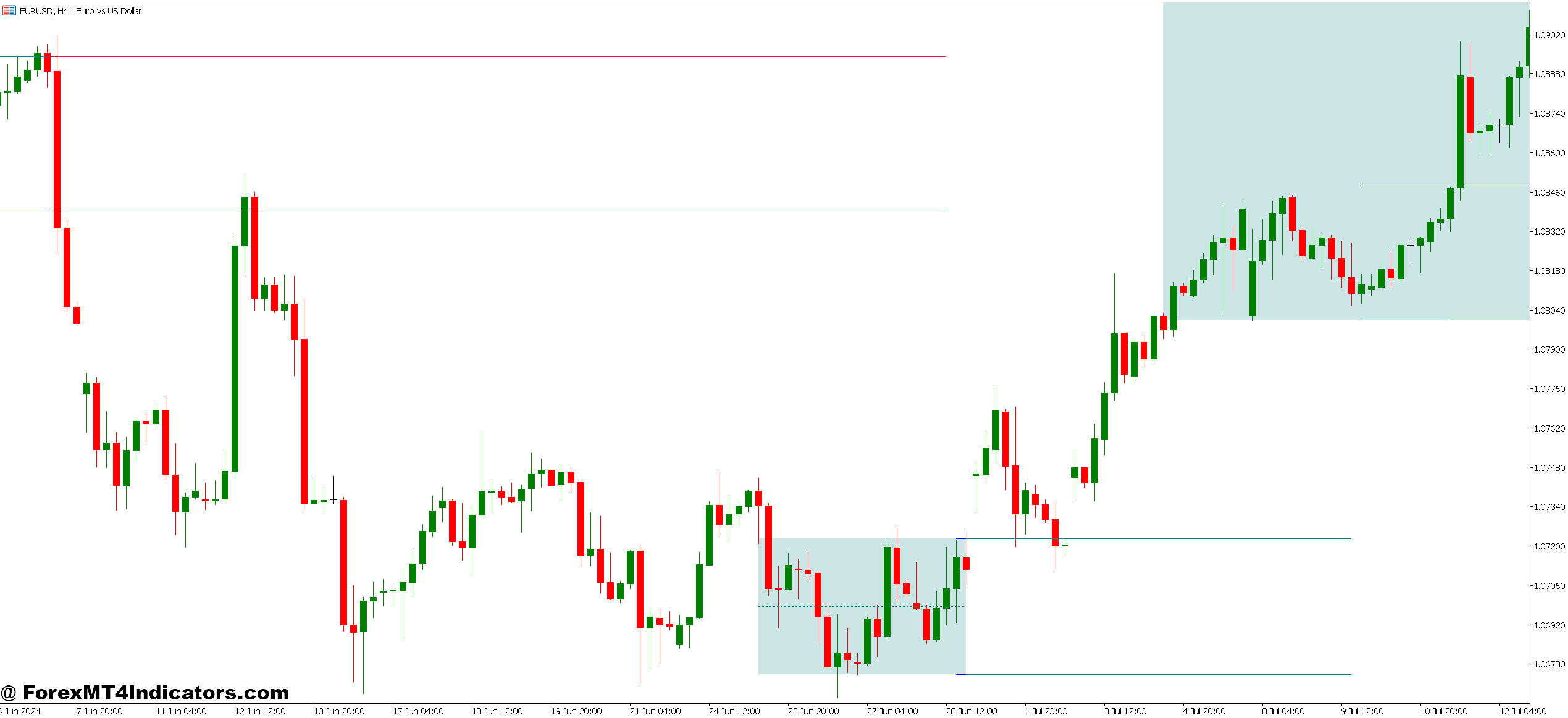

The Vary Filter indicator features as a volatility-adjusted shifting common that adapts to market situations. Not like conventional shifting averages that lag behind value, this indicator incorporates range-based calculations to filter out insignificant value actions.

Right here’s what makes it completely different: The indicator measures the common true vary over a specified interval and makes use of this information to create a dynamic filter. When value motion exceeds the calculated vary threshold, the filter acknowledges it as a sound sign. Smaller actions that fall beneath this threshold get ignored completely.

Visually, merchants see a coloured line that shifts between bullish (sometimes blue or inexperienced) and bearish (often purple or orange) states. The road follows value however doesn’t react to each minor fluctuation. That’s the filtering impact in motion.

