Pepsi inventory is wanting low-cost, however below the hood, issues are a bit shaky

The corporate has gotten into bother, however I argue why its headwinds are momentary

I break down Pepsi’s fundamentals and clarify why it would deserve a spot in your portfolio…

“Elevator Pitch” Overview

PepsiCo is a world snacks-and-beverages powerhouse with practically $92 billion in FY2024 income. Its valuation is exhibiting the largest reductions in many years. Why? Administration stumbled by climbing costs aggressively to offset inflation. That helped income, however harm volumes—particularly in North America. Now they’re slicing prices and making an attempt to reignite development. With world-class manufacturers and a vertically built-in provide chain, can Pepsi get again on target?

What does the corporate truly do?

PepsiCo isn’t simply soda. In reality, most of its gross sales come from salty snacks—Lay’s, Doritos, Cheetos, and so on.—plus a smaller phase of handy meals (Quaker, Cap’n Crunch,…). Drinks like Pepsi and Gatorade make up the remainder.

Not like Coca-Cola, which licenses and outsources a lot of its operations, Pepsi runs a vertically built-in empire—proudly owning manufacturing, logistics, and even an enormous direct-store supply (DSD) community throughout 200+ nations. This makes the enterprise extra asset-heavy (with $58B in PPE vs. Coca-Cola’s $20B), but in addition provides Pepsi extra management.

In FY2024, 58% of revenues got here from meals, and 42% from drinks, with Frito-Lay as the primary revenue engine, producing $24.8B in gross sales and $6.5B in revenue. You may see an in depth overview right here:

To be clear, Pepsi is a boring, mature enterprise. However that’s the place the chance lies in plain sight.

Why ought to traders care now?

Pepsi is in the midst of a turnaround. Inflation jacked up manufacturing prices, which Pepsi responded to with steep worth hikes—double-digit in some quarters. That helped offset the strain on earnings, however volumes fell:

Whole quantity: -2% in FY2024

North America drinks: -3.5% YoY

Frito-Lay: -2.5% YoY

Whereas worth hikes offset some EPS impression, a shopper enterprise has to promote, particularly one with slim margins.

Pepsi now faces two key challenges:

Reviving development in a more durable financial surroundings, with customers choosing cheaper alternate options and enter prices nonetheless rising.

Adapting to shifting preferences: low-sugar, practical, and “clear label” manufacturers are successful. New gamers like Olipop are stealing share and relevance. Pepsi should adapt to customers who realized 40 grams of sugar of their drink isn’t nice.

