The QQE Mod indicator takes a unique strategy. It smooths out that noise whereas retaining the responsive edge merchants want for high quality entries. This modified model of the Qualitative Quantitative Estimation indicator doesn’t get rid of false indicators—nothing does—, but it surely filters the junk higher than commonplace momentum instruments.

What the QQE Mod Indicator Truly Is

QQE Mod is a momentum oscillator that builds on the unique QQE indicator, which itself was derived from the RSI. Consider it as RSI’s extra subtle cousin. Whereas commonplace RSI measures the pace of worth modifications, QQE Mod provides a number of smoothing layers and a volatility part that adapts to market situations.

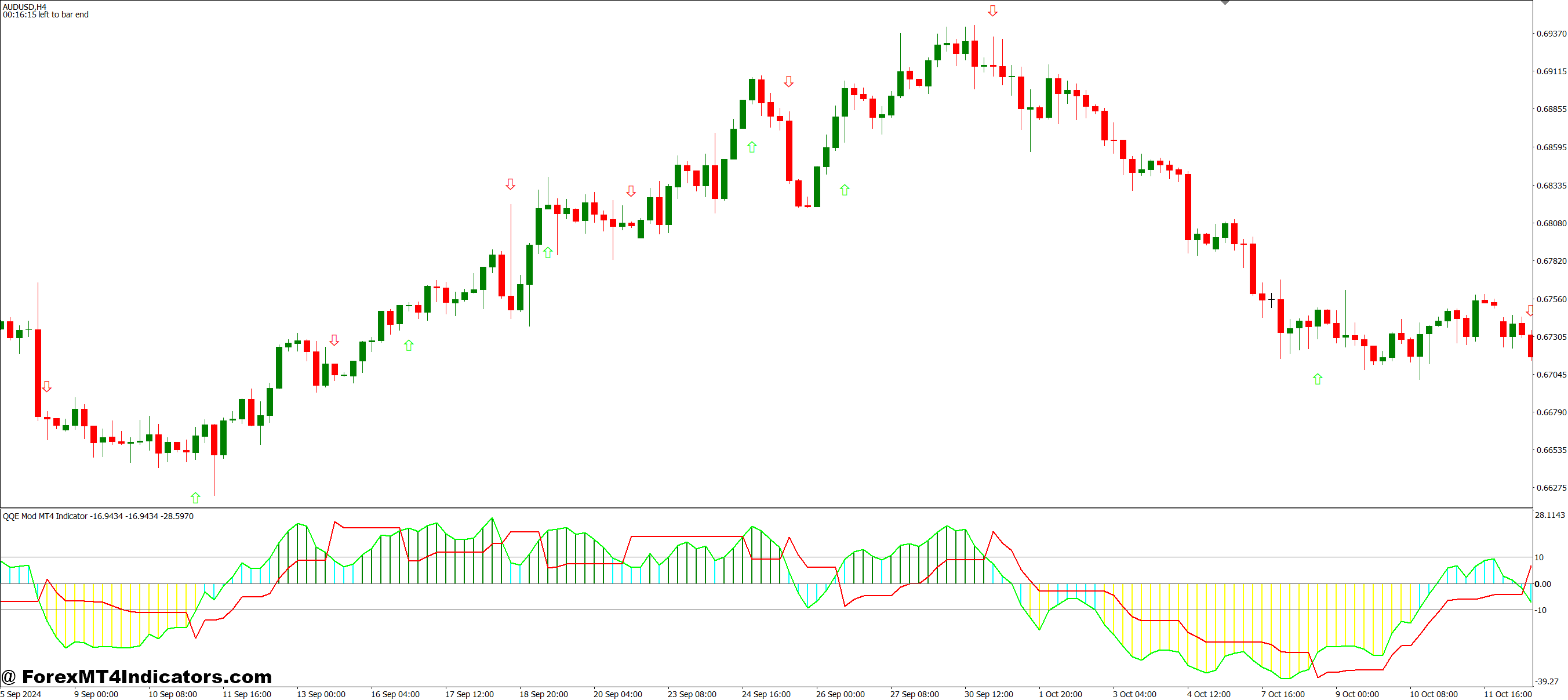

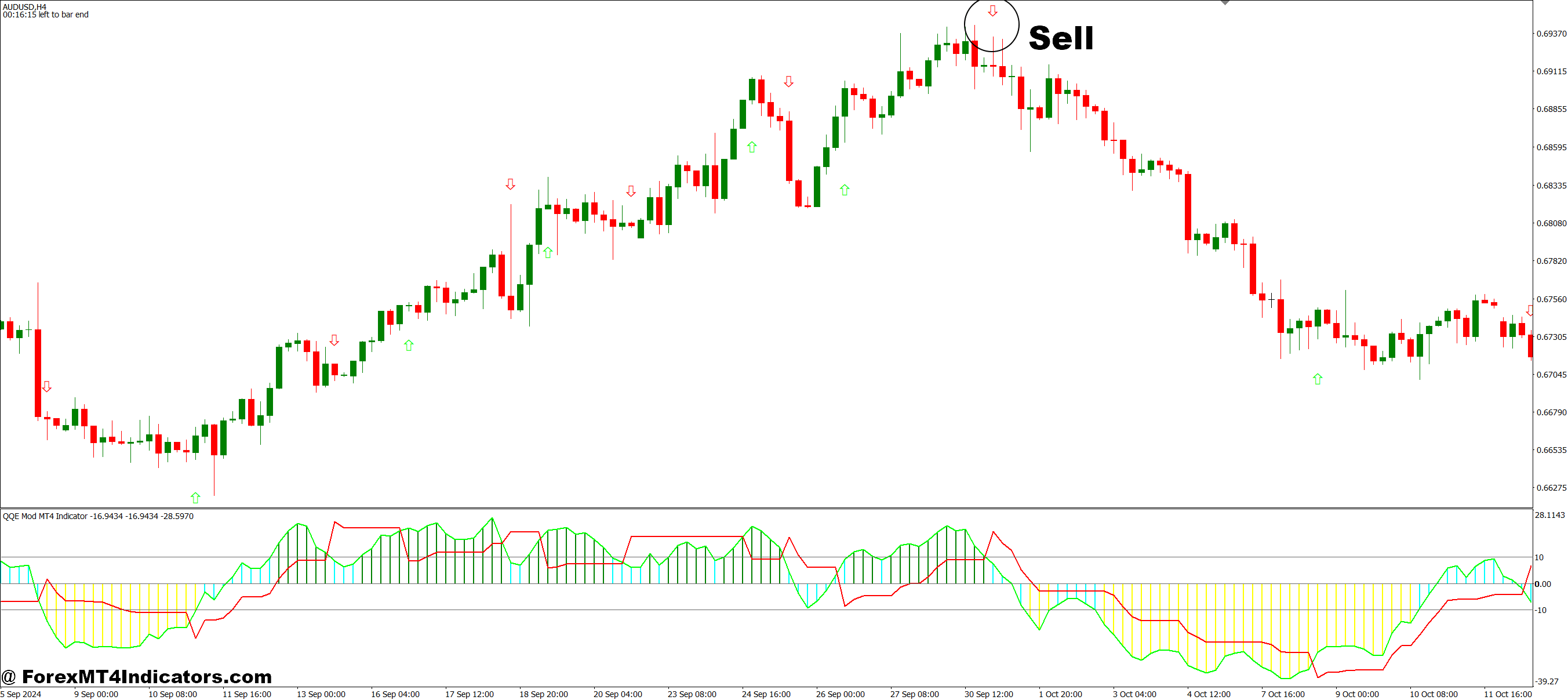

The indicator shows on a separate window under the value chart, just like MACD or Stochastic. Merchants sometimes see two fundamental elements: a faster-moving line (normally blue) and a slower sign line (usually purple or orange). When these traces cross, they generate potential entry indicators. However right here’s the place it will get fascinating—the QQE Mod additionally contains histogram bars that present the energy behind these crosses.

