Good Cash Ideas (SMC) refers to cost motion rules that reveal how institutional merchants—banks, hedge funds, and huge monetary entities—transfer markets. The MT5 indicator automates the detection of those patterns, which in any other case require hours of guide chart evaluation.

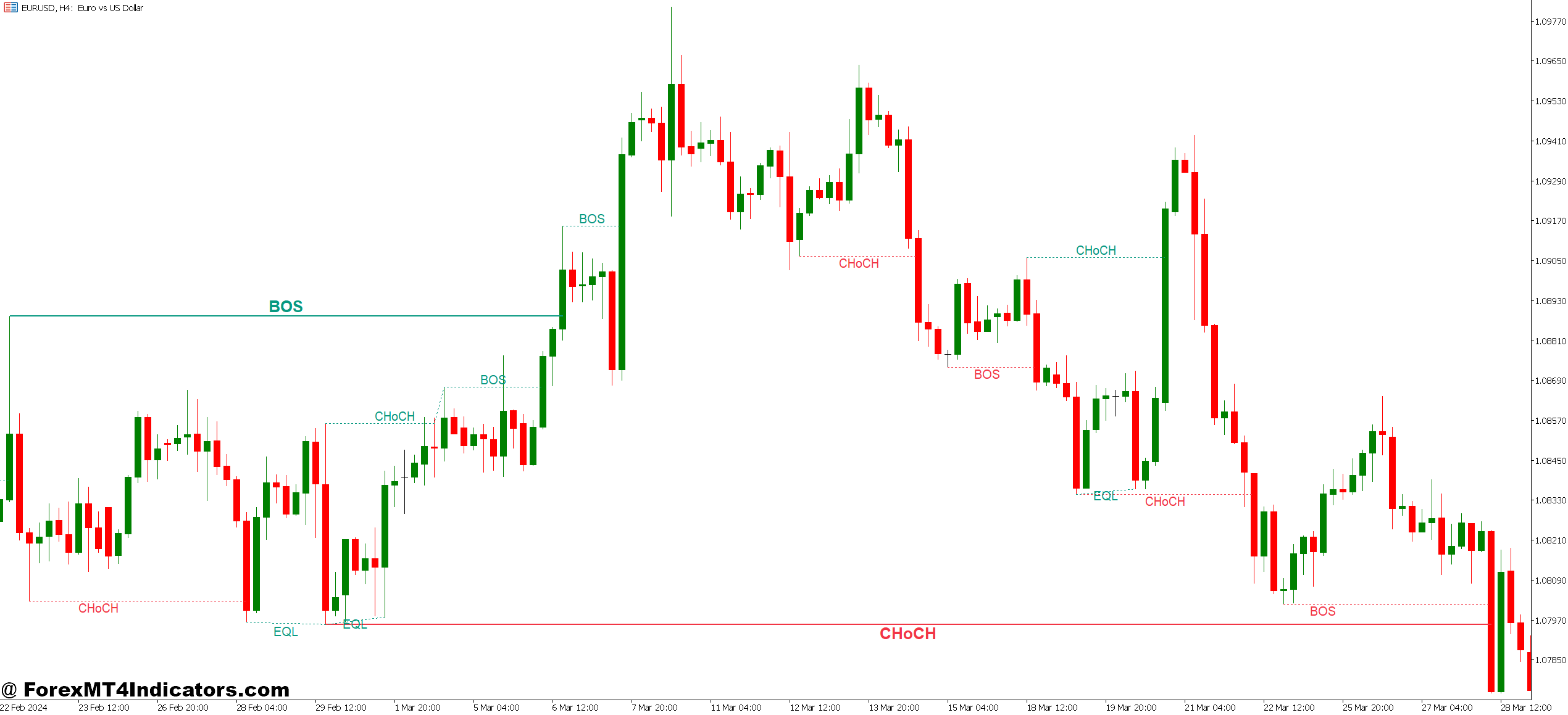

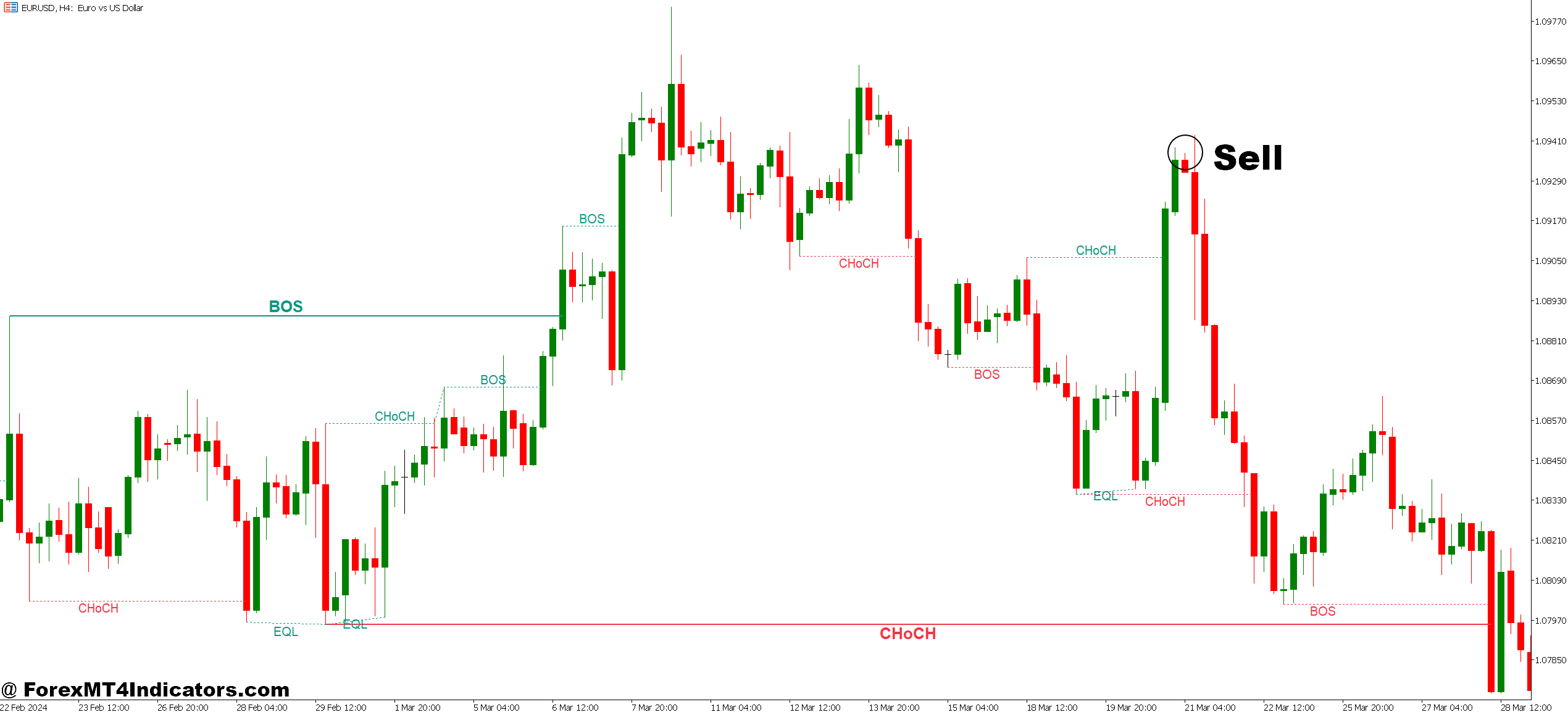

The indicator marks a number of key buildings. Order blocks seem as rectangles highlighting the final bullish or bearish candle earlier than a powerful transfer. These zones signify the place establishments positioned important orders. Truthful worth gaps (FVGs) present imbalances the place value moved too rapidly, leaving inefficiencies that always get stuffed later. Break of construction (BOS) factors establish when value breaks earlier swing factors, confirming development path.

What separates this from customary help and resistance? Specificity. Relatively than drawing arbitrary zones, the indicator pinpoints precise areas the place institutional algorithms doubtless triggered. On EUR/USD’s day by day chart, an order block at 1.0850 may signify the place the European Central Financial institution’s buying and selling desk amassed positions throughout a quiet Asian session.

