As Bitcoin enters 2026 with sustained institutional adoption and worth stability following the 2024-2025 bull run, self-custody stays a cornerstone of the asset’s sovereignty promise. But the panorama has developed considerably. Spot Bitcoin ETFs have unlocked entry to passive traders comfy with Wall Road’s “belief me, bro” brokerage fashions, whereas bodily assaults on crypto customers have surged to report ranges, generally known as “wrench assaults”. So, is self-custody a factor of the previous, a useless meme many people fell for, or is it reworking as Bitcoin matures?

In a current interview with Bitcoin Journal, Casa CEO Nick Neuman supplied a candid perspective of those dynamics, positioning his firm’s multisig options as a bridge between the imaginative and prescient of pure self-sovereignty and sensible usability for high-value holders, tailored to cope with trendy safety challenges and even geopolitical danger.

Casa, based in 2018, targets customers securing significant Bitcoin quantities—usually 5 figures or extra—the place monetary freedom is extra necessary than comfort. Neuman described Casa’s north star as “maximizing sovereignty and safety on the earth” via Bitcoin and personal key cryptography. In recent times, this has solidified into “constructing the Swiss financial institution for the sovereign particular person”—a service for individuals who view cash as integral to private autonomy.

Bitcoin Journal has lined the corporate’s progress extensively all through the years, together with a November 2024 interview with Neuman by Frank Corva and a June 2025 story on its partnership with Swiss platform Relai for multisig safety and inheritance planning.

ETFs and the Promise of Comfort

“Not everybody desires to be a sovereign particular person proper now,” Neuman famous when discussing the challenges self-custody faces in 2026, pointing to an more and more apparent actuality: Bitcoin self-custody calls for excessive private duty and a major quantity of technical competence. These stay true regardless of greatest efforts in person interface design. NVK, the founding father of the Coldcard Q, has joked publicly that making an attempt to design self-custody merchandise able to resisting nation-state intrusions, with “grandma” ranges of ease of use, could be a pipe dream. On the very least, the persona kind and technical competence wanted for optimum self-custody stay a limiting issue on the belief of the cypherpunk utopia.

ETFs supply plug-and-play publicity to a brand new and broad userbase, whereas self-custody appeals principally to high-agency customers unwilling to simply accept black-box custodian dangers — and that’s the excellent news, “at scale, you merely can’t afford to belief that Coinbase or anybody else is getting each course of proper,” he stated.

Establishments equivalent to household workplaces, firms, custody banks, and funding funds are additionally beginning to perceive the dangers of outsourcing Bitcoin custody. Neuman revealed that “More and more over the past 12 months, Casa helps giant establishments that must have provable safety and provable management to safe their property,” including that establishments “are beginning to notice that in quite a lot of methods regulators are requiring them to have precise management over this asset.”

In 2025, for instance, the OCC clarified that nationwide banks and federal financial savings associations have the freedom to custody crypto property for shoppers, including the caveat that “As with every exercise, a financial institution should conduct crypto-asset custody actions, together with by way of a sub-custodian, in a secure and sound method and in compliance with relevant legislation”. The GENIUS Act supplied additional construction by giving the inexperienced gentle to full reserve Stablecoins in U.S. monetary markets.

The SEC’s January 2025 rescission of SAB 121 (by way of SAB 122) eliminated capital penalties for crypto custody, making it extra sensible for banks. Some banks publicly identified to be creating unbiased crypto custody platforms for his or her customers embody BNY Mellon, State Road, Citi, and JPMorgan. That is in distinction to outsourcing all custody to the most well-liked custodians like Coinbase, which some fear poses systemic dangers to the Bitcoin community and its traders.

Neuman factors out that self-custody multi-signature platforms like Casa deal with the issues and wishes of institutional gamers. Multisig requires a number of keys to signal a sound transaction, but in addition permits key rotations for personnel modifications, with added auditability. “If somebody who managed a key leaves, you possibly can rotate that key out fully… We make that course of easy, and for establishments, we’ve added further guardrails, auditability, and visibility,” stated Neuman.

Because of this rising development, we’d quickly begin to see a wave of competitors in retail dealing with custodial bank-like providers within the U.S., whereas institutional gamers would possibly start to decouple from the plug-and-play custody outsourcing we’ve seen up to now, a step in direction of custody decentralization of Bitcoin.

