Ondo Finance continues to strengthen its place as a number one drive within the tokenized finance area. Since launching its token in January 2024, the undertaking has grown quickly, carving out a outstanding position within the intersection of Actual World Asset (RWA) tokenization and decentralized finance (DeFi) integration with conventional finance (TradFi).

This momentum reached a brand new milestone yesterday when the White Home, by the President’s Working Group on Digital Asset Markets, formally acknowledged Ondo Finance in a brand new report. The report highlights tokenized securities, stablecoins, and programmable settlement as foundational to the way forward for the worldwide monetary system—and named Ondo among the many key gamers main that shift.

This recognition not solely legitimizes Ondo’s work but in addition reinforces the rising position of RWA tokenization in institutional and regulatory conversations. Their deal with fairness tokenization by its custom-built Ondo Chain and its flagship tokenized US Treasury product has attracted rising curiosity from buyers and establishments. With coverage and innovation converging, the undertaking stands out as a vital bridge between legacy markets and the decentralized future, signaling sturdy potential forward for each the protocol and the broader tokenization narrative.

Ondo Finance Spotlighted in White Home Report

Within the latest report from the President’s Working Group on Monetary Markets, Ondo was featured as a core instance of how tokenized programs function—additional cementing its position on the forefront of the Actual World Asset (RWA) tokenization motion. In response to the report, trade estimates counsel that over $600 billion in RWAs might be tokenized by 2030, together with cash market fund shares, fixed-income devices, personal credit score, and personal fund shares.

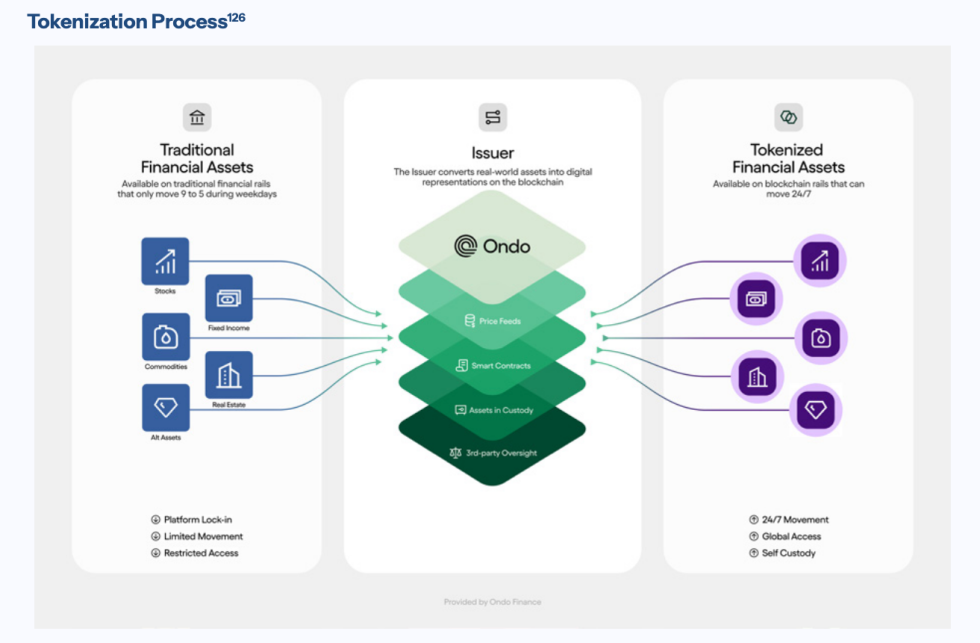

The report highlights that companies are approaching tokenization by two main fashions: both constructing personal, permissioned blockchains or deploying permissioned layers on prime of public, permissionless networks. Ondo stands out for its hybrid strategy—leveraging public infrastructure whereas sustaining institutional-grade compliance. An in depth chart within the report even makes use of Ondo for instance the end-to-end tokenization course of.

Crucially, the regulatory standing of tokenized property is decided not by the act of tokenization itself, however by the character of the underlying asset. Since most present tokenization quantity includes securities resembling fastened earnings and personal credit score, these property are usually topic to securities regulation. Nonetheless, the report additionally notes the rising presence of tokenized commodities like gold and tokenized non-financial property resembling actual property and uncommon collectibles.

Ondo’s inclusion within the White Home report indicators rising mainstream and regulatory acknowledgment of tokenized finance. With its flagship US Treasury-backed merchandise and enlargement into tokenized equities by way of Ondo Chain, the protocol is poised to play a serious position in shaping the digital monetary infrastructure of the following decade.

Worth Motion Particulars: Key Stage To Watch

Ondo has reclaimed the $0.99 degree after a unstable pullback, gaining almost 5% on the day. The latest value bounce comes after testing the 50-day shifting common (MA) at $0.86 as help, which coincides with a key psychological threshold and prior accumulation vary. This space has traditionally triggered renewed curiosity from consumers, particularly after sharp corrections just like the one seen in mid-July.

Nonetheless, ONDO stays beneath the 200-day MA at $0.97, which now acts as rapid resistance. The token broke above this degree final week after bullish momentum pushed the value previous $1.20 however failed to carry the highs as sellers took income. A sustained shut above the 200-day MA might re-establish bullish management and open the trail again towards the $1.20 zone.

The construction nonetheless displays a broader restoration from the multi-month downtrend that began in January 2025. If ONDO can consolidate above $0.95 and reclaim $1.05, it might mark a brand new greater low and sign development continuation. Then again, dropping the 50-day MA once more would invalidate the present bounce and counsel a deeper retest towards $0.85 and even $0.78 help.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.