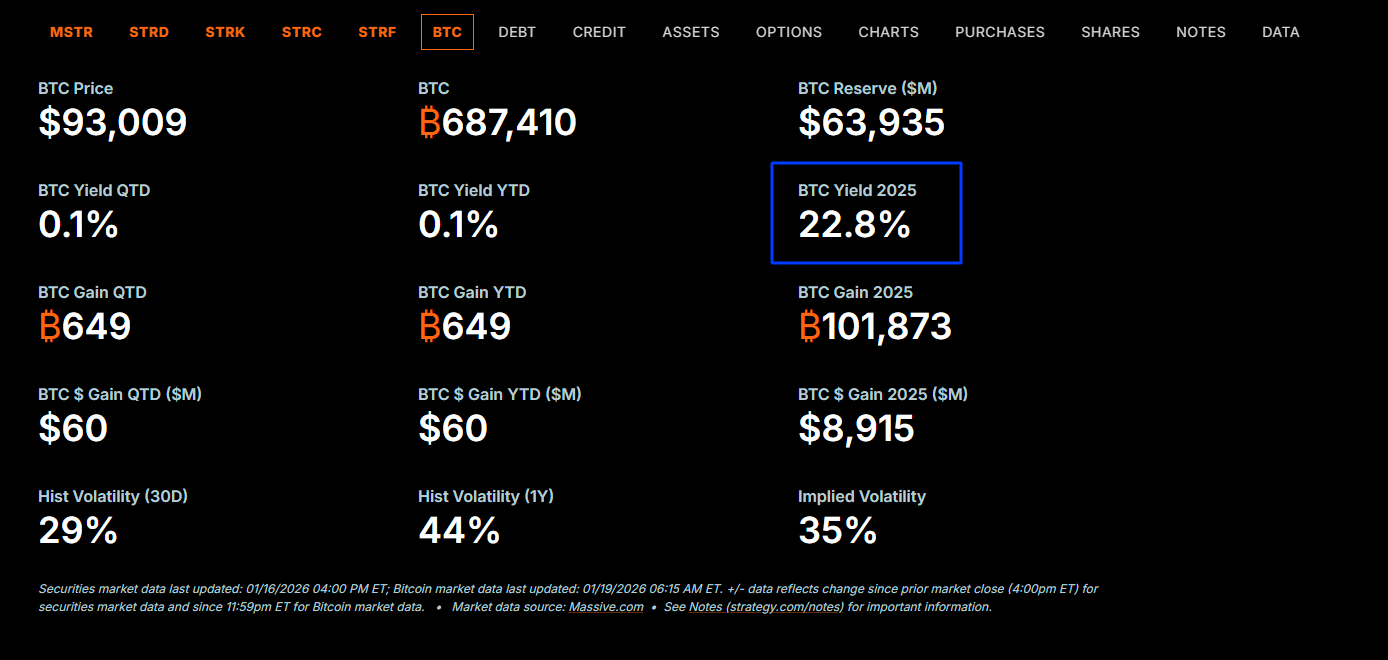

Technique, previously MicroStrategy, is likely one of the greatest Bitcoin advocates. For years, the enterprise intelligence agency has been shopping for BTC, including the digital gold into its stability sheet. Up to now, MicroStrategy is the biggest holder of BTC with over 687,000 BTC value over $63Bn.

Whereas their technique has been an inspiration to many different public corporations, together with MetaPlanet, MicroStrategy is going through challenges: The Bitcoin value has, in latest months, been stalling, even dropping. Consequently, the MSTR inventory has been beneath immense promoting strain, dropping at a sooner price than Bitcoin itself.

7d

30d

1y

All Time

When writing, the MicroStrategy inventory is altering fingers above $173. It’s down -53% year-to-date. In the meantime, at spot charges, the Bitcoin value is down simply +11% within the final 12 months. Traditionally, the MSTR inventory traded at a 2x+ premium to its Bitcoin holdings.

(Supply: Technique)

In mid-January 2026, that premium has collapsed, with the inventory sometimes buying and selling at a reduction to its Web Asset Worth (NAV); a uncommon occasion that alerts investor worry.

DISCOVER: Greatest Meme Coin ICOs to Spend money on 2026

Why is MicroStrategy MSTR Inventory Falling Quicker Than Bitcoin

Given this divergence, it’s no marvel that the Bitcoin-focused public firm is beneath contemporary scrutiny. Apparently, critics are heavy on MicroStrategy simply when extra public companies are actively shopping for Bitcoin, including them to their stability sheets.

This pessimism on MicroStrategy is smart. Whereas it’s a enterprise intelligence agency, it now not acts like a traditional software program firm. It operates as a Bitcoin treasury firm, which suggests it makes use of inventory gross sales and borrowed cash to purchase Bitcoin and maintain it long run. Criticism of their plan has intensified resulting from latest dangers that would decimate the agency and their Bitcoin technique.

Lately, the MSCI reviewed whether or not “digital asset treasury” companies with greater than +50% of their belongings in crypto as “funds” relatively than “working corporations” ought to be eliminated. This reclassification will straight impression MicroStrategy. JPMorgan estimated {that a} elimination from the MSCI index might set off as much as $8.8Bn in passive outflows.

What’s extra? To fund its latest buy of 13,627 BTC in early January, the corporate issued over $1.1Bn in new inventory. Whereas they’re shopping for extra BTC, the fixed issuance of recent shares dilutes current shareholders. If the Bitcoin value doesn’t develop sooner than the share depend, the “Bitcoin-per-share” worth truly drops.

And it will get worse. In This autumn 2025, they reported $17.44Bn unrealized loss. Now, critics are pointing to the corporate’s legacy software program enterprise, which generates solely about $125M in working money circulate. That is nowhere close to sufficient to service the billions in debt used to purchase the Bitcoin.

DISCOVER: Greatest New Cryptocurrencies to Spend money on 2026

What’s Subsequent for MicroStrategy?

Regardless of criticism and apparent strain, Saylor has remained defiant. In a podcast, he argued that an organization dropping $10M in operations is “saved” if its Bitcoin positive factors $30M.Furthermore, the founder maintains that MicroStrategy is a “Bitcoin Improvement Firm” and that conventional cash-flow metrics are out of date in a digital-asset financial system.

Bullish as Saylor is, MicroStrategy’s fortunes now squarely rely on how the Bitcoin value and among the prime Solana meme cash evolve. If crypto costs tick larger, the MSTR inventory will start buying and selling at a premium to its web asset worth, which is nothing greater than its Bitcoin stash. As soon as this premium will increase, the “MSTR flywheel” will start spinning once more, permitting them to situation shares at a excessive value to purchase Bitcoin at a low relative value.

The upper premium can also permit MicroStrategy to pivot again to utilizing low-interest convertible debt as a substitute of pure fairness issuance. When this occurs, dilution considerations will fade, boosting their “Bitcoin Yield. By finish of 2025, the yield stood at over +22%.

(Supply: Technique)

Past costs, MSCI must formally affirm that “Digital Asset Treasury Corporations” like MicroStrategy shall be a part of the index. As soon as they do, MicroStrategy will discover aid, and the specter of the over $9Bn in compelled promoting eliminated, stabilizing the MSTR inventory value.

DISCOVER:

16+ New and Upcoming Binance Listings in 2026

99Bitcoins’ This autumn 2025 State of Crypto Market Report

Observe 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Day by day Professional Market Evaluation.

The submit Michael Saylor’s Bitcoin Guess Faces Actuality Examine as Technique Slips appeared first on 99Bitcoins.