The Calculation Logic Behind the Scenes

The Vary Filter makes use of a multi-step calculation course of. First, it determines the worth vary by measuring the distinction between highs and lows over your specified sampling interval. This vary worth will get smoothed utilizing an exponential shifting common to stop erratic readings.

Subsequent, the indicator calculates higher and decrease filter bands round value. These bands broaden throughout risky durations and contract when markets cool down. The filter line itself solely adjustments route when value crosses these adaptive bands with sufficient momentum to recommend an actual transfer is underway.

Most implementations use the method: Filter = EMA(Supply, Interval) ± (Multiplier × Vary). The multiplier parameter determines sensitivity—greater values create wider bands that filter extra noise however might delay indicators. Decrease values catch strikes earlier however threat extra false indicators.

Actual Buying and selling Functions That Work

On the GBP/JPY 4-hour chart, the Vary Filter excels throughout trending periods. When the Financial institution of Japan introduced coverage adjustments final March, the pair dropped 400 pips over three days. Merchants utilizing the Vary Filter with customary settings (interval: 100, multiplier: 3.0) would have seen the indicator flip bearish inside the first 8 hours and keep purple all through your entire transfer.

The indicator works finest as a directional filter reasonably than a standalone entry instrument. One sensible method: mix it with help and resistance ranges. When value breaks a key degree AND the Vary Filter confirms with a coloration change, that’s a higher-probability setup. Skip trades the place value breaks a degree however the filter hasn’t flipped—these usually flip into fake-outs.

For scalping, the instrument turns into much less dependable. On the EUR/USD 5-minute chart, even with aggressive settings, the lag can price 5-10 pips per entry. However that very same lag turns into beneficial on the every day timeframe, the place it prevents merchants from abandoning positions throughout regular pullbacks.

Day merchants would possibly watch the 1-hour chart on USD/CAD throughout oil stock studies. The Vary Filter helps ignore the preliminary spike and whipsaw that sometimes occurs within the first quarter-hour post-release. As soon as the filter stabilizes in a single route, that’s often when the cleaner, tradable transfer develops.

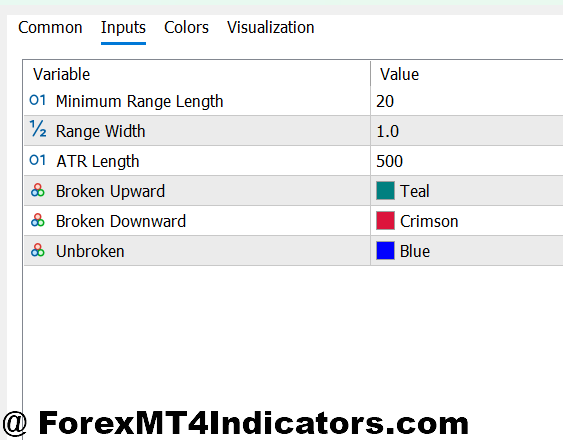

Dialing within the Settings

The 2 essential parameters want adjustment based mostly on what you’re buying and selling. The sampling interval (usually known as “size” or “interval”) sometimes defaults to 100. Shorter durations like 50 make the indicator extra responsive, which fits risky pairs like GBP/NZD. Longer durations round 200 work higher on steady pairs like EUR/CHF the place you need to ignore smaller swings completely.

The vary multiplier often sits between 2.0 and 4.0. Consider it like a sensitivity management. At 2.0, you’ll catch extra strikes however cope with extra false indicators. At 4.0, you’ll wait longer for affirmation however get cleaner developments. There’s no excellent setting—it is dependent upon your threat tolerance and buying and selling fashion.

Testing completely different configurations helps. Run the indicator with interval 80 and multiplier 2.5 on AUD/USD versus interval 150 and multiplier 3.5. You’ll instantly see how the primary setup provides extra indicators whereas the second filters extra aggressively. Some merchants even run two situations concurrently—one quick, one gradual—to gauge pattern power.

However right here’s the factor: Don’t optimize based mostly on backtests alone. What works on historic information usually fails in dwell markets since you’re curve-fitting to previous value motion. Select settings that make logical sense to your timeframe and stick to them lengthy sufficient to collect significant information.

