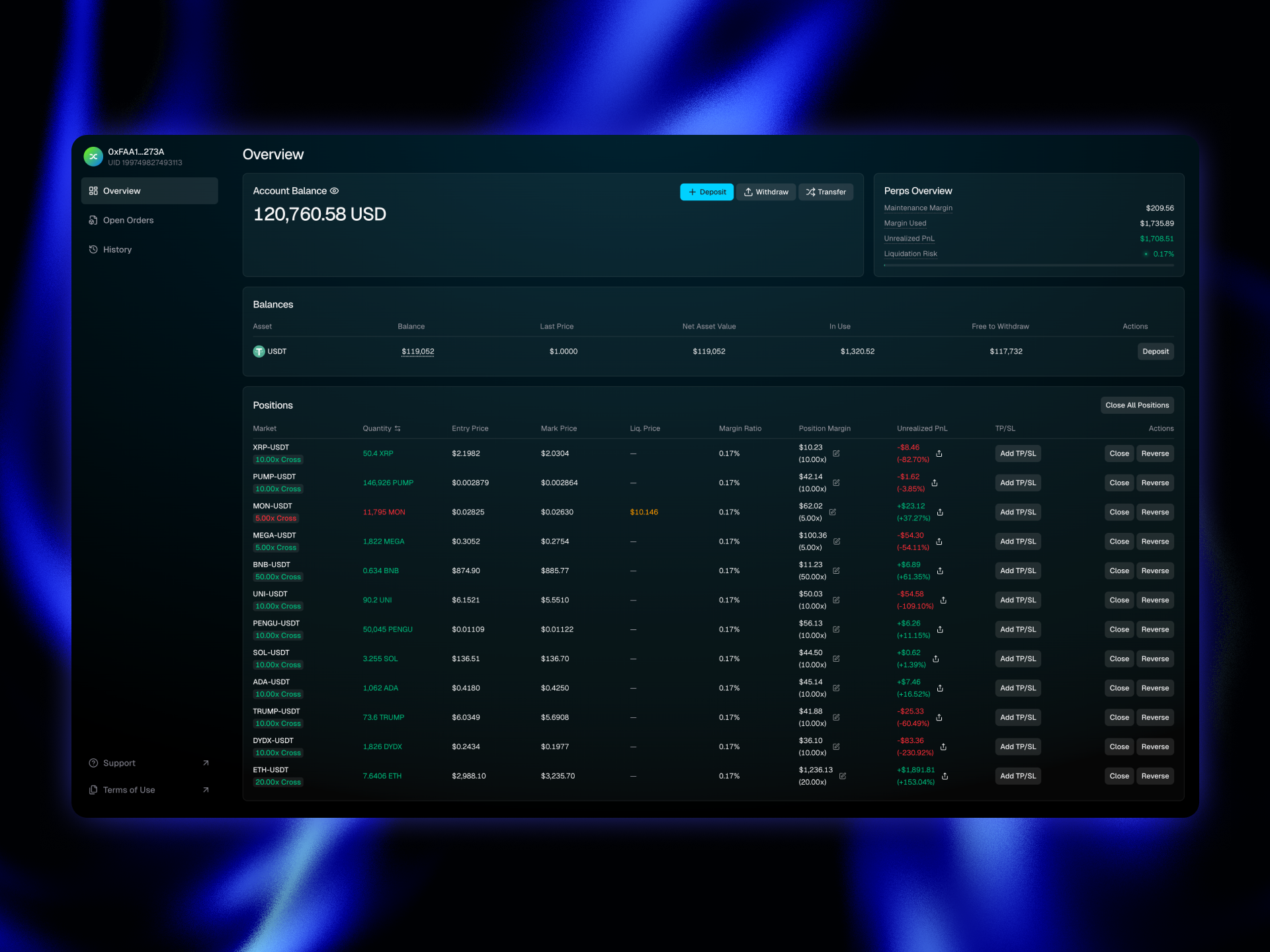

At launch, Synthetix will assist three markets: Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), and as much as 50X leverage on every pair. Synthetix may even be restricted to a most of 500 customers. These 500 customers will encompass historic Synthetix/Kwenta energy customers, sUSD and 420 pool stakers, buying and selling competitors individuals, and choose Synthetix Groups depositors. Deposits will probably be capped at 40,000 USDT per person.