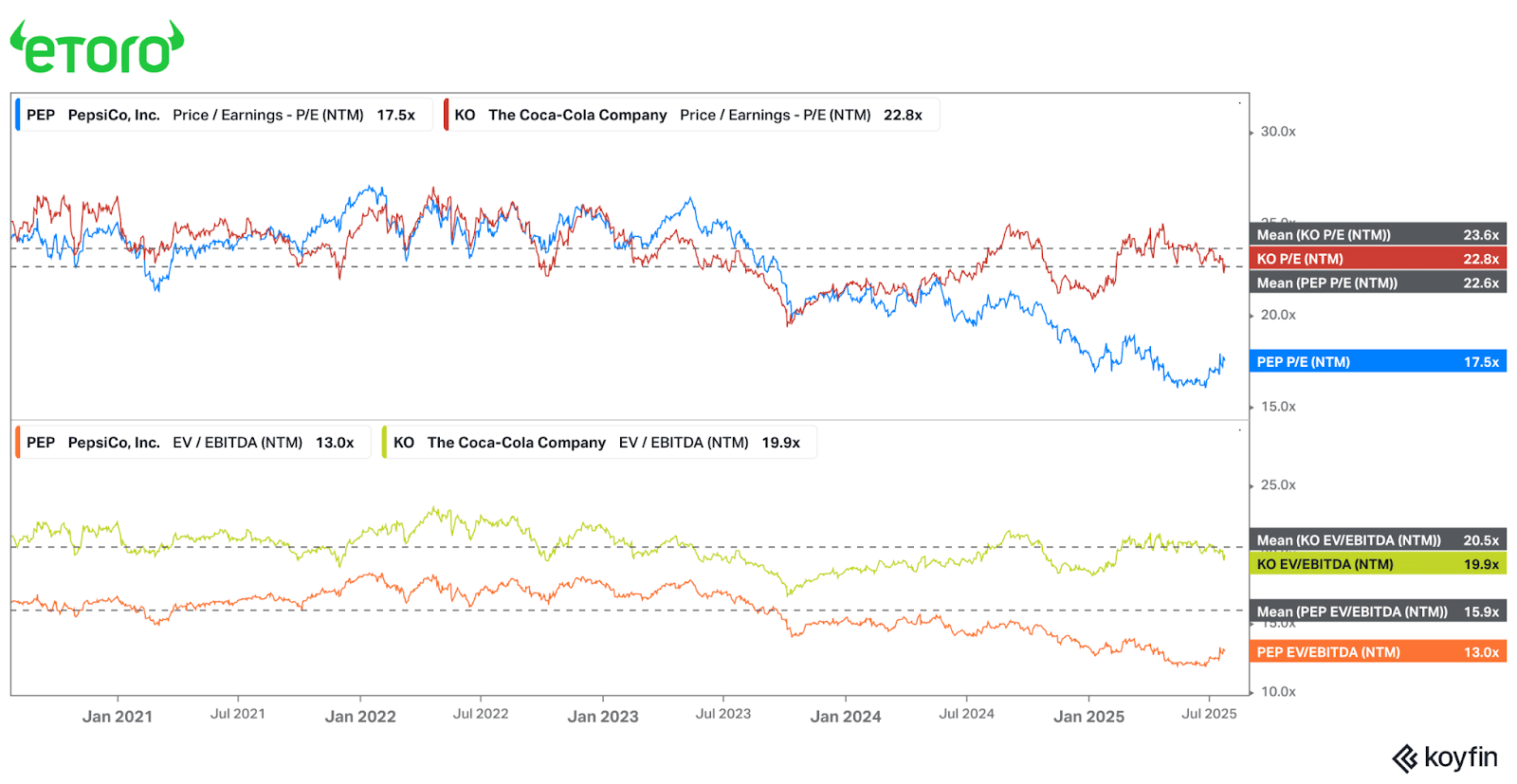

All of this, plus being an asset-heavy enterprise in an unsure macro local weather, has created the widest valuation hole between Pepsi and Coke in many years.

The turnaround hinges on administration executing higher and sentiment bettering, which may result in margin re-rating nearer to the historic common.

Trump Tariffs: A New Headwind

So as to add salt to the wound, Trump’s tariffs disproportionately drawback Pepsi in comparison with Coca-Cola. Why?

Pepsi produces focus in Eire (to avoid wasting on taxes), now topic to a ten% tariff, whereas Coca-Cola manufactures within the U.S., principally avoiding this hit.

Each will really feel the ache of fifty% aluminum tariffs, as cans make up ~25% of their packaging. Coca-Cola is already shifting to PET bottles. However Pepsi hasn’t given us a lot path but.

Enjoyable Reality: Do you know that Trump put in a Food plan Coke button on his desk within the Oval Workplace? Twice.

The tariff struggle comes at a foul time for Pepsi, inflicting investor sentiment to fizzle out. However none of Trump’s tariffs are ultimate, with Pepsi already lobbying for an exemption.

Newest Earnings Present Indicators Of Success

Regardless of gloomy sentiment, Pepsi shocked to the upside:

Beat expectations

Quantity development in PFNA and EMEA

Bettering tendencies in APAC and IB

Slower deceleration in LATAM

Pepsi guided for low-single-digit natural development and flat EPS for the yr. Doesn’t sound thrilling—however it was sufficient to spark a +7% rally in someday.

If this momentum holds, and tariff strain eases, there’s a possible 10–20% upside as valuations revert nearer to their long-term common. That’s assuming that Pepsi continues to commerce cheaper than Coca-Cola for apparent causes.

