The Hyperliquid blockchain, one of many fastest-rising names in decentralized finance (DeFi), is going through a mounting safety disaster after a string of high-profile incidents solid doubt on the protection of its cash markets.

On September 27, Hyperdrive, a flagship yield protocol on Hyperliquid, was pressured to pause all markets following a confirmed exploit that drained an estimated $700,000 from two compromised Treasury Market positions.

What’s Behind the Hyperdrive Hack?

Positions on two accounts on the thBILL market have been compromised.

Hyperdrive has paused all cash markets as a precaution whereas we examine additional.

This difficulty doesn’t have an effect on $HYPED.

— Hyperdrive (@hyperdrivedefi) September 27, 2025

Builders attributed the breach to a flaw in operator permissions: customers had designated Hyperdrive’s Router as an operator, successfully granting it sweeping entry to name any whitelisted contract. Attackers leveraged that loophole to control positions and extract funds.

Hyperdrive insisted the thBILL asset and HYPED governance token weren’t straight impacted, however the harm prolonged past the stolen funds.

The incident marked the second main assault in 48 hours on Hyperliquid’s DeFi ecosystem. Only a day earlier, HyperVault, one other yield protocol, noticed $3.6M bridged out and laundered by Twister Money earlier than its web site went offline and social media accounts had been deleted, pointing to an exit rip-off.

DISCOVER: 9+ Finest Memecoin to Purchase in 2025

Mounting Exploit Strain on Hyperliquid: Community Beneath Siege?

The speedy sequence of losses has sharpened questions on Hyperliquid’s resilience. Group sentiment has shifted from celebrating Hyperliquid’s velocity and composability to nervousness that the community is changing into a magnet for attackers.

Safety researchers say the issues might run deeper than particular person protocol missteps. Hyperliquid, launched simply final 12 months with a $1.6Bn HYPE airdrop, operates on a high-throughput chain constructed atop Arbitrum.

Its design, prioritizing ultra-fast execution, has lengthy raised issues about centralization. The community runs on simply 4 validators, a focus critics argue might make it extremely weak to coordinated breaches.

These warnings gained traction in December 2024 when blockchain sleuths linked North Korean Lazarus Group wallets to check transactions on Hyperliquid.

MetaMask’s Taylor Monahan warned on the time that DPRK hackers had been “kicking the tires” of the chain to determine exploits.

Whereas Hyperliquid Labs dismissed the claims, the HYPE token plunged over 20% in a single day as buyers fled.

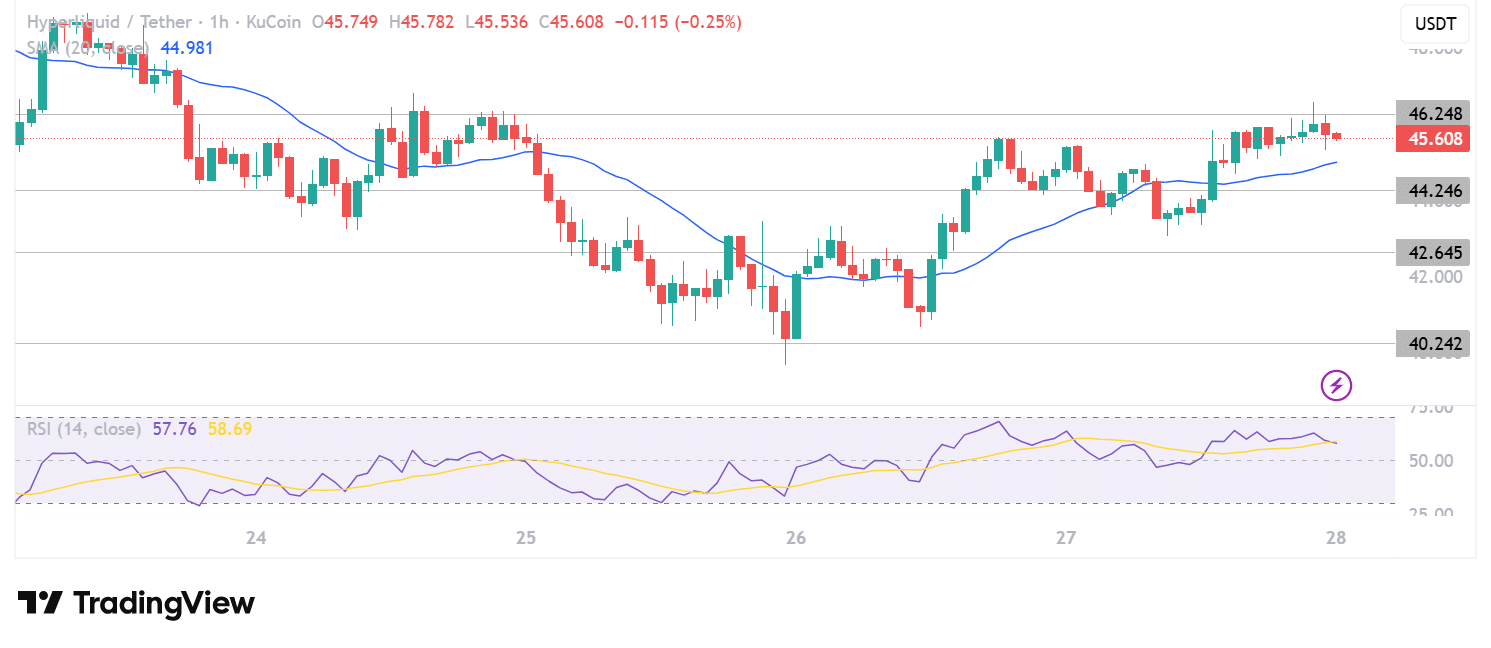

(Supply – HYPE USDT, TradingView)

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

The most recent breaches seem to have reignited these fears. On-chain analytics present rising internet outflows from Hyperliquid protocols since Friday, with over $200M in USDC withdrawn in lower than 24 hours.

The HYPE token, which reached a market cap above $11Bn earlier this 12 months, has shed double-digit percentages in weekend buying and selling.

The reputational hit extends past value motion. Establishments exploring publicity to Hyperliquid at the moment are weighing whether or not its younger ecosystem can assist the extent of safety required for scaling.

The truth that each Hyperdrive and HyperVault focused yield-hungry retail customers solely deepens issues that Hyperliquid has develop into fertile floor for opportunistic attackers.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The submit Is a Safety Disaster Heading For Hyperliquid? Flagship Protocol Hacked appeared first on 99Bitcoins.