On-chain knowledge exhibits Litecoin miners have seen their reserves shoot up over the previous yr, an indication that the massive swimming pools have been accumulating.

Litecoin Miner Reserve Has Gone Up Throughout The Final Yr

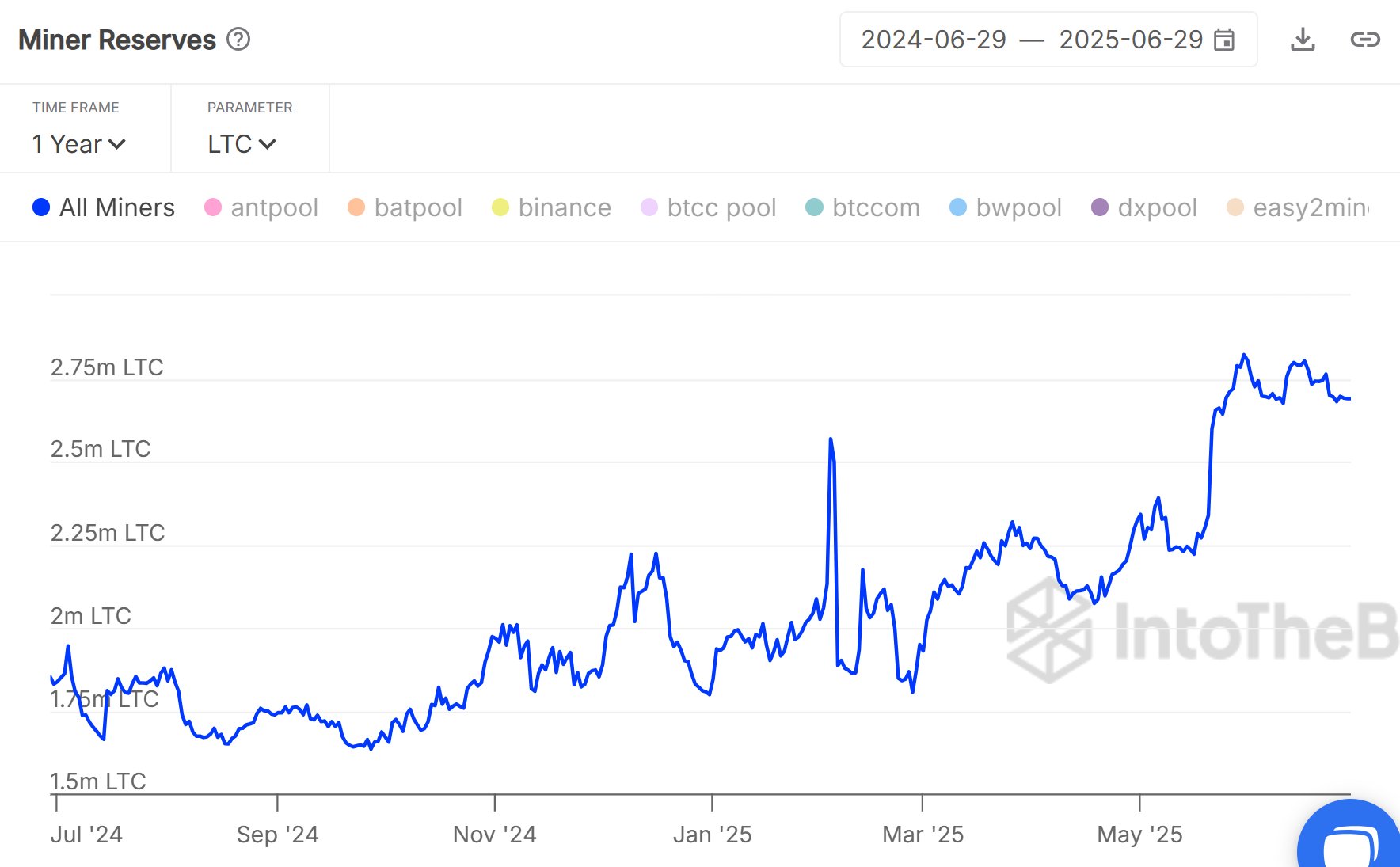

In a brand new put up on X, Litecoin Basis has shared how the stability of the Litecoin miners has modified through the previous yr. The indicator of relevance right here is the Miner Reserves from the institutional DeFi options supplier Sentora (previously IntoTheBlock).

The Miner Reserves metric measures the entire quantity of LTC that’s sitting within the wallets related to the massive mining swimming pools. These holdings could embody not simply the quantity that the validators have been receiving as mining rewards, but additionally the tokens that they’ve acquired by means of purchases.

Now, here’s a chart that exhibits the development within the Miner Reserves for Litecoin over the previous yr:

The worth of the metric seems to have been shifting sideways since its sharp climb | Supply: Litecoin Basis on X

As displayed within the above graph, the Litecoin Miner Reserves indicator has adopted an upwards trajectory during the last twelve months, an indication that miners have been including to their holdings.

Miners are entities which have fixed working prices within the type of electrical energy payments, so it’s commonplace for them to take part in some promoting in an effort to pay them off. Curiously, nevertheless, the massive mining swimming pools have been prepared to build up LTC these days.