The Mechanics Behind the Indicators

The indicator scans for particular value patterns that counsel institutional exercise. For order blocks, it identifies the final opposite-color candle earlier than a powerful impulse transfer. If value rallies 50 pips with out retracement, that remaining bearish candle earlier than the surge turns into a bullish order block—establishments doubtless absorbed all promoting strain there.

Truthful worth gaps emerge when three consecutive candles create an area between the excessive of candle one and the low of candle three. This occurs when massive orders hit the market, inflicting slippage and gaps within the order ebook. The indicator marks these zones as a result of establishments typically let value revisit them earlier than persevering with the development.

Change of character (CHoCH) detection requires the algorithm to trace swing highs and lows. When value breaks a earlier swing level with momentum, it alerts potential development reversal. The indicator measures the break’s energy by analyzing quantity and candle measurement—weak breaks typically fail, robust ones persist.

The calculation isn’t rocket science, nevertheless it’s tedious. Merchants who manually mark these ranges may miss half of them throughout fast-moving classes. The indicator processes each candle mechanically, sustaining consistency that guide evaluation can’t match.

Actual-World Buying and selling Eventualities

Right here’s how merchants apply this. On USD/JPY’s 4-hour chart final month, value created a bearish order block at 149.80 after a pointy selloff. Two days later, throughout London open, value rallied again to 149.75—proper into that zone. Sellers appeared instantly, pushing value down 120 pips over the subsequent 12 hours. That’s textbook order block rejection.

Truthful worth gaps work otherwise. When EUR/GBP dropped 80 pips in half-hour after a BOE assertion, it left a niche between 0.8520 and 0.8535. Good merchants didn’t chase the transfer down. They waited. Three classes later, value retraced to 0.8528—the center of that hole—earlier than persevering with decrease. Affected person merchants who set restrict orders within the FVG caught the continuation.

However right here’s the factor—not each sign works. In the course of the 2023 March banking disaster, USD/CHF created a bullish order block at 0.9180. Value returned to check it 3 times, and all 3 times it failed. Why? Basic worry overwhelmed technical buildings. The Swiss franc’s safe-haven demand trumped technical ranges.

That’s why skilled merchants mix SMC with context. A bullish order block means little if the Federal Reserve simply introduced emergency price cuts. The indicator exhibits the place establishments traded earlier than, not what they’ll do throughout unprecedented occasions.

