Picture supply: Getty Photographs

After a 35% decline this 12 months, might the Diageo (LSE:DGE) share value be set to bounce again in 2026? Analysts are optimistic, however buyers want to consider carefully.

The FTSE 100 spirits firm has a brand new CEO who sees clear potential for the enterprise. However there are nonetheless some massive challenges going through the corporate within the 12 months forward.

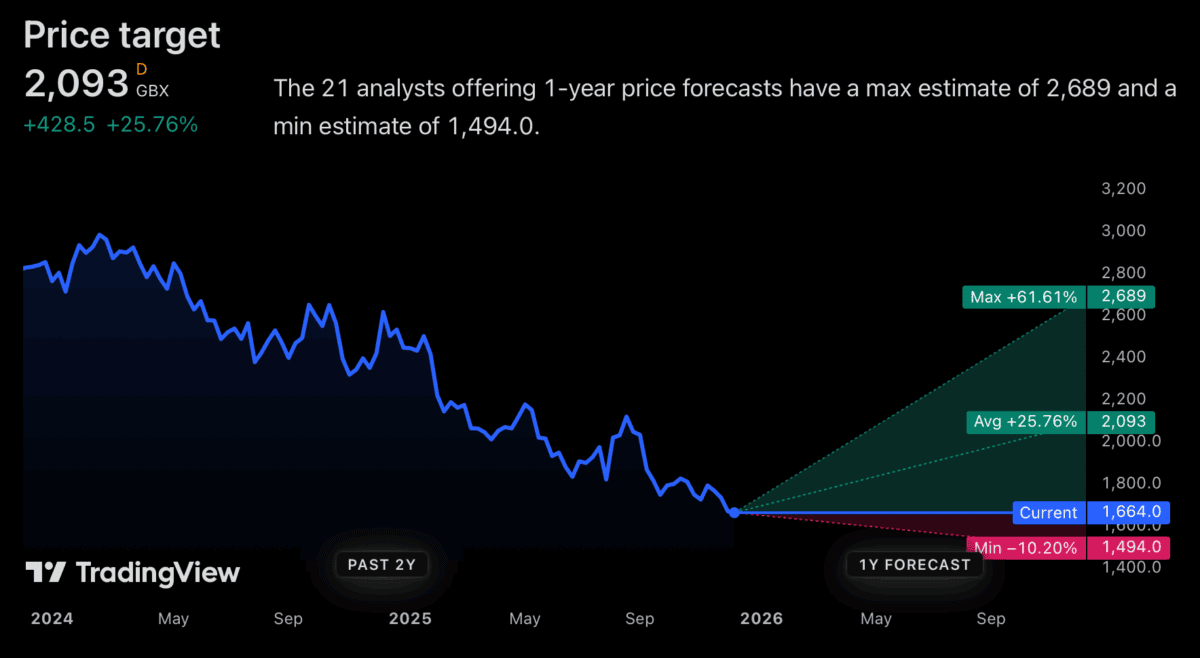

Analyst forecasts

Generally, analyst value targets for Diageo over the subsequent 12 months are fairly constructive. From what I can see, the typical is £20.93, which is 25% above the present share value.

That may be a very good return in 2026, however is it possible? Realistically, for the inventory to maneuver 25%, the enterprise goes to should get again to gross sales and revenue development.

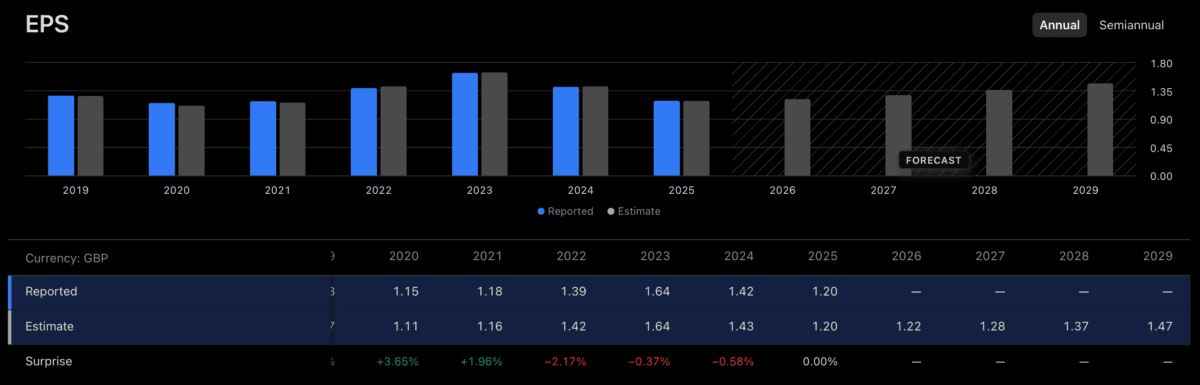

It’s price noting that analyst forecasts on this entrance are fairly modest. Whereas 2025’s anticipated to be a low level, issues aren’t anticipated to get again to 2023 ranges any time quickly.

