Ethereum is buying and selling under the $3,000 stage as promoting strain continues to weigh on the broader crypto market. After weeks of unstable value motion, ETH has did not reclaim key psychological and technical ranges, reinforcing a fragile market construction.

Sentiment stays decisively bearish, with worry and even apathy beginning to dominate dealer habits. Volatility has compressed, participation has thinned, and lots of analysts are more and more pointing towards a chronic bear market situation extending into 2026.

This lack of conviction is just not restricted to retail contributors. In line with knowledge shared by Lookonchain, two giant whales dumped a mixed 14,000 ETH, price roughly $40.82 million, in simply the previous two hours. Such aggressive promoting throughout already weak situations provides strain to an asset that’s struggling to draw sustained demand.

Whereas remoted whale exercise doesn’t outline the broader development by itself, timing issues. Massive distributions during times of low liquidity usually amplify draw back strikes and reinforce adverse sentiment throughout the market.

Ethereum Whale Promoting Meets Lengthy-Time period Conviction

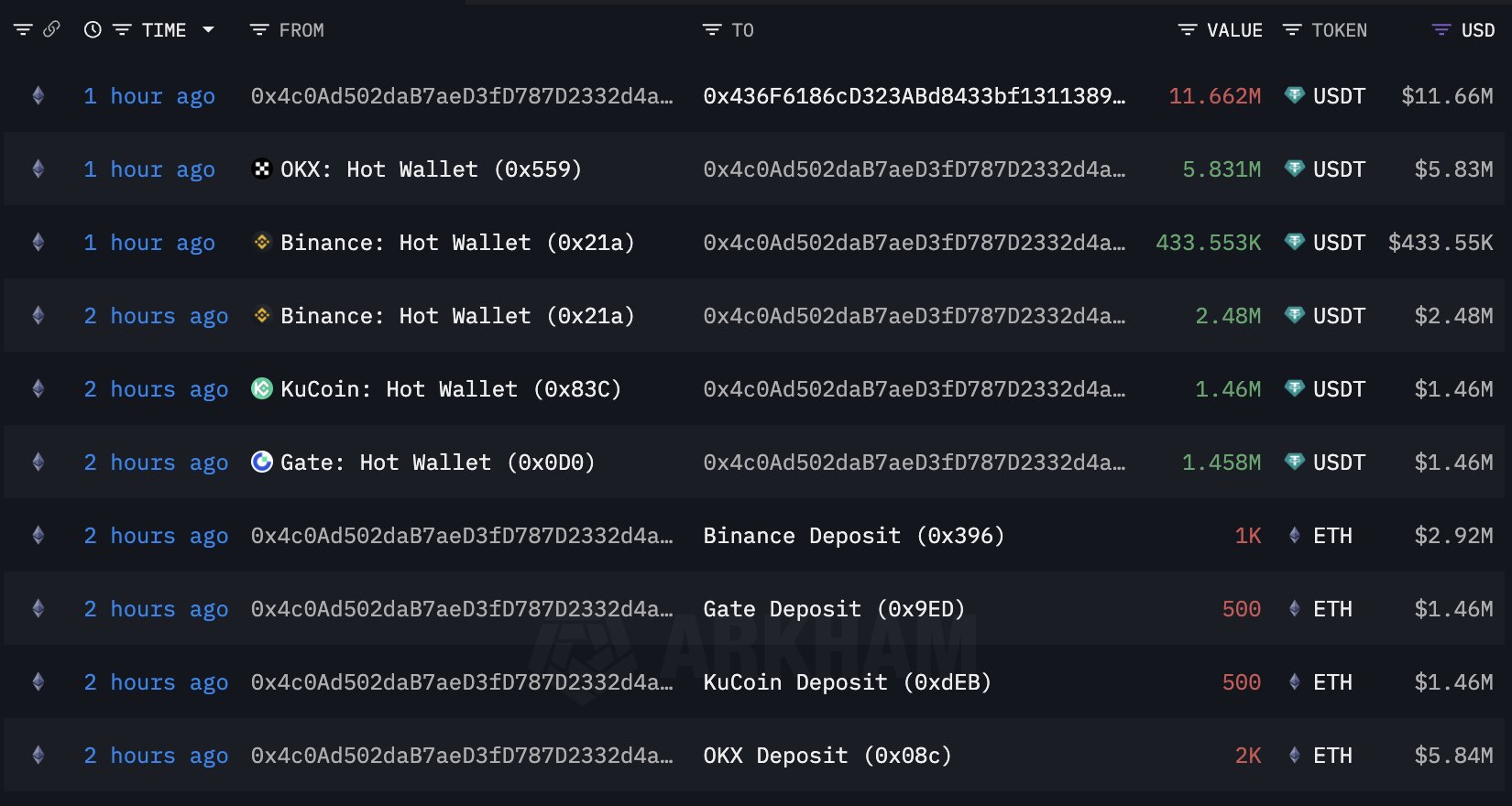

Arkham knowledge shared by Lookonchain reveals contemporary proof of large-scale promoting as Ethereum trades below sustained strain. Handle 0x2802 bought 10,000 ETH, price roughly $29.16 million, at a mean value of $2,915.5 via decentralized exchanges.

Shortly after, one other whale, 0x4c0A, offloaded 4,000 ETH, valued at round $11.66 million, distributing the sale throughout a number of centralized venues, together with OKX, Binance, KuCoin, and Gate. The timing and coordination of those strikes reinforce the present bearish tone, notably as liquidity stays skinny and broader market sentiment leans defensive.

Within the quick time period, such exercise provides to draw back strain and fuels uncertainty amongst smaller buyers, who usually interpret whale promoting as a sign of deeper weak spot forward. Nonetheless, value motion and sentiment don’t inform the complete story. Regardless of the drawdown, Ethereum’s fundamentals proceed to strengthen at a tempo not often seen earlier than. Institutional adoption is accelerating, not slowing.

Most notably, JP Morgan not too long ago introduced the usage of Ethereum to launch its first tokenized money-market fund, a milestone that underscores rising confidence in Ethereum as a settlement and monetary infrastructure layer. Whereas markets might stay bearish within the close to time period, the divergence between value sentiment and basic progress is changing into more and more tough to disregard.

Ethereum Value Struggles to Maintain Key Weekly Assist

Ethereum continues to commerce below strain on the weekly chart, with value now sitting round $2,950 after a pointy rejection from the $3,200–$3,300 area. This space beforehand acted as a key pivot zone and has now clearly flipped into resistance. The lack to reclaim it confirms that sellers stay in command of the medium-term construction.

From a development perspective, ETH is consolidating round its 200-week transferring common (purple line), a traditionally vital stage that always determines whether or not corrections stay cyclical or evolve into deeper bearish phases. Up to now, this transferring common is performing as dynamic help, stopping a extra aggressive breakdown. Nonetheless, momentum stays weak, and upside follow-through is restricted.

The 50-week and 100-week transferring averages (blue and inexperienced traces) are starting to flatten and converge, reflecting indecision and decreased development energy. Quantity additionally stays muted in comparison with prior growth phases, suggesting that neither sturdy accumulation nor capitulation is happening at present ranges.

Structurally, ETH stays in a large consolidation vary between $2,500 and $3,300. A weekly shut under the $2,800–$2,900 space would expose draw back towards the decrease finish of that vary. Conversely, reclaiming $3,300 is required to reestablish bullish momentum. Till then, Ethereum stays technically fragile regardless of its long-term fundamentals.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.