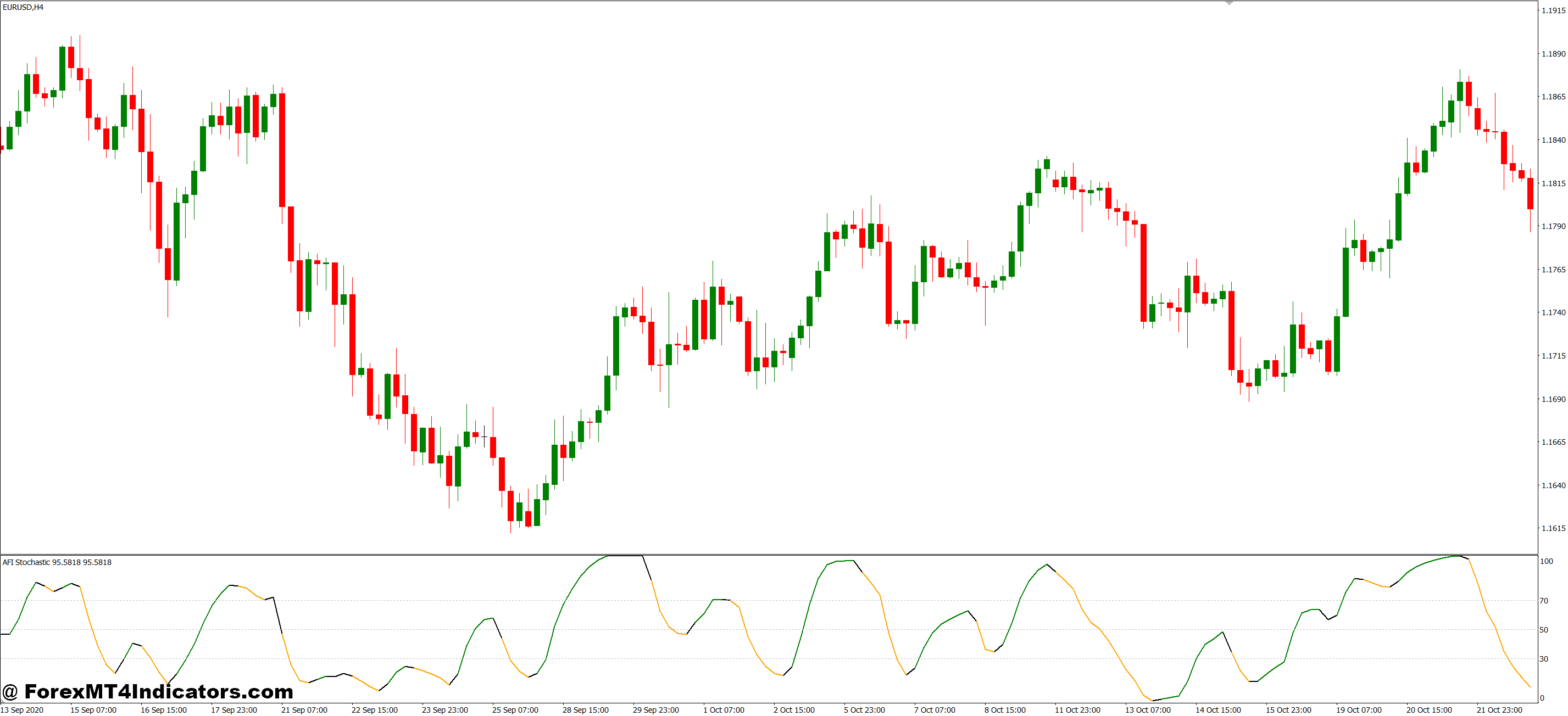

The Stochastic indicator compares a foreign money pair’s closing worth to its worth vary over a set variety of intervals. George Lane developed it within the Fifties on a easy statement: in an uptrend, costs have a tendency to shut close to the highs, whereas downtrends see closes close to the lows.

The indicator produces two strains—%Ok and %D—that oscillate between 0 and 100. The %Ok line is the quicker, extra reactive line. The %D line smooths out %Ok, performing like a sign line. When %Ok crosses above %D close to the oversold zone (beneath 20), it suggests shopping for strain is constructing. A cross beneath %D close to overbought ranges (above 80) warns that sellers would possibly take management.

Right here’s what makes it totally different from easy shifting averages or development indicators: Stochastic doesn’t care whether or not worth is at 1.0850 or 1.0950. It solely cares the place the present shut sits inside the latest vary. This relative positioning reveals momentum shifts that absolute worth ranges miss.

The Math Behind the Sign

The usual calculation makes use of a 14-period lookback. The formulation divides the distinction between the present shut and the 14-period low by the entire 14-period vary, then multiplies by 100.