In contrast to primary oscillators that use mounted thresholds (like RSI’s 30/70 ranges), QQE Mod operates in a free-floating vary. This implies indicators adapt to the present volatility surroundings somewhat than treating quiet Asian session worth motion the identical as wild NFP bulletins.

How QQE Mod Calculates Its Indicators

The calculation begins with an RSI base, sometimes set to 14 durations, although some merchants modify this. That RSI worth then goes via a smoothing course of utilizing a transferring common—usually a Wilder’s smoothing or exponential MA. This primary smoothing step is the place QQE diverges from commonplace RSI.

Subsequent comes the volatility part. The indicator calculates an Common True Vary (ATR)-based trailing degree that strikes with worth momentum. This creates dynamic bands that develop throughout risky durations and contract throughout consolidation. The “Mod” in QQE Mod refers to modifications that improve these bands and add the histogram part for simpler visible interpretation.

When the quick line crosses above the gradual line, and the histogram turns optimistic (normally proven in inexperienced), that implies constructing bullish momentum. The reverse—quick line crossing under with damaging histogram bars—indicators potential bearish strain. The energy of the histogram bars issues. A weak crossover with barely seen bars usually results in fast reversals, whereas robust bars counsel real momentum shifts.

Utilizing QQE Mod in Actual Buying and selling Situations

Let’s get sensible. Throughout a trending market, QQE Mod excels at entry timing. Say GBP/JPY is in a stable uptrend on the 4-hour chart. Worth pulls again to the 20-period transferring common, and merchants begin on the lookout for continuation entries. When QQE Mod’s quick line crosses above the sign line whereas the value respects that transferring common, that’s a high-probability setup.

A dealer may enter lengthy when the crossover happens, place a cease under the latest swing low (possibly 50-60 pips relying on pair volatility), and goal the following resistance degree. The bottom line is ready for the histogram to indicate dedication—not less than three to 4 bars of constant shade after the cross.

However QQE Mod reveals its true worth in uneven markets. On a typical Wednesday afternoon when EUR/USD is grinding sideways in a 40-pip vary, commonplace RSI may generate six or seven indicators. QQE Mod, with its smoothing, may solely flash two. These two usually tend to be precise breakout makes an attempt somewhat than noise.

That stated, the indicator isn’t magic. In the course of the 2024 USD/JPY volatility in July (when Financial institution of Japan intervention rumors swirled), QQE Mod generated a number of false indicators as a result of the whipsaws have been so violent. No smoothing algorithm can totally compensate for that form of market chaos.

