The Each day Breakdown takes a better have a look at Salesforce, which has its valuation buying and selling close to the lows, whereas enterprise stays robust.

The TLDR

Salesforce nonetheless has progress

The valuation is traditionally low

Margins and earnings are up

Deep Dive

After lagging the broader market and all of its sector friends from Q3 2024 to Q1 2025, tech loved a large rebound in Q2 because it climbed greater than 20% and hit new document highs. One identify inside the area that didn’t benefit from the run, although? Salesforce.

Shares of CRM climbed simply 1.6% within the second quarter. Whereas shares are up barely over the previous 12 months (+3.7%), the inventory is down greater than 20% thus far in 2025. That’s regardless of boasting strong progress expectations and a valuation that’s close to a low level.

Digging Into the Enterprise

Salesforce is a cloud-based software program firm specializing in buyer relationship administration (or “CRM” — making for a becoming ticker). Its principal merchandise — together with Gross sales Cloud, Service Cloud, Advertising and marketing Cloud, and Information Cloud — assist companies handle gross sales, customer support, advertising and marketing, and information analytics. Income primarily comes from subscription charges, with extra earnings from consulting and assist providers. AgentForce, one among its newer instruments, has gained fast traction throughout industries.

Salesforce will not be at its peak progress section, nevertheless it’s nonetheless anticipated to churn out regular outcomes:

The corporate is in its fiscal 2026 12 months and consensus estimates name for roughly 9% to 10% income progress this 12 months, in 2027, and in 2028. On the earnings entrance, (GAAP) estimates name for progress of ~14% this 12 months, ~16% in 2027, and 21% in 2028.

Keep in mind, we don’t prefer to look too far out on expectations, however that provides a fairly good concept of the anticipated progress within the coming quarters and years.

Valuation

Once we have a look at the ahead price-to-earnings ratio — which divides the inventory value (P) by anticipated earnings (E) — we discover that it tends to trough within the low 20s and, at the very least over the previous couple of years, peak within the low 30s. At the moment at simply 22, CRM inventory is reasonable by this metric based mostly on the previous 5 years.

Wish to obtain these insights straight to your inbox?

Join right here

Diving Deeper

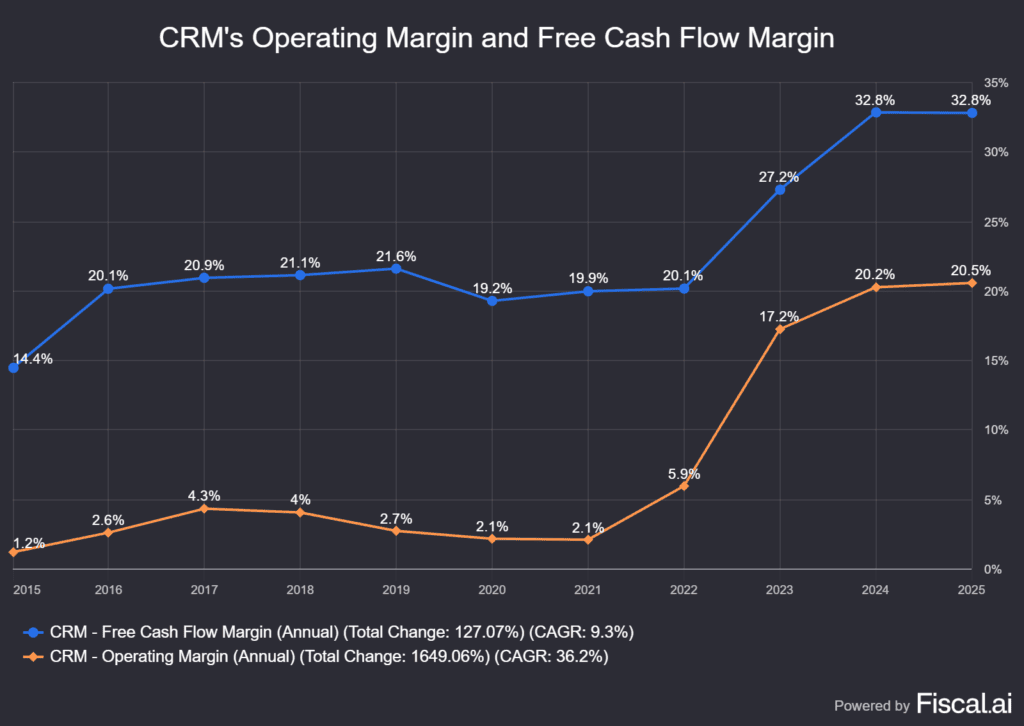

As we dig deeper into Salesforce’s enterprise, discover how the corporate’s working margins (in orange) stagnated between the two% to 4% vary for a number of years. Likewise, the corporate’s free money circulation margin — which measures how effectively an organization converts its income into money after masking working bills and capital expenditures — hovered close to 20% in that very same span (from 2016 by means of 2021).

Then each metrics broke greater. As the corporate’s margins expanded, it allowed earnings and free money circulation to rise. It’s one cause that we’ve seen the valuation come down a lot as effectively.

Dangers

Maturing corporations may be onerous to guage. In CRM’s case, earnings and margins are up, the valuation is down, and whereas progress continues to be fairly strong, it’s not what it as soon as was. By nature, that’s usually going to lead to a decrease valuation — which we’re seeing now.

However will the present valuation measures maintain? Which means, will a ahead P/E ratio within the low 20s proceed to attract in consumers and assist the inventory? A decrease valuation is one doable threat for CRM. One other is extra apparent: too excessive of progress expectations. If progress is decrease than anticipated, then even when the valuation stays the identical, that equates to a decrease inventory value. Whether or not that potential progress slowdown can be company-specific or the results of the broader economic system doesn’t matter.

The Backside Line

With its $250 billion market cap, Salesforce has proved to be a power inside tech. Regardless of regular progress expectations and an enormous enchancment to its working and free money circulation margins, the valuation stays low relative to its historic vary.

Does that make it a purchase, or will buyers go for different shares as an alternative?

Disclaimer:

Please notice that attributable to market volatility, a number of the costs could have already been reached and eventualities performed out.