So if GBP/USD closes at 1.2650, and over the previous 14 hours (on a 1-hour chart) the low was 1.2600 and the excessive was 1.2700, you’d calculate: (1.2650 – 1.2600) / (1.2700 – 1.2600) × 100 = 50. A studying of fifty means worth is closing proper in the midst of its latest vary—no momentum edge both method.

When readings climb above 80, worth has been closing close to the highest of its vary repeatedly. That’s sturdy bullish momentum, but it surely additionally means the transfer is likely to be overextended. Beneath 20 alerts the alternative—constant closes close to the lows, suggesting both sturdy bearish momentum or an oversold bounce alternative.

The %D line applies a 3-period shifting common to %Ok, which is why crossovers between these strains generate buying and selling alerts.

Actual Buying and selling Situations: The place Stochastic Shines

Let’s get particular. On July 18, 2024, EUR/USD spent the Asian and early London periods grinding greater on the 15-minute chart. By 9:00 AM GMT, Stochastic had pushed above 80 and stayed there for 3 consecutive candles. Worth seemed sturdy, however momentum was stalling.

At 9:15 AM, %Ok crossed beneath %D on the 83 degree. Inside two candles, EUR/USD reversed 25 pips. Merchants utilizing Stochastic prevented chasing that top and both stayed flat or positioned for the pullback.

However right here’s the factor—Stochastic additionally generated a false sign earlier that morning. At 7:30 AM, it dipped to 25 and crossed upward, suggesting a purchase. Worth did bounce 10 pips earlier than rolling over into new lows. That’s the trade-off: you get early alerts, however not all of them play out.

Vary-bound markets are the place Stochastic actually earns its preserve. When USD/JPY trades between 149.50 and 150.20 for a whole session, conventional development indicators give uneven, conflicting alerts. Stochastic, nonetheless, helps pinpoint the vary extremes. Readings above 80 close to 150.20 counsel shorting towards the vary backside. Beneath 20 close to 149.50 alerts a possible bounce.

Customizing Settings for Totally different Model

The default 14-period setting works nicely for swing buying and selling on 4-hour or day by day charts. However scalpers and day merchants typically want quicker alerts.

For the 5-minute chart, some merchants drop the %Ok interval to eight or 9. This makes the indicator extra responsive, catching fast momentum shifts throughout London or New York periods. The draw back? Extra whipsaws. You’ll see overbought and oversold readings consistently, many main nowhere.

On the flip facet, place merchants utilizing day by day or weekly charts would possibly prolong the interval to 21 and even 25. This filters out noise however means fewer alerts. You gained’t catch each swing, however the ones you do catch are typically greater high quality.

The smoothing interval (sometimes 3 for each %Ok and %D) will also be adjusted. Growing it to five creates smoother strains with fewer crossovers. Fewer alerts, much less noise, however doubtlessly slower entries. Day merchants typically keep on with 3, whereas swing merchants experiment with 4 or 5.

Foreign money pair volatility issues too. GBP/JPY swings tougher than EUR/CHF, so equivalent settings produce totally different outcomes. Testing in your particular pairs and timeframes beats blindly accepting defaults.

Strengths, Weaknesses, and What Merchants Get Mistaken

Stochastic excels at figuring out potential reversals earlier than they occur. That’s highly effective in range-bound markets or when buying and selling counter-trend pullbacks in sturdy traits. It additionally helps keep away from the basic mistake of shopping for breakouts proper as momentum dies.

The limitation? Sturdy traits break Stochastic. Throughout a strong directional transfer, the indicator can keep pegged above 80 or beneath 20 for hours and even days. Merchants who brief just because readings hit 85 get steamrolled when momentum persists.

That’s why skilled merchants mix it with development filters. If the 200-period shifting common slopes upward and worth trades above it, ignore oversold Stochastic readings—they’re simply pullbacks in a wholesome uptrend. Solely take overbought alerts towards the development or search for divergences.

Divergence is the place Stochastic exhibits its experience. When EUR/GBP makes a better excessive however Stochastic makes a decrease excessive, momentum is weakening regardless of rising costs. This divergence typically precedes reversals. Recognizing it requires expertise, but it surely’s some of the dependable Stochastic setups.

Stochastic vs. RSI: Selecting the Proper Instrument

Merchants typically confuse Stochastic with RSI since each oscillate between 0 and 100 and determine overbought/oversold circumstances. The important thing distinction: RSI measures the magnitude of latest worth modifications, whereas Stochastic measures the place the shut sits inside the latest vary.

