Bitcoin is getting into a important consolidation section after every week of heightened volatility and promoting strain. Following its surge to a brand new all-time excessive of $124,500 simply ten days in the past, BTC has since retraced by greater than 10%, now struggling to carry the $115K degree as help. This pullback alerts potential shopping for exhaustion, with analysts warning of a attainable deeper correction if momentum fails to get better.

Market sentiment has shifted as merchants weigh whether or not this retrace is a wholesome cooldown or the start of a extra sustained decline. A number of consultants spotlight that value motion beneath $115K suggests bulls are dropping management of short-term momentum, elevating the chance of additional draw back.

Including to the strain, Lookonchain information highlights the strikes of a Bitcoin OG who has just lately re-emerged after years of dormancy. This whale, who first acquired 100,784 BTC seven years in the past, has begun shifting giant parts of his holdings out of Bitcoin. As an alternative of holding, he’s aggressively reallocating into Ethereum, utilizing each spot purchases and lengthy positions to execute the rotation.

Bitcoin Rotation: New Market Dynamics At Play

Based on Lookonchain, the previous 5 days have seen one of the crucial aggressive onchain strikes from this Bitcoin OG. The whale deposited roughly 22,769 BTC, value almost $2.59 billion, into Hyperliquid on the market. As an alternative of holding BTC, the capital was quickly shifted into Ethereum, the place the whale purchased 472,920 ETH on spot markets, valued at $2.22 billion, and concurrently opened a large 135,265 ETH lengthy value round $577 million.

What makes the transfer much more notable is the whale’s follow-up technique. Hours later, Lookonchain reported that this OG started closing his ETH longs and changing them into spot holdings. Particularly, he closed 95,053 ETH longs, value roughly $450 million, at a mean value of $4,735, locking in over $33 million in earnings. Instantly after, he bought a further 23,575 ETH in spot markets, valued at $108 million.

Regardless of the shift, the whale nonetheless maintains an energetic derivatives place of 40,212 ETH longs (value about $184 million) with $11 million in unrealized revenue.

This sequence of trades highlights an simple capital rotation from Bitcoin into Ethereum, a transfer that aligns with the rising narrative of ETH gaining dominance available in the market. It additionally helps clarify latest value divergences between BTC and ETH, the place Bitcoin has stalled beneath resistance ranges whereas Ethereum continues testing new highs.

Technical Evaluation: Testing Pivotal Value Stage

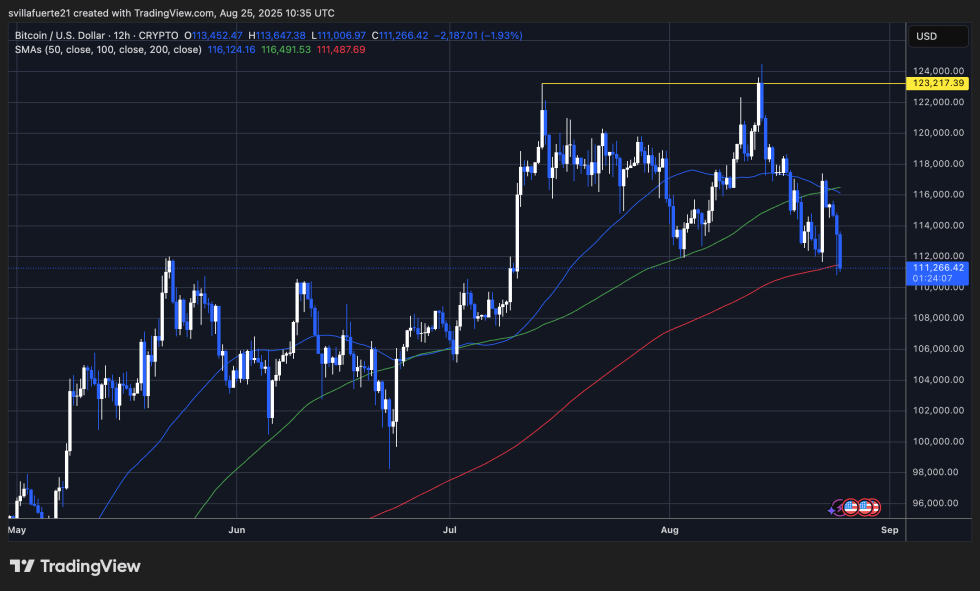

Bitcoin is at present buying and selling round $111,266, displaying weak point after failing to carry momentum above the $115K mark. The chart reveals a pointy decline from the $123,217 ATH, with BTC now testing important help ranges. Value is sitting simply above the 200-day shifting common (pink line at ~$111,487), which has traditionally acted as a powerful demand zone. A decisive break beneath this degree may speed up promoting strain, doubtlessly driving BTC towards the $108K–$110K vary.

The 50-day (blue) and 100-day (inexperienced) shifting averages have each began to flatten and slope downward, reflecting waning bullish momentum. This alerts that the market could also be getting into a consolidation section after months of aggressive upside. On the upside, bulls might want to reclaim the $116K–$118K vary to shift short-term momentum and try one other run towards the ATH at $123K.

The chart highlights an important crossroads for BTC. A profitable protection of the 200-day MA may restore confidence amongst patrons, whereas a breakdown dangers a deeper correction. Merchants are watching carefully as this degree may outline whether or not Bitcoin resumes its broader bullish cycle or enters a protracted consolidation.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.