The crypto market is regaining momentum as Bitcoin (BTC) value trades close to $107,000, whereas high altcoins like Ethereum (ETH), Solana (SOL), and Avalanche (AVAX) present regular restoration after latest pullbacks. Market sentiment is popping optimistic, supported by renewed institutional curiosity and rising on-chain exercise.

On the similar time, the full stablecoin provide has surged to a file, signaling an enormous pool of sidelined liquidity ready for deployment. Traditionally, such progress in stablecoin reserves has preceded main rallies in Bitcoin, DeFi tokens, and the broader altcoin market, suggesting that the following large crypto uptrend may very well be approaching.

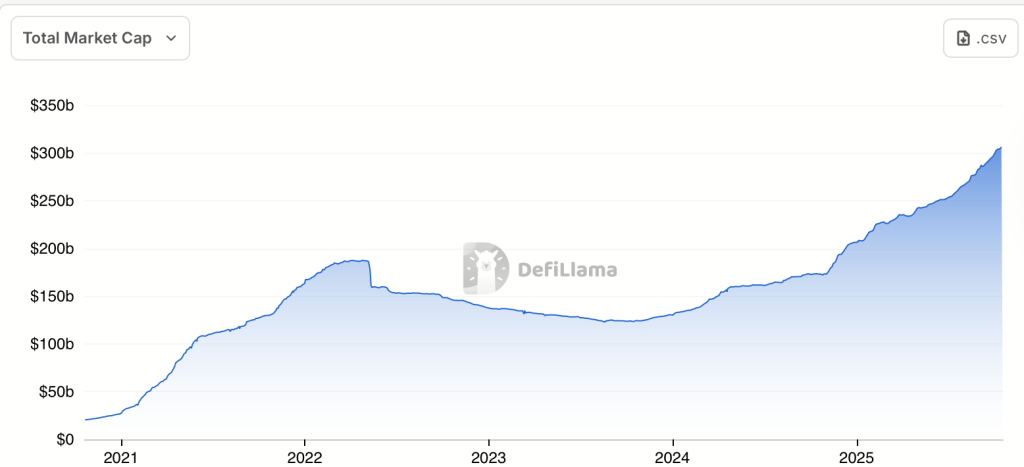

Stablecoin Provide Hits Document $304.5 Billion

The overall stablecoin provide has soared to an all-time excessive of $304.5 billion, signaling a serious liquidity buildup within the crypto ecosystem. This large quantity of idle capital signifies rising investor confidence and readiness to redeploy funds into high-yield crypto alternatives. Stablecoins, pegged to the U.S. greenback, proceed to function the spine of the crypto economic system, providing stability, seamless transfers, and entry to decentralized markets.

A rising stablecoin market cap usually precedes main market strikes. It suggests traders are accumulating dry powder, ready for the proper second to enter Bitcoin (BTC), Ethereum (ETH), and altcoin markets. Analysts observe that such giant reserves sometimes set off bullish momentum throughout the broader digital asset sector as soon as reinvested into danger belongings or yield-generating protocols.

DeFi and Tokenization: The Subsequent Huge Locations

Specialists imagine the following main liquidity wave may stream into Decentralized Finance (DeFi) and tokenized real-world belongings (RWAs).

DeFi Progress: Lending platforms, decentralized exchanges, and yield farms proceed to draw stablecoin inflows looking for actual yield alternatives. Improved safety and institutional-grade protocols are additional legitimizing DeFi as a core monetary layer.Tokenization Surge: Actual-world belongings like bonds, treasuries, and actual property are being introduced on-chain. Monetary giants reminiscent of BlackRock and Commonplace Chartered are already experimenting with blockchain-based settlements utilizing stablecoins as the first medium.

A Bullish Sign for Bitcoin and DeFi

A number of catalysts may ignite this large liquidity pool—together with regulatory readability, institutional adoption, and macroeconomic shifts pushing capital on-chain. A good coverage transfer or a serious monetary establishment integrating stablecoin funds may set off the following crypto liquidity supercycle.

The record-breaking $304.5 billion in stablecoins isn’t simply sidelined money—it’s gasoline for the following main crypto enlargement. With DeFi, RWAs, and blockchain adoption accelerating, this liquidity may quickly stream again into the market, probably driving Bitcoin, Ethereum, and DeFi tokens to new highs.

Belief with CoinPedia:

CoinPedia has been delivering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict Editorial Tips based mostly on E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness). Each article is fact-checked towards respected sources to make sure accuracy, transparency, and reliability. Our evaluation coverage ensures unbiased evaluations when recommending exchanges, platforms, or instruments. We attempt to offer well timed updates about every part crypto & blockchain, proper from startups to business majors.

Funding Disclaimer:

All opinions and insights shared signify the creator’s personal views on present market situations. Please do your individual analysis earlier than making funding selections. Neither the author nor the publication assumes accountability on your monetary selections.

Sponsored and Commercials:

Sponsored content material and affiliate hyperlinks might seem on our web site. Commercials are marked clearly, and our editorial content material stays solely impartial from our advert companions.

![Crypto News Today [Live] Updates On March 2, 2026 Crypto News Today [Live] Updates On March 2, 2026](https://i0.wp.com/image.coinpedia.org/wp-content/uploads/2025/04/03180108/Crypto-News-Today-3rd-April-_-Pi-Coin-Price-ADA-Price-Bitcoin-News-Ripple-News-and-XRP-ETF.webp?w=350&resize=350,250&ssl=1)