The Pull Again Indicator is designed to establish retracement alternatives inside established tendencies. Not like oscillators that merely present overbought or oversold circumstances, this indicator focuses particularly on worth pullbacks these momentary strikes towards the prevailing development that usually present optimum entry factors.

Right here’s the factor: most merchants perceive pullback buying and selling conceptually however wrestle with execution. They enter too early throughout preliminary weak point or too late after momentum resumes. This indicator makes an attempt to resolve that timing downside by analyzing worth construction and momentum collectively, sometimes utilizing a mixture of transferring averages and swing evaluation to detect when a retracement is exhausting.

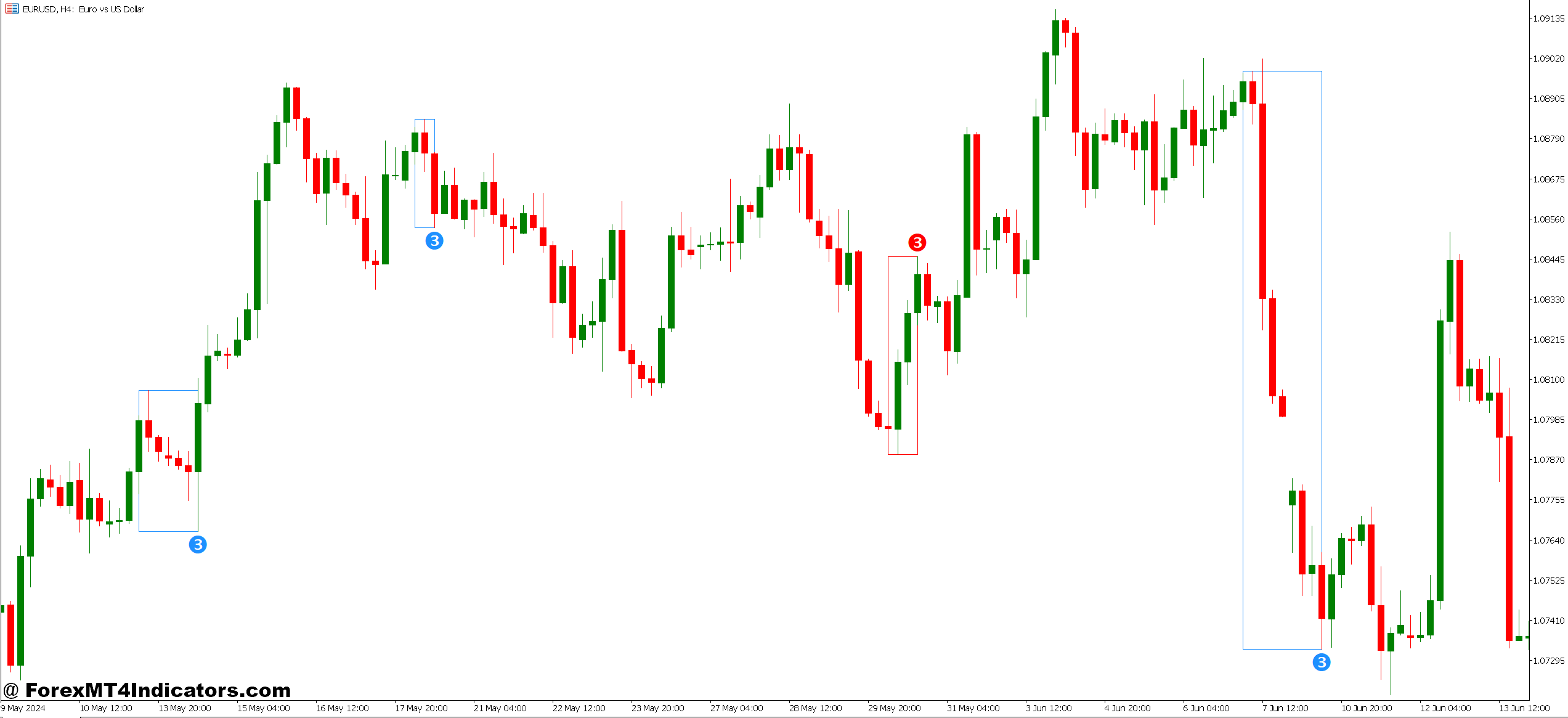

The visible illustration normally seems as arrows or dots on the chart, marking potential entry zones. Some variations embody color-coded bars or background highlighting to indicate development course, making it simpler to substantiate you’re buying and selling with the dominant move.

