Picture supply: Getty Photos

The BT (LSE:BT.A) share value has risen a powerful 23% within the 12 months so far. And Metropolis analysts don’t assume the FTSE 100 inventory is completed but.

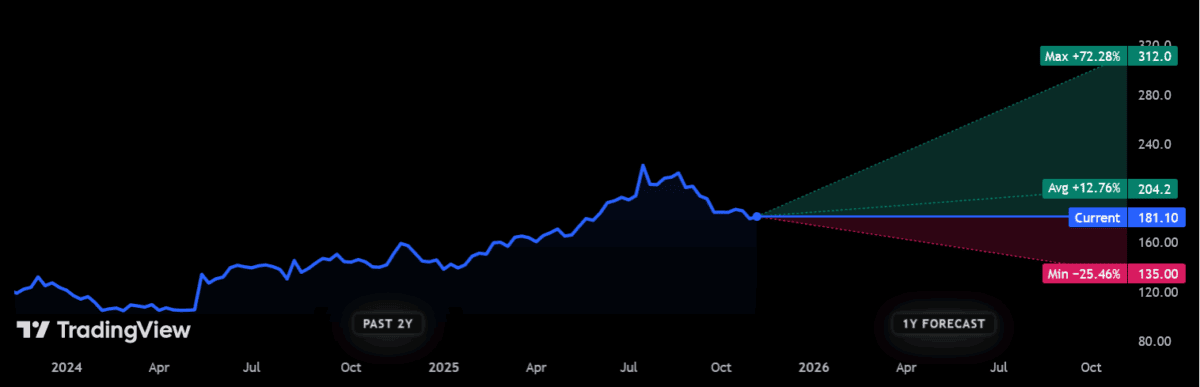

BT shares have been final altering palms at 181p per share. If forecasts are appropriate, they’ll surge via the 200p marker over the subsequent 12 months, to 204.2p per share. That may signify a 12% rise from present ranges.

When one additionally elements in predicted dividends, buyers in BT might realise a complete return of 16% to 17% throughout the subsequent 12 months. However how real looking are these forecasts?

Progress

Firstly, it’s vital to say that brokers aren’t unanimously bullish of their estimates. That 200p-plus goal is a mean among the many 15 forecasts at present on supply from the analyst group.

One analyst believes BT’s share value might drop greater than 1 / 4 between now and subsequent Remembrance Day. Having mentioned that, one other reckons it might print value beneficial properties north of 70% over the interval.

What do Metropolis analysts imagine might drive the corporate ever increased? Bulls reckon BT’s restructuring programme won’t solely assist it proceed its spectacular cost-cutting technique. They see it as a approach of streamlining its product ranges to assist it rescuscitate its dragging revenues.

BT’s restructuring plan achieved a strong £1.2bn price of financial savings within the 18 months to September, smashing forecasts.

Optimism additionally abounds over the agency’s high-margin Openreach infrastructure division as new fibre connections proceed to develop. It’s on track to attach 25m premises by the top of subsequent 12 months, and 30m by the shut of the last decade.

Issues

But whereas BT’s been making progress on these fronts, I worry the inventory could also be working out of street as issues proceed elsewhere.

It’s nonetheless proven no approach of overcoming its continued gross sales issues — adjusted revenues dropped once more within the six months to September, by 3%, with reversals recorded throughout its Shopper, Enterprise, and Worldwide divisions. Towards a backdrop of accelerating competitors and a weakening UK financial system, I can’t see its revenues points easing any time quickly.

On the identical time, capital expenditure continues to tick up, rising 8% within the half 12 months. Which means internet debt can also be heading steadily increased, up one other 3% 12 months on 12 months to finish September at £20.9bn.

It makes for much more grim studying when one considers the price of BT’s huge pension deficit. That is costing the corporate round £800m a 12 months.

Costly

There’s additionally a valuation downside I really feel could restrict additional beneficial properties for BT’s share value. This 12 months’s fast ascent leaves it buying and selling on a ahead price-to-earnings (P/E) ratio of 10.3 occasions.

That’s above the 10-year common of 8.8 occasions. Given the enduring issues the enterprise faces, this rising premium is particularly arduous to fathom.

Added to this, BT shares now additionally command a price-to-book (P/B) ratio of 1.4. That is up from beneath one simply 14 months in the past, and signifies that the agency trades at a premium to its asset values.

I wouldn’t be stunned if BT’s share value have been to proceed rising. However I feel the percentages are stacked in opposition to it, so I’d quite purchase UK shares that supply a lot decrease danger.