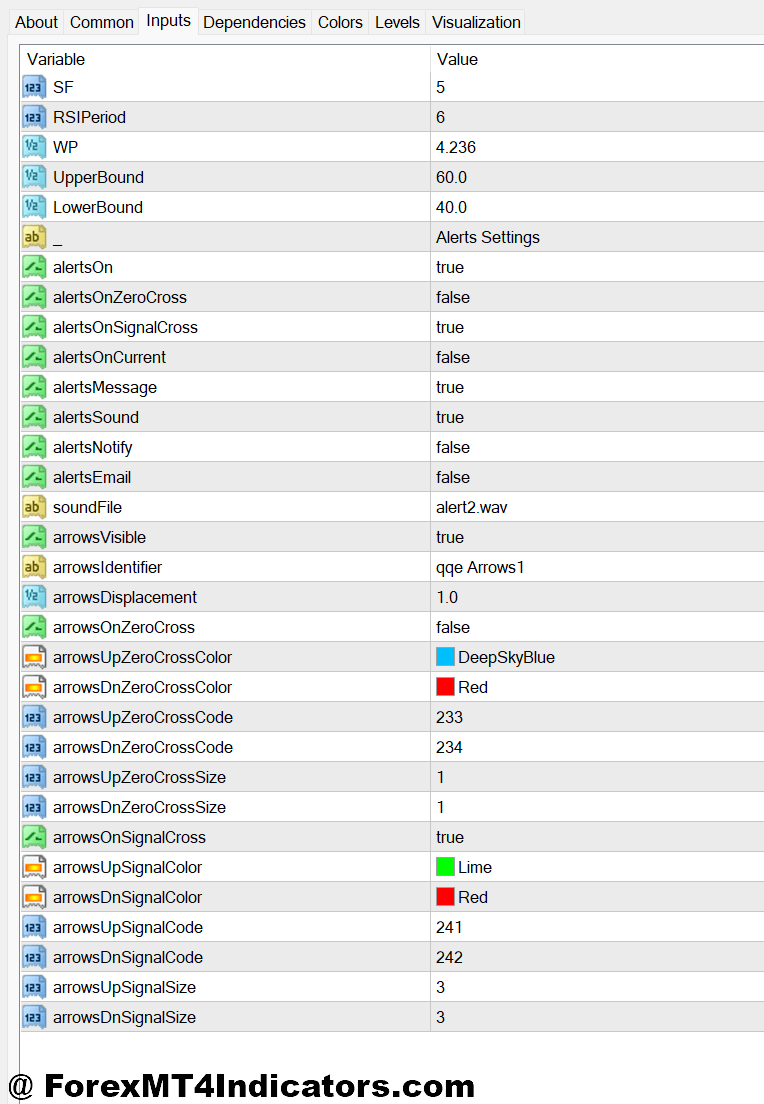

Settings That Matter (And These That Don’t)

The default settings (RSI interval of 14, RSI smoothing of 5, and QQE issue of 4.236) work moderately properly throughout a number of timeframes. However merchants ought to modify primarily based on their buying and selling model.

Scalpers utilizing 5-minute or 15-minute charts may scale back the RSI interval to eight or 10 for quicker reactions. Day merchants on hourly charts normally stick nearer to defaults. Swing merchants taking a look at 4-hour or every day timeframes generally improve the RSI interval to 21 for smoother indicators.

The QQE issue controls band sensitivity. Decrease values (round 3.0) make the indicator extra responsive however improve false indicators. Larger values (5.0 or above) scale back indicators however enhance reliability. There’s no excellent quantity—it relies on whether or not you’d somewhat catch extra strikes with decrease accuracy or fewer strikes with increased accuracy.

Right here’s one thing many merchants miss: the histogram threshold setting. Some QQE Mod variations allow you to filter out weak indicators by requiring a minimal histogram energy earlier than contemplating a cross legitimate. Setting this threshold at 10-15% of the indicator’s vary can dramatically scale back dropping trades.

The Good, The Dangerous, and When It Fails

QQE Mod’s largest benefit is its filtering functionality. It cuts noise higher than RSI, Stochastic, or CCI whereas sustaining first rate responsiveness. The visible readability helps too—that histogram makes sign energy instantly apparent, not like indicators the place you’re squinting at line angles making an attempt to find out conviction.

The indicator additionally adapts pretty properly to totally different market situations. These volatility-adjusted bands imply indicators throughout quiet durations aren’t handled identically to indicators throughout main information occasions. This adaptability prevents the “indicator labored nice final month, ineffective this month” drawback that plagues fixed-parameter instruments.

However limitations exist. QQE Mod lags—all smoothed indicators do. By the point a sign confirms, the value has already moved. In fast-trending markets, entries will be 10-20 pips away from optimum. Merchants want to simply accept that trade-off or mix QQE Mod with quicker affirmation strategies like worth motion patterns.

Ranging markets pose issues, too. Sure, QQE Mod reduces false indicators in comparison with different oscillators, however “reduces” doesn’t imply “eliminates.” Merchants nonetheless get chopped up in tight ranges, simply much less continuously. The answer isn’t higher indicator settings—it’s staying flat when market construction reveals no clear route.

One other subject: QQE Mod doesn’t present worth targets or cease placement steering. It tells you when momentum may be shifting, however not how far the value will run. Merchants want separate strategies for commerce administration—trailing stops, assist/resistance exits, or time-based stops.

Evaluating QQE Mod to Commonplace Instruments

Towards commonplace RSI, QQE Mod wins on sign high quality however loses on simplicity. RSI’s overbought/oversold ranges give clear reference factors. QQE Mod requires interpretation—is that this crossover robust sufficient? That studying curve turns some merchants off.