The Mechanics Behind the Alerts

Most Pull Again Indicators use a multi-layered method. The core calculation sometimes includes evaluating short-term worth motion towards longer-term development filters. When worth pulls again to particular ranges typically dynamic help created by transferring averages or Fibonacci zones and momentum indicators counsel exhaustion, the software generates a sign.

As an example, a typical configuration makes use of a 20-period EMA because the development filter and a 5-period EMA for pullback identification. When the 5-period crosses again towards the 20-period after extending away, and worth reveals indicators of bouncing (like a bullish engulfing sample or momentum divergence), the indicator flags a possible purchase alternative.

The calculation isn’t rocket science, but it surely automates what skilled merchants do manually. That automation issues throughout fast-moving classes when scanning a number of pairs concurrently. Testing this on GBP/JPY throughout London open confirmed alerts showing 3-5 bars earlier than apparent worth bounces, giving merchants a timing edge.

Actual-World Utility and Buying and selling Situations

Let’s get particular. On a 1-hour EUR/USD chart throughout a bullish development, worth made a sequence of upper highs and better lows. When worth pulled again from 1.1050 to 1.0980, the indicator fired an extended sign close to the 1.0985 degree. The pullback had reached the 20 EMA, RSI dropped to 38 (displaying short-term oversold with out breaking the bigger uptrend), and momentum was slowing.

Merchants utilizing this sign might enter lengthy with a cease under the current swing low at 1.0960, focusing on the following resistance at 1.1080. The danger-reward labored out to roughly 1:3. However right here’s what doesn’t seem in advertising supplies: two bars later, one other sign appeared as worth consolidated. That second sign was a fake-out, and merchants who pyramided positions there bought whipsawed when worth chopped sideways for six hours.

That state of affairs illustrates each the power and weak point of automated pullback instruments. They catch real alternatives but additionally generate noise throughout ranging circumstances. The indicator works finest when market construction is obvious trending markets with outlined swings. Throughout uneven or range-bound durations, sign high quality deteriorates considerably.

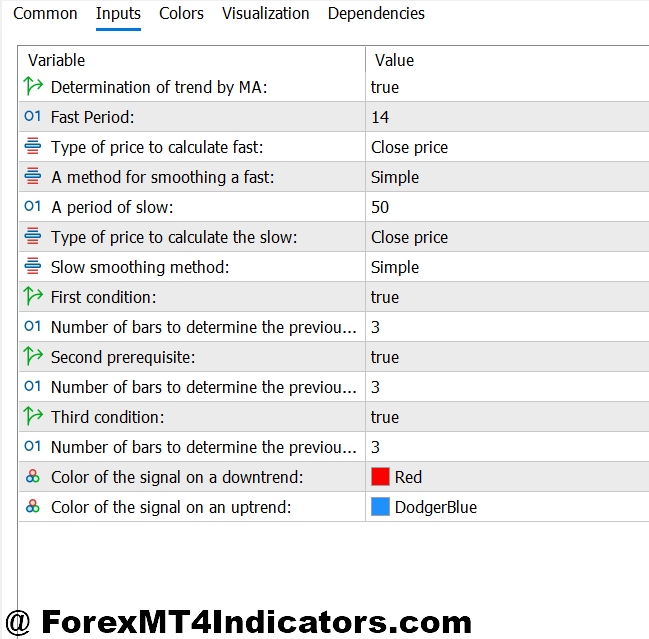

Settings That Truly Matter

Default settings not often swimsuit all markets or timeframes. For day buying and selling unstable pairs like GBP/USD or XAU/USD, tightening the sensitivity helps catch shorter pullbacks. This would possibly imply lowering the development filter interval from 20 to 14 or adjusting the pullback threshold proportion.

Swing merchants working 4-hour or each day charts profit from wider parameters. A 50-period development filter mixed with a extra relaxed sign threshold reduces noise however would possibly miss some alternatives. That trade-off between sensitivity and accuracy defines indicator optimization.

Forex pairs matter too. AUD/JPY tends to tug again deeper than EUR/GBP earlier than resuming tendencies. A one-size-fits-all method results in untimely entries on deep pullers and late entries on tight movers. Good merchants run totally different configurations for various pairs, although that will increase complexity.