The Trustworthy Fact About Limitations

The Vary Filter isn’t a crystal ball. It lags throughout pattern reversals as a result of it wants value to maneuver considerably earlier than altering route. When USD/JPY reversed from 152 right down to 148 final quarter, merchants who relied solely on this indicator missed the primary 150 pips whereas ready for affirmation.

Sideways markets expose one other weak point. Throughout consolidation durations—which make up roughly 70% of market situations—the indicator can flip forwards and backwards a number of instances. These transitions usually set off false entries if you happen to’re utilizing the colour change as your solely sign. You’ll find yourself in the identical whipsaw scenario the indicator was meant to stop.

The instrument additionally doesn’t account for basic occasions. When the Federal Reserve surprises markets with surprising hawkish steerage, value can hole proper by your filter zones. Technical indicators usually battle with news-driven volatility as a result of calculations based mostly on historic value can’t predict central financial institution selections or geopolitical shocks.

In comparison with one thing just like the SuperTrend indicator, the Vary Filter gives smoother indicators however with extra lag. SuperTrend reacts sooner to cost adjustments, which implies earlier entries but additionally extra fake-outs. The Vary Filter takes a extra conservative method. Neither is superior—they serve completely different buying and selling philosophies.

In opposition to conventional shifting averages, this indicator filters noise higher however gained’t substitute the simplicity of a 200-period EMA for figuring out main pattern route. Good merchants usually use each: the MA for general bias and the Vary Filter for tactical entry timing.