Please observe: Withdrawals won’t be enabled on day one, so that you gained’t have the ability to withdraw funds from the trade instantly. This can be a precautionary measure to observe the onchain deposit contract. We’ll allow withdrawals inside roughly one week following launch.

That is solely a shadow of what Synthetix will appear like in 3 months’ time, with new markets launching weekly, extra leverage, higher liquidity, greater deposit caps, and extra options coming Soonthetix.

Synthetix’s 2026 roadmap encompasses a stacked lineup of novel merchandise and game-changing new options, together with:

New markets and options each week starting December 29, 2025. Multicollateral marginWick insuranceReal World Belongings (RWAs)Deep composability with Ethereum DeFi applicationsMore order typesPartnerships with main protocolsOptimistic and trust-minimized orderbooksAnd a lot, far more

We Are So Again

We all know that Synthetix nonetheless holds a particular place within the hearts of the OG DeFi & Ethereum group, but it surely’s no secret that we haven’t delivered an inspiring imaginative and prescient for the previous couple of years, leaving many to cease paying consideration.

We’ve acknowledged this and have accomplished a dramatic overhaul of practically each side of our product, advertising technique, and core group:

Efficiently executed 2 buying and selling competitions: That includes a whole lot of the largest and finest merchants within the crypto business, in addition to core group members and historic Synthetix energy customers. Through the mixed 6 weeks of the buying and selling competitors interval, merchants generated a staggering $11 billion in quantity and paid over $4.5 million in charges. Over $2,000,000 in prizes have been distributed to profitable merchants. Cracked new group: 18/20 group members have joined within the final 14 months.OG leaders Kain and Jordan have returned: including key strategic oversight and business experience.Full-stack protocol: proudly owning the consumer-facing product empowers Synthetix by eradicating dependencies and bettering model positioning available in the market.Sport-changing new technique: CLOB not AMM, Ethereum Mainnet not L2s, delegated not discretionary staking/minting.

Why Mainnet?

Synthetix has spent the final 5 years constructing, iterating, and studying how one can good the DeFi & perp expertise for customers on Ethereum and L2s. We realized that the L2 scaling roadmap had some harsh trade-offs for functions, and now we’re laser-focused on creating a high-performance, non-custodial perpetual futures platform on Ethereum Mainnet:

To return to mainnet, we’re using a very completely different structure than something we’ve ever finished earlier than, with offchain order matching, and batch settlement onchain:

L1 Custody and Settlement: Customers don’t need to bridge giant quantities to L2, so we’re utilizing L1. Consumer funds are custodied on L1, and trades settle on to L1. Dealer margin is managed by the offchain orderbook (for now), however onchain withdrawals are permissionless.Offchain Matching Engine: Institutional-grade exchanges demand high-throughput, low-latency, fault-tolerant matching engines. Neither L2s nor Solana, by no means thoughts Ethereum, has ample throughput to run an identical engine onchain. Our offchain engine delivers the efficiency skilled and discerning merchants anticipate.

We imagine that working a high-performance offchain matching engine on probably the most safe, decentralized, credibly impartial, and highest TVL blockchain (Ethereum) far outweighs the entire downsides of working a completely onchain matching engine on a centralized blockchain.

Following the latest Fusaka improve, which was efficiently activated in December, it’s clearer now than ever earlier than that as Ethereum Mainnet scales, extra performance will migrate onchain and Ethereum will return to dominance because the central level of capital focus for the broader crypto financial system.

Comply with Synthetix as we usher in perps on Ethereum Mainnet.

Be part of the dialog: discord.gg/synthetixSubscribe to Telegram: t.me/+v80TVt0BJN80Y2YxFollow on X: x.com/synthetix