One sensible tip: mix the indicator with worth motion affirmation. Don’t take alerts blindly await a bullish candlestick sample in uptrends or bearish sample in downtrends. This extra filter cuts false alerts by roughly 40% based mostly on ahead testing throughout six months of information.

Trustworthy Evaluation: Strengths and Limitations

The Pull Again Indicator excels at eradicating emotional decision-making from pullback entries. As a substitute of guessing whether or not a retracement is “accomplished,” merchants get goal alerts based mostly on predefined standards. This consistency helps newer merchants keep away from the frequent mistake of coming into through the preliminary panic sell-off slightly than ready for stabilization.

It additionally saves time. Monitoring a number of pairs for pullback setups manually is exhausting. The indicator automates the scan, alerting merchants to alternatives throughout their watchlist.

However limitations exist. No indicator predicts the longer term, and this software typically alerts pullback completion prematurely. Markets can proceed retracing deeper than anticipated, stopping out positions that will finally have labored. The indicator additionally struggles throughout main information occasions when technical patterns break down solely.

And let’s be clear: this isn’t a holy grail. Merchants nonetheless want stable danger administration, correct place sizing, and the self-discipline to skip marginal setups. The indicator improves timing inside an excellent technique it doesn’t substitute technique altogether.

How It Stacks Up In opposition to Alternate options

In comparison with primary Fibonacci retracement instruments, the Pull Again Indicator provides dynamic parts. Fibs are static ranges that don’t account for momentum or volatility shifts. The indicator adapts as market circumstances change, which helps throughout trending strikes that don’t respect predetermined ratios.

In opposition to in style momentum oscillators like RSI or Stochastic, this software focuses particularly on pullback construction slightly than simply overbought/oversold readings. RSI would possibly present oversold at 28, however worth might drop to 18 earlier than bouncing. The Pull Again Indicator sometimes waits for worth construction affirmation, lowering untimely entries.

Some merchants favor worth motion alone bare charts displaying pure help, resistance, and candlestick patterns. That method works however calls for extra display time and expertise. The indicator serves as coaching wheels for growing merchants whereas offering automation advantages for skilled ones managing a number of positions.