In trending markets, RSI tends to carry out higher. It doesn’t keep pinned at extremes so long as Stochastic does, so that you get fewer false reversal alerts throughout sturdy runs.

Stochastic wins in ranging markets and for timing particular entries. The twin-line crossover system gives clearer entry alerts than RSI’s single line. Many merchants run each—RSI for development context, Stochastic for entry timing.

The way to Commerce with MT4 Stochastic Indicator

Purchase Entry

%Ok crosses above %D beneath 20 – Await each strains to drop below the 20 degree on EUR/USD 1-hour chart, then enter when %Ok crosses upward via %D, focusing on 20-30 pip strikes.

Bullish divergence at assist – When GBP/USD makes a decrease low however Stochastic makes a better low close to the 15-25 zone, worth momentum is shifting; enter on the following bullish candle shut with a 25-pip cease.

Double-bottom in oversold zone – If Stochastic touches beneath 20 twice inside 10-15 candles on the 4-hour chart with out breaking decrease, purchase the second bounce as promoting strain exhausts.

Exit oversold throughout uptrend – On day by day charts with worth above the 200 EMA, purchase when Stochastic climbs again above 20 after an oversold dip; don’t anticipate it to succeed in 50—momentum is already turning.

Confirmed by worth motion – By no means purchase on Stochastic sign alone; anticipate a bullish engulfing candle or pin bar rejection on the oversold degree to verify purchaser curiosity.

Threat 1.5% most per commerce – Even with good Stochastic alignment, restrict place dimension so a 30-pip cease equals not more than 1.5% of your account; indicators fail, danger administration saves you.

Keep away from throughout sturdy downtrends – Skip all purchase alerts when worth is beneath the 50 and 200 EMA on the 4-hour chart; Stochastic can keep oversold for 20+ candles in highly effective selloffs.

Set life like revenue targets – Ebook 50-70% of the place at 2:1 risk-reward (40-60 pips if risking 20); let the rest run with a trailing cease as Stochastic approaches 80.

Promote Entry

%Ok crosses beneath %D above 80 – Enter brief on EUR/USD 1-hour chart when %Ok drops via %D after each strains exceed 80, putting stops 5 pips above the latest swing excessive.

Bearish divergence at resistance – When worth makes a better excessive however Stochastic peaks decrease on the 4-hour GBP/USD chart above 75, momentum is fading; brief the following bearish candle with 30-pip cease.

Rejection from excessive overbought – If Stochastic hits 95+ and instantly reverses on the 15-minute chart throughout London open, promote aggressively for fast 15-20 pip scalps earlier than the pullback completes.

Failed breakout above 80 – When %Ok pushes above 80 however can’t pull %D with it and as a substitute crosses again down, it alerts weak shopping for; brief with conviction on the crossover.

Overbought in ranging markets – Between 8 AM-12 PM GMT when USD/JPY trades in a 40-pip vary, promote each Stochastic studying above 85 towards the vary midpoint with tight 15-pip stops.

Don’t struggle prolonged rallies – Ignore overbought alerts above 80 if the day by day chart exhibits worth climbing with sturdy bullish candles; anticipate precise development construction breaks or decrease timeframe divergence first.

Path stops as Stochastic drops – As soon as brief and worthwhile with Stochastic declining from 80 towards 50, transfer your cease to breakeven at 10 pips revenue, then path it 15 pips behind worth.

Exit earlier than oversold extremes – Shut 75% of your brief place when Stochastic reaches 25-30 on the 1-hour chart; attempting to squeeze out the final 10 pips typically leads to giving again 20.

Placing It All Collectively

The Stochastic oscillator provides merchants a window into momentum shifts that worth alone doesn’t reveal. It really works greatest in ranging markets, for timing pullback entries in traits, and for recognizing divergences that sign exhaustion. The twin-line crossover system gives particular entry alerts, whereas overbought/oversold zones determine potential reversal areas.

However it’s not good. Sturdy traits render it ineffective until you’re filtering alerts with the broader context. False alerts occur, particularly on decrease timeframes or with aggressive settings. And like several technical instrument, it requires observe to learn appropriately.

Buying and selling foreign exchange carries substantial danger. No indicator ensures income, and previous efficiency doesn’t predict future outcomes. Stochastic can enhance your timing and decision-making, however solely when mixed with stable danger administration and life like expectations.

Begin by including it to your charts and easily observing. Watch how readings behave throughout totally different market circumstances. Word when crossovers result in precise worth motion and once they fail. That hands-on expertise will train you greater than any article can. The indicator is only a instrument—your judgment about when to make use of it makes all of the distinction.

Really useful MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Successful Foreign exchange Dealer

Extra Unique Bonuses All through The 12 months

Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90