In comparison with MACD, QQE Mod reacts quicker to momentum shifts. MACD’s twin smoothing makes it lag significantly, particularly on shorter timeframes. However MACD’s histogram reveals momentum divergence extra clearly, which some merchants want for recognizing pattern exhaustion.

Stochastic oscillator customers usually like QQE Mod as a result of it gives comparable crossover indicators with out Stochastic’s tendency to hold in overbought/oversold zones throughout traits. When EUR/USD is working 200 pips in a day, Stochastic stays pegged on the prime whereas QQE Mod continues producing helpful data.

Find out how to Commerce with QQE Mod MT4 Indicator

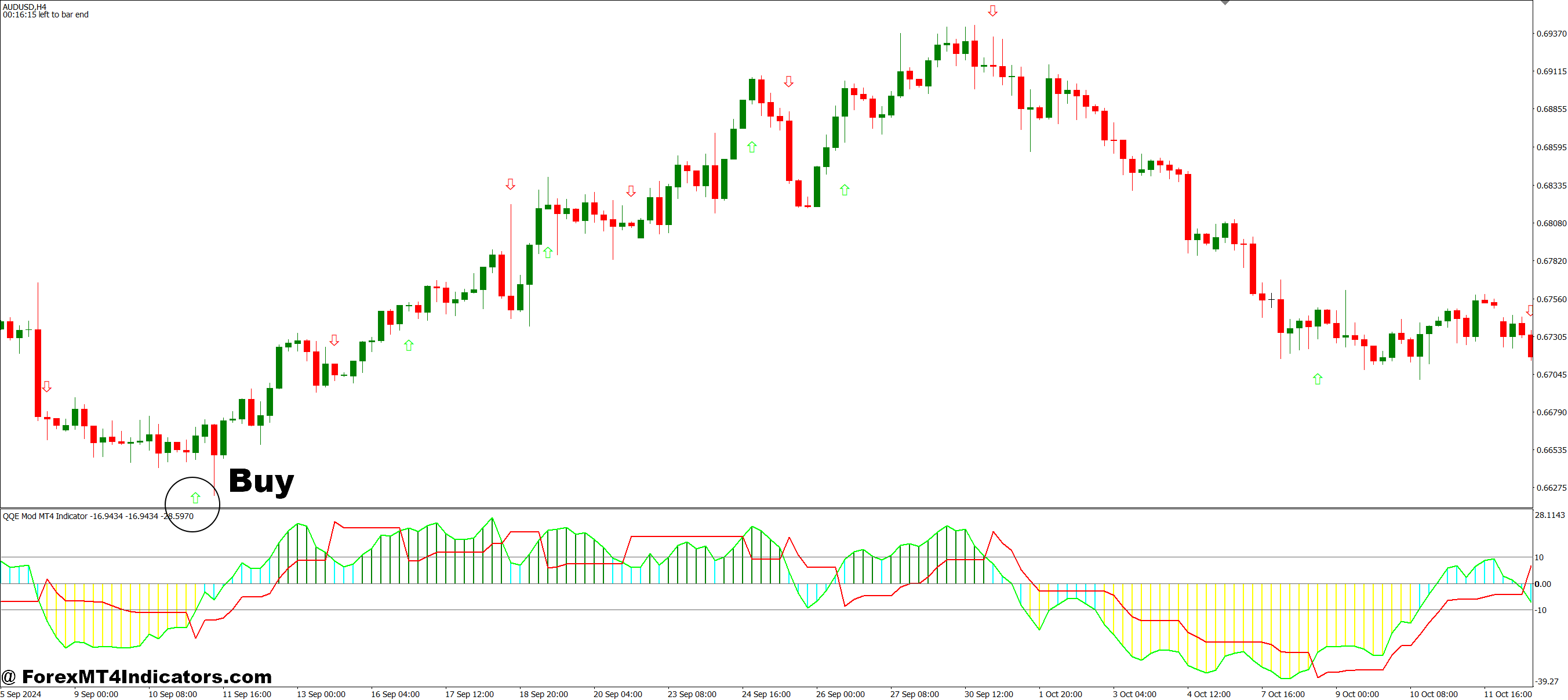

Purchase Entry

Quick line crosses above sign line – Enter lengthy when the blue line crosses above the purple line and the histogram turns inexperienced with not less than 3-4 consecutive optimistic bars displaying momentum dedication.