Settings and Customization

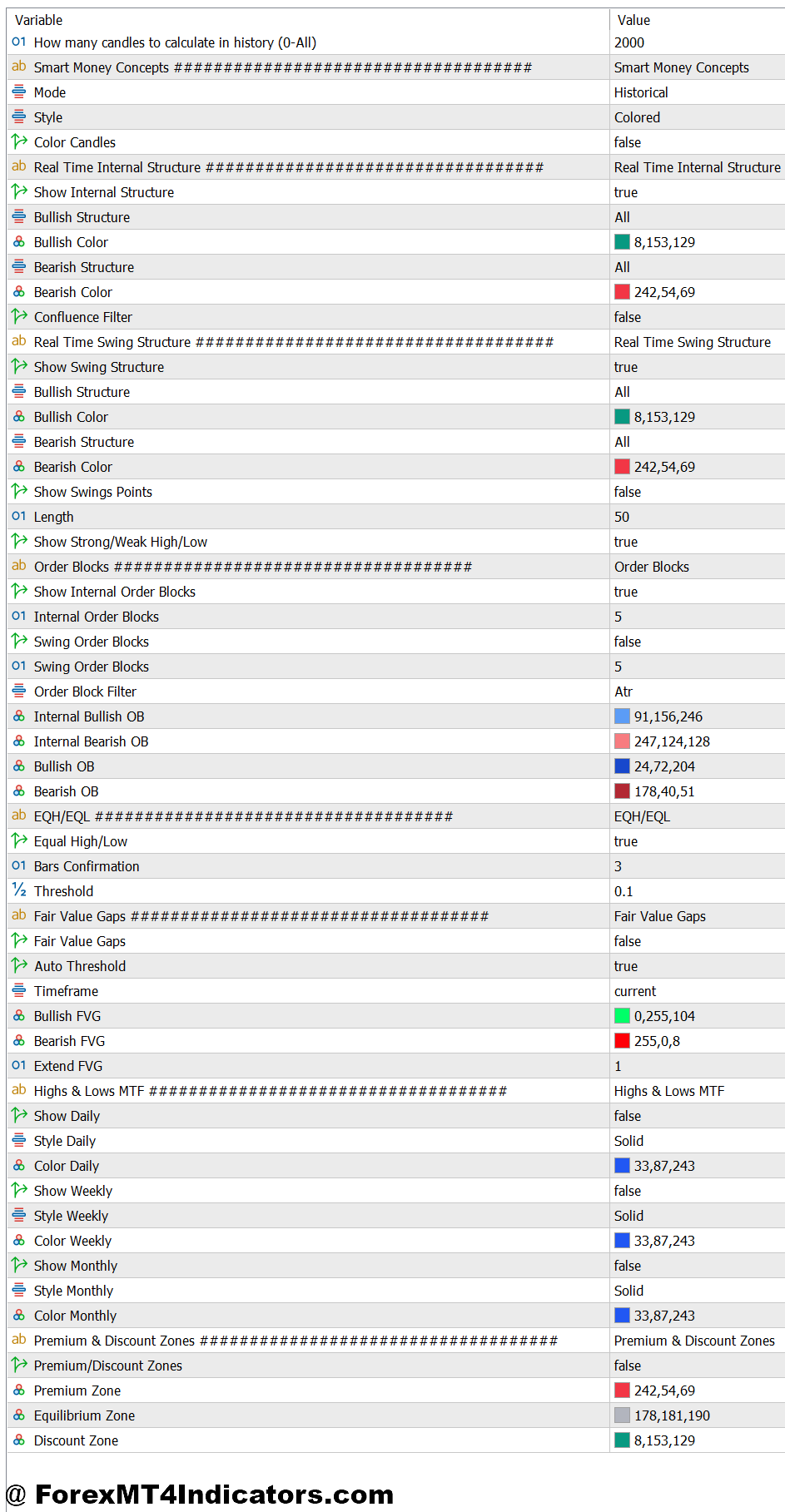

The indicator’s default parameters work for swing buying and selling on H4 and day by day timeframes. The lookback interval—often set to 50 candles—determines how far again the algorithm scans for swing factors. Shorter lookbacks (20-30) go well with scalpers on 15-minute charts however generate extra false alerts. Longer lookbacks (100+) scale back noise however may miss latest construction shifts.

Order block sensitivity controls what number of zones seem in your chart. Excessive sensitivity exhibits each minor block, cluttering the display screen. Low sensitivity shows solely the strongest zones the place institutional exercise was most evident. Most merchants set this to medium, then modify based mostly on their pair’s volatility.

Shade coding helps handle info overload. Bullish zones in blue, bearish in purple, mitigated blocks in grey—this visible hierarchy lets merchants scan charts rapidly. Some merchants make older blocks clear, focusing solely on latest buildings.

For GBP/JPY’s wild 200-pip day by day ranges, wider order blocks (15-20 pips) work higher than the default 10 pips. Tight spreads on EUR/USD enable narrower zones. The indicator doesn’t mechanically modify for volatility, so merchants should fine-tune settings for every pair.

Strengths and Weaknesses

The indicator’s largest benefit is sample recognition pace. What takes 20 minutes to mark manually seems immediately. Throughout NFP releases or central financial institution bulletins, this pace issues—alternatives vanish in seconds.

It additionally removes emotional bias. Merchants typically draw help and resistance the place they need it, not the place it truly exists. The algorithm doesn’t care about your place or bias. It marks buildings based mostly on pure value motion.

The restrictions? It’s reactive, not predictive. The indicator exhibits the place establishments traded, not the place they’ll commerce subsequent. That bullish order block may by no means get examined if fundamentals shift. And through low-liquidity Asian classes, order blocks from skinny buying and selling circumstances typically fail when London quantity arrives.

False alerts enhance throughout ranging markets. When USD/CAD chops in a 40-pip vary for weeks, the indicator generates a number of conflicting zones. In trending markets, it shines. In sideways grind, it struggles like each different technical device.

