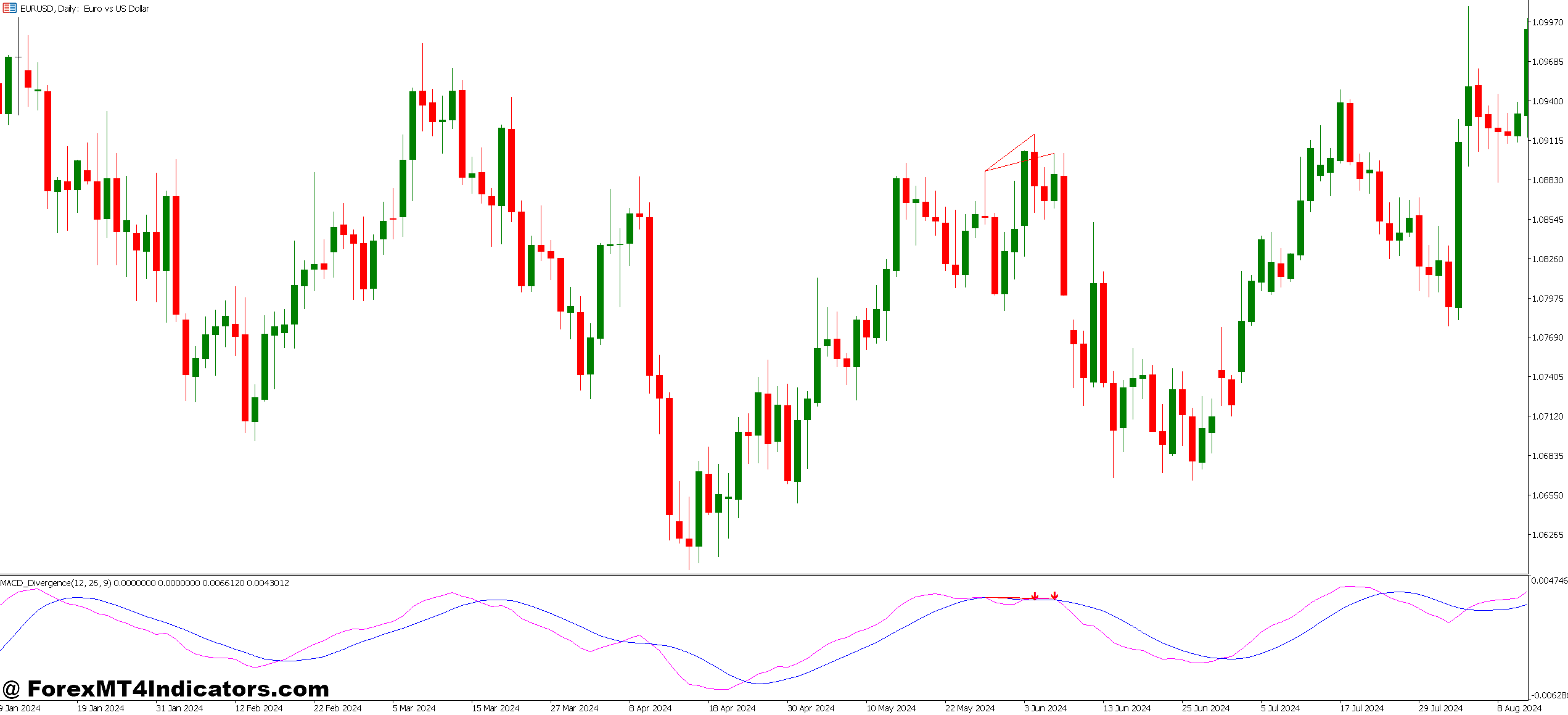

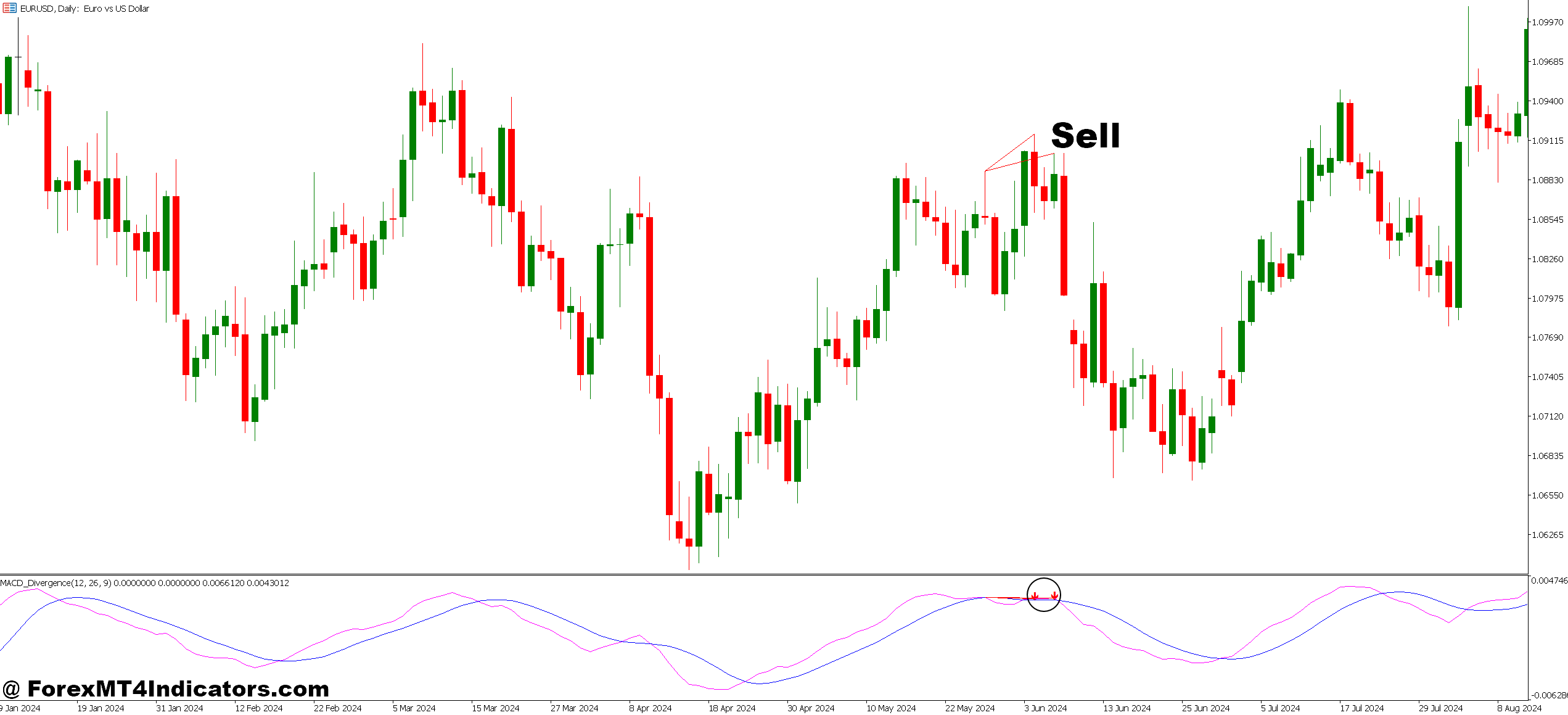

MACD divergence happens when worth motion and the MACD histogram transfer in reverse instructions. Common bearish divergence occurs when worth makes larger highs however the MACD makes decrease highs—momentum is weakening at the same time as worth climbs. Common bullish divergence is the mirror picture: worth makes decrease lows whereas MACD kinds larger lows.

The MT5 model automates the detection course of. As an alternative of squinting at charts on the lookout for these patterns manually, the indicator scans worth swings and MACD peaks, then attracts connecting strains when it finds a mismatch. It sometimes marks these with trendlines or arrows immediately in your chart.

What separates this from the usual MACD? Automation and visible readability. The essential MACD histogram exhibits momentum shifts, certain. However it’s essential determine the divergence patterns your self—evaluating swing factors on each worth and indicator. The divergence indicator does that heavy lifting, which issues if you’re watching a number of pairs or buying and selling on quicker timeframes the place alternatives vanish shortly.