Histogram energy affirmation – Solely take the purchase sign if histogram bars attain not less than 15-20% of the indicator’s seen vary; weak crosses usually reverse inside 10-15 pips on EUR/USD 1-hour charts.

Align with worth construction – Look ahead to the crossover to happen close to assist ranges or above the 20-period transferring common on 4-hour timeframes to verify pattern route earlier than getting into.

Set cease under latest swing low – Place your cease loss 5-10 pips under the closest swing low, sometimes 30-50 pips on GBP/USD, relying on volatility and timeframe used.

Keep away from throughout flat histogram durations – Skip purchase indicators when the histogram has been oscillating between optimistic and damaging for the previous 6-8 bars; this means uneven, ranging situations.

Verify increased timeframe alignment – Confirm the every day chart reveals bullish construction earlier than taking 1-hour or 4-hour purchase indicators; counter-trend trades have 60-70% increased failure charges.

Danger not more than 1-2% per commerce – Calculate place measurement primarily based in your cease distance so a loss solely impacts 1-2% of account stability, even when the setup seems excellent.

Skip information occasion home windows – Don’t enter inside half-hour earlier than or after high-impact information (NFP, FOMC, ECB) as QQE Mod indicators develop into unreliable throughout risky spikes.

Promote Entry

Quick line crosses under sign line – Enter quick when the blue line drops under the purple line and histogram bars flip purple with sustained damaging momentum for 3+ bars.

Look ahead to resistance rejection – Take promote indicators that happen close to key resistance zones or under the 50-period transferring common on 4-hour charts to stack chances in your favor.

Verify with damaging histogram depth – Search for histogram bars reaching -15 to -20 on the size; shallow crosses underneath -5 usually fail inside 20-30 pips on EUR/USD.

Place cease above latest swing excessive – Set stops 5-10 pips above the closest swing excessive, adjusting for pair volatility (GBP/JPY wants wider stops than EUR/USD).

Ignore throughout robust uptrends – Don’t take promote indicators when worth is making increased highs and better lows on the every day chart; preventing traits destroys accounts quicker than dangerous entries.

Verify for divergence affirmation – Stronger promote setups happen when worth makes increased highs, however QQE Mod makes decrease highs, signaling momentum weak point earlier than the cross.

Goal assist ranges or 1.5-2R minimal – Goal for the following assist zone or not less than 1.5 occasions your threat; don’t take trades with lower than 30-pip potential on main pairs.

Exit if histogram reverses shortly – If the histogram flips again to optimistic inside 2-3 bars after your entry, exit instantly at breakeven or small loss somewhat than hoping for restoration.

Conclusion

QQE Mod sits in a candy spot between responsiveness and reliability. It’s not the quickest indicator, not the smoothest, not probably the most correct—but it surely balances these elements higher than most alternate options.

Buying and selling foreign exchange carries substantial threat. No indicator ensures earnings, and even the perfect instruments fail in sure market situations. QQE Mod improves odds when used appropriately with correct threat administration, however it could possibly’t overcome poor place sizing or emotional decision-making. Merchants ought to take a look at any new indicator on demo accounts for not less than 50 trades earlier than risking actual capital.

The QQE Mod indicator works finest when merchants perceive what it’s really telling them—momentum shifts with energy affirmation—and what it isn’t—a standalone buying and selling system. Mixed with stable worth motion studying, affordable expectations, and disciplined threat management, it could possibly filter entries extra successfully than commonplace oscillators. Simply don’t count on it to work miracles throughout sideways chop or news-driven chaos. No indicator can.

Really helpful MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Profitable Foreign exchange Dealer

Further Unique Bonuses All through The 12 months

Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90