One other metric that helps gauge the sentiment among the many community validators is the Hashrate, which measures the entire quantity of computing energy that they’ve hooked up to the blockchain.

Under is a chart from CoinWarz that exhibits the development on this indicator for Litecoin.

Appear to be the miners have elevated their energy through the interval | Supply: CoinWarz

From the graph, it’s obvious that the Litecoin Hashrate has additionally gone up over the previous yr, implying miners have been including extra energy to the community. Although, the timing of their expansions hasn’t precisely matched their accumulation spree.

Nonetheless, it stays true that each tendencies level to a bullish sentiment among the many chain validators. It solely stays to be seen, nevertheless, whether or not the conviction would repay.

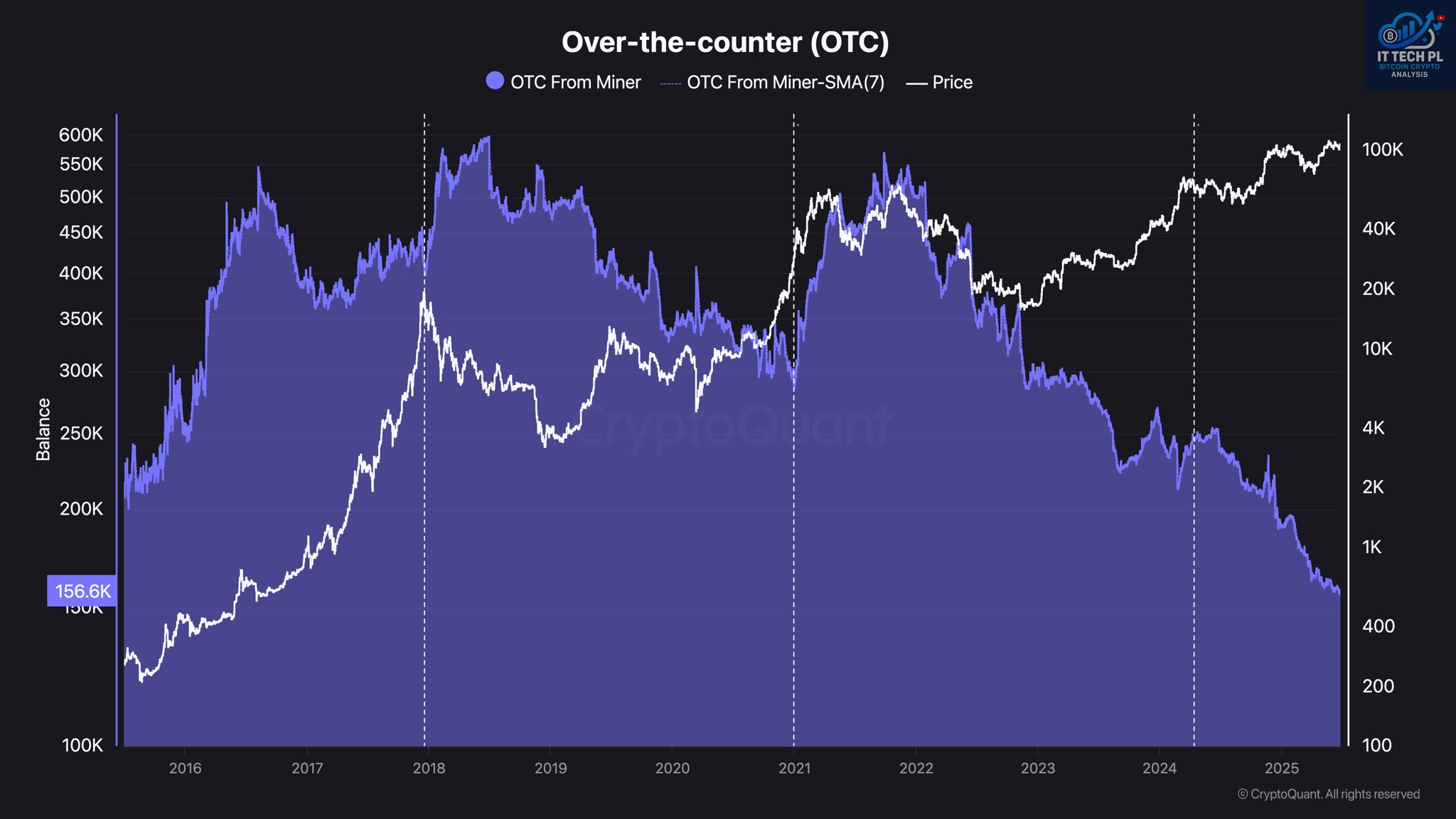

In another information, Bitcoin miners might also be dropping their sell-side strain, as CryptoQuant writer IT Tech has identified in an X put up.

The development within the stability of the OTC desks utilized by miners | Supply: @IT_Tech_PL

The above chart exhibits the information associated to the stability of the over-the-counter (OTC) desks utilized by Bitcoin miners. Clearly, the metric has just lately registered a major decline. “This means restricted miner liquidity obtainable for institutional block offers, usually a precursor to supply-side constraints,” notes the analyst.

LTC Value

On the time of writing, Litecoin is floating round $84, down over 2% within the final 24 hours.

The worth of the coin has declined since its weekend excessive | Supply: LTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, CoinWarz.com, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.