Technique has simply revealed its newest Bitcoin purchase, its largest shortly and a sign that the value crash hasn’t scared away the BTC hoarder.

Technique Has Acquired One other 8,178 Bitcoin

In a brand new submit on X, Technique Chairman Michael Saylor has introduced the newest BTC acquisition made by the corporate. As is often the case, the Monday announcement was preceded by a Sunday submit with the corporate’s Bitcoin portfolio tracker, this time with the caption “₿ig Week.”

Saylor had additionally been doing different teasing for this buy, like writing on Friday, “We purchased bitcoin day by day this week.” And certainly, the purchase has turned out to be a giant one.

In whole, Technique has added 8,178 tokens to its holdings with this buy, spending $835.6 million. In line with the submitting with the US Securities and Alternate Fee (SEC), the acquisition was funded alongside $136.1 million in gross sales of the corporate’s STRF, STRC, and STRK at-the-market (ATM) inventory choices.

Technique has been a constant purchaser of BTC in latest months, however recently, the agency was solely making small purchases, making it appear like its accumulation was slowing down. The newest purchase, nonetheless, has damaged the sample.

It’s the biggest Bitcoin acquisition that the corporate has accomplished since July twenty ninth, when it made a monster buy of 21,021 BTC for $2.46 billion. Again then, market circumstances had been utterly totally different, with BTC having hit contemporary highs simply earlier that month.

The newest buy, then again, has come whereas the market has been dealing with vital bearish momentum, making it an particularly daring one. To this point, although, the guess hasn’t labored out, as BTC has solely continued to slip decrease.

The brand new $835 million spherical of accumulation occurred within the interval between November tenth and sixteenth, and concerned a median coin value of $102,171. BTC’s present worth is down greater than 8.5% in comparison with this mark.

Following the acquisition, Technique owns a complete of 649,870 BTC, with a value foundation of $48.37 billion. For the time being, the corporate’s treasury is price $60.6 billion, placing it in a revenue of 25%. Thus, whereas Bitcoin might have been taking place, the agency nonetheless has room to soak up additional draw back.

Technique isn’t the one massive market participant that has ramped up shopping for lately. As analyst James Van Straten has identified in an X submit, the massive holders have been displaying a slowdown in distribution.

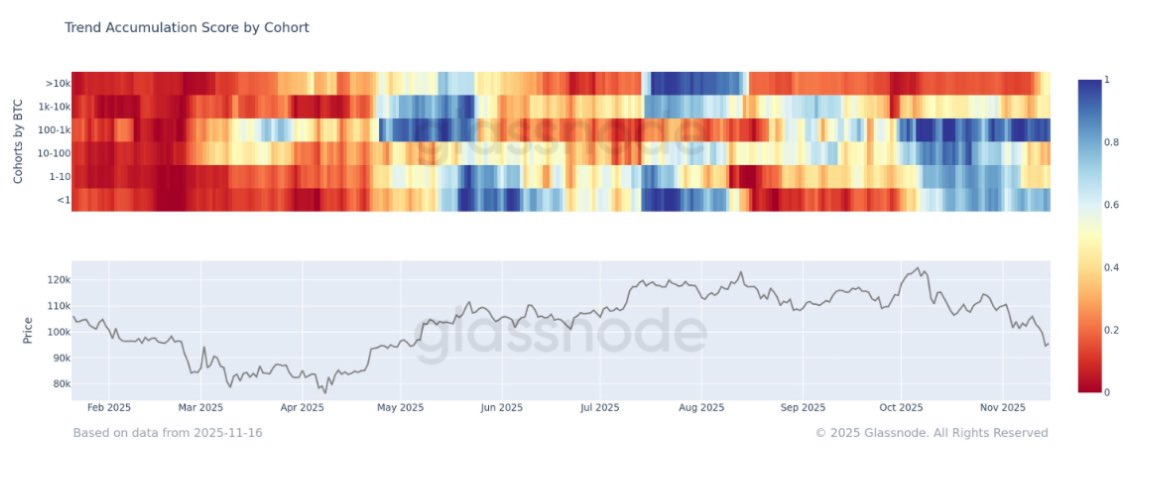

The information for the BTC Accumulation Development Rating over the previous yr | Supply: @btcjvs on X

The indicator cited by the analyst is Glassnode’s Accumulation Development Rating, which tells us whether or not shopping for or promoting is dominant amongst Bitcoin traders. From the above chart, it’s obvious that this metric has been near 1 for the 100 to 1,000 BTC traders lately, an indication that the so-called “sharks” have been collaborating in robust accumulation.

The “whales,” holders mendacity within the 1,000 to 10,000 BTC vary, have proven extra blended conduct, however the newest pattern has been that of neutrality. The ten,000+ BTC holders, usually referred to as “mega whales,” are additionally displaying a impartial conduct proper now, however of their case, the neutrality marks a shift: these traders had been in a section of distribution since August.

BTC Value

On the time of writing, Bitcoin is floating round $92,700, down greater than 12% over the past seven days.

Seems like the value of the coin has been extending its decline | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.