Evaluating it to straightforward pivot factors or Fibonacci retracements exhibits clear variations. Pivots use mathematical calculations based mostly on earlier excessive/low/shut. Fibonacci imposes predetermined ratios on strikes. Good Cash Ideas displays precise traded ranges the place quantity absorbed value. That’s extra related than theoretical math—however solely when markets respect technical ranges in any respect.

Find out how to Commerce with Good Cash Ideas Indicator MT5

Purchase Entry

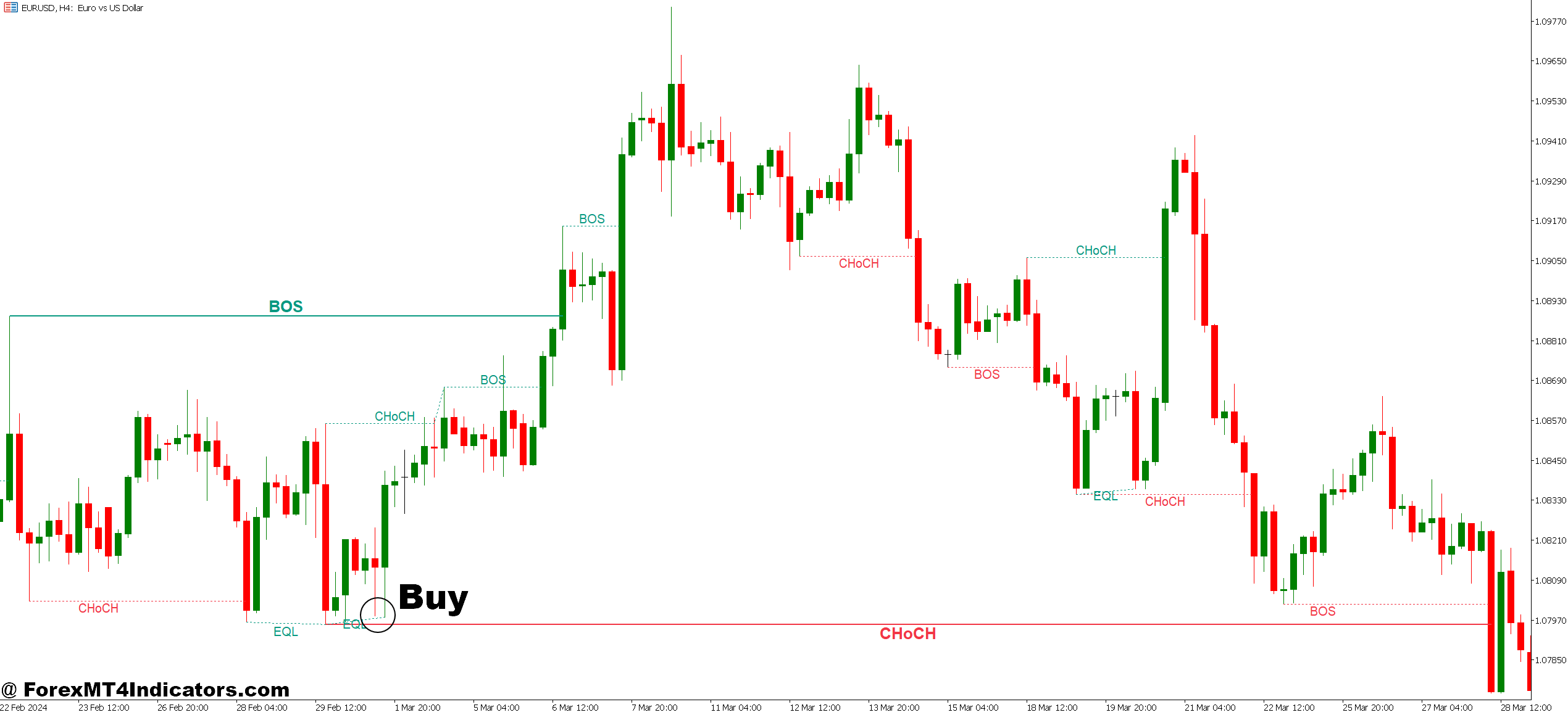

Order Block Retest – Look ahead to value to drop again right into a bullish order block (marked in blue) on EUR/USD 4-hour chart, then enter lengthy when a bullish engulfing candle types inside the zone, concentrating on 40-60 pips.