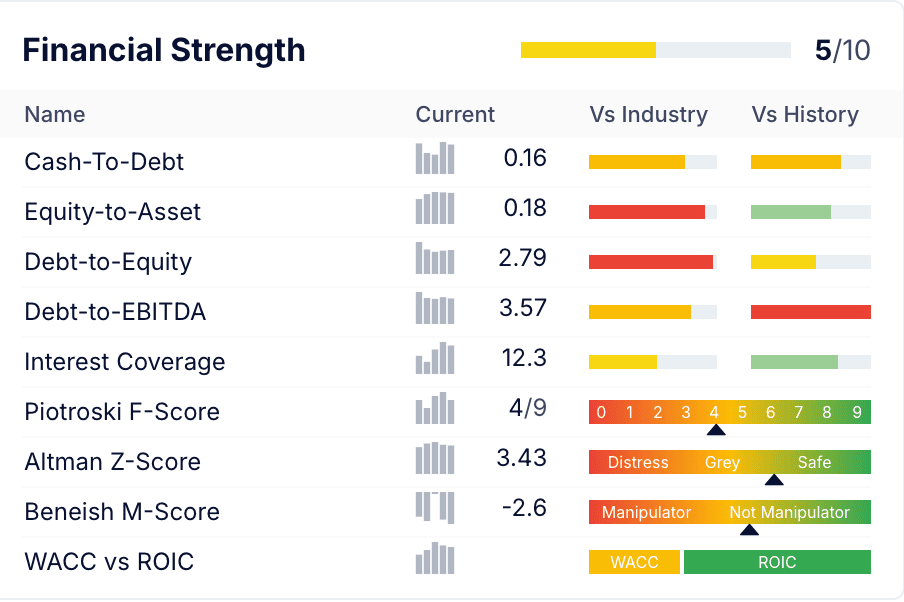

Monetary Well being Examine

Pepsi has a powerful stability sheet, although it carries extra debt than some friends attributable to acquisitions and shareholder returns. It maintains an funding grade credit standing and has sufficient money circulation to simply cowl its monetary obligations.

Nothing alarming right here.

Moat Evaluation

The moat, or aggressive benefit, is an important a part of a enterprise for worth traders, and Pepsi’s moat is large and deep.

Moat pillar

Proof

Model Energy

Pepsi, Lay’s, Doritos, Gatorade, Quaker, and extra get pleasure from robust buyer loyalty and belief and rank among the many world’s prime manufacturers.

Vertical Integration

Pepsi owns an enormous direct-store-delivery (DSD) system, controlling the route from manufacturing to retail shelf. This ensures prime shelf placement and fast replenishment.

Economies of Scale

PepsiCo’s economies of scale permit it to barter enter pricing and provides it large advertising and marketing budgets.

Robust manufacturers drive quantity –> scale lowers prices –> funds advertising and marketing and innovation –> additional strengthens manufacturers

At the same time as shopper preferences shift, Pepsi’s scale and shelf dominance are robust to beat.

Business & Aggressive Panorama

Pepsi and Coca-Cola dominate their industries. In 2024, they managed ~18% and ~21% of the US beverage market. Nonetheless, Coca-Cola has a market share benefit abroad.

Evaluating the leaders newest earnings, Coca-Cola guided for 3% EPS development whereas Pepsi reaffirmed its goal of flat EPS this yr, justifying the valuation hole.

The business is now characterised by a rising share of health-oriented manufacturers and shopper preferences for more healthy snacks. Nonetheless, whereas Smooth-drink volumes fell 3% globally in 2024, salty snacks grew 6,4%, giving Pepsi the higher hand because of a broader providing.

The entire elements we mentioned on this evaluation are short-term, solvable issues that administration has already set its sights on. Sure, the valuation hole is smart to a level, however the market seems overly bearish.

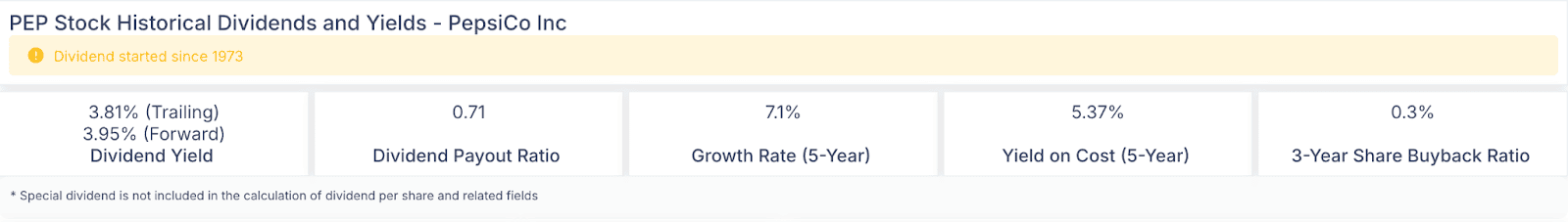

Capital return to shareholders

Pepsi’s capital return is centered round steadily rising dividends. The inventory presently yields a hefty 3,95% dividend that has grown at a tempo of seven,1% over the previous 5 years.