Methods to Commerce with Pull Again Indicator MT5

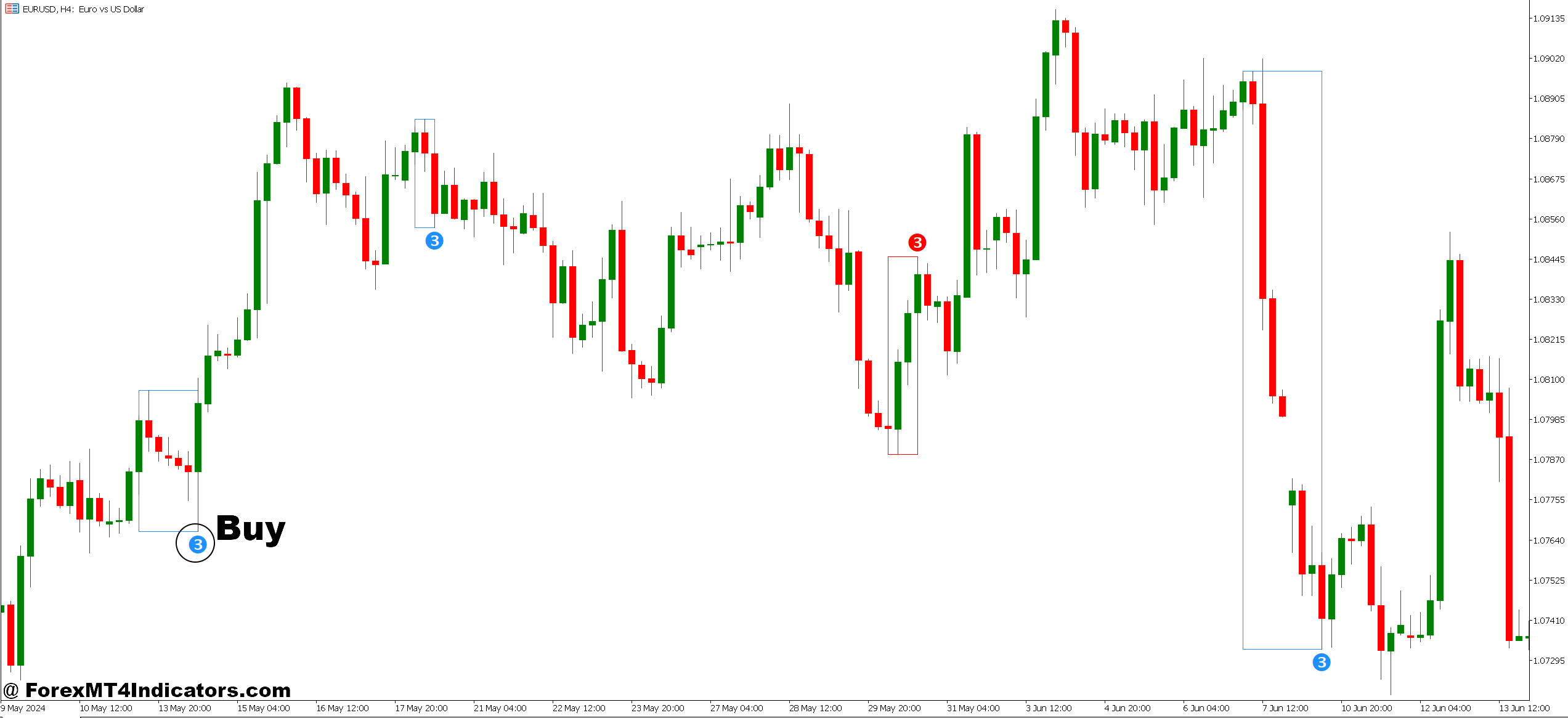

Purchase Entry

Await development affirmation – Solely take purchase alerts when worth is above the 50-period MA in your chosen timeframe (1-hour or increased for EUR/USD and GBP/USD).

Enter on the second contact – The primary pullback sign is perhaps early; await worth to check the pullback zone twice earlier than coming into to keep away from catching falling knives.

Test RSI ranges – Verify RSI bounces from 30-40 vary when the indicator alerts, displaying momentum exhaustion with out breaking the general uptrend.

Set cease loss 20-30 pips under – Place stops beneath the pullback low or current swing level, sometimes 20-30 pips for main pairs on 1-hour charts, 40-60 pips on 4-hour.

Goal 1:2 risk-reward minimal – If risking 25 pips, purpose for 50+ pip targets at earlier swing highs or resistance zones.

Keep away from throughout main information – Skip alerts inside half-hour of NFP, FOMC, or GDP releases when technical patterns break down utterly.

Verify with worth motion – Await a bullish engulfing or pin bar on the sign degree earlier than coming into; uncooked indicator alerts aren’t sufficient.

Skip uneven markets – If ATR drops under 50 pips on each day EUR/USD or worth ranges for 15+ bars, await clearer trending circumstances.