Truthful Worth Hole Fill – Enter purchase when value fills 50-75% of a bullish FVG on GBP/USD 1-hour chart, inserting cease loss 5 pips beneath the hole’s low and aiming for two:1 risk-reward minimal.

Break of Construction Affirmation – Take lengthy positions solely after value breaks earlier swing excessive by a minimum of 15 pips on the day by day chart, then watch for a pullback to enter slightly than chasing the breakout instantly.

Liquidity Sweep Setup – Purchase when value wicks beneath a key low (cease hunt), then closes again above it inside 1-2 candles, indicating establishments grabbed liquidity earlier than pushing increased—works finest throughout London session.

Danger 1% Most – By no means threat greater than 1% of account steadiness per SMC sign, even when the setup appears excellent; EUR/USD order blocks fail 30-40% of the time throughout high-impact information occasions.

Keep away from Vary Situations – Skip purchase alerts when value has chopped in a 50-pip vary for 20+ hours on USD/JPY; SMC indicators generate false order blocks in sideways markets that don’t maintain.

Quantity Affirmation Required – Solely enter when the bullish order block shaped on robust quantity (test quantity indicator); thin-volume blocks on AUD/USD Asian session typically fail when London opens.

A number of Timeframe Alignment – Confirm the purchase sign on 1-hour chart aligns with bullish construction on 4-hour and day by day charts; counter-trend trades towards increased timeframe order blocks usually get stopped out.

Promote Entry

Bearish Order Block Check – Enter brief when EUR/USD rallies right into a red-marked bearish order block on the 4-hour chart, ready for a bearish engulfing or robust rejection wick earlier than promoting.

Truthful Worth Hole Resistance – Promote when value retraces 60-80% right into a bearish FVG on GBP/USD 15-minute chart throughout risky information releases, setting cease loss 10 pips above hole’s excessive.

Change of Character Break – Go brief after value breaks beneath earlier swing low with momentum, however wait 2-3 candles for affirmation on day by day chart—speedy entries typically catch false breaks.

Premium Zone Rejection – Promote when value reaches the higher 25% of a broader vary after tapping a bearish order block, indicating establishments distributed at premium costs earlier than markdown.

Cease Loss 2x ATR – Place stops at twice the Common True Vary above bearish order blocks on risky pairs like GBP/JPY; tight 20-pip stops get clipped throughout regular value fluctuation.

Skip Throughout Robust Traits – Don’t take promote alerts towards apparent uptrends on USD/CHF weekly chart; counter-trend SMC trades have 60%+ failure charges when preventing main institutional path.

Information Occasion Filter – Keep away from brief entries half-hour earlier than and after NFP, FOMC, or central financial institution choices; even legitimate bearish order blocks get blown by throughout high-impact elementary releases.

Mitigation Test – By no means promote at order blocks that already received examined twice and held; mitigated zones (turned grey by indicator) lose their energy after establishments already executed their orders there.

Utilizing This Indicator Responsibly

Good Cash Ideas Indicator MT5 offers a framework for understanding institutional habits. Merchants who blindly enter at each order block will face disappointment. The device works finest when mixed with development evaluation, elementary consciousness, and correct threat administration.

Danger per commerce ought to by no means exceed 1-2% of account fairness, no matter how excellent a setup appears. No indicator, together with this one, predicts the long run with certainty. Markets can stay irrational longer than accounts can stay solvent—a harsh lesson discovered by merchants who over-leveraged on “certain factor” setups.

The true worth comes from constant utility over a whole bunch of trades. Some will fail. That’s buying and selling. However when used correctly, the indicator helps tilt chance barely in your favor by figuring out the place the large cash truly operates. In a recreation the place 70% of retail merchants lose cash, a slight edge makes all of the distinction.

Beneficial MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Successful Foreign exchange Dealer

Further Unique Bonuses All through The 12 months

Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90