In a surprising phishing assault, North Korean-connected cybercriminals hit a BNB crypto whale to steal $13.5M in Binance cash, and now the XVS value may very well be in query – right here’s why.

A significant Venus Protocol person misplaced about $13.5M on Sept. 1 after a phishing assault focused their positions. On-chain knowledge and safety experiences confirmed the assault. It occurred at 3:26 PM UTC.

Venus Protocol paused operations instantly after the incident. The platform stated its sensible contracts have been nonetheless safe, and investigations are ongoing.

We’re conscious of the person pockets being drained (sensible contract is protected) and are actively investigating.

Venus is at present paused following safety protocols. We’ll preserve you all up to date as quickly as we all know extra.

— Venus Protocol (@VenusProtocol) September 2, 2025

Was the BNB {Hardware} Pockets Actually Protected from Phishing?

Safety agency Beosin first reported losses of over $27M. Later, PeckShield revised the quantity to $13.5M. The preliminary determine included the person’s debt place. PeckShield stated, “Preliminary estimates have been increased as we didn’t exclude the debt place.”

Yu Xian, founding father of SlowMist, stated the person’s {hardware} pockets itself was safe. However attackers compromised the browser extension linked to it.

This gave them borrowing and redemption entry to the person’s Venus Protocol holdings with out the proprietor figuring out. The case exhibits that {hardware} wallets can nonetheless be uncovered if related software program is weak. Even safe storage can fail towards cautious social engineering.

Evaluation exhibits the assault was deliberate and well-funded. Fuel charges got here from Monero (XMR) exchanges and different funds traced again to eXch, a darkish internet alternate linked to North Korean hackers.

Xian stated the whale was particularly focused and it wasn’t a broad assault. The Venus Protocol frontend was probably protected whereas the occasion raises considerations about state-backed actors utilizing phishing to go after high-value DeFi customers.

Venus Protocol paused the platform to guard the remaining belongings. The staff confirmed direct contact with the affected person, and so they stated resuming too quickly might have put extra funds in danger. The protocol centered on person safety quite than restarting operations shortly.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Is XVS Value Restoration Sustainable After Venus Protocol Phishing Assault?

In line with Coinglass knowledge, the market was largely bullish between June and earlier than the assault.

The optimistic and regular funding charge signifies that the XVS token is supported by the overall development of the derivatives merchants primarily being geared in direction of making features.

Though intervals of bearishness have been skilled, particularly in mid-June, the overall development is that of a market with a long-term curiosity in lengthy positions.

(Supply – XVS Funding Fee, CoinGlass)

The XVS/USDT pair noticed excessive volatility over the previous 24 hours as XVS fell as much as -9% after the assault, then partially recovered.

It briefly dropped under the $6.00 degree earlier than bouncing again above it. Presently, XVS trades at $6.11, up +0.58% on the 1-hour chart. Patrons tried to get well after a heavy sell-off.

(Supply – XVS USDT, TradingView)

A big pink Heikin Ashi candle on excessive quantity exhibits a potential liquidation or panic promoting. Costs briefly fell beneath $5.60 however bounced shortly.

This drop met sturdy buy-side assist, and it might have been a liquidity seize or stop-hunt. Quantity hit 3.23K, a lot increased than the same old hourly turnover.

Technically, the 50 EMA (pink) and 100 EMA (blue) now act as resistance at $6.20 and $6.26. The value is under each EMAs, suggesting a short-term bearish development.

The 100 EMA slope is flattening, exhibiting that latest bullish momentum is fading. Earlier than the assault, XVS value had been shifting sideways to barely downward since August. It repeatedly failed to interrupt $6.50. The breakdown exhibits bears have short-term management.

Nonetheless, the quick swing round $6.00 signifies that patrons are defending this degree. The $6.00-$6.26 vary is probably a call zone.

An upward transfer above the 100 EMA might lure momentum merchants who need $6.40. A decline to under $6.00 might problem latest lows of about $5.60.

