Ripple’s settlement to amass GTreasury has triggered a pointy, technically knowledgeable response on X, the place a number of long-time market observers argue the deal quietly routes XRP and Ripple’s stablecoin ambitions into the middle of company finance. Their case rests on the place GTreasury sits within the worth chain, what it already connects to, and the way Ripple can insert settlement decisions—XRP or RLUSD—with out forcing enterprises to vary screens, ERPs, or financial institution relationships.

Why The GTreasury Deal Is Huge For Ripple And XRP

“I’m fairly positive nobody in crypto Twitter even understands what that is,” wrote developer Vincent Van Code (@vincent_vancode), earlier than laying out why the plumbing issues. “GTreasury gives software program that allows primarily massive, multinational firms [to] deal with funds, liquidity, money move and so forth. The software program hyperlinks into banking and fee methods akin to SWIFT, and is ISO20022 compliant.”

In different phrases, GTreasury just isn’t a speculative wager on future rails; it’s an orchestration layer that already standardizes and routes money, messages, and danger information between a company’s financial institution portals, fee networks, and ERP.

Van Code’s key implication is distribution, not hype: “So this acquisition together with Hidden Roads and Commonplace Custody and Belief, permits Ripple to introduce digital property into the $100T Treasury market. Ripple doesn’t must ‘promote’ XRP to the massive corporates, that’s simply a part of the plumbing. The SaaS and UI doesn’t change, it simply means Ripple progressively rolls out sooner, extra environment friendly rails. That’s the sport.”

That line of considering is echoed by Ray Fuentes (@RayFuentesIO), who argues the strategic shortcut just isn’t merely technical but additionally authorized and compliance-oriented. “As soon as this deal clears with GTreasury, Ripple will personal a treasury platform already dwell within the SWIFT-interoperability lane. Translation: no constructing SWIFT integrations from scratch—there’s a authorized, technical, and compliant path in place. HUGE win for enterprise adoption. #XRP.”

The purpose is much less a couple of headline-grabbing re-architecture and extra a couple of low-friction insertion into flows that already move audit, safety, and regulatory muster. If the financial institution and ERP adapters are in place, new settlement choices will be uncovered as toggles reasonably than rebuilds.

What Ripple Will get From The Acquisition

Wrathof Kahneman (@WKahneman) expands the distribution map and the product floor space by situating GTreasury in its historic and technical context. “They’ve ~40 years integrating w/ 800+ banks worldwide. They combine straight with main ERP methods like SAP, Oracle, & NetSuite, and connects to main banks like JPMorgan, Goldman Sachs, Financial institution of America, Wells Fargo, and PNC.”

That checklist issues as a result of company treasurers don’t purchase ledgers or tokens; they purchase time-tested connectivity that gained’t break money positioning, FX hedging, pooling, and reconciliation. The argument is that when Ripple owns the connectivity material and the person interface, it will possibly floor settlement paths—on-ledger through XRP, on-chain through RLUSD, or established order—behind an unchanged workflow.

That is additionally why @WKahneman frames the deal as “Direct entry to the company international cash motion. With this Ripple can deliver #RLUSD & #XRP settlement choices into present treasury workflows. A co might transfer funds throughout subsidiaries, currencies, or counterparties immediately, w/ altering software program or banks. It’s the final mile for company finance.”

The operative phrase is “present treasury workflows.” Treasurers stay inside SAP, Oracle, or NetSuite, whereas GTreasury orchestrates financial institution messages and funds. If Ripple can slot XRPL or RLUSD as routable choices underneath that orchestration, the adoption barrier turns into a coverage choice, not a methods undertaking.

The Lengthy-Time period Plan

The buying sample that led right here just isn’t incidental. @WKahneman tallies the stack: “Metaco – $250 million (2023) / Hidden Street – $1.25 billion / Rail – $200 million / GTreasury – $1 billion. Ripple has spent ~$3b constructing an entire company finance stack. They will provide each layer between a company CFO’s dashboard and on-chain settlement.”

Framed this manner, Metaco covers custody and tokenization controls; Hidden Street provides institutional execution and collateral plumbing throughout venues; Rail provides stablecoin fee orchestration; GTreasury turns into the company command console with financial institution and ERP integrations.

This in flip raises the query most readers leap to: how, precisely, does this contact XRP? @WKahneman doesn’t over-promise however attracts the strategic circle: “I do know, I do know,… ‘however what about XRP?’ I’ll depart it to you to think about what the implications are for an organization that was constructed across the XRPL changing into embedded in company finance whereas holding 40% of the XRP provide. It’s necessary market penetration.”

The assertion just isn’t that XRP turns into obligatory; it’s that XRP turns into native—current on the level of choice inside treasury workflows the place pace, pre-funding, and FX paths are calculated. If the “bridge asset” case is ever to be examined at scale, it is not going to be through retail hypothesis however through the quiet default settings of treasury middleware.

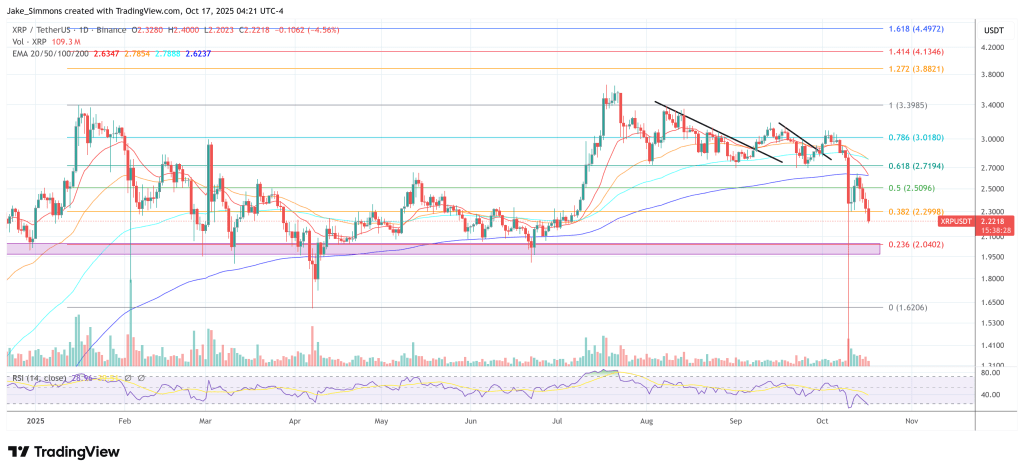

At press time, XRP traded at $2.22.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.