For 2026, analysts expect revenues to climb 0.5% and earnings per share development of 1%. And I’m not satisfied that will likely be sufficient to get the inventory to just about £21.

Progress challenges

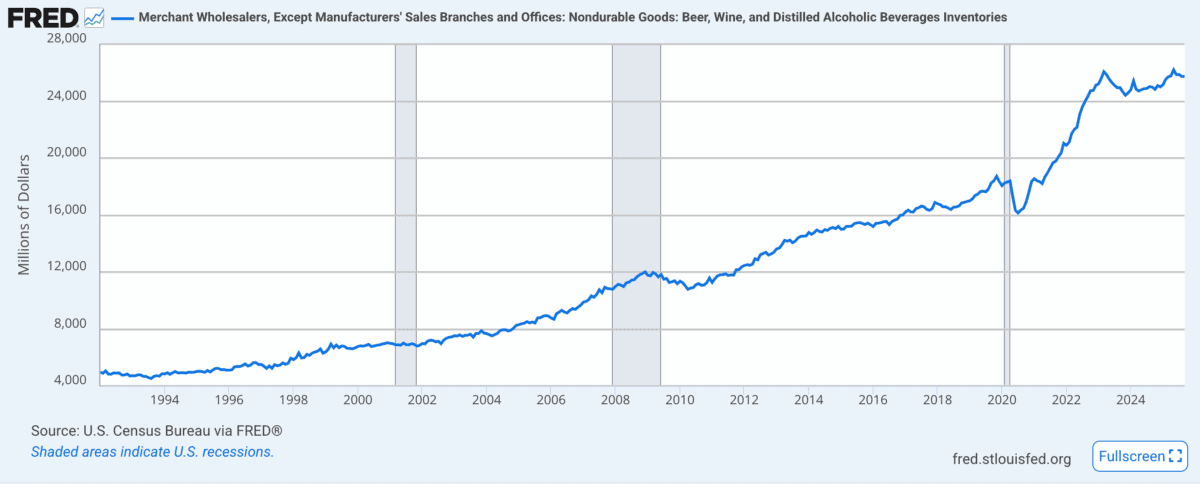

One of many largest points for Diageo has been current weak demand in key markets, such because the US. And there are causes for considering this would possibly proceed in 2026. Within the US, alcohol producers promote to wholesalers, as an alternative of on to retailers. In consequence, wholesaler stock ranges generally is a helpful information level for buyers.

Supply: Federal Reserve Financial institution of St. Louis

The image isn’t significantly constructive for Diageo on this entrance. Excessive inventories (relative to gross sales) are more likely to imply weak demand and it’s presently near file ranges.

I feel this could possibly be a giant problem for the FTSE 100 agency. And that’s why I’m cautious concerning the firm’s potential to attain the sort of development that may transfer its share value in 2026.

Past 2026

I’m not satisfied Diageo shares are set to bounce again in 2026, however this may not matter for long-term buyers. The truth is, it is perhaps price taking a look at as a shopping for alternative.

The agency’s current points have all been on the demand aspect and there’s not a lot the corporate can do about this. Its aggressive strengths nonetheless, are nonetheless very a lot intact.

On prime of this, the brand new CEO has a formidable file in terms of reinvigorating faltering companies. That’s another excuse buyers would possibly need to be affected person with the inventory.

Diageo may not get again to its 2023 earnings any time quickly, nevertheless it may not must with the intention to be a very good funding. At in the present day’s costs, regular development would possibly nicely be sufficient.

Lengthy-term investing

I don’t suppose Diageo’s going to be the inventory to contemplate for buyers who’re in search of motion in 2026. However for these with a long-term outlook, the story is perhaps totally different.

Investing nicely is about shopping for shares once they’re low-cost. And that inevitably means when different individuals suppose there’s one thing flawed with the underlying enterprise.

That is perhaps the case with Diageo. Excessive stock ranges will proceed to be a problem subsequent 12 months, however the agency’s distinctive property imply the long-term equation is perhaps totally different.