How It Features on MT5

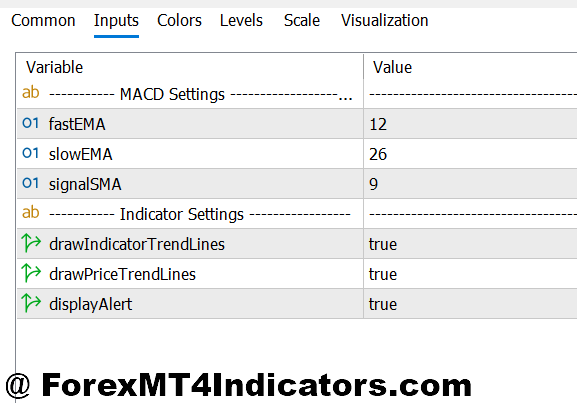

The indicator runs the standard MACD calculation first: subtracting the 26-period EMA from the 12-period EMA, then plotting a 9-period sign line. That’s normal. The divergence detection layer compares latest worth pivots in opposition to corresponding MACD pivots utilizing a swing detection algorithm.

When worth kinds what the algorithm identifies as a swing excessive (peak), it checks the MACD worth at that very same bar. Then it compares this to the earlier swing excessive. If worth went larger however MACD went decrease, the indicator flags bearish divergence. Identical logic applies to swing lows for bullish setups.

Most MT5 variations allow you to modify the swing detection sensitivity. A setting of 5, as an illustration, means the indicator seems to be for pivots the place the excessive or low isn’t exceeded for five bars on both facet. Decrease numbers catch extra divergences however generate extra false indicators. Larger numbers anticipate clearer swings however may lag.

The visible output often consists of coloured strains connecting the divergent factors—inexperienced for bullish, crimson for bearish. Some variations add alerts that pop up or ship notifications to your cellphone. That characteristic alone saves hours of chart-watching, particularly in case you’re scanning 10+ pairs.

Buying and selling With Divergence Alerts

Right here’s the place idea meets actuality. On EUR/USD’s 4-hour chart final month, worth pushed from 1.0850 to 1.0920 over two days. Clear uptrend, proper? However MACD peaked on the first excessive round 1.0880 and fashioned a decrease peak at 1.0920. The indicator drew the divergence strains, and inside 12 hours, EUR/USD dropped 70 pips.

The setup labored as a result of it appeared at a key resistance degree. That’s the essential context most merchants miss—divergence isn’t a standalone sign. It performs greatest when it confirms what different elements already recommend. Close to main help or resistance zones, after prolonged traits, or when worth hits vital Fibonacci retracements.

On the flip facet, divergence in the midst of robust traits typically fails. GBP/JPY confirmed bearish divergence thrice throughout a 400-pip rally final quarter. Merchants who shorted these indicators received steamrolled. The pattern was just too robust, and divergence solely indicated transient pauses earlier than continuation.

Timeframe choice issues too. The 1-hour chart generates divergence indicators incessantly—possibly one each few days per pair. The every day chart may present one or two per 30 days. Day merchants lean towards H1 or M30 charts however settle for larger false sign charges. Swing merchants persist with H4 or every day charts for higher high quality setups, even when they’re much less frequent.

Customizing Settings for Your Model

The default MACD parameters (12, 26, 9) work fantastic for many situations, however they’re not set in stone. Shorter settings like 5, 13, 8 react quicker, catching divergences earlier. This helps on scalping timeframes however will increase whipsaws. Longer settings like 19, 39, 9 easy out noise on larger timeframes—helpful for place merchants who need solely the strongest indicators.

The swing detection parameter wants adjustment primarily based in your timeframe. On M15 charts, a swing setting of 3-4 bars works. On the every day chart, you may use 5-7. Too low and also you’ll see divergence on each minor wiggle. Too excessive and also you’ll miss legitimate setups as a result of the algorithm waits for enormous swings that not often kind.

Alert preferences deserve consideration too. Some merchants need a notification the second divergence kinds. Others choose ready for the candle to shut, which filters out divergences that seem mid-bar however vanish by shut. That single setting change can minimize false indicators by 30-40%, although you’ll often miss fast-moving setups.

Coloration and line fashion choices may appear beauty, however they matter if you’re reviewing a number of charts. Making bullish divergence shiny inexperienced and bearish divergence shiny crimson helps your eye catch indicators quicker. Some merchants overlay the divergence strains with their fundamental help and resistance ranges to identify confluences immediately.

Actual Speak: Strengths and Weaknesses

The indicator excels at early warning detection. It typically indicators potential reversals 10-20 bars earlier than worth confirms with a transparent break. For merchants who scale into positions, that early heads-up is gold. You possibly can put together restrict orders or tighten stops on current trades earlier than the group catches on.