Find out how to Commerce with Vary Filter MT5 Indicator

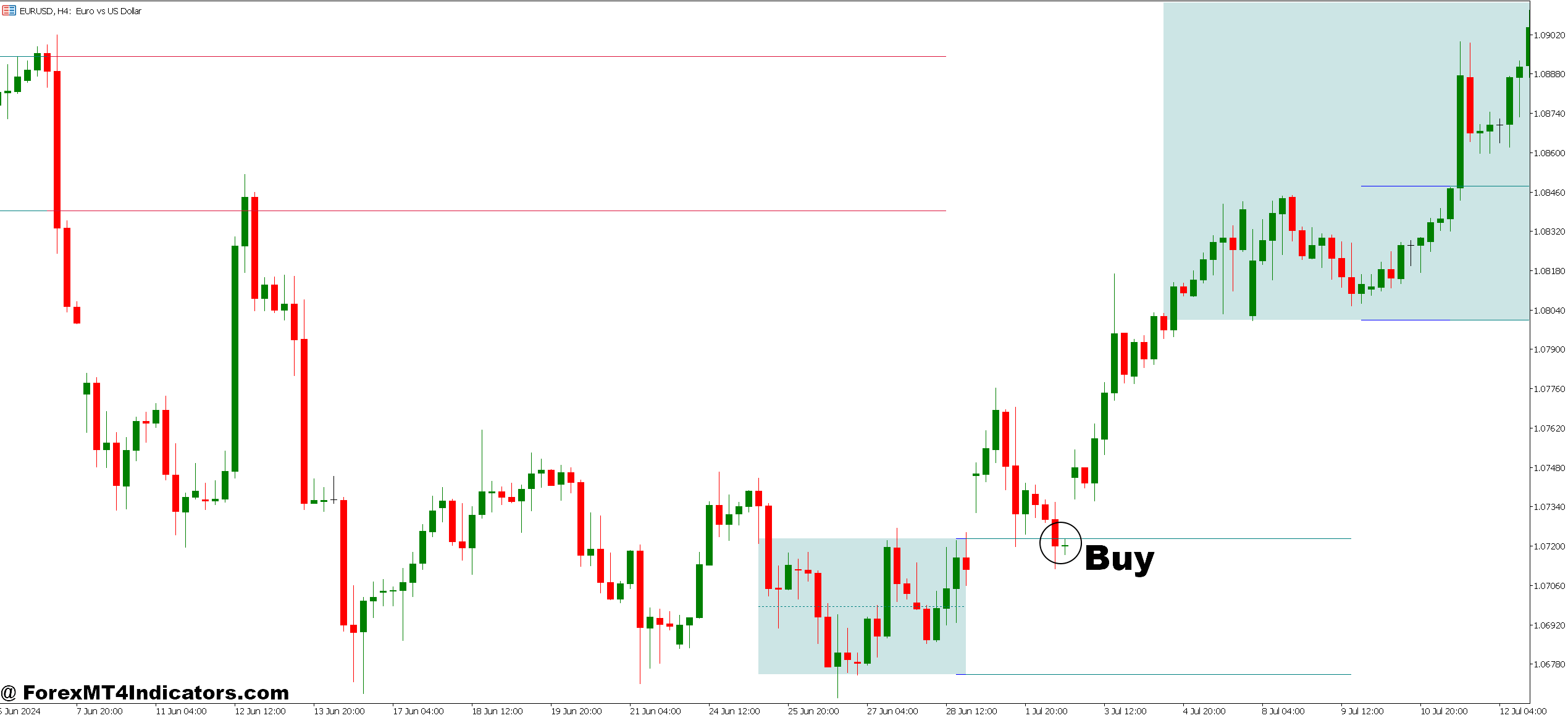

Purchase Entry

Filter flips blue above help – Enter lengthy when the Vary Filter adjustments from purple to blue inside 10-20 pips of a key help degree on EUR/USD 4-hour chart; this confirms patrons are defending the zone.

Double affirmation with RSI – Take the purchase sign solely when the filter turns bullish AND RSI crosses above 50; skip entries when RSI is already overbought above 70.

Retest entry after breakout – Anticipate value to interrupt resistance, pull again to retest it, then enter when the filter stays blue all through the pullback on GBP/USD 1-hour charts.

Cease loss 20 pips beneath filter line – Place your cease 20-30 pips beneath the blue filter line on majors; if value touches the road and bounces, it validates the pattern.

Keep away from throughout ranging periods – Don’t take purchase indicators between 12 AM-3 AM GMT when USD/JPY sometimes consolidates; anticipate London or New York session quantity.

Quantity affirmation required – Solely enter when the filter flips blue with quantity 30%+ above the 20-period common; low-volume indicators usually fail inside 50 pips.

Threat 1% most per commerce – By no means threat greater than 1% of your account on a single Vary Filter sign; consecutive false indicators throughout uneven markets can occur 3-4 instances in a row.

Scale out at 2:1 ratio – Shut half your place when value strikes 60 pips in revenue (if risking 30 pips), let the remainder run with a trailing cease 40 pips behind the filter line.