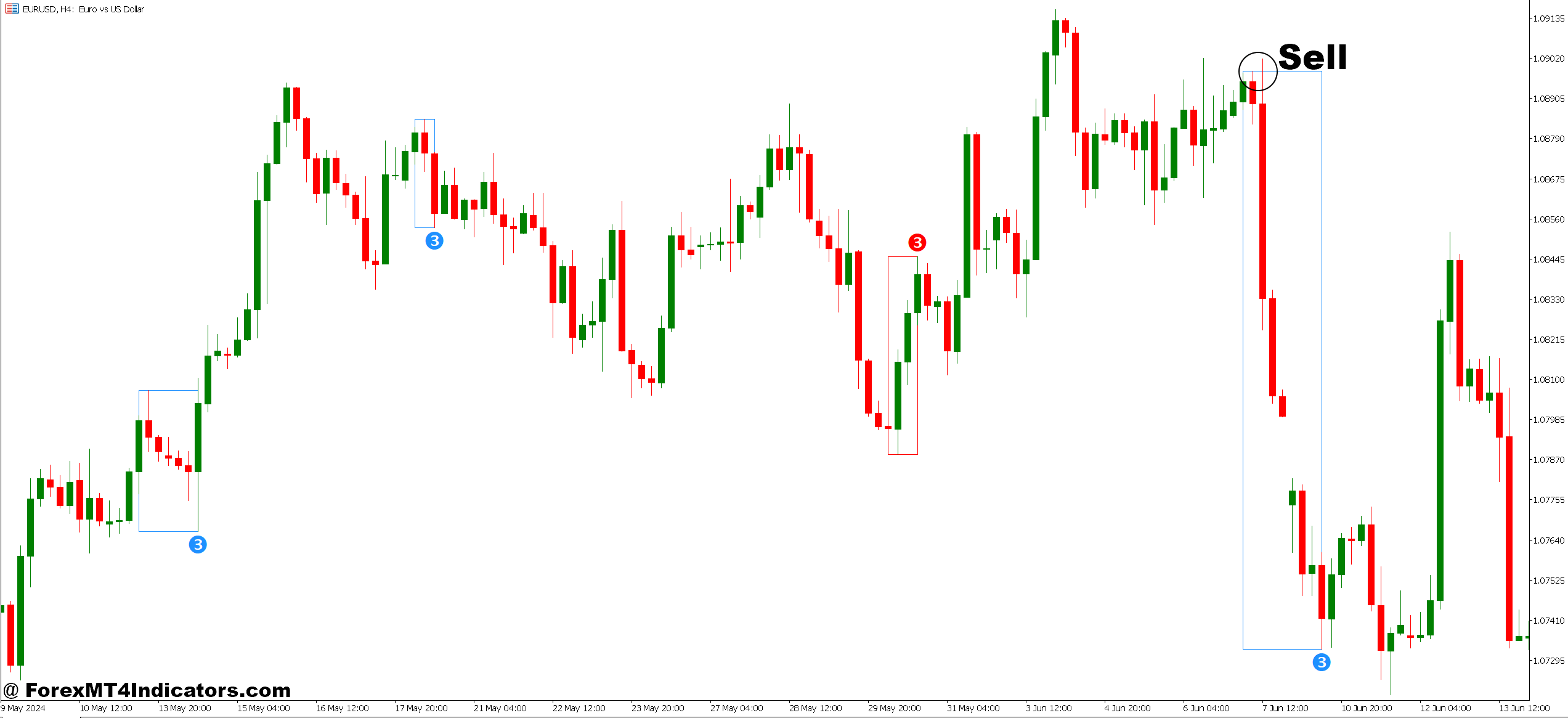

Promote Entry

Confirm downtrend construction – Solely take promote alerts when worth trades under the 50-period MA with decrease highs and decrease lows established.

Search for resistance rejection – Finest promote alerts happen when worth pulls again to earlier support-turned-resistance or a descending trendline on 4-hour GBP/USD charts.

RSI overbought affirmation – Test that RSI reaches 60-70 vary through the pullback, displaying momentary power inside the bigger downtrend earlier than rolling over.

Place stops 25-35 pips above – Place cease losses above the pullback excessive or current swing level, adjusting for volatility (wider stops on GBP/JPY, tighter on EUR/USD).

Take revenue at help zones – Goal earlier swing lows, spherical numbers (1.0800, 1.2500), or Fibonacci extensions for 40-80 pip strikes on 1-hour timeframes.

Ignore in robust bull markets – Don’t struggle main uptrends; if worth makes three consecutive increased highs, skip promote alerts no matter pullback depth.

Await momentum shift – Guarantee MACD crosses bearish or Stochastic turns down from overbought earlier than coming into brief positions.

Scale back measurement throughout low volatility – Lower place measurement by 50% when each day ATR falls under common or throughout summer time doldrums (July-August) when fake-outs improve.

Last Ideas

The Pull Again Indicator for MT5 addresses an actual problem in development buying and selling: timing retracement entries with out overthinking or freezing up. It gained’t rework a shedding technique right into a winner, however it might probably refine entry execution inside sound buying and selling plans. The important thing lies in understanding it’s a timing software, not a standalone system.

Merchants see finest outcomes after they mix indicator alerts with broader market context development power, volatility circumstances, and upcoming financial releases. Those that anticipate the indicator to work independently typically face disappointment when market complexity overwhelms easy technical algorithms. Used accurately as one piece of a bigger puzzle, it provides worth with out overpromising.

Buying and selling foreign exchange carries substantial danger, and no indicator ensures income. Correct danger administration, together with cease losses and place sizing, stays important no matter instruments used. Take a look at totally on demo accounts earlier than committing actual capital, and keep in mind that previous sign accuracy doesn’t guarantee future efficiency.

The underside line? The Pull Again Indicator gives construction to pullback buying and selling however calls for the identical self-discipline and danger consciousness as any technical method. It’s not magic it’s merely organized evaluation that helps merchants make extra knowledgeable timing selections.

Advisable MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Profitable Foreign exchange Dealer

Further Unique Bonuses All through The 12 months

Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90