As you may see within the yellow field, there’s no have to concern for the dividend. Pepsi is likely one of the famed dividend kings, or firms which have paid dividends for greater than 50 years.

Bull vs Bear case

View

Key Factors

Upside / Draw back

Bull case

– Quick-term headwinds are priced in

– Administration adapts to new shopper tendencies

– Tariffs get rolled again or softened

– Secure dividend + a number of growth

10–20% upside

Bear case

– Structural quantity declines

– Failure to innovate

– Tariffs strain prices

– Well being tendencies erode core enterprise

-10 to -15% draw back

Valuation & Avenue view

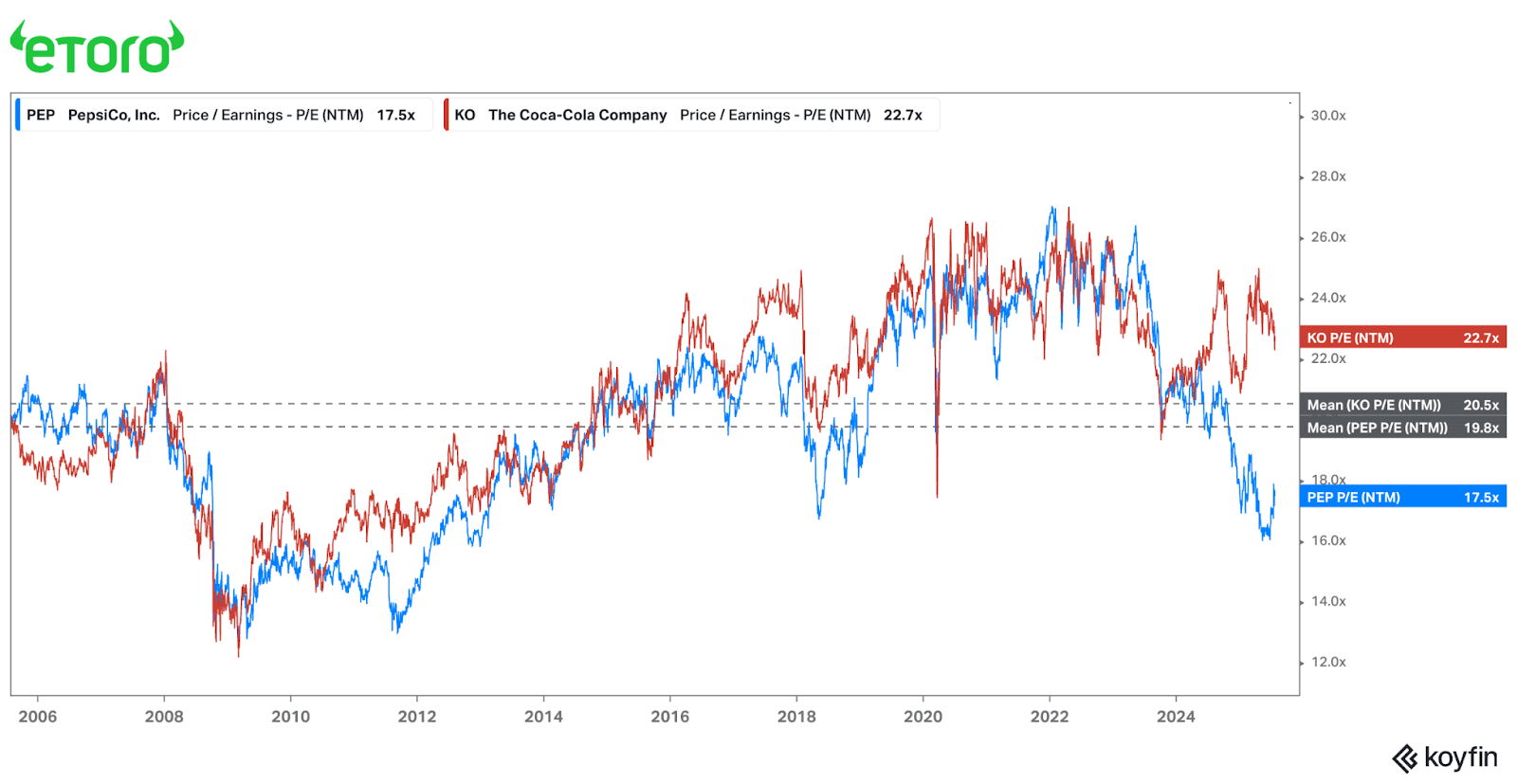