It additionally removes the subjectivity of handbook divergence recognizing. Two merchants wanting on the identical chart may disagree on whether or not divergence exists. The algorithm applies constant guidelines, so what you see on Monday matches what you see on Friday. That consistency helps when backtesting methods.

However—and this issues—the indicator can’t distinguish between vital and meaningless divergences. A divergence at main resistance carries completely different weight than one in a random mid-trend consolidation. You continue to want to guage context: the place’s the closest help or resistance? What’s the broader pattern? Has this pair been ranging or trending?

False indicators spike throughout uneven, range-bound markets. When worth oscillates in a decent vary, the indicator may flag divergence each different day, none of which lead anyplace. That’s not the indicator’s fault—divergence merely works higher in trending situations approaching exhaustion, not throughout sideways motion.

When to Belief It (And When to Ignore It)

Skilled merchants don’t take each divergence sign. They filter utilizing a guidelines. Is worth at a major degree? Test. Has the pattern been working for a minimum of 50-100 pips already? Test. Is quantity declining as worth makes new extremes? Bonus affirmation. Do different indicators (RSI, Stochastic) present comparable divergence? Even higher.

With out these filters, win charges hover round 40-45%. With correct context and affirmation, that jumps to 60-65% on larger timeframes. The distinction isn’t the indicator—it’s how you employ it.

Another factor: hidden divergence exists too. That’s when worth makes a better low however MACD makes a decrease low, signaling pattern continuation reasonably than reversal. Many MT5 variations spotlight this individually. It’s helpful for including to profitable positions throughout pullbacks.