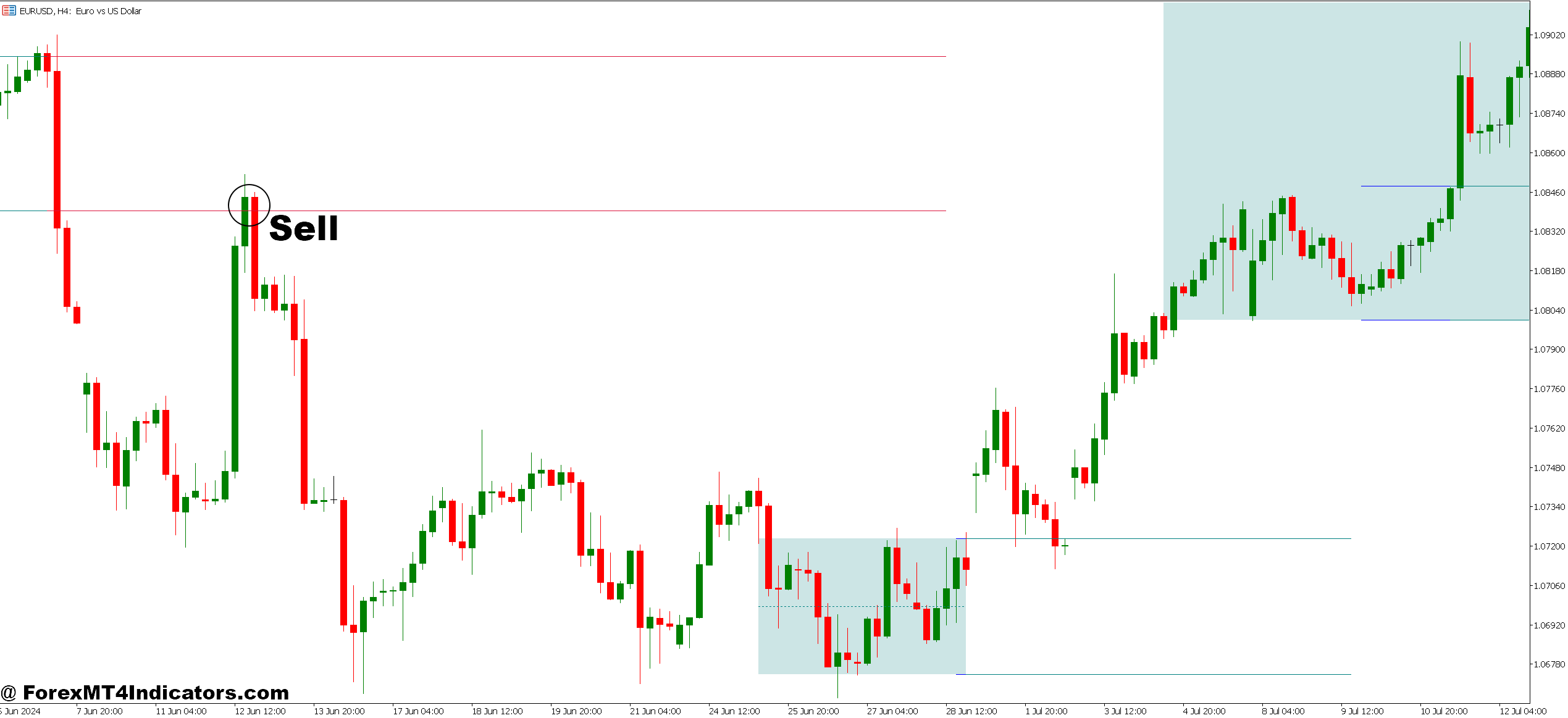

Promote Entry

Filter flips purple beneath resistance – Enter brief when the Vary Filter turns bearish inside 15 pips underneath a resistance degree on EUR/USD every day chart; this indicators distribution is full.

Momentum divergence setup – Take promote indicators when the filter turns purple AND value makes a better excessive however RSI reveals a decrease excessive; these reversals usually drop 100+ pips.

Failed breakout entry – Quick when value breaks above resistance however instantly reverses with the filter flipping purple; false breakouts on GBP/USD 4-hour charts sometimes retrace 80% of the spike.

Cease above latest swing excessive – Place stops 25-35 pips above the newest swing excessive, not simply above the filter line; this prevents getting stopped by minor spikes throughout NFP or central financial institution bulletins.

Skip sells throughout robust uptrends – Don’t take purple indicators when value is above the 200-period EMA on the every day chart; counter-trend trades have 60%+ failure charges even with filter affirmation.

Anticipate candle shut affirmation – By no means enter mid-candle when the filter simply flipped purple; anticipate the 1-hour or 4-hour candle to totally near keep away from head-fake reversals.

Cut back dimension earlier than information occasions – Lower place dimension by 50% if coming into inside 2 hours of FOMC, ECB, or BOE bulletins; volatility spikes invalidate technical indicators.

Exit if filter flips again rapidly – Shut the commerce instantly if the filter adjustments from purple again to blue inside 3-5 candles; this whipsaw sample indicators uneven situations and the pattern hasn’t established.

Making It Work in Your Buying and selling

The Vary Filter MT5 indicator earns its place on charts by offering readability in uneven situations and serving to merchants stick with developments once they develop. It reduces false indicators in comparison with uncooked value motion however gained’t eradicate losses or assure earnings. Buying and selling foreign exchange carries substantial threat, and no indicator adjustments that basic actuality.

For sensible implementation, deal with the filter as one part of an entire system. Use it to verify directional bias from different evaluation strategies. Respect its limitations throughout consolidation and main information occasions. Regulate settings thoughtfully based mostly on the precise pairs and timeframes you commerce, then resist the urge to continuously tweak them.

The indicator proves Most worthy for merchants who battle with overtrading in rangy markets. If you end up taking too many marginal setups and getting chopped up, this filter forces persistence by highlighting solely the cleaner directional strikes. That’s the place its actual worth lies—not in prediction, however in choice.

Beneficial MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Profitable Foreign exchange Dealer

Extra Unique Bonuses All through The Yr

Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90