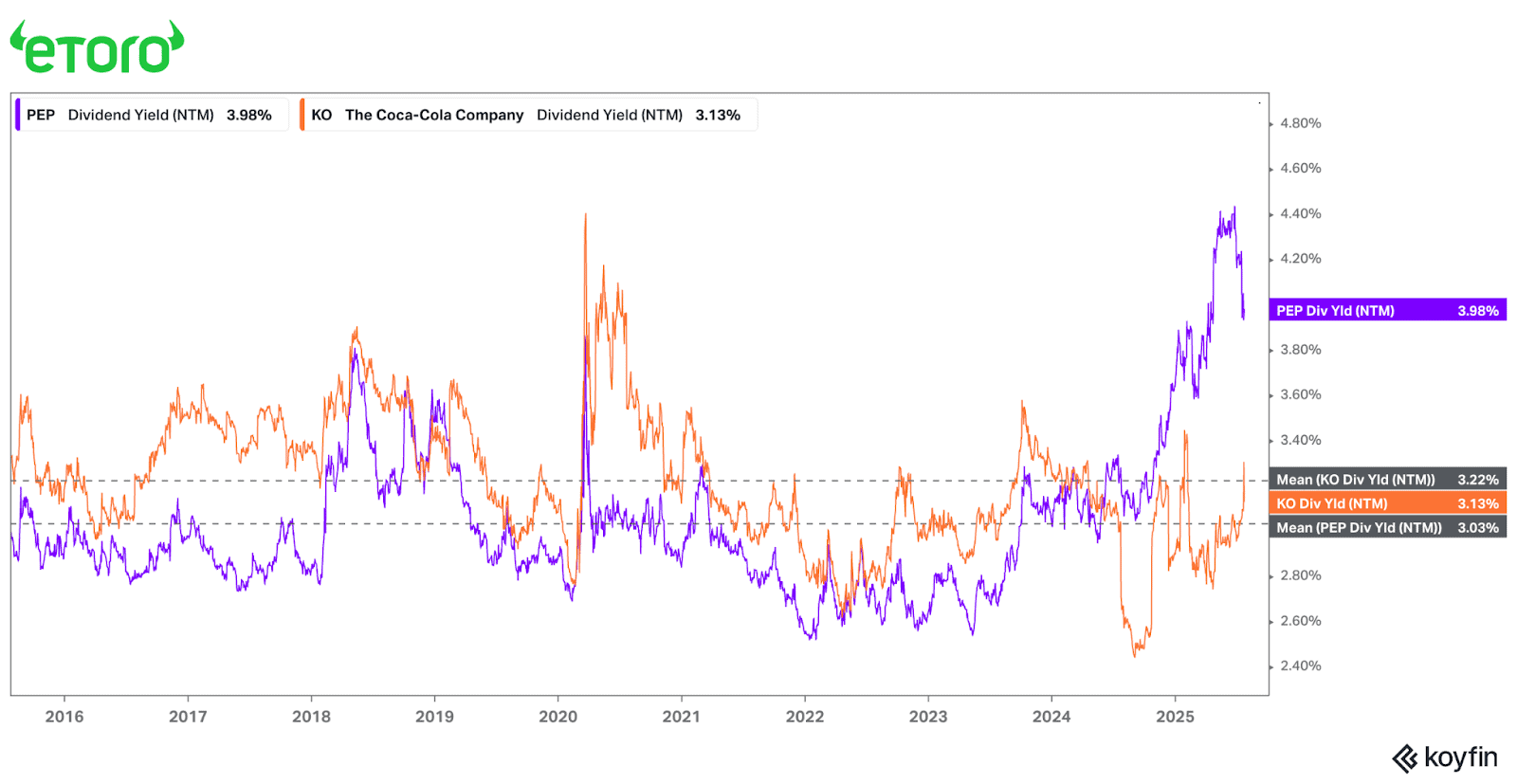

Pepsi and Coca-Cola have lengthy traded in sync. Traditionally, traders flocked to Coca-Cola when the business was dealing with financial or political headwinds, because of its leaner, beverage oriented operations. Such a divergence within the valuation as we’re seeing now’s unprecedented during the last 20 years.

Whereas Pepsi is dealing with headwinds once more, and traders are possible apprehensive concerning the potential impression of tariffs and macroeconomics, these are short-term headwinds that may be sorted out. In such a case, Pepsi inventory may see a number of growth on the again of the just about 4% dividend and flat EPS this yr.