Defeating Wrench Assaults

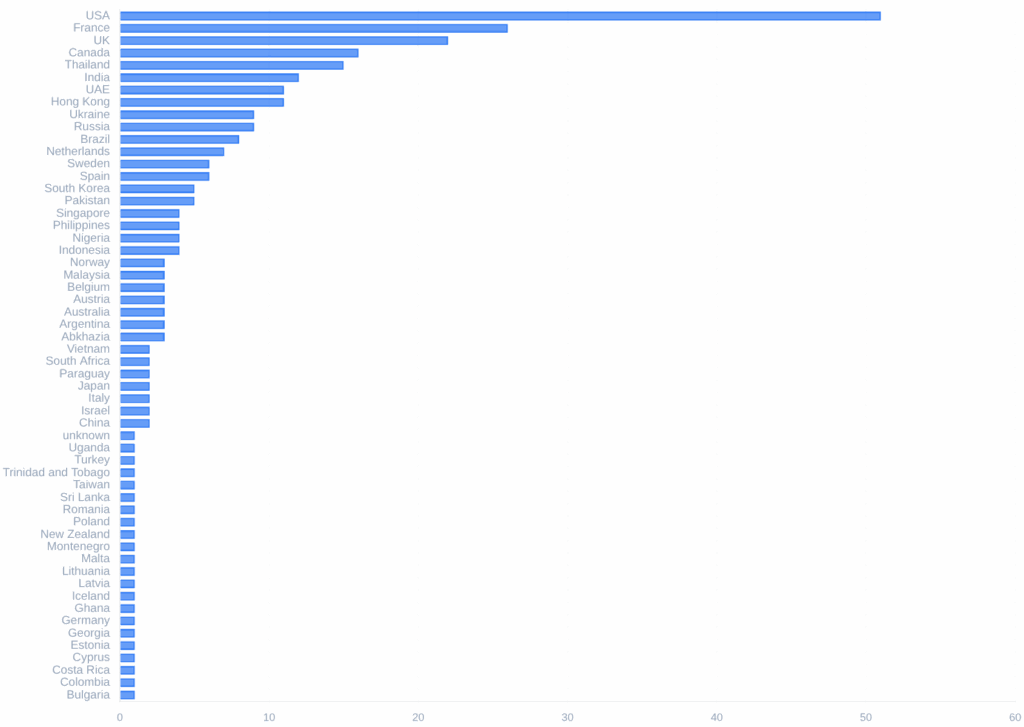

Bodily coercion assaults—generally known as “$5 wrench assaults”—reached unprecedented ranges in 2025. Jameson Lopp, Casa’s chief safety officer, maintained a decade-long database, documenting roughly 65–70 incidents, the best on report, with not less than 4 fatalities. Alena Vranova, co-founder of Trezor, now operating a wrench assault prevention startup known as Glok.me, locations the quantity at 292, breaking down the info into numerous classes.

France emerged as a hotspot, with not less than 10 reported wrench assaults in 2025, usually linked to tax reporting, doubtlessly exposing addresses and identities, together with a case the place a tax official was convicted for promoting taxpayer information to criminals. America is main the pack in complete numbers of identified crypto-related assaults.

Nevertheless, you will need to weigh information of this kind with a grain of salt. It must be thought-about on a per capita foundation, as international locations just like the U.S. have near 400 million residents in comparison with France with round 70 million. Comparisons to fiat fraud like identification theft and different types of violent crime are sometimes not included in these kind statistics. It’s nonetheless an alarming development and a standard speaking level, giving crypto customers pause when deciding to take self-custody.

Neuman believes, nevertheless, that the general public is misunderstanding the issue at hand, pondering that giving custody to a 3rd get together is definitely the answer; it’s not. He shared a non-violent case that challenges this “simply use a custodian” narrative: A Casa consumer was drugged and coerced at a bar. Funds in Casa’s multisig stayed safe as a result of dispersed keys — the person didn’t have sufficient keys on him to signal a transaction — however a small Coinbase steadiness was drained from the consumer’s telephone app. “It simply fully flips the prevailing knowledge,” Neuman famous, “Really, that doesn’t all the time clear up the issue.”

Finest practices on this entrance revolve round not changing into a goal within the first place, as in not changing into an influencer flaunting crypto wealth. Nevertheless it additionally means not exposing information that reveals you’ve got crypto wealth, a privateness danger legacy finance is especially weak to, as seen by the unimaginable rise in monetary information hacks and identification theft. Although {hardware} pockets producers like Ledger have suffered a number of cost infrastructure-related hacks which have resulted in person information being compromised, placing customers in danger.

