The US Securities and Alternate Fee and Ripple Labs have requested the Second Circuit Court docket of Appeals to maintain their dueling appeals on ice whereas they proceed to influence the trial choose {that a} hard-fought, four-and-a-half-year authorized struggle ought to finish in a $50 million settlement and the lifting of an injunction towards the San-Francisco-based funds firm.

Ripple And SEC Push For Remaining Deal

In an eight-page standing report filed late Monday, the Fee advised the appellate panel that “the events had reached an agreement-in-principle, topic to Fee approval, to resolve the underlying case and the appeals” and subsequently “respectfully request[ed] that this Court docket proceed to carry the appeals in abeyance” till the subsequent replace is due on 15 August 2025.

The submitting recaps a rapid-fire sequence that started after each side signed a settlement settlement on 8 Might. Below that pact, Ripple would pay $50 million—barely 40 p.c of the $125 million civil penalty imposed final yr—whereas the rest of the escrowed funds and accrued curiosity can be returned to the corporate.

The deal is contingent on US District Choose Analisa Torres dissolving the everlasting injunction she entered on 7 August 2024 and ordering launch of the escrow. “If the district courtroom points the requested indicative ruling,” the standing report explains, the events will search a restricted remand in order that the trial courtroom can rewrite its judgment and, as soon as that’s executed, each the SEC’s enchantment and Ripple’s cross-appeal “will [be] dismiss[ed].”

Choose Torres initially balked. On 15 Might she rejected the primary indicative-ruling movement as a result of it didn’t grapple with Federal Rule 60(b)’s “distinctive circumstances” customary. The adversaries returned on 12 June with a 52-page memorandum arguing that continued litigation would waste judicial assets, that vacating the injunction is a “vital situation of settlement,” and that the SEC’s personal coverage pivot towards negotiated crypto resolutions after Appearing Chair Mark T. Uyeda’s January crypto process power announcement reinforces the equities of ending the struggle.

The Fee’s new tone contrasts sharply with its posture beneath former Chair Gary Gensler, whose enforcement-first technique produced the December 2020 grievance and—after a bruising discovery battle—a cut up summary-judgment ruling on 13 July 2023. Choose Torres held that Ripple’s $728.9 million in direct institutional XRP gross sales have been unregistered securities choices, however that programmatic trade gross sales and different distributions weren’t.

The ultimate judgment that adopted in August 2024 locked within the $125 million penalty and the injunction whereas ordering Ripple to park 111 p.c of the high-quality in an interest-bearing escrow account. Either side appealed in October 2024; the SEC’s opening transient landed on 15 January 2025, however earlier than Ripple’s response was due the events collectively requested the Second Circuit on 10 April to pause the case in gentle of their nascent settlement. The courtroom granted that request on 16 April.

What has modified since then, the renewed movement argues, is a confluence of things courts have lengthy acknowledged as “distinctive”: a complete settlement conditioned on modifying remaining aid, the SEC’s publicly acknowledged recalibration of crypto enforcement, and the absence of any non-party prejudice as a result of the underlying summary-judgment opinion would stay intact. The memorandum cites current voluntary dismissals of different high-profile crypto circumstances as proof that “terminat[ing] the appeals … can be per [the] dismissals by joint stipulation.”

Whether or not Choose Torres shall be persuaded this time is the important open query. If she indicators a willingness to dissolve the injunction and slash the penalty, a restricted remand from the Second Circuit would observe virtually robotically. If she demurs, the appeals—now totally briefed solely on the SEC’s aspect—may roar again to life.

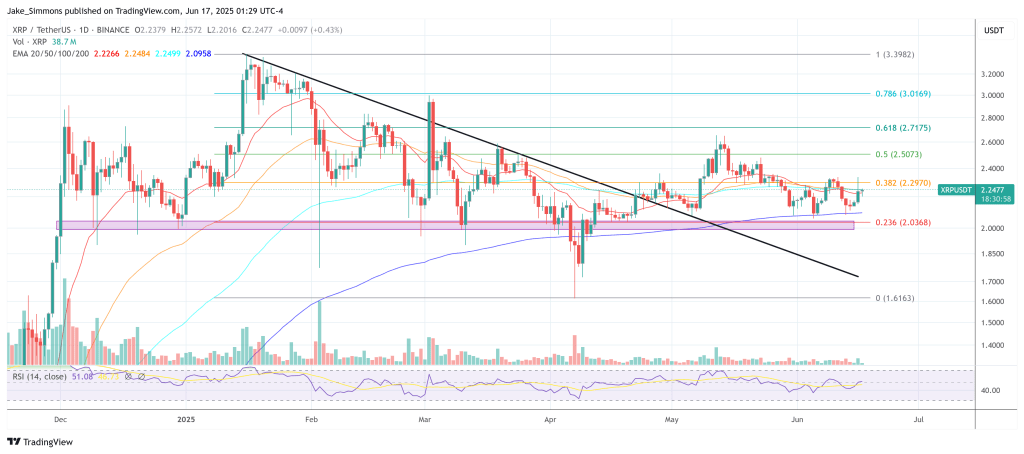

At press time, XRP traded at $2.247.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.