The dividend yield of the 2 shares additionally clearly reveals that Pepsi is comparatively undervalued. A reversal to the imply signifies an extra double-digit upside from right here, if the momentum from the final earnings report retains up.

You both pay for development, otherwise you pay for boredom. Pepsi is a boring enterprise, and in a market that’s chasing development in any respect prices, it’s straightforward to miss.

Will pepsi develop 100%? In all probability not, but when administration can steer the corporate in the proper path within the coming quarters, you’re straightforward development potential from right here.

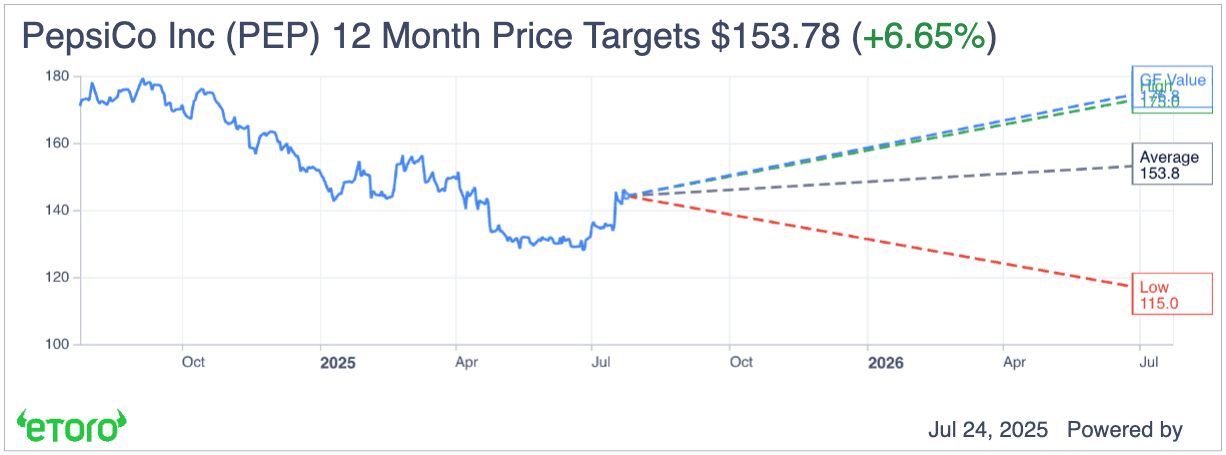

Wall Avenue has a diverging view of the inventory, with the indicated 12-month upside at 6,65% whereas analysts expectations have an enormous vary. Once more, exhibiting the uncertainty that’s being priced in.

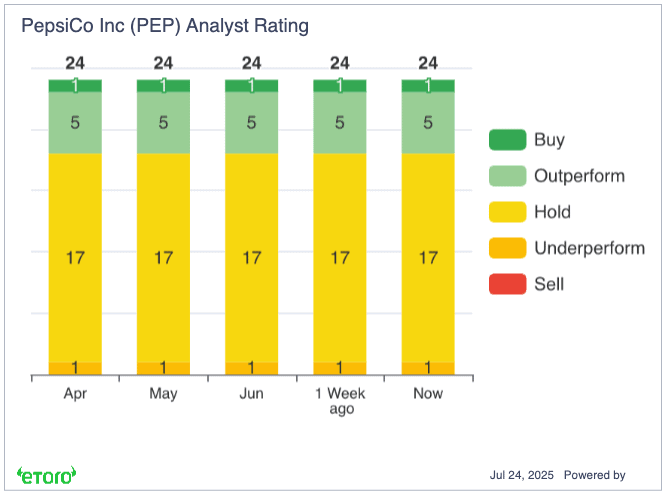

Out of 24 analysts, 17 charge the inventory a maintain, with 5 anticipating it to outperform, and just one analyst in each the “purchase” and “underperform” camp.

Backside-line wrap

Whereas I choose to drink from the crimson cans, Pepsi inventory is perhaps the smarter decide proper now. If administration navigates price slicing, quantity growth and shifting shopper preferences proper, I count on 10 to twenty% upside in a non-cyclical stalwart that gives stability in uneven waters.

Is PepsiCo a greater wager than Cola-Cola as we speak? Share your take by tagging me as @TheDividendFund on eToro or examine the PEP ticker to dive deeper.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.