Goal inventory has been crushed, dropping two-thirds of its worth from its prior peak. The Each day Breakdown digs into its valuation and dividend.

Earlier than we dive in, let’s be sure you’re set to obtain The Each day Breakdown every morning. To maintain getting our day by day insights, all you could do is log in to your eToro account.

Deep Dive

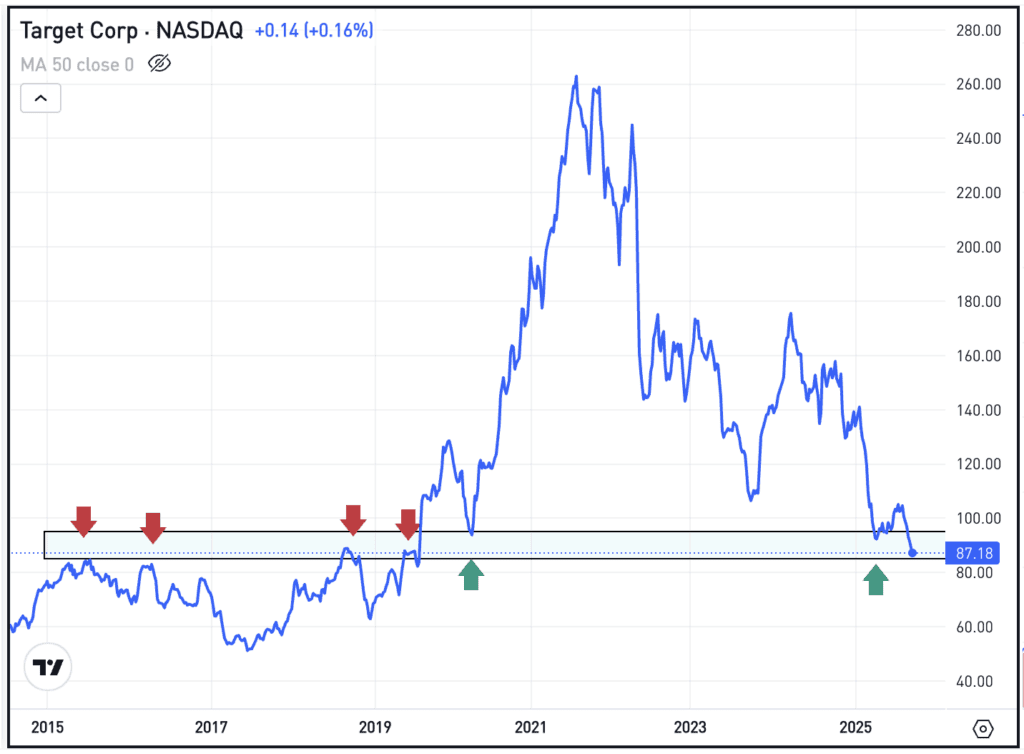

It’s been a extremely tough stretch for Goal, with shares down greater than 35% in 2025 and down about 67% from its report excessive made close to $269 in late-2021 — which was close to the peak of the prior bull market. Whereas the S&P 500 recovered from the bear market, Goal hasn’t achieved so.

Corporations like TJX, Walmart, Costco and Amazon have achieved a stellar job at managing evolving shopper preferences and macro-level modifications. Goal used to be on that checklist too.

For context, Goal’s report excessive was nearly 4 years in the past (about 200 weeks in the past, to be precise). In the identical period of time main as much as that peak, shares had been up about 300%. Additional, from the beginning of 2010 to the top of 2020, TGT shares rose 264%. With the dividend included — i.e. “whole return” — that determine climbs to 393% (vs. returns of “simply” 235% and 317% for the S&P 500, respectively).

Can Goal Be Fastened?

When big retailers battle to maneuver merchandise — consider Lululemon’s current woes — it creates an unlimited challenge for the corporate. As gross sales drop, stock bloats and margins contract. Goal has been pressured to decrease its steerage over time as operational points lingered.

Final quarter, the corporate introduced Michael Fiddelke as its new CEO, hoping that the change will help spark a turnaround. New CEOs can face robust hurdles, and in consequence, administration can present disappointing steerage — identified on Wall Road as “sandbagging” — to assist decrease the bar. We’ll see if that finally ends up being the case for Goal in 2026.

Final quarter, Goal reported disappointing outcomes, however reaffirmed its full-year outlook. If the enterprise is actually close to a trough, maybe the inventory has an opportunity to rebound. After we have a look at the valuation metrics above — the ahead price-to-earnings (P/E) and price-to-gross-profit ratios — each metrics are at their trough ranges of the previous decade.

In different phrases, if the enterprise has bottomed — which stays to be seen — then the valuation may level to an inexpensive inventory, traditionally talking.

Need to obtain these insights straight to your inbox?

Enroll right here

Diving Deeper — The Dividend & Technicals

Goal is worthwhile, even when income haven’t grown a lot over the previous few years. And whereas its valuation could also be reflecting that lack of progress, one facet to the retailer’s story is its dividend.

Goal has not solely paid however has really raised its dividend for greater than 50 consecutive years. No matter bear markets or recessions, this firm has been very constant on this regard, as TGT inventory now yields greater than 5%.

The Chart

Shares are buying and selling down into an fascinating space on the chart, because the $85 to $95 zone had been resistance from 2015 into 2019, and has been assist since 2020. Bulls may see this technical a part of the equation, the low valuation, and the constant dividend, and resolve a protracted place is warranted. Consider although, if the $80 to $85 space doesn’t maintain as assist, nothing says TGT inventory can’t preserve sliding decrease.

The Backside Line: Retail could be a robust gig. As soon as a giant decline has occurred, many traders are attempting to find worth. Typically they discover it, whereas different instances it turns into a worth entice. From right here, Goal may develop into both one.

Disclaimer:

Please word that as a consequence of market volatility, a few of the costs could have already been reached and situations performed out.