(Supply – Hacken)

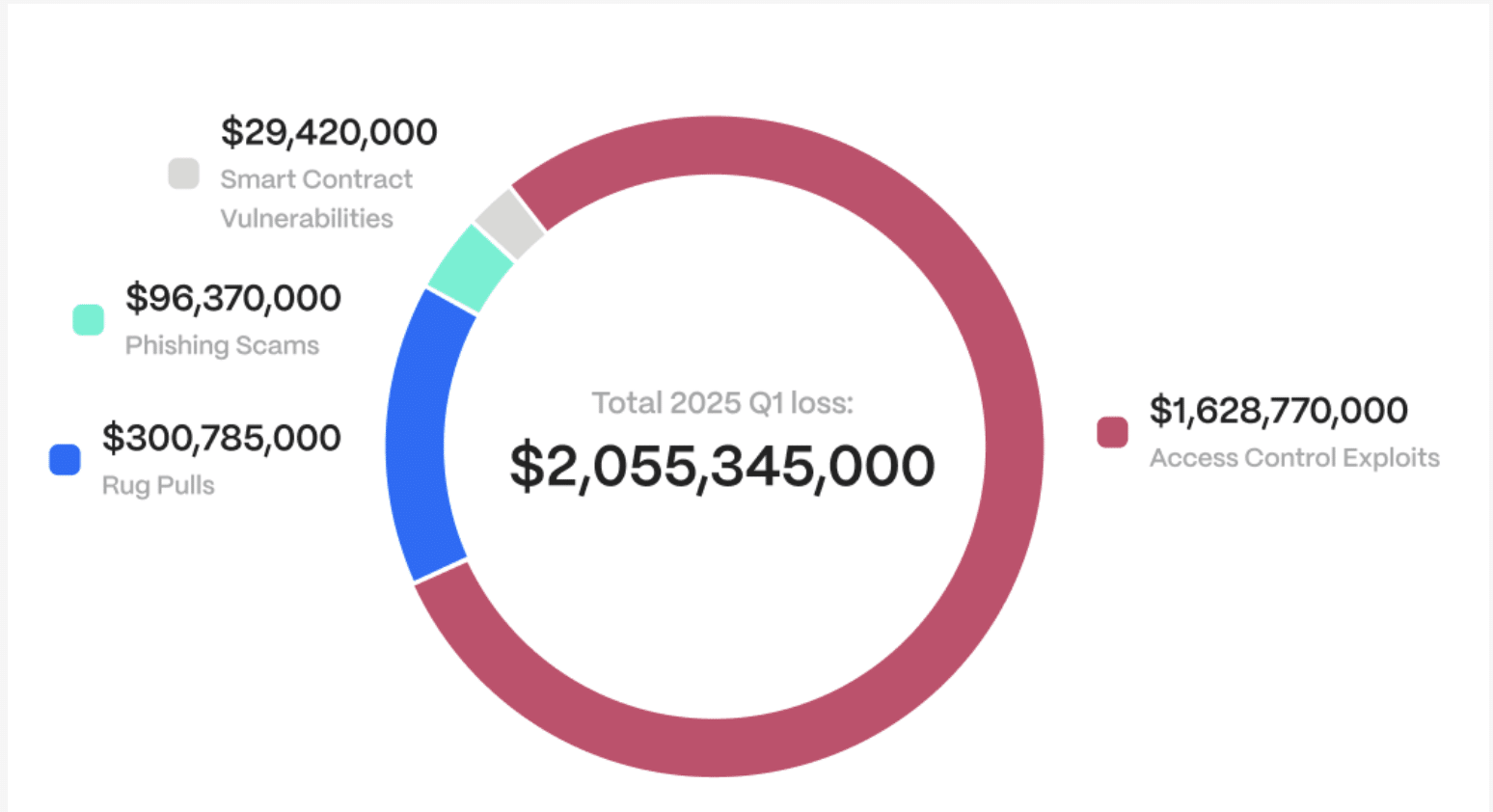

This assault exhibits a typical threat in DeFi: phishing scams that trick customers into approving tokens. Attackers can drain funds till permissions are revoked. CertiK experiences phishing precipitated $410M in losses throughout 132 circumstances within the first half of 2025. Hacken estimates social engineering and phishing value $600M in the identical interval.

EXPLORE: Finest Meme Coin ICOs to Spend money on 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The publish Is Binance Safu? North Korea Simply Stole $13.5M in XVS Crypto Heist appeared first on 99Bitcoins.