Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

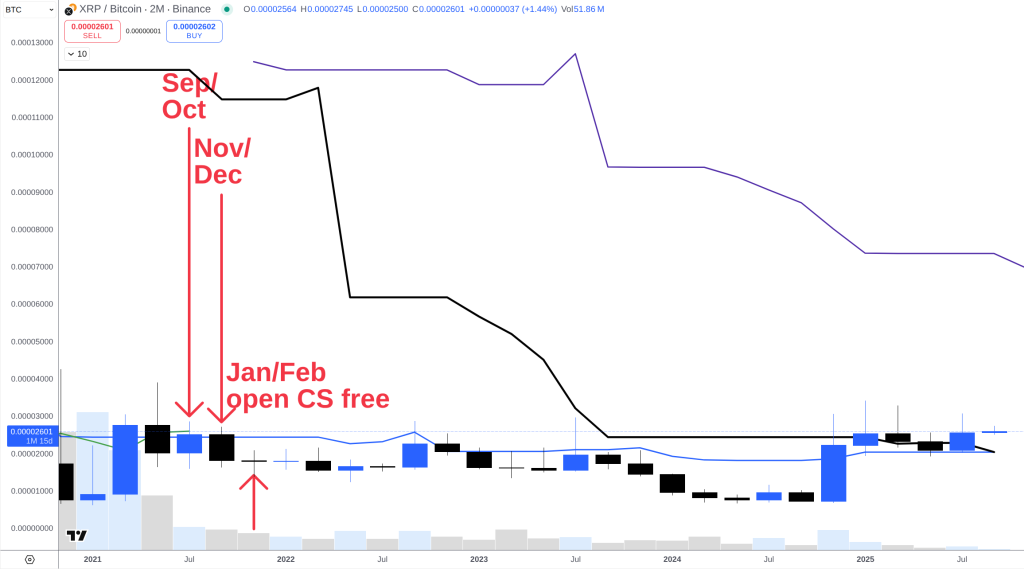

An XRP/BTC long-term chart shared by pseudonymous market technician Dr Cat (@DoctorCatX) factors to a delayed—however doubtlessly explosive—upswing for XRP versus Bitcoin, with the analyst arguing that “the subsequent monster leg up” can’t start earlier than early 2026 if key Ichimoku situations are to be glad on the best time frames.

Posting a two-month (2M) XRP/BTC chart with Ichimoku overlays and date markers for September/October, November/December and January/February, Dr Cat framed the setup across the place of the Chikou Span (CS) relative to cost candles and the Tenkan-sen. “Primarily based on the 2M chart I count on the subsequent monster leg as much as begin no sooner than 2026,” he wrote. “As a result of the logical time for CS to get free above the candles is Jan/Feb 2026 on an open foundation and March 2026 on a detailed foundation, respectively.”

XRP/BTC Breakout Window Opens Solely In 2026

In Ichimoku methodology, the CS—worth shifted again 26 durations—clearing above historic candles and the Tenkan-sen (conversion line) is used to substantiate the transition from equilibrium to trending situations. That threshold, in Dr Cat’s view, hinges on XRP/BTC defending roughly 2,442 sats (0.00002442 BTC). “As you see, the value wants to carry 2442 in order that CS is each above the candles and Tenkan Sen,” he mentioned.

Associated Studying

Ought to that situation be met, the analyst sees the market “logically” focusing on the subsequent main resistance band first round ~7,000 sats, with an prolonged 2026 goal in a 7,000–12,000 sats hall on the best time frames. “If that occurs, solely trying on the 2M timeframe the logical factor is to assault the subsequent resistance at ~7K,” he wrote, earlier than including: “In any other case on highest timeframes all the pieces nonetheless appears to be like wonderful and factors to 7K–12K in 2026, till additional discover.”

The roadmap shouldn’t be with out nearer-term dangers. Dr Cat flagged a growing sign on the weekly Ichimoku cloud: “Yet one more factor to control until then: the weekly chart. Which, if doesn’t renew the yearly excessive by November/December will get a bearish kumo twist. Which nonetheless is probably not the tip of the world however nonetheless deserves consideration. So yet one more analysis is required at late 2025 I suppose.” A bearish kumo twist—when Senkou Span A crosses beneath Senkou Span B—can foreshadow a medium-term lack of momentum or a interval of consolidation earlier than pattern resumption.

The dialogue rapidly turned to the real-world affect of the satoshi-denominated targets. When requested what ~7,000 sats may imply in greenback phrases, the analyst cautioned that the conversion floats with Bitcoin’s worth however provided a tough yardstick for right this moment’s market. “In present BTC costs are roughly $7.8,” he replied. The determine is illustrative moderately than predictive: XRP’s USD worth at any future XRP/BTC stage will rely upon BTC’s personal USD worth at the moment.

The posted chart—which annotates the possible home windows for CS clearance as “Jan/Feb open CS free” and “March shut” following interim checkpoints in September/October and November/December—underscores the time-based nature of the decision. On multi-month Ichimoku settings, the lagging span has to “work off” previous worth construction earlier than a clear upside pattern affirmation is feasible; forcing the transfer earlier would, on this framework, threat a rejection again into the cloud or beneath the Tenkan-sen.

Contextually, XRP/BTC has been basing in a broad vary since early 2024 after a multi-year downtrend from the 2021 peak, with intermittent upside probes failing to reclaim the extra consequential resistances that sit 1000’s of sats greater. The two,442-sats space Dr Cat highlights aligns with the necessity to maintain the lagging span above each contemporaneous worth and the conversion line, a situation that tends to scale back whipsaws on very excessive time frames.

Associated Studying

Whether or not the market in the end delivers the 7,000–12,000 sats advance in 2026 will, by this learn, rely upon two issues: XRP/BTC’s capacity to carry above the ~2,442-sats pivot because the calendar turns via early 2026, and the weekly chart avoiding or rapidly invalidating a bearish kumo twist if new yearly highs aren’t set earlier than November/December. “If that occurs… the logical factor is to assault the subsequent resistance at ~7K,” Dr Cat concludes, whereas stressing that the weekly cloud nonetheless “deserves consideration.”

As with all Ichimoku-driven thesis, the emphasis is on alignment throughout time frames and the interplay of worth with the system’s 5 traces—Tenkan-sen, Kijun-sen, Senkou Spans A and B (the “kumo” cloud), and the Chikou Span. Dr Cat’s thread leans on the lagging span mechanics to clarify why an earlier “monster leg” is statistically much less possible, and why the second half of 2025 might be a crucial checkpoint earlier than any 2026 pattern try.

For now, the takeaway is a timeline moderately than an imminent set off: the analyst’s base case defers any outsized XRP outperformance versus Bitcoin till after the CS clears historic overhead in early 2026, with interim monitoring of the weekly cloud into year-end. As he summed up, “On highest timeframes all the pieces nonetheless appears to be like wonderful… till additional discover.”

At press time, XRP traded at $3.119.

Featured picture created with DALL.E, chart from TradingView.com