Bitcoin is navigating a vital take a look at because it trades barely above the $110,000 mark, with bulls working to defend key assist after final Friday’s sharp crash. The market stays tense, and sentiment is cut up between hopes of restoration and fears of one other leg down.

Associated Studying

After one of the vital unstable weeks of the 12 months, BTC is displaying indicators of consolidation, however uncertainty dominates as merchants assess whether or not that is the beginning of a stabilization part or a brief pause earlier than one other sell-off. Analysts observe that value construction stays fragile, and momentum indicators counsel the market wants stronger demand inflows to maintain present ranges.

In the meantime, onchain information factors to notable whale exercise. A number of newly created wallets have been noticed withdrawing massive quantities of Bitcoin from main exchanges, signaling that some massive traders could also be transferring property to chilly storage — a transfer usually interpreted as an indication of accumulation or strategic repositioning.

These flows spotlight the continuing tug-of-war between market worry and institutional curiosity. Because the market seeks route, merchants are intently watching whale conduct for clues about whether or not this consolidation will flip right into a rebound — or one other wave of volatility.

Whale Exercise Alerts Strategic Accumulation

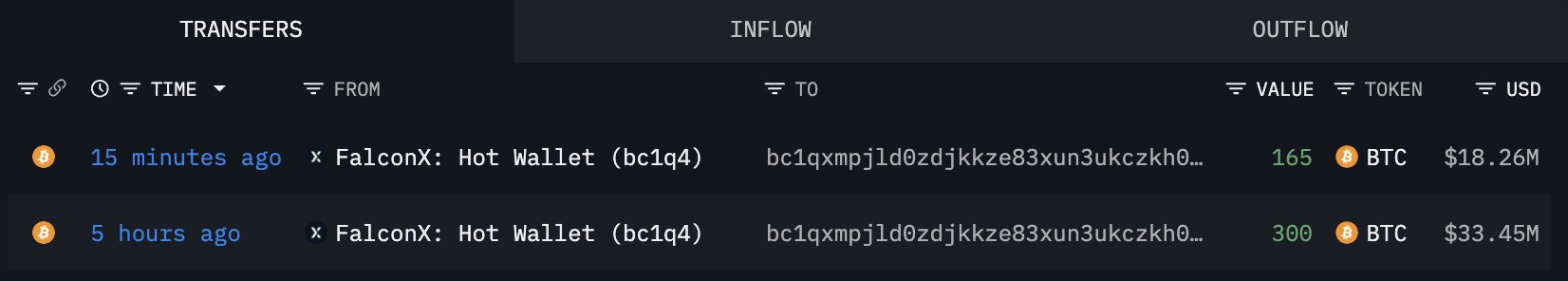

Knowledge from Lookonchain exhibits renewed whale exercise as Bitcoin consolidates close to the $110K mark. A newly created pockets, bc1q0q, withdrew 1,000 BTC ($110.65 million) from Binance, whereas one other pockets, bc1qxm, pulled 465 BTC ($51.47 million) from FalconX over the previous 5 hours. These two withdrawals — totaling greater than $160 million in Bitcoin — have caught the eye of analysts monitoring institutional and large-scale investor flows.

Traditionally, such actions of newly created wallets withdrawing vital sums from exchanges have a tendency to point accumulation conduct somewhat than short-term hypothesis. When massive gamers transfer funds off exchanges, it sometimes indicators decreased promoting intent and a choice for holding BTC in self-custody — a bullish long-term signal, even amid short-term market weak point.

Nonetheless, this doesn’t imply volatility is over. The market stays fragile after final week’s sharp drop, and plenty of merchants count on a interval of sideways consolidation earlier than any clear directional transfer. Bitcoin might proceed to hover throughout the $108K–$115K vary because it absorbs latest liquidations and rebuilds construction.

Associated Studying

Bitcoin Bulls Defend $110K Help Amid Consolidation

Bitcoin continues to hover round $111,300, displaying resilience after final week’s sharp crash that briefly despatched costs close to $103,000. The chart reveals that BTC is presently consolidating simply above the $110K assist zone, a key space that has repeatedly acted as a short-term ground throughout previous corrections.

Value motion exhibits restricted momentum, with the 50-day transferring common (blue line) sloping downward and performing as resistance close to $115K, whereas the 200-day transferring common (crimson line) sits round $107K, offering a broader structural base. This setup means that Bitcoin stays in a neutral-to-bearish short-term part, as patrons and sellers proceed to battle for management inside a tightening vary.

Associated Studying

For now, the $117,500 degree stays the important thing resistance to reclaim if BTC desires to substantiate a restoration development. A decisive breakout above this zone might set off renewed momentum towards $120K–$122K. Conversely, a drop beneath $109K would doubtless prolong the correction towards $106K.

Market sentiment stays cautious however secure. Consolidation at these ranges might enable BTC to rebuild assist and reset indicators earlier than trying one other transfer, making the present part vital for figuring out the subsequent main route in value motion.

Featured picture from ChatGPT, chart from TradingView.com