The way to Commerce with MT5 MACD Divergence Indicator

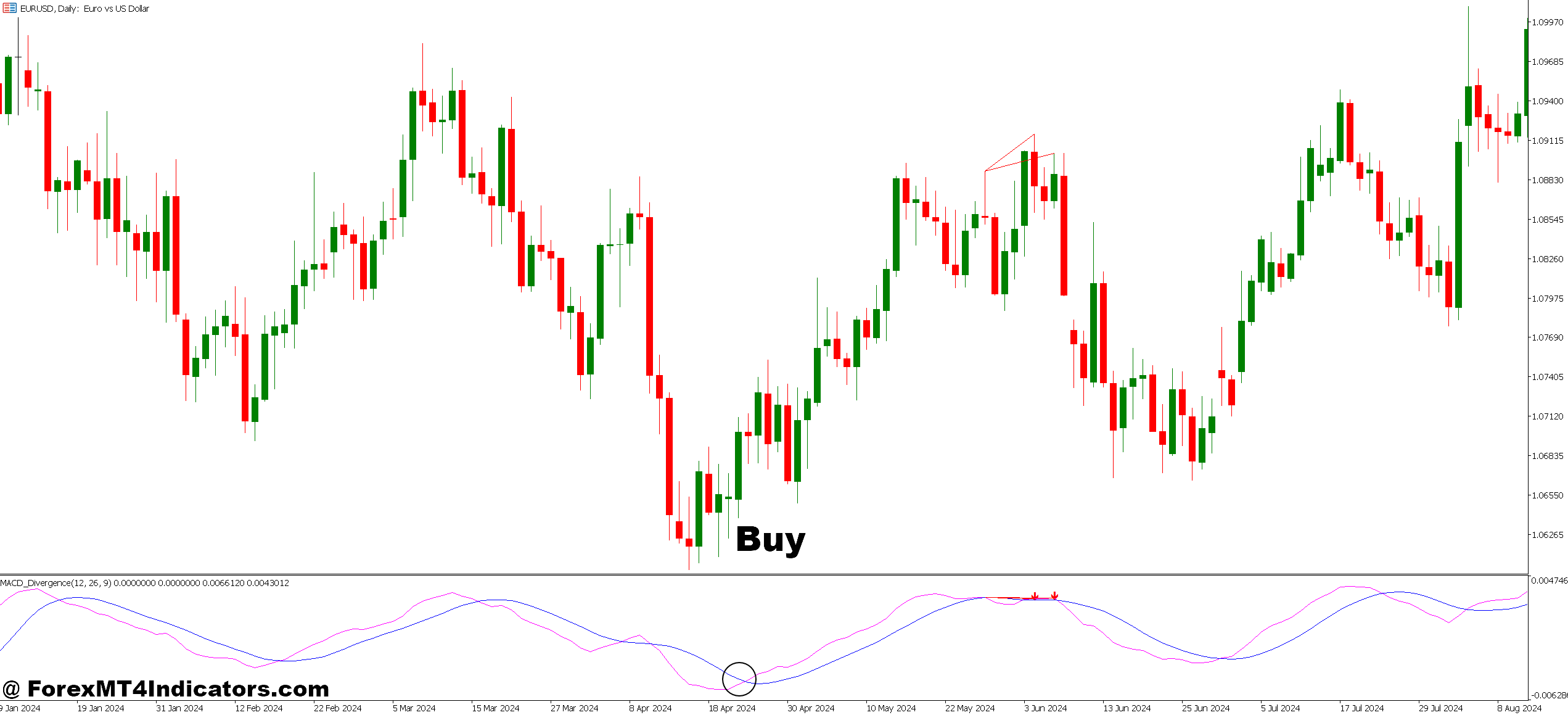

Purchase Entry

Await bullish divergence at help – Value makes decrease low whereas MACD makes larger low close to main help zone; enter when subsequent candle closes above the divergence low on EUR/USD 4-hour chart.

Verify with 20-pip bounce – Don’t enter instantly at divergence; anticipate worth to bounce a minimum of 20 pips from the low to substantiate consumers are stepping in on GBP/USD.

Set stop-loss 10-15 pips beneath swing low – Place your cease simply beneath the divergence low level; this retains danger tight whereas permitting for regular worth fluctuation on 1-hour timeframes.

Goal the earlier swing excessive – Goal for 40-70 pips by focusing on the place worth failed earlier than; modify primarily based on pair volatility and every day ATR.

Skip divergence throughout robust downtrends – If EUR/USD dropped 150+ pips within the final 5 days, ignore bullish divergence indicators; the pattern is just too robust and prone to proceed.

Enter solely after candle shut affirmation – Wait till the 1-hour or 4-hour candle totally closes exhibiting rejection of lows; mid-candle divergence typically disappears by shut time.

Use half place measurement on H1 charts – Sooner timeframes produce extra false indicators; danger solely 0.5-1% per commerce as an alternative of your typical 2% when buying and selling hourly divergence setups.

Keep away from throughout main information releases – Don’t take divergence indicators half-hour earlier than or after NFP, central financial institution choices, or GDP information; volatility invalidates technical setups.

Promote Entry

Search for bearish divergence at resistance – Value makes larger excessive whereas MACD makes decrease excessive close to key resistance; enter when candle closes beneath the divergence excessive on 4-hour GBP/USD.

Await 20-30 pip rejection – Let worth drop a minimum of 20-30 pips from the divergence peak earlier than getting into; this confirms sellers management and filters weak indicators.

Place cease 15-20 pips above swing excessive – Set your cease simply above the divergence peak the place worth failed; offers respiratory room whereas retaining danger managed on EUR/USD trades.

Goal 1.5:1 minimal risk-reward – If risking 30 pips, goal for a minimum of 45-pip revenue; bearish divergence on every day charts typically yields 80-120 pip strikes.

Ignore indicators in ranging markets – If GBP/USD traded in a 50-pip vary for 3+ days, skip divergence; it generates false indicators when worth oscillates with out pattern.

Test RSI for affirmation – Strongest setups present MACD divergence plus RSI above 70 creating bearish divergence concurrently; this doubles affirmation power.

Scale back measurement after 2 dropping divergence trades – In case your final two divergence indicators stopped out, minimize place measurement by 50% on the following sign; market situations might not swimsuit this technique at the moment.

Keep away from divergence mid-trend with out context – Don’t quick EUR/USD bearish divergence if worth is 30 pips from any main resistance or help degree; context-free indicators fail 70% of the time.

Placing It All Collectively

The MT5 MACD Divergence Indicator automates what used to require fixed chart monitoring and sharp sample recognition expertise. It flags potential reversals by evaluating worth momentum in opposition to precise worth motion, giving merchants advance discover when traits is perhaps topping or bottoming out. Works greatest when mixed with help and resistance evaluation, utilized on clear trending strikes, and filtered for high-quality setups at key ranges.

Don’t anticipate magic. Count on a device that, used accurately alongside correct context and danger administration, helps you see high-probability turning factors. The indicator exhibits you the place momentum and worth disagree. What you do with that info—that’s nonetheless on you.

Really useful MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Profitable Foreign exchange Dealer

Further Unique Bonuses All through The 12 months

Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90