Casa counters bodily threats of this kind with multisig key distribution, making it in order that customers wouldn’t have sufficient entry to their Bitcoin to have the ability to ship all of it below duress. The app additionally consists of an emergency lockdown characteristic, and the restoration key Casa holds in these multi-sig accounts received’t co-sign a transaction with out correct authentication. Customers can configure their Casa service to require video verifications and pre-arranged duress procedures. “When you have used our product appropriately and adopted our steering, you may be assured that the attacker not less than received’t get your cash,” Neuman defined.

Casa’s pseudonymous assist—permitting customers to keep away from sharing names, faces, or places—attracts from Lopp’s personal experiences, together with being swatted, and is embedded within the firm’s privacy-focused DNA.

Geopolitical Hedge

The brokerage mannequin of Bitcoin custody, equivalent to ETFs, additional insulates customers from organized crime kinds of wrench assaults, however introduces new dangers like rehypothecation – sale of pretend shares or under-collateralized paper Bitcoin. Moreover, Neuman factors out that criminals may nonetheless come after ETF customers, pondering they’ve self-custody bitcoin as effectively, “it doesn’t actually clear up the issue of you getting harm.” ETFs are additionally weak to politically motivated persecution.

Casa has noticed this particular use case, which it refers to as a geopolitical hedge, the place political operatives or influencers shield their wealth from the present political administration of their international locations, in instances once they discover themselves on the again foot. “Proper now, we see that Democrats are apprehensive concerning the Trump administration confiscating their cash… However 4 years in the past… we had individuals who had been Republicans doing the very same factor,” Neuman defined.

Shoppers of this kind arrange Bitcoin wallets which are exterior of the fast attain of the present administration, by, for instance, giving a key to a legislation agency exterior of the nation, positioned in overseas secure deposit containers, with trustees, or members of the family, guaranteeing mobility if home property are frozen. Casa’s restoration key additionally offers on a regular basis usability with out frequent journey, with guide authentication of the person. Bitcoin, on this instance, serves as an answer to what you would possibly as effectively name a nation-state-level wrench assault.

Self-Custody Insurance coverage

A brand new technology of insurance coverage has additionally emerged to serve Bitcoin holders who take self-custody. Particularly, corporations like AnchorWatch and Bitsurance shield person wealth as much as sure limits backed by giants like Lloyd’s of London. If a person does get kidnapped, they will doubtlessly surrender their insured cash, minimizing hurt to themselves, after which name their insurer, who may have a powerful incentive to forestall that from taking place.

Neuman acknowledged the innovation however highlighted limitations: “When lots of people take into consideration insurance coverage with their self-custody, they’re occupied with… reasonably priced insurance coverage… And that simply doesn’t exist.” Broad protection usually requires transaction approvals, growing supplier reliance—a compromise many sovereign customers reject. Casa, nonetheless, has explored partnerships with this rising insurance coverage business.

The Self-Custody Specialist

the consumer advisory position in bitcoin self-custody, specialised staff, story or two? quote. ledger display screen story rofl.

Casa has additionally developed a specialised advisory staff, centered on serving its consumer base with instruments the corporate developed. Advisors full a six-month coaching program, shadowing consultants who serve shoppers in emergency conditions, in addition to reply regular questions and educate their customers. “Our advisors convey humanity to Bitcoin, they usually convey humanity to serving to you be a sovereign particular person… that’s actually useful on this world of don’t belief confirm,” Neuman stated.

Shoppers reward advisors by identify. A current Bitcoin pockets rescue mission by Casa saved 100 BTC for a pseudonymous consumer with a Ledger {hardware} pockets whose display screen had died—advisors shipped a alternative Ledger and guided the person to switch the display screen themselves. A case examine is forthcoming.

Open-Supply and Self-Custody

With a lean staff of about 35, Casa optimizes for longevity, open-sourcing software program merchandise selectively, like their current YubiKey integration. Their pockets, whereas not open-source, doesn’t are inclined to do transaction signing, since its person base primarily indicators transactions with {hardware} wallets which are usually already open-source. The Casa app primarily helps customers assemble the mandatory key materials, and in keeping with Neuman, the Casa app’s behaviour may be verified and replicated through the use of superior desktop wallets like Sparrow.

General, whereas some current developments seem to place self-custody on the again foot, the cypherpunk imaginative and prescient continues to maneuver ahead, seeking to deal with real-world person wants and threats, one step at a time. Quietly creating a brand new layer of property rights protection that the best company participant on the earth is now keenly conscious of.