Be a part of Our Telegram channel to remain updated on breaking information protection

A Spanish analysis institute is about to money in on a forgotten $10,000 Bitcoin purchase from 2012 that’s surged 1,000x to $10 million

The Institute of Expertise and Renewable Energies (ITER), run by the Tenerife Island Council, acquired 97 BTC over a decade in the past as a part of a blockchain analysis challenge, in accordance with a report by the Spanish-language newspaper El Día.

Tenerife’s innovation councillor Juan José Martínez mentioned the council is now finalizing plans for the sale with an accredited Spanish monetary establishment. Proceeds will fund new ITER analysis, together with work on quantum applied sciences.

Analysis Institute’s Bitcoin Stash Skyrockets 100,000%

Bitcoin’s value has soared since 2012, leaving the institute with a 100,000% enhance on its funding.

BTC value (Supply: CoinMarketCap)

In early October, when Bitcoin’s value reached a brand new all-time excessive (ATH) round $126,198, the stash was value greater than $12.2 million.

Institute’s Bitcoin Purchase Wasn’t An Funding

Martínez advised the information outlet that the 2012 buy was by no means meant as an funding however somewhat as a part of an experimental challenge geared toward understanding Bitcoin’s underlying blockchain expertise.

Extra particularly, a computing staff at ITER explored how the Bitcoin mining course of works.

“It was one of many quite a few analysis initiatives ITER has undertaken to discover and experiment with new technological techniques,” Martínez mentioned.

ITER is at present working with a Spanish monetary establishment that’s licensed by the Financial institution of Spain and the Nationwide Securities Market Fee (CNMV) to facilitate the Bitcoin sale.

Martinez mentioned he expects the transaction to be accomplished within the coming months.

Main US Tutorial Establishments Make investments In Bitcoin

Whereas ITER has mentioned that its Bitcoin buy was not meant to be an funding, different main tutorial establishments have began to put money into the most important crypto by market cap.

Harvard Administration Firm, which oversees the college’s $50 billion endowment, disclosed a $116 million place in BlackRock’s iShares Bitcoin Belief (IBIT) in considered one of its current quarterly filings with the US Securities and Change Fee (SEC).

Did You Know?

Harvard College’s portfolio holds extra Bitcoin ETFs than Google shares. pic.twitter.com/iiPWbEr2Cq

— Bitinning (@bitinning) September 19, 2025

The funding offers Harvard oblique publicity to Bitcoin’s value actions by way of BlackRock’s regulated spot BTC ETF (exchange-traded fund). It’s additionally one of many college’s high 5 publicly disclosed fairness positions, behind Microsoft, Amazon, Reserving Holdings, and Meta.

Harvard’s funding got here after US spot Bitcoin ETFs obtained the regulatory inexperienced mild for launch in 2024. They’ve since attracted billions of {dollars} in funding, and provides conventional traders a well-known car to achieve BTC publicity.

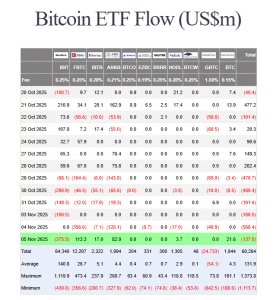

Of these ETFs, BlackRock’s IBIT has been the preferred, and has attracted $63.34 billion in cumulative inflows so far, in accordance with information from Farside Traders.

US spot Bitcoin ETF flows (Supply: Farside Traders)

Brown College additionally reported that it held roughly $4.19 million value of IBIT shares as of the center of this yr. Earlier this yr, the College of Austin in Texas introduced a devoted $5 million “bitcoin fund” inside its endowment. The proceeds might be